Syllabus

advertisement

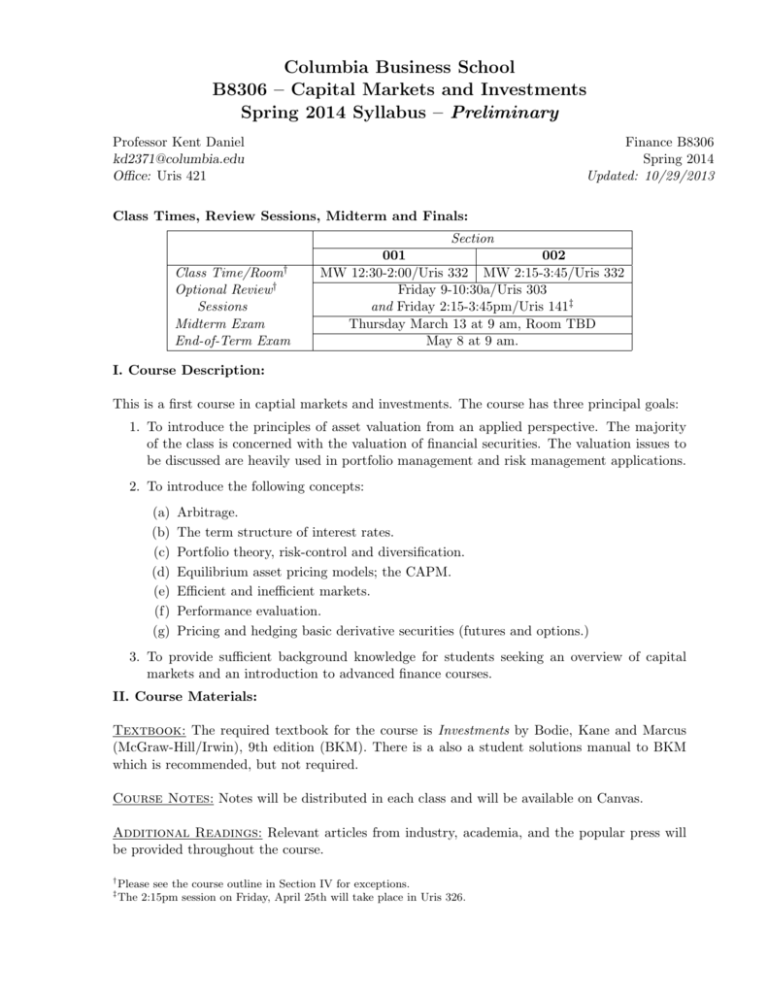

Columbia Business School B8306 – Capital Markets and Investments Spring 2014 Syllabus – Preliminary Professor Kent Daniel kd2371@columbia.edu Office: Uris 421 Finance B8306 Spring 2014 Updated: 10/29/2013 Class Times, Review Sessions, Midterm and Finals: Class Time/Room† Optional Review† Sessions Midterm Exam End-of-Term Exam Section 001 002 MW 12:30-2:00/Uris 332 MW 2:15-3:45/Uris 332 Friday 9-10:30a/Uris 303 and Friday 2:15-3:45pm/Uris 141‡ Thursday March 13 at 9 am, Room TBD May 8 at 9 am. I. Course Description: This is a first course in captial markets and investments. The course has three principal goals: 1. To introduce the principles of asset valuation from an applied perspective. The majority of the class is concerned with the valuation of financial securities. The valuation issues to be discussed are heavily used in portfolio management and risk management applications. 2. To introduce the following concepts: (a) (b) (c) (d) (e) (f) (g) Arbitrage. The term structure of interest rates. Portfolio theory, risk-control and diversification. Equilibrium asset pricing models; the CAPM. Efficient and inefficient markets. Performance evaluation. Pricing and hedging basic derivative securities (futures and options.) 3. To provide sufficient background knowledge for students seeking an overview of capital markets and an introduction to advanced finance courses. II. Course Materials: Textbook: The required textbook for the course is Investments by Bodie, Kane and Marcus (McGraw-Hill/Irwin), 9th edition (BKM). There is a also a student solutions manual to BKM which is recommended, but not required. Course Notes: Notes will be distributed in each class and will be available on Canvas. Additional Readings: Relevant articles from industry, academia, and the popular press will be provided throughout the course. † ‡ Please see the course outline in Section IV for exceptions. The 2:15pm session on Friday, April 25th will take place in Uris 326. B8306 – Capital Markets – Daniel – Preliminary Syllabus 2 III. Course Administration: The course grade will be based on cases, problem sets, class participation and a midterm and final examination. The weights in your course grade are: Cases Problem Sets Midterm Exam End of Term Exam Participation & Quizzes 15% 25% 20% 25% 15% Cases: There will be four case assignments, but the first case will not be graded. Cases should be done in groups of 3 members (MBA Assignment Type A). Students are responsible for organizing these groups, and should add all group members to one of the “Assignment Groups” available on Canvas. Each case will be distributed at least one class in advance and due by 10 am on the due date. Cases and solutions will be available only in Angel. Submitted cases will be √ √ √ graded on a + = 3, = 2, − = 1 basis. The three case grades are weighted equally in your course grades. Because case solutions are discussed in class, late cases will not be accepted under any circumstances. Problem Sets: There will be six problem sets. Your worst problem set grade is thrown out – that is only the highest 5 grades count. As with cases, problem sets should be done in groups of 3 members (MBA Assignment Type A). Students are responsible for organizing these groups. Each assignment will be distributed one week in advance and is due by 5pm on the due date. Problem Sets and solutions will be available only in Angel. Submitted problem sets will be graded on √ √ √ a + = 3, = 2, − = 1 basis. Although grades will be assigned to six assignments, only your highest five grades will count towards your course grade. Late problem sets will not be accepted under any circumstances. Class Participation: You will gain points by regularly attending class, being prepared, answering questions, asking questions, generally by providing positive externalities to the other members of the class. You lose points by not coming to class, not participating in the class, not being prepared, and particularly by distracting or disruptive behavior. Please note that laptops and cell phones should be turned off Weekly Canvas Quizzes: Each week, students must take a short quiz on Canvas between Wednesday at 6pm and the following Monday at 10:30am. Each quiz consists of no more than three review questions based on the weeks lectures and readings. Quizzes must be taken individually. Any books, references, computing or calculating equipment may be used. Quiz scores count towards the participation component of your grade. Solutions will be posted soon after quizzes are due. Mid-Term Examination: The mid-term exam will be held on Thursday March 13 at 9 am (room TBA). Any books, references, computing or calculating equipment may be used. End-of-Term Exam: The end-of-term exam will be on May 8 at 9 am. The exam, like the mid-term, is open book: any books, references, computing or calculating equipment may be used. B8306 – Capital Markets – Daniel – Preliminary Syllabus 3 Review Sessions and Office Hours: There will generally be two review sessions each Fridays – from 9-10:30am in Uris 303, and from 2:15-3:45 in Uris 141. I will conduct one, and the course teaching assistant will run a second review session. We run two sessions so as to provide you with some extra flexibility and choice. These sessions are completely optional, and no new material will be covered. In addition to the weekly review sessions, I will conduct a review session prior to the midterm and final exams. I prepare nothing new for the review sessions. I am happy to work through the problems in the problem sets, other problems, to answer questions, or to explain the material in different ways. Please come prepared with questions. I have no scheduled office hours; in the past I have found that most students get their questions answered at the weekly review sessions. However, if you still don’t understand something after attending the review session you should make an appointment to see either the teaching assistant for the course, or to see me. Tips for Studying Finance: 1. Work Problems: In my experience, working problems is an integral part of learning finance. While intuition is very important, the language of finance is mathematics, and you will need to learn how to apply this language to make financial decisions. The only way to learn how to do this is by working problems. Try to work through the the assigned problem sets on your own before getting together with your homework group. Additionally, there are problems at end of each chapter in the textbook (BKM), and solutions to these problems in the Student Solutions Manual for BKM. Finaly, most of the weekly review sessions will probably be devoted to working through problems. 2. Ask Questions: Ask questions in class. If you have a question about something, you can be assured that someone else has a similar question. Ask questions at the review sessions. Ask lots of questions in your homework/case groups. 3. Don’t Fall Behind: Between classes, recruiting, other demands on your time, the spring term of your first year will one of your most difficult. Keeping up with the material is important. B8306 – Capital Markets – Daniel – Preliminary Syllabus 4 IV. Course Outline This is a tentative schedule of topics that will be covered. Class dates and assignment due dates are subject to change. Lecture Notes will all be handed out in class, and will also be available on Canvas. Cls 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 † The Date 29-Jan 3-Feb 5-Feb 10-Feb 12-Feb 17-Feb 24-Feb 25-Feb∗∗ 26-Feb 3-Mar 5-Mar 10-Mar 13-Mar 24-Mar 26-Mar 31-Mar 2-Apr 7-Apr TBD∗∗ 14-Apr 16-Apr 21-Apr 23-Apr 28-Apr 30-Apr 8-May Sec.† Intro Intro FI FI FI FI FI EQ EQ EQ EQ EQ EQ PE PE BeFi BeFi BeFi Deriv Deriv Deriv Deriv Deriv Deriv Topic Course Outline and Background Shorting, Leverage, and No-arbitrage Pricing STRIPS and Coupon Bonds Term Structure of Interest Rates Interest Rate Risk (Duration) Risk Management (Immunization) Interest Rate Swaps Approaches to Valuation Diversification The Efficient Frontier The CAPM – Theory The CAPM – Applications Midterm Examination – 9 am. CAPM Anomalies Beyond the CAPM Performance Evaluation Biases & Limits to Arbitrage Empirical Anomalies Guest Speaker: TBD Payoffs and Arbitrage Relationships Replicating an Option Binomial Model Black-Scholes Valuation Applications and Trading Strategies Derivative Applications/Course Synthesis End-of-Term Exam – 9 am. BKM‡ Chptrs 1, 2 2, 3 14 15 16 16 16 5, 18 6 7 8, 9 8, 9 9, 11 10, 13 4, 24 12 12 26, 27 20 21 21 21 21 21 Assign Case 0 HW 0 Assign DueDate∗ 3-Feb 10-Feb HW 1 Case 1 19-Feb 17-Feb HW 2 26-Feb HW 3 5-Mar HW 4 Case 2 3-Apr 31-Mar HW 5 TBD HW 6 23-Apr Case 3 28-Apr course Sections are: Introduction, Fixed Income (FI), Equities (EQ), Performance Evaluation (PE), Behavioral Finance (BeFi), and Derivative Securities. ‡ BKM refers to the textbook by Bodie, Kane and Marcus. You should at least skim the relevant chapters prior to the lecture. ∗ Case assignments are due by 10:30 am on the due date. Problem Set assigments are due by 5 pm on the due date. ∗∗ Note that there is no class on Wednesday, February 19, or on Wednesday April 9. There is a regular class on the evening of Tuesday February 25 (room & time TBD), and we will have a guest speaker the week of April 7 (date, time and room TBD). Attendance for these two sessions is not mandatory, and both of these will be recorded and posted on the web.