Chapter 9

advertisement

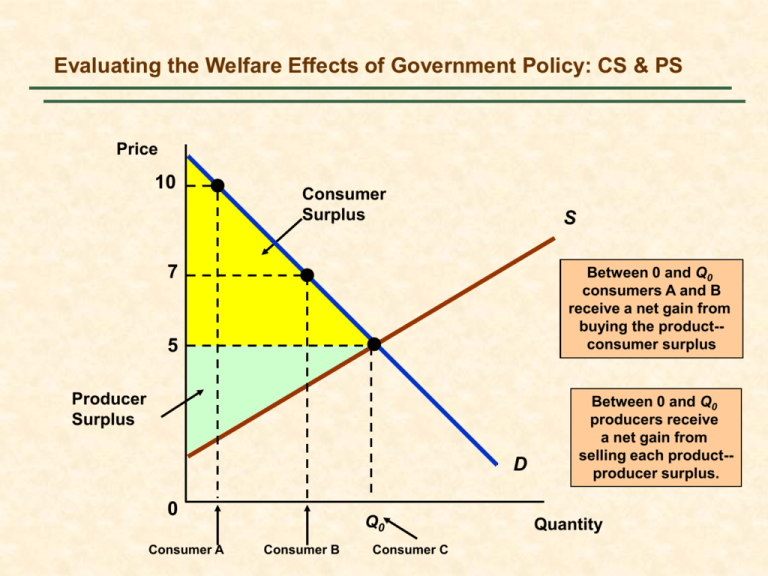

Evaluating the Welfare Effects of Government Policy: CS & PS Price 10 Consumer Surplus S 7 Between 0 and Q0 consumers A and B receive a net gain from buying the product-consumer surplus 5 Producer Surplus D 0 Consumer A Q0 Consumer B Consumer C Between 0 and Q0 producers receive a net gain from selling each product-producer surplus. Quantity Price Ceilings and the Welfare Loss Suppose the government imposes a price ceiling Pmax which is below the market-clearing price P0. Price S Deadweight Loss The gain to consumers is the difference between the rectangle A and the triangle B. B P0 A C The loss to producers is the sum of rectangle A and triangle C. Triangle B and C together measure the deadweight loss. Pmax D Q1 Chapter 9 Q0 Q2 Quantity Slide 2 Price Ceiling: Demand Is Inelastic Price D If demand is sufficiently inelastic, triangle B can be larger than rectangle A and the consumer suffers a net loss from price controls. S B P0 Pmax C A Q1 Chapter 9 Example Oil price controls and gasoline shortages in 1979 Q2 Quantity Slide 3 Price Controls and Natural Gas Shortages Price ($/mcf) D S The gain to consumers is rectangle A minus triangle B, and the loss to producers is rectangle A plus triangle C. 2.40 B 2.00 C A (Pmax)1.00 0 Chapter 9 5 10 15 18 20 25 30 Quantity (Tcf) Slide 4 Price Floors and the Welfare Loss When price is regulated to be no lower than P2 only Q3 will be demanded. The deadweight loss is given by triangles B and C Price S P2 A P0 B What would the deadweight loss be if QS = Q2? C D Q3 Chapter 9 Q0 Q2 Quantity Slide 5 Price Floor: The Minimum Wage Firms are not allowed to pay less than wmin. This results in unemployment. w S wmin A The deadweight loss is given by triangles B and C. B C w0 Unemployment L1 Chapter 9 L0 D L2 L Slide 6 Price Floors: Airline Deregulation Prior to deregulation price was at Pmin and QD = Q1 and Qs = Q3. Price S Area D is the cost of unsold output. Pmin A P0 B After deregulation: Prices fell to PO. The change in consumer surplus is A + B. C D D Q1 Q3 Q0 Chapter 9 Q2 Quantity Slide 7 Agricultural Price Floors: Price Supports and Production Quotas Price S The cost to the government is the speckled rectangle Ps(Q2-Q1) Qg Ps A P0 To maintain a price Ps, the government buys quantity Qg . The change in CS = -A – B; the change in PS = A + B + D. Total welfare loss is D-(Q2-Q1)ps D B Total Welfare Loss D + Qg D Q1 Chapter 9 Q0 Q2 Quantity Slide 8 Price Floors: Supply Restrictions •Supply restricted to Q1 •Supply shifts to S’ @ Q1 Ps is maintained with production quota and/or financial incentive S+ C + D Cost to government = B S’ Price PS D A B P0 •CS reduced by A + B •Change in PS = A - C •Deadweight loss = BC C D Q1 Chapter 9 Q0 Quantity Slide 9 Import Tariff or Quota: General Case The increase in price can be achieved by a quota or a tariff A = the gain to domestic producers The loss to consumers = A + B + C+D If a tariff is used the government gains D, so the net domestic product loss is B + C. If a quota is used instead, D becomes part of the profits of foreign producers, and the net domestic loss is B + C + D. S Price P* A B Pw D C D QS Chapter 9 Q’S Q’D QD Quantity Slide 10 US Sugar Quota in 1997 B and C = the DWL = $800 m. DUS SUS Price (cents/lb.) D = the gain to foreign firms with quota rights = $600m PUS = 21.9 The cost of the quotas to consumers was A + B + C + D, or $2.4b. The gain to producers was area A, or $1b. 20 A D 16 B C PW = 11 11 8 4 0 Qd = 24.2 5 QS = 4.0 10 15 Q’S = 15.6 20 25 Q’d = 21.1 30 Quantity (billions of pounds) Incidence of a Specific Tax Pb is the price (including the tax) paid by buyers. PS is the price sellers receive, net of the tax. The burden of the tax is split evenly. Price Pb A D Buyers lose A + B, and sellers lose D + C, and the government earns A + D in revenue. The deadweight loss is B + C. B P0 C t S PS D Q1 Chapter 9 Q0 Quantity Slide 12 Incidence of a Specific Tax Conditions that must be satisfied after the tax is in place: 1) Quantity sold and Pb must be on the demand line: QD = QD(Pb) 2) Quantity sold and PS must be on the supply line: QS = QS(PS) 3) QD = QS 4) Pb - PS = tax Chapter 9 Slide 13 Impact of a Tax Depends on Es & Ed Burden on Buyer Burden on Seller D Price Price S Pb S t Pb P0 P0 PS t D PS Q1 Q0 Quantity Q1 Q 0 Quantity Impact of a 50 Cent Gasoline Tax Deadweight loss = $2.75 billion/yr D Price ($ per 1.50 gallon) S Lost Consumer Surplus Pb = 1.22 P0 = 1.00 The annual revenue from the tax is .50(89) or $44.5 billion. The buyer pays 22 cents of the tax, and the producer pays 28 cents. A D t = 0.50 Lost Producer Surplus PS = .72 .50 11 0 Chapter 9 50 60 89 100 150 Quantity (billion gallons per year) Slide 15 Effect of a Subsidy Price S PS s P0 Pb Like a tax, the benefit of a subsidy is split between buyers and sellers, depending upon the elasticities of supply and demand. D Q0 Chapter 9 Q1 Quantity Slide 16 The Efficiency of a Competitive Market: Any Market Failure? 1) Externalities: Costs or benefits that are not reflected in the market price (e.g. pollution) 2) Lack of Information: Imperfect information prevents consumers from making utilitymaximizing decisions. Government intervention in these markets can increase efficiency. Government intervention without market failure creates inefficiency or DWL. Chapter 9 Slide 17