Adjustments to the final accounts

advertisement

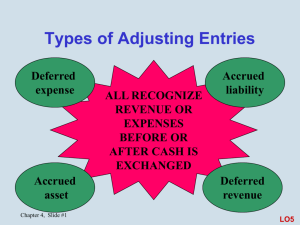

Adjustments to the final accounts Principles and procedures 1 Learning objectives 1. i. ii. iii. iv. v. Identify the main adjustments to the final accounts; Prepaid and accrued expenses Prepaid and accrued revenues Bad debts & provision for bad debts or doubtful debts Depreciation and provision for depreciation of fixed assets goodwill 2 Learning objectives 2. Explain and apply to problem situations. i. Show General Journal entries Show ledger accounts Prepare Profit & Loss a/c (extract) Prepare Balance Sheet (extract) ii. iii. iv. 3 Prerequisite knowledge 1. 2. 3. 4. Knowledge of Accounting concepts – accrual or matching concept Review nominal accounts; i.e. expense and revenue accounts Ability to post to ledgers Ability to prepare unadjusted final accounts. 4 Process 1. 2. 3. Explanation of concept Demonstration of principle Application to problem situation 5 Prepayments and Accruals: Reason Ensures that the matching or accruals concept is followed and that a true and fair valuation takes place. Thus, expenses for the period are matched against revenues earned in that period. Adjustments are necessary to show the actual expenses incurred and revenue earned whether or not they have been paid for or collected. 6 Problem situation 1- Accrued expense On June 5, 2002 John Doe paid electricity by cheque; $600. The electricity incurred for the period was actually $800. REQUIRED: Show the general journal and ledger entries and the P & L a/c and Balance sheet extracts. 7 General Journal Date Details 2002 Dec. 31 Electricity exp. a/c Accrued Electricity To record the amount of electricity incurred but not yet paid Profit & Loss a/c Electricity exp. a/c To close the electricity exp. a/c to the P & L a/c 2002 Dec. 31 F Debit Credit 200 200 800 800 8 Accrued expenses Electricity a/c 2002 Jun. 5 Bank Dec.31 Accrued bal.c/d $ 600. 2002 Dec.31 P & L a/c 200. 800. $ 800. 800. 2003 Jan. 1 Bal. b/d 200. 9 Profit & Loss a/c (extract) Gross Profit Less: Expenses Electricity Expense $ XXXX 800. 10 Balance sheet (extract) $ Liability and Owner’s Equity Current Liabilities: Accruals (Electricity exp.) 200. 11 Problem 2 – Prepaid Expense Jane Doe paid rent by cheque, $1 000. on July 9, 2002. Of this amount $300 represented part-payment for the following year. REQUIRED: Show the general journal and ledger entries and the P & L a/c and Balance sheet extracts. 12 General Journal Date Details F Debit 2002 Dec. 31 Prepaid Rent exp. a/c Rent expense a/c To record rent paid in advance 300 2002 Dec. 31 Profit & Loss a/c Rent Expense a/c To close the Rent exp. a/c to the P & L a/c 700 Credit 300 700 13 Prepaid Expenses Rent expense a/c 2002 July. 9 Bank $ 1 000 2002 Dec. 31 P & L a/c Prepaid Bal. c/d 1 000 2003 Jan. 1 Bal b/d 700. 300 1 000 300 14 Profit & Loss a/c (extract) Gross Profit Less: Expenses Rent Expense $ XXXX 700. 15 Balance sheet (extract) $ Assets Current Assets: Prepayments (Rent exp.) 300. 16 Prepaid and Accrued Revenues EXAMPLES: ► Rent received a/c ► Commission received a/c ► Discount received a/c ► Dividends received a/c ► Interest received a/c 17 Problem 3 – Accrued Revenue B. Mann is the owner of a Hot Dog Stand which he rents for $1 200 per year. At the end of the year he is owed $400 rent on the Hot Dog Stand. REQUIRED: Show the general journal and ledger entries and the P & L a/c and Balance sheet extracts. 18 General Journal Date Details F Debit 2002 Dec. 31 Accrued Rent rec. a/c Rent Receivable a/c To record rent earned but not yet received 400 2002 Dec. 31 Rent Receivable a/c Profit & Loss a/c To close the rent receivable a/c to the P & L a/c 1 200 Credit 400 1 200 19 Accrued Revenues Rent receivable a/c 2002 Dec. 31 P & L a/c 1 200 2002 Aug. 4 Cash Dec. 31 Accrued Bal.c/d 1 200 2003 Jan 1 Bal. b/d 800 400 1 200 400 20 Profit & Loss a/c (extract) $ XXXX Gross Profit Add: Other Revenue 1 200 21 Balance sheet (extract) $ Assets Current Assets: Accrued Revenue ( Rent) 400. 22 Problem 4 – Prepaid Revenues The following information is extracted from the books of W. Smith on Dec. 2002: Commissions received $1 800 Notes: One sixth of the cheque received for commission relates to the following year. REQUIRED: Show the general journal and ledger entries and the P & L a/c and Balance sheet extracts. 23 General Journal Date Details 2002 Dec. 31 Commissions Rec. a/c Prepaid Commission Rec. a/c To record commission receivable paid in advance 300 Commission receivable a/c Profit & Loss a/c To close off the commission receivable a/c to the P & L a/c 1 500 2002 Dec. 31 F Debit Credit 300 1 500 24 Prepaid Revenues Commissions receivable a/c 2002 Dec. 31 P & L a/c 1 500 Prepaid bal. c/d 300 1 800 2002 Dec. 31 Bank 1 800 1 800 2003 Jan. 1 Bal. b/d 300 25 Profit & Loss a/c (extract) $ XXXX Gross Profit Add: Other Revenue 1 500 26 Balance sheet (extract) $ Liabilities and Owner’s Equity Current Liabilities Prepaid Revenue (Commission) 300. 27 Exercise: See worksheet: Prepayments and accruals 28