SUPPLY CHAIN BOOM AND BUST SUMMER PROJECT

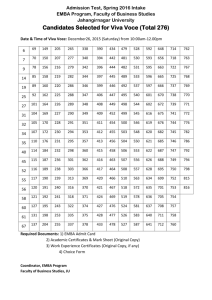

advertisement