Western Union - ZEN Portfolios

advertisement

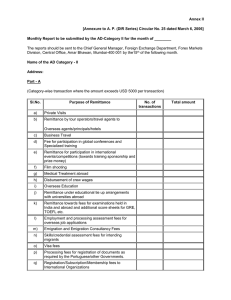

Yutao Tian BADM 466 Case Study—Western Union Managing Change Western Union is the worldwide money transfer leader. It attained reputation by providing consumers with fast and convenient ways to send and receive money all around the world. As an aggressive company, Western Union’s strategy is to focus on growing its global consumer and payment business. In order to accomplish its global objectives, Christina Gold, the CEO of Western Union, had begun implementing a new organization structure. This new structure is expected to help company’s expansion and fit for company’s global operations. The key point of Western Union’s change strategy is to change its focus on U.S. product line to regional structure with three main divisions. Under this strategy, the company’s operational structure, culture, marketing channels will be changed accordingly. In addition, how to handle the challenges and resistance of change will play an important role when company manages changes. In my opinion, having a regional structure is a wise way for companies which want global expansion. The reason is that regional structure allows each region to spend their time focusing on local customers’ needs and therefore company can provide excellent global service. In particularly, as a company in remittance market, mastering local situation and specific demands is an essential element to be succeeded. After setting the strategy objectives, Western Union faced challenges of implementing. Western Union wants to develop a global brand; therefore, how to make sure that each agent will provide same standard of service will be a challenge for WU. In other words, how WU can act as an entity when having more than 365,000 Agent locations in over 200 countries and territories. Based on Gold’ point of view, Western Union shows its respect to different culture by creating a regional structure. On the other hand, as a company, each region should have common goals and share a lot of ideas. I agree with point of view because this point will help a global company make sense. Western Union handles the challenges and resistance to change by improving its training and recruiting process, decentralization and increasing the number of agent location as well. However, some problems need to be further discussed, such as the profit and loss responsibility; and who will responsible for developing products. Personally speaking, I think what WU is trying to do is risky. Because its implementation steps can not help the company get the whole control of all regions or agent locations. Indeed, what WU is doing can improve customer service. However, it seems that WU needs more information and communication channel in order to know how each region operates. If the centric part of company lost control of regions, WU can not manage this change successfully, and it will lose opportunities to solve problems related to this change. My suggestions will be have WU shape its operational model by shifting to standard systems, but the marketing operation could be varied depends on local situations and culture. In addition, due to the downsizing of remittance market, WU may create a platform which will bring together key stakeholders to discuss opportunities and innovations in the global remittance industry and share experiences from all over the world on successful ways to strengthen remittance channels and create market incentives for customers to shift from informal to formal financial systems. Meanwhile, after defining the responsibility of developing products, WU may consider how innovative technology can be used to establish new products to generate competition among service providers. In conclusion, a main change in a company will bring up a number of related changes to be managed. Therefore, when companies are thinking of strategies to manage changes, they should come up with comprehensive implementing steps for not only the main change but also for the related changes.