The Creation of Tax Law

advertisement

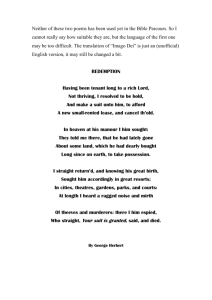

What is Effective Tax Planning? Maximize net present value of after-tax return on investment How does this differ from tax minimization? 1-1 Consider both tax and nontax factors Consider alternative forms of business transactions and their tax effects, versus an after-the-fact tax compliance approach Strategic, active participation in the tax system versus a passive, uninformed role What is a Tax? 1-2 A compulsory, non-penal transfer of resources from the private sector to the public sector Levied without receipt of a specific benefit Levied on a predetermined basis Typical tax formula: T = r B where T is the tax liability r is the tax rate B is the tax base Common Tax Bases 1-3 Income tax Payroll taxes - fund Social Security and Medicare Property taxes - usually on real property, but some states also impose on personal property Franchise tax - a tax on net worth Sales tax Value-added tax - a tax imposed on corporations theoretically based on the increase in value of a good ‘created’ by a corporation Wealth transfer taxes - gift and inheritance Objectives of Taxes Raising revenue Usually the most common objective, so that governmental (public) units have an income Economic objectives Specific tax provisions may be enacted to stimulate economic activity Examples: investment tax credit, lower tax rates to ‘jump start’ the economy in periods of recession Social objectives Tax provisions may be used to promote social welfare Examples: tax exempt organizations, taxes or credits (dependent-care, earned income) whose objective is to redistribute wealth 1-4 Some Conceptual Issues Tax incidence - identifying the party who ultimately bears the burden of taxation Example: taxes may be passed on to the consumer in the form of higher prices. Implies an inelastic demand curve. 1-5 Implicit taxes - taxes that are paid in the form of a lower return on investment in a taxfavored asset, rather than through explicit taxation Example: tax exempt municipal bonds, which typically pay lower pre-tax returns than taxable corporate bonds Tax Avoidance Vs. Evasion Tax Avoidance involves legal, legitimate tax planning techniques to reduce tax liability Tax Evasion involves illegal means to reduce tax liability A federal crime (felony offense) punishable by significant monetary penalties and imprisonment 1-6 The Creation of Tax Law In the beginning was the Act, then the Regulations and Interpretations. And the Act was without form and the Interpretations were void. And darkness was upon the faces of the taxpayers. And they spoke unto a member of the Revenue Service saying, “It is a crock of ___ and it stinketh.” And the member of the Revenue Service went to his Manager saying, “It is a crock of excrement, and none may abide its odor.” And the Manager went to the Commissioner of Internal Revenue saying, “It is a container of excrement, and is very strong, such that all are stunned by it.” And the Commissioner went before a member of Congress saying, “It is a vessel of fertilizer, and none may stand before its strength.” And the member of Congress went before the Joint Committee saying, “It contains that which aids plant growth, and it is very strong.” And the Joint Committee went before the House of Representatives and the Senate saying, ”It promotes growth and it is powerful.” And the House of Representatives and the Senate went before the President saying, “This powerful new law will promote employment and reduce the deficit.” 1-7 And the President looked upon the law and saw that it was good. And so it was written.