USING CIRCULAR FLOW DIAGRAMS TO GENERATE NUMERICAL EXAMPLES Hannes Kvaran

advertisement

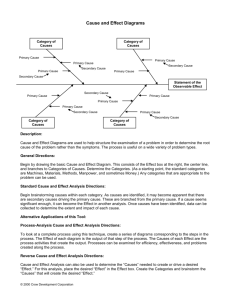

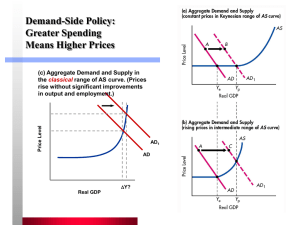

USING CIRCULAR FLOW DIAGRAMS TO GENERATE NUMERICAL EXAMPLES Hannes Kvaran An earlier version of this paper was presented at the 15th annual Teaching Economics Conference at Robert Morris University and published in the conference proceedings. ABSTRACT This paper explores a variety of different approaches by which circular flow diagrams can be adapted to present numerical examples in macroeconomics. The models allow for exposition of the roles of monetary and fiscal policy and the differences in monetarist and Keynesian theories, among other topics. I. INTRODUCTION The circular flow diagram (CFD), in one of its many variations, is ubiquitous in economics pedagogy. The use of the diagram to generate illustrative numerical examples has been, as far as I know, unexplored, but offers rich opportunities. This paper is intended to demonstrate the possibilities of such an approach. This method has been an integral part of my class for many years. As any teaching strategy, it has strengths and weaknesses. Some students like it and some don’t but I find it an indispensable part of my teaching tool-kit. I find these diagrams to be pedagogically useful on a par supply and demand. Whereas supply and demand shows the workings of a particular market, circular flow diagrams are the tool designed to view an entire economy at once. The diagrams that follow exist in two forms: 1. as hand-drawn diagrams for use in a classroom and in notebooks. This is, to my mind their essential purpose. In this paper I use word processor drawing tools to laboriously produce the diagrams, but it is important to see that these can be hand-drawn quickly enough to be a useful complement to lecture. I use these diagrams as often as I use supply and demand graphs as the complementary analytical tool. 2. as computer programs on the Internet and on a stand-alone program. In this incarnation it is possible to integrate supply and demand graphs into the diagrams. This allows for a significant expansion of the model’s scope into issues of cost and technology. After some introductory remarks, I will explore each of the presentations in turn Models. Circular flow diagrams come in three broad types, each with four possible variations. Students are always encouraged to use the simplest model for any particular purpose. • Open Models are used to demonstrate Keynesian theory. The principle purpose of these diagrams is to illustrate that fluctuations of aggregate spending are determined by the inequality of leakages and injections. These models represent the viewpoints of Keynesian theory and therefore better describe economies in the short run and in periods of underemployment. • Closed Models are used to demonstrate monetarist or classical theory. These are directed toward demonstrating crowding out, showing how one sector’s spending impacts others and essentially disavows the possibility of fiscal policy influencing aggregate demand. These are more appropriate models for examining an economy at full employment and in the longer run. • Money Models add the Federal Reserve and/or the demand for money as elements of the economy. Their conclusions stand mid-way between the open and closed models. Variations Each of these four types can be presented in four variations depending on which variable one chooses to include: • the Basic Model includes the variables Income, Aggregate Spending, Consumption, Savings and Investment • the Treasury Model adds to the basic model the elements of fiscal policy -- taxes, government purchases, transfer payments and the budget balance. • the Foreign Sector Model adds to the basic model exports, imports, and foreign financial capital flows. • the Full Model combines the Treasury and Foreign Sector elements. Notation and Terminology. PrM X LaM C wages profit H/B Y The usual CFD pictures the economic flow as an exchange between a household sector and a business sector, mediated by the markets for goods and factors. I have found it more useful to compress the two sectors into the “Household/Business Sector” (H/B) and see them as interacting with the Product Market. This corresponds quite closely to the Federal Reserve flow of funds approach, which includes the “Domestic Nonfinancial Private Sector” as a component. The simplest CFD is therefore as shown in Figure 1. When a Credit Market, a Foreign Exchange Market and a Treasury are added, the result is quite similar to the economic categories used in the flow of funds accounts. Making this slight shift does, however, force another, more substantial change of perspective. Since households and businesses have been combined, it is no longer possible to define consumption and investment PrM in the traditional NIPA fashion as, respectively, “Spending by X Households” and “Spending by Businesses.” Looking at Figure 2 it is I clear at the symbol C indicates “Spending out of Income (by both Households and Businesses)” and that the symbol I represents “Spending C LaM CrM out of Credit (by both Households and Businesses).” There are several notation/vocabulary solutions available. One could invent totally new terminology, or one can continue to use the designations C and I, and S even the words “consumption” and “investment” and redefine them. No doubt there are pitfalls to both approaches; I use an intermediate course. H/B Y At some point I carefully define terms, and then, for the most part, casually blur the distinctions between the competing definitions, Figure 2. The Meanings of C and I revisiting terminology in the few instances where course content warrants it. Of all the problems inherent in this approach, I have never felt this one to be important. If this seems unduly heretical, I invite you to look at the classification systems used in the Fed’s flow of funds accounts. Also ask yourself, aside from historical convention, which definitional distinction is more relevant to analyzing a macroeconomy, which question is of primary importance in classifying a spender: Figure 1. The Simplest Circular Flow Diagram “Who are you?” (as NIPA does) or “Where did you get the money?” (as Flow of Funds does). I submit that, in an age of huge consumer debt and reinvested profits as a significant source of investment that the latter question is the relevant one. Some idiosyncratic notational conventions deserve immediate mention: X = Total Expenditures, aka nominal GDP, aka Aggregate Demand Y = nominal Income E = exports F = Imports Cd = domestic Consumption = C - F (on the simplifying assumption that all imports are consumer goods.) M = money supply III. THE HAND-DRAWN MODELS In this section I will demonstrate some uses of the diagrams that are suitable to a lecture presentation. I will start by doing a comparison of the Keynesian and monetarist views of an increase of spending by a sector. PrM X Injections I+G+E Cd The open model is used to present Keynesian theory. The diagram, shown in Figure 3, incorporates onto the circular S+T+F Leakages flow the notions of leakages and injections. A numerical H/B Y example begins by placing the initial values onto the Figure 3. The Open Model diagram, as in Figure 4. I always use the same initial values, shown in Appendix 3. Note that, for this example, the model has been simplified to include only one Leakage (S) and one Injection (I). It is stressed that all the numbers must add 1010 up according to Y = C + Leakages and 1000 1000 410 PrM PrM X = C + Injections. The problem asks the 400 400 student to increase Investment by $10. The results are shown in Figure 5. We see that the 600 600 increased spending has resulted in a rise of aggregate demand (X). This is initially interpreted as an economic expansion and “a 400 400 H/B H/B good thing according to this model.” 1000 1000 Figure 4. An Open Model Example Figure 5. Increased Injections To multiply or not. At this point one has a choice. You can trace the effect of the increased spending around the circuit several times and derive the multiplier effect, as higher spending means more income, which means more consumption and so on. Or you can merely note that the model’s prediction is that an increase of spending (investment, in this case) will induce an economic expansion. My method is to briefly trace out the multiplier effect once -- because a good student almost certainly notices the possibility -- and then say that we will content ourselves with noting the rise of aggregate demand, without tracing its magnitude. (The computerized version includes a module for deriving the multiplier. I rarely use it). The structure of all problems thereafter is to stop the analysis once the change (or lack thereof) of X has been noted. This introduces into this method two elements uncomfortable to most economics teachers. First, Income is (until much later) treated as an exogenous variable, rather than the object of analysis. Second, the problems do not end in equilibrium. I’ve gotten used to both issues. My justification for the cavalier disregard for equilibrium and multipliers deserves a quick defense. I find the most compelling point to be made in a presentation of Keynesian theory is that an exogenous increase in spending induces an economic expansion and is “good for the economy.” The size of the effect strikes me as an issue of secondary importance (actually capable of distracting from the essential point). Furthermore, I think the faith in multipliers has subsided somewhat over the years. Extensions Starting with this simple problem, a variety of examples can be used to introduce Keynesian views on issues of savings, investment, fiscal policy, foreign trade and general philosophy. Figure 6 illustrates an increase of leakages. The basic use of all the diagrams is also established. As is typical of economics problems, we begin with the system in equilibrium, introduce a change, compare the initial state with the outcome, and interpret the result. PrM 990 1000 400 600 590 H/B 410 400 1000 Figure 6. Increased Leakages The closed model is used to present PrM X classical/monetarist theory. While the open model G generates decidedly “liberal” conclusions, E I particularly as regards the efficacy of FxM CrM Cd Trsy K B expansionary fiscal policy, the closed model -d shown in Figure 7 -- presents the other version of F S T economic theory. In these models, aggregate demand never changes -- it always remains equal H/B Y to initial level of income (until money is added to Figure 7. The Closed Model the model). The model concentrates on the concept of opportunity cost by showing changes in one sector’s The Closed Model notations are: spending as inevitably being offset by the crowding out of CrM = The Credit Market some other sector’s spending. This diagram is introduced a bit FxM = The Foreign Exchange Market at a time, starting with the “Basic” model that includes only Trsy = The Government Treasury the product and credit markets, then adding the Treasury to K = Foreign Financial Capital Flows examine fiscal policy, and finally adding the foreign sector to B = Budget Balance discuss trade and international capital flows. For most foreign sector problems, I take the Treasury off. In fact, the entire diagram is fairly rarely used. To illustrate the use, and political flavor, of the diagram, we can start by putting numbers on the diagram -- as in Figure 8 -- and then analyze the effect of an increase of government spending -- as in Figure 9. Important to the use of the closed model is that the numbers into and out of each “node” -- the Treasury and the markets -- must add up. For example, dollars into the credit market must equal dollars out of the credit market. Quite a different result emerges than came from the open model. The increase of the deficit is shown here as crowding out investment by diverting funds from the credit market. Prior discussions of the role of investment on growth are used to suggest that this model criticizes deficit spending for its anti-growth potential. 1000 PrM 600 H/B 200 200 CrM Trsy 200 200 1000 Figure 8. Values on the Closed Model PrM 1000 200 190 CrM 600 200 210 0 -10 Trsy 200 200 Comparison of the Open and Closed Models. In a H/B 1000 variety of contexts the open and closed models disagree as to the effects of given policies. For example, expansionary Figure 9. A Change of Gov’t Purchases fiscal policy will generate increases in aggregate demand in the open model, in keeping with Keynesian analysis. In the closed model, in keeping with monetarist conclusions, the same policy will crowd out investment, with a presumably detrimental effect of future growth, and leave aggregate demand unaffected. A great power of these diagrams is the capability of fast side-by-side comparisons of competing theories on a wide variety of issues. The tax rule is used in analyzing the effect of tax changes. It is arbitrarily decided that, for every $4 change of taxes, savings will change by $1 and consumption by $3. This produces the effect that changes of government spending are, per dollar, more powerful than tax changes either for harm or good. Most of us were introduced to this concept via the differing sizes of the tax and spending multipliers. See Figures 10 and 11 for examples. It is instructive to work these problems making different assumptions about the propensity to consume out of a tax cut, since the results are the stuff of political debates. The same tax rule can be applied to both the open and closed models to, again, illustrate a variety of viewpoints. PrM 1000 1006 200 200 200 202 200 192 600 606 H/B 1000 Figure 10. An $8 Tax Decrease, Open Model PrM 1000 200 194 600 606 H/B CrM 200 202 200 0 -8 Trsy 200 192 1000 Figure 11. An $8 Tax Decrease, Closed Model The twin deficits problem is a fairly sophisticated use of the full closed model. In this application, an increase of government deficit is financed by foreign capital flows. This leaves foreigners with fewer dollars with which to purchase our exports and a trade deficit results. See Figure 12. PrM X 100 90 FxM H/B 10 CrM -10 200 210 Trsy Y Figure 12. The Twin Deficits MONEY The next major class of models extends the tool to include two new elements, as shown in Figure 13: I G A box labeled “Fed” to indicate the Federal Reserve Board and a box labeled “Cash” to CrM BB Trsy C illustrate the demand for liquidity. These models act like open models in that it is possible for dMD dMS aggregate demand to change as the result of T S Cash Fed changes of either the money supply or money H/B Y demand. I refer to these as “money models” to Figure 13. The Money Model avoid the “open” versus “closed” vocabulary. The dual-headed arrows indicate that money supply and demand can both rise or fall. As with the previous models, one can use less than the full model. The model shown in Figure 13, for example, excludes the foreign exchange market. PrM X The Cash box is the most problematic part of the diagram. It is an attempt to describe the velocity of money -- here assumed inversely related to the demand for money. An increase of the velocity of money is shown as money coming out of the Cash box; a decrease of velocity ids shown as money entering the Cash box. Classical theory is illustrated merely by omitting the Cash box and therefore disallowing any velocity change. As proficiency with the models grows, it becomes unnecessary to put all the numbers on them. Instead, it is only necessary to include the changes of values. This results in significantly cleaner diagrams. The following examples illustrate a few of the issues that can be portrayed in this fashion. PrM +5 . PrM +5 +5 +5 CrM CrM +5 +5 H/B Trsy +5 Fed Fed 1. Printing money raises aggregate demand H/B 2. The deficit rises and the Fed monetizes the debt. Expansionary monetary policy looks like expansionary fiscal policy. PrM PrM +5 +0 +5 CrM CrM +5 Trsy -5 -5 Cash Cash H/B 3. The deficit rises and the public buys the bonds by reducing Cash. The velocity of money is increased; spending rises. This is the scenario in which fiscal policy is actually expansionary. Cash -5 Fed H/B 4. The Fed reduces the money supply – hoping to cause a recession that will end inflation – and the public sends out of Cash. The recession does not happen, or is, at least, delayed. Let me suggest that some of the scenarios and issues described in these examples are fairly sophisticated and yet are conveyed quite simply by these diagrams. Furthermore I contend that, at least for some students, the ability to draw diagrams of situations is useful. We certainly operate of that assumption in teaching supply and demand analysis. III. THE COMPUTER MODELS Computerized versions of these models, dubbed CirF, have been developed and are available online at http://gnet.acad.gc.maricopa.edu/cirf/cirf/CFFrame.htm and as a download at http://staff.gc.maricopa.edu/~hkvaran/Macro. The two versions operate essentially the same with a few minor differences. Computerization led to some interesting pedagogical choices and some significant extensions of the models. CirF operates in two distinct modes: Flag Mode and Market Mode. I discuss them each in turn. FLAG MODE allows the user to enter values for any of the macro variables onto a circular flow diagram. The program responds with “flags” that change color to alert the user that some values do not add up. Changing Consumption, for instance, will elicit flags indicating that the equations X = C + I + G and Y = C + S + T do not hold. The user then adjusts other values to eliminate all flags. This produces a description of the effects of the initial change. There is something pedagogically interesting here: the user is told that something is not right and then is left to discover how to fix it. It is easy to create problems that have multiple solutions, but it is always possible to constrain the statement of the problem to allow only a single correct answer. The Open Market Flags are: Y = Cd + S + T + F (Uses of Income) X = Cd + I + G + E (Sources of Spending) Tnet = G + B (Government Budget. Tnet = Taxes, net of Transfer Payments) The Closed Market adds to the above flags: S + K + B = I (Credit Market Equilibrium) E + K = F (Foreign Exchange Market Equilibrium) The Money Models modify the Credit Market equilibrium condition to: S + K + B +∆MS= I + ∆MD (Credit Market Equilibrium) The Open Model This screen print illustrates an increase of G of 10. Flags are on at the boxes for X Spending (because X ≠ C + I + G) and for Government Treasury (because T ≠ G + B). The problem would be completed by entering 10 at X and -10 at B. The Closed Model This illustrates a rise of Imports of 10. Flags are “on” at The Foreign Exchange Market (Imports ≠ Exports plus Foreign Capital) and at Y Income (the uses of income are currently greater than income.). There are a variety of ways to complete this problem. One solution would be: reduce domestic consumption by 10, raise Foreign Capital by 10, increase Investment by 10. Money Model This example shows an increase of the money supply of 10. Possible solutions are: increase Investment and Spending by 10, illustrating an expansion, or increase liquidity by 10 as the public hoards the extra liquidity, illustrating a Keynesian liquidity trap. MARKET MODE incorporates supply and demand graphs into the circular flow diagram. In this mode the user enters an exogenous change, or changes, and the model displays the results either via graphs or tables of hypothetical numbers. This mode also adds variables such as energy costs, technological change and labor force growth rate as user determined values. Results are displayed for short, medium and long time horizons. Here we see the result of an increase of the money supply: an increase of supply in the credit market, causing a capital outflow as interest rates fall. Aggregate demand and the demand for labor rise. In this example we have increased the rate of technical growth from 2% to 3%. The results are displayed for the medium and long runs as tables of numbers. APPENDIX. NOTATION AND VALUES FOR THE VARIABLES. TABLE 1. NOTATION Abbreviation Stands for… Abbreviation B Gov’t Budget Balance I C Consumption K CrM Credit Market LaM ∆MD Change of Money Demand PrM ∆MS Change of Money Supply S E Exports T F Imports Tn Fed The Federal Reserve TP FxM Foreign Exchange Market Trsy G Government Purchases X H/B Households & Businesses Y Stands for… Investment Foreign Financial Capital Flows Labor Market Product Market Saving Taxes Taxes, net of Transfers Transfer Payments The Government Treasury Total Expenditures (Agg. Demand) Income Received by Private Sector Values I have found it useful to always use the same sets of starting numbers for the examples. Those values, however, depend on the variables included in the problem. The very presentation of these numbers presents a variety of challenges and opportunities. One may discuss the trade-off between simplicity and correctness (A quote attributed to Einstein is, “You can be correct or you can be clear, but not both.”). One may present more accurate numbers. My strategy has been to use numbers that are easy, and then to use real data to point out the inaccuracies of the hypothetical values. Incidentally, if the numbers for saving seem unrealistically large, consider that saving includes business saving, particularly capital consumption allowances. The values I use are summarized below. TABLE 2. VALUES USED Income (Y) Consumption (C) Domestic Consumption (Cd) Saving (S) Investment (I) Taxes (T) Government Purchases (G) Budget Balance (BB) Imports (F) Exports (E) Foreign Capital Flows (Kf) Total Expenditures (X) Basic 1000 600 NA 400 400 NA NA NA NA NA NA 1000 VARIATION Treasury Foreign 1000 1000 600 600 NA 500 200 400 200 400 200 NA 200 NA 0 NA NA 100 NA 100 NA 0 1000 1000 Full 1000 600 500 200 200 200 200 0 100 100 0 1000