Assessment and Good Practice Paper on

advertisement

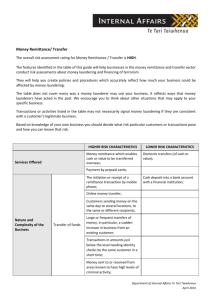

ASSESSMENT AND GOOD PRACTICE ON REMITTANCES by Antero Vahapassi ASIAN DEVELOPMENT BANK Second Labour Migration Ministerial Consultation for Countries of Origin in Asia 22-24 September 2004, Manila, Philippines 1 ADB and Remittances • Remittances have become a major source of external development finance • Remittances can accelerate private sector development • Remittances are believed to reduce poverty, as it is the poor who migrate and send back remittances • Migration is an informal risk reduction and coping strategy in social protection 2 ADB interventions in Migration • PHI - Enhancing efficiency of overseas workers remittances (TA No. 37590), approved in 2003, finished • REG - Southeast Asia workers remittance study (TA No. 38233), exp. approval 10/2004 • PHI - Remittance and migration (TA No. 38283), expected approval 2005 • REG - Promoting safe migration for women and prevention of trafficking of girls and women in the GMS (TA No. 37667), expected approval 2004 3 Focus of this presentation THIS PRESENTATION DRAWS ITS DATA MAINLY FROM THREE SOURCES: 1. Philippines TA study (No. 37590) 2. ADB study in India by U.K. Varma and S.K. Sasikumar (V.V. Giri National Labour Institute), 2004 3. ADB study in Bangladesh by Prof. T. Siddiqui (University of Dhaka), 2004 4 Remittances are a major source of external development finance Source: Dilip Ratha, Senior Economist, World Bank 5 Objectives of the Study on Flows of Remittances • • • To possibly increase remittance volumes Facilitate shift from informal to formal or regulated channels Encourage the use of remittances for sustainable poverty reduction 6 Stocks of Overseas Filipinos 7 Characteristics of Flows from Philippines • • • • • • Outflows are 2,700 daily/almost 1 million annually Overseas Filipinos are in the range of 7.6 million in 2003 197 Destination Economies– Mostly in ME, South-Asia and US Land-based and Sea-based Workers Professionals and Service Workers 65 to 70% of contract based are female 8 Characteristics of Flows from Bangladesh • On an average, 250,000 people annually migrate (1995-2003) • Total number of Bangladeshis working abroad is more than 3 million • Flow of remittance is more than US$ 3 billion in 2002-03, half of that from Saudi Arabia • Most migrants are men (women are less than 1 %) • Remittances have been around 35% of export earnings (more important than garments sector) 9 Characteristics of Flows from India • • People with technical skills and professional expertise migrated to the countries such as USA, Canada, UK and Australia as permanent migrants, since the early 1950s Unskilled and semi-skilled workers migrate to the oil exporting countries of the Middle East on temporary contracts, especially following the dramatic oil price increases of 1973-74 and 1979 10 Characteristics of Flows from India (cont.) • Around 1.25 million Indians emigrated to the US, Canada, UK and Australia between 1950-2000 • Today, some 3 million Indian migrants live in Gulf countries • Most migrants come from Kerala, Tamil Nadu, Andhra Pradesh and Punjab • However, internal migration is much larger: in 1991 census, 27.4%, i.e. 232 million, had migrated 11 Characteristics of Flows from India (cont.) • Currently, India is the world’s largest remittance recipient country; in 2002-03 the remittance flows amounted to US$ 15.2 billion Amount in US $ million Workers' Rem ittances to India 16000 14000 12000 10000 15174 12073 10341 8000 6000 4000 2000 0 12192 12290 11875 2083 116 2692 1970-71 1980-81 1990-91 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 Year 12 Remittance Characteristics • • Formal Flows through banks, exchange houses, and money transfer agencies Unregulated Flows consist of: Sent through unregulated ethnic stores, mail, cargo boxes Sent through friends Cash brought home Goods sent home 13 Remittance Trends in Philippines • • • Vibrant Competition due to long history of Philippine overseas deployment Convergence of services through partnerships, alliances and revenue sharing New Players and technology or card based remittance products Mobile Phones Internet based services Card Products Postal Office Entry of non-traditional players (credit unions, coops, microfinance institutions) OFW E-cards 14 Remittance Behavior in Philippines • 80% are remitting through banking or regulated channels • • • • 70% maintain bank accounts in the Philippines • Majority are interested to help contribute to community development • From 41 to 49% incur debt to migrate 90% save Average amount of remittance sent is US$340 Use of remittances dominantly for food, utilities, personal care and dwelling related expenses 15 Remittance Behavior in Bangladesh (based on a study in 2003) • 46% of the total volumes of remittance have been channeled through official sources • Around 40% through hundi • 4.6% moved through friends and relatives • About 8% were hand-carried by the migrant workers themselves 16 Remittance Behavior in Bangladesh: Why hundi? • the demand for foreign exchange from racketeers who wish to finance smuggling of various items including gold; • the demand from importers’ for foreign exchange from other sources in order to benefit from the existing tax regime by under-invoicing imports; • an unholy alliance among officials of financial institutions, business and hundi operators; • financing recruitment charges of the recruiters; • difference between official and unofficial exchange rates; and • quality and speed of service, and ability to reach clients both in destination countries and in the source 17 countries. Barriers to Remittance Flows (Philippines) • • • • • Anti-money laundering (AML) compliance First Mile Issues–Licensing costs/restrictive laws in certain countries The ‘Unbanked’ on both first and last mile Uneven Application of AML compliance Funding problems to upgrade infrastructure affects local and international interconnectivity 18 Barriers to Remittance Flows: High cost of sending money! Average: 13% 19 The Extra Mile–What can government, the private sector and civil society do to enhance formal remittance flows? • • • • • Financial Literacy and Information Programs Identify and support Best Practices on Remittance Leveraging of NGOs and LGUs Strengthen rural based financial and economic organizations by improving interconnectivity Organize and support initiatives of Associations of Overseas Workers Study and institute proper incentives system 20 Some recommendations • The governments should commit adequate resources to migration sector. • A large segment of informal remittance (padala-, hundi-, hawala-system) could be channeled to finance smuggling: review taxation policies, and tariff and duty structures (remove the red-tape). • Governments may give migrant workers the right to import goods that can be considered as remittance in kind. Such remittance in kind may be exempted from custom duties. • Banking systems and arrangements needs to be reviewed and revised, if necessary. 21 CLOSING • Good economic policy begins at home, not in sending workers abroad, no matter how green the proverbial grass may be at the other side. • Although remittances received from abroad have been seen as the next best alternative to countries that are permanently looking for foreign aid, research has shown that once a country is "addicted" to remittances, it is difficult to wean off of them. • However, before economic situation and labor markets allow migrant workers to work at home, the governments, civil society, and international agencies should find ways to improve the migrant workers’ economic, social and political status abroad, and help their families at home. 22 END For More Information E-mail socialprotection@adb.org ADB Web Site http://www.adb.org 23