Chapter 8 Costs of Taxation

advertisement

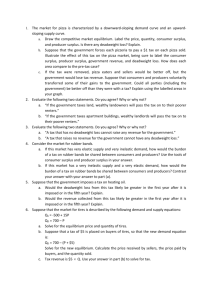

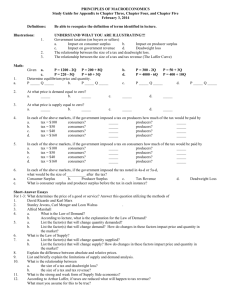

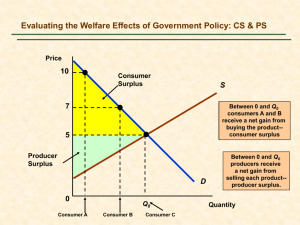

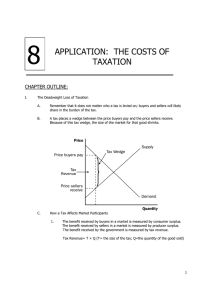

Chapter 8 Costs of Taxation 1. Suppose that the government places a tax on sellers of socks. a. Illustrate the effect of this tax on equilibrium price and quantity in the sock market. Identify the following areas both before and after the imposition of the tax: total spending by consumers, total revenue for producers, and government tax revenue. b. Does the price (net of tax paid to government) received by producers rise or fall? Can you tell whether total receipts for producers rise or fall? Explain. c. Does the price paid by consumers rise or fall? Can you tell whether total spending by consumers rises or falls? Explain carefully. (Hint: Think about elasticity.) If total consumer spending falls, does consumer surplus rise? Explain. d. Identify the areas describing CS, PS and government revenue before and after the tax. 2. Taxes on goods and services: a. Raise prices to consumers, reducing consumer surplus b. Lower prices to producers, reducing producer surplus c. (Reduce equilibrium quantity and thus total surplus) d. Reduce consumer surplus + producer surplus more than the revenue received by government. Deadweight loss of a tax: The amount by which losses in CS and PS exceed the government revenue. 3. In problem 1 above, identify the area describing the deadweight loss (DWL). The deadweight loss of a tax is larger when the elasticities of supply and demand are larger, because the equilibrium quantity falls by a larger amount. a. In problem 1 above, what is the DWL if demand is perfectly inelastic? b. If Supply is perfectly inelastic? c. Henry George proposed that all taxes be on land. What was he thinking? 4. Hotel rooms in Bozeman go for $100, and 1,000 rooms are rented on a typical day. a. To raise revenue, the mayor decides to charge hotels a tax of $10 per rented room. After the tax is imposed, the going rate for hotel rooms rises to $108, and the number of rooms rented falls to 900. Draw a clearly labeled S&D diagram illustrating the situation before and after the tax. Calculate the amount of revenue this tax raises and the deadweight loss of the tax. (Hint: The area of a triangle is ½ × base × height.) b. The mayor now doubles the tax to $20. The price rises to $116, and the number of rooms rented falls to 800. Calculate tax revenue and deadweight loss with this larger tax. Do they double, more than double, or less than double? Explain. The deadweight loss of a tax is proportional to the square of the tax rate. Thus, doubling a tax rate causes the DWL to quadruple. 5. Supply Side Economics a. Higher tax rates reduce quantity, so a sufficiently high tax rate will reduce government revenue (=T*Q) b. The Laffer curve c. The marginal tax rate (tax on one more dollar) of labor earnings is close to 40% for some people (15.3% Social Security + Medicare; Federal income (Max = 35%) + State income (Montana Max = 6.9%); and sales taxes (MT = 0 but 8-10% in some states), d. Many economists believe labor supply is quite inelastic (others disagree) e. Some economists and politicians argued that higher Federal income tax rates in the Clinton era (max increased from 35% to 39.6%) would “abort the recovery” from the 1991-92 recession. In reality, the longest period of economic expansion since WWII.