INTERMEDIATE

ACCOUNTING

Sixth Canadian Edition

KIESO, WEYGANDT, WARFIELD, IRVINE, SILVESTER, YOUNG, WIECEK

Prepared by

Gabriela H. Schneider, CMA; Grant MacEwan College

CHAPTER

24

Full Disclosure in

Financial Reporting

Learning Objectives

1. Review the full disclosure principle and describe

problems of implementation.

2. Explain the use of notes in financial statement

preparation.

3. Describe the disclosure requirements for major

segments of a business.

4. Describe the accounting problems associated

with interim reporting.

Learning Objectives

5. Identify the major disclosures found in the

auditor’s report.

6. Understand management’s responsibilities for

financials.

7. Identify issues related to financial forecasts and

projections.

8. Describe the profession’s response to

fraudulent financial reporting.

Full Disclosure in

Financial Reporting

Current

Auditors

Reporting

and

Issues

Management

Reports

Auditor’s

Forecasts or

Increase in Accounting Special

report

projections

reporting

policies

transactions

Internet

Management’s

requireCommon or events

financial

reports

ments

reporting

notes

Post

Diversified

Fraudulent

Differential

balance

companies

financial

disclosure

sheet

reporting

Interim

events

reports

Criteria for

accounting

and reporting

choices

Full

Disclosure

Principle

Notes to

Disclosure

Financial Issues

Statements

The Full Disclosure Principle

• The full disclosure principle calls for financial

reporting of significant facts affecting the

judgment of an informed reader

• The problems of implementing this principle

are costs of disclosure or information overload

• The profession is still in the process of

developing guidelines as to

• whether a given transaction should be disclosed

• what format this disclosure should take

Increase in

Reporting Requirements

• Reasons for increasing reporting

requirements:

• Complexity of the business environment

(derivatives, business combinations,

pensions)

• Need for timely information (interim data,

forecasts)

• Accounting used as a control and monitoring

device

Differential Disclosure

• The OSC requires that companies report certain

important information items (if not found in the

annual report)

• Nonpublic enterprises are exempt from certain

reporting requirements (e.g., segment

reporting)

• Arguments are also made for excluding small

companies from certain complex reporting

requirements (e.g., pensions, deferred taxes)

• CICA is proposing a simplified GAAP; FASB

maintains the position of a single GAAP

Notes to the

Financial Statements

• Notes amplify or explain items presented in

the body of the financial statements

• A statement that identifies the accounting

policies of the entity must be disclosed

(Summary of Significant Accounting Policies)

• Notes to the financial statements include:

• Inventory

• Contingencies and commitments

• Changes in accounting policies

Notes to the

Financial Statements

• Major disclosures

• Inventory

• Property, Plant and

Equipment

• Liabilities

• Equity

• Contingencies and

Commitments

• Taxes, Pensions and

Leases

• Changes in Accounting

Policies

• Special

Transactions or

Events

• Subsequent

events

• Segment

reporting

• Interim

reporting

• Related

party

transactions

• Accounting

errors

• Illegal acts

Related Party Transactions

• Can significantly influence policies

• Measurement is a major accounting and

reporting issue

• Related party transactions are

individually assessed

Related Party Transactions –

Decision Tree

Related party transaction occurs

Is transaction in the

normal course of

operations?

No

Is there a substantive

change in the ownership interests of the

item transferred?

No

Yes

Is the amount of the

Yes exchange supported

Yes

by independent

evidence?

Yes

No

Is there culmination of

the earnings process?

No

Measure at carrying amount

Is the

transaction

non-monetary?

No

Yes

Measure at exchange amount

Related Party Transactions

The following disclosures are recommended:

• The nature of the relationship

• Description of the transactions

• The recorded amounts of transactions

• Measurement basis used

• Amounts due from or due to related parties

at the balance sheet date, and terms and

conditions

• Contractual obligations with related parties

• Contingencies involving related parties

Post-Balance Sheet Events

• Notes to the financial statements must explain

• Any significant financial events that occurred

after the balance sheet date, but before the

issue of the financial statements

Financial statement period

Post balance sheet events

Balance

sheet date

Issue date

Types of Transactions

to be Disclosed

• Two types of post-balance sheet events

must be disclosed

• Events that provide additional evidence

about conditions that existed at balance

sheet date and require adjustment

• e.g., customer’s bankruptcy

• Events that provide evidence about

conditions that did not exist at balance

sheet date and do not require adjustment

• e.g., bond or share issuance

Reporting for Diversified

(Conglomerate) Companies

• Information on how the segment contributes to

the total business operations

• Information from the segment income

statement, balance sheet, and cash flow

statement

• Information about segment’s contribution or

impact on the company’s

• Profitability

• Risk

• Growth potential

• Considerable arguments both for and against

segment reporting

Reporting for Diversified

(Conglomerate) Companies

•

•

What is an operating segment?

Any component of an enterprise that

1. Engages in business activities

•

Earns revenues, incurs expenses

2. Has senior management regularly review

results

•

•

Assess performance

Review resource allocation decisions made

3. Has discrete financial information available

Reporting for Diversified

(Conglomerate) Companies

•

Objectives of reporting segmented

information

1. To better understand performance

2. To better assess future cash flow

prospects

3. To make more informed judgments on

the whole enterprise

Reporting by Conglomerates:

Operating Segments

• CICA Handbook requires that the

financial statements include selected

information on a single basis of

segmentation

• The segments are evident from their

organizational structure (operating

segments)

• This method is called the management

approach

Aggregation of

Operating Segments

• Operating segments may be aggregated if

they have the same basic characteristics

• the nature of the products and services

provided

• the nature of the production process

• the type or class of customer

• the methods of product or service distribution

• the nature of the regulatory environment, if

applicable

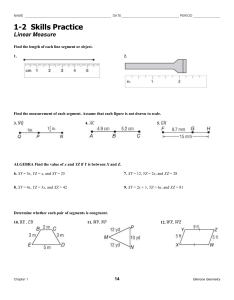

Reportable Segments

•

An operating segment is identified as a

reportable segment if it satisfies one or more

of the following criteria

1. The revenue criterion

2. The profit or loss criterion

3. The identifiable assets criterion

•

Two other factors are considered in addition to

the above tests

1. Segment results are 75 percent or more of

combined sales to unrelated customers

2. No more than 10 segments are required to be

disclosed

Reportable Segments

Criterion

Thresholds

Revenue

10 percent or more of the combined

revenue of all operating segments

Profit or loss

10 percent or more of the greater of:

- the combined profit of all operating

segments not showing a loss or

- the combined loss of all operating

segments reporting a loss

Identifiable assets

10 percent or more of the combined

assets of all operating segments

Measurement Principles

• The accounting principles used for segment

reporting and for consolidated statements

need not be the same

• Some accounting principles may not apply at

the segment level

• Common costs are not required to be allocated

among the segments

• Such allocation is arbitrary and may not produce

an objective division of costs among segments

Required Segmented

Information

• General information about its reportable

segments

• Segment profit and loss, assets, and related

information

• Reconciliation of segment revenues, profits

and losses, and segment assets

• Information about products and services and

geographical areas

• Major customers

Interim Reporting

Discrete View

Integral View

• Each interim period

considered as separate

accounting period

• Deferrals and accruals

recognized for each

interim period, without

specific consideration of

the fiscal year

• CICA Handbook

preferred method – with

noted exceptions

• Each interim period

considered a part of the

fiscal accounting period

• Deferrals and accruals

recognized in the interim

period, based on the

respective portion of the

fiscal year

Interim Reporting

•

Annual reports and interim reports must use

the same accounting principles

•

•

Exceptions regarding certain inventory reporting

Minimum disclosure requirements include:

1.

2.

3.

4.

5.

6.

7.

8.

Any noncompliance with GAAP

Accounting policies and methods

Any seasonal or cyclical period considerations

Estimate changes

Reportable segment information

Events subsequent to interim reporting period

Notable events (combinations, reorganization)

Contingencies

Interim Reporting Problem Areas

1. Advertising and similar costs

•

Test is whether the benefits extend beyond the

current interim period. If yes, then defer; otherwise

expense

2. Changes in Accounting

•

•

Changes applied retroactively to prior interim periods

Comparable interim periods from previous fiscal years

also restated

3. Earnings per share

•

Each interim period EPS is stand alone

4. Seasonality

5. Continuing Controversy

Auditor’s Reporting Standards

CICA Handbook, Section 5100

1. Identify the financial statements

•

Distinguish management and auditor’s

responsibilities

2. Describe scope of the auditor’s examination

3. State either an opinion or statement that an

opinion cannot be expressed

• If an opinion is provided, it should state

whether the statement fairly presents the

financial position, operating results, and cash

flows in accordance with GAAP

Auditor’s Opinion

The auditor can render or provide

•

•

•

•

An Unqualified (clean) opinion

A Qualified opinion

An Adverse opinion (circumstances)

A disclaimer of an opinion (no opinion can

be given)

Management’s Report

Management’s Discussion and Analysis (MD&A)

•

Covers three aspects of an enterprise

1. Liquidity

2. Capital resources

3. Results of operations

•

•

Identifies favourable or unfavourable trends

Identifies any significant events and uncertainties

that affect the three aspects

Management’s Report

MD&A raises continuing discussion and

questions

1. Is sufficient forward-looking information

disclosed?

2. Should disclosures become

more of a risk analysis?

3. Should the report be

externally audited?

Financial Forecasts

and Projections

• The investing public needs a greater quantity

and quality of information about corporate

expectations

• The disclosures take one of two forms

• Financial forecast of an entity’s expected financial

position

• Financial projection based on hypothetical

assumptions

• The difference is one of likelihood of

happening

Forecast Arguments

For

Against

• Information about the

future facilitates better

decisions

• Corporate disclosures

limit the speculation

about forecasts that are

informally circulated

• Historical information

may not be adequate in

a world of frequently

changing circumstances

• Information about the

future may be misleading

and unreliable

• Corporations may strive

to meet published

projections regardless of

shareholders’ interests

• Incorrect projections may

lead to legal actions

• Forecasts may provide

information to

competitors that may be

detrimental to corporate

interests

Internet Financial Reporting

• Companies are increasingly disclosing

financial information through websites

• Corporations can reach more users by the

Internet

• Internet reporting can make traditional

reports more useful

• Corporations can report more timely information

• They can also report disaggregated data

• There is concern about security on the

Internet (hackers)

Fraudulent Financial

Reporting

Issues of Fraudulent Financial Reporting

• How well are accounting practices and

disclosures serving the public?

• Are auditors meeting their obligations?

• What are the effects of the SEC’s policies?

• What are the effects of regulatory accounting

policies?

• What legislative proposals are needed to

correct perceived weaknesses?

Fraudulent Financial

Reporting

Opportunities exist when:

1. Board of directors or audit committee are

absent

2. Internal accounting controls are weak or

nonexistent

3. Unusual or complex transactions

4. Accounting estimates made with significant

subjective judgment

5. Internal audit staff ineffective

COPYRIGHT

Copyright © 2002 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by CANCOPY

(Canadian Reprography Collective) is unlawful.

Request for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may

make back-up copies for his / her own use only and

not for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information

contained herein.