OVERVIEW OF GRADUATE CURRICULUM DEVELOPMENT

advertisement

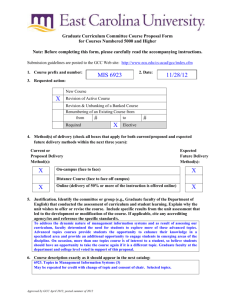

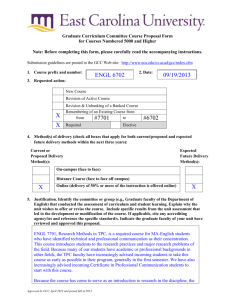

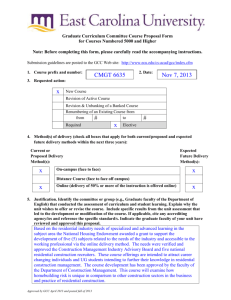

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 5000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. Submission guidelines are posted to the GCC Web site: http://www.ecu.edu/cs-acad/gcc/index.cfm 1. Course prefix and number: MATH 6300 2. Date: 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # Required # Elective 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): X On-campus (face to face) Expected Future Delivery Method(s): X Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification. Identify the committee or group (e.g., Graduate faculty of the Department of English) that conducted the assessment of curriculum and student learning. Explain why the unit wishes to offer or revise the course. Include specific results from the unit assessment that led to the development or modification of the course. If applicable, cite any accrediting agency/ies and reference the specific standard/s. Mathematical interest theory is a key requirement for passing the Actuarial Exam FM/2, the Probability Exam, and Exam MFE/3F, the Models for Financial Economics Exam. As such, the Mathematics Department faculty determined that offering a course in the Financial and Actuarial Mathematics would offer mathematics majors another career option, and it would provide both our students as well as the department further options in applied directions. This course is an addition to MATH 6100, which prepares the students for the Actuarial Exam P/1, the Probability Exam, and Exam C, the Construction and Evaluation of Actuarial Models Exam. Approved by GCC April 2012; posted summer of 2012 6. Course description exactly as it should appear in the next catalog: 6300. Financial and Actuarial Mathematics (3) P: Math 2172, 3307; or consent of instructor. A comprehensive introduction of the mathematical interest theory. Topics include time value of money, annuities, loan repayment, bond, valuation of derivative securities (European options, American options, Exotic options), Black-Scholes Model, delta-hedging risk management. Prepares the student for of the Society of Actuaries Exam FM “Financial Mathematics”, and MFE “Models for Financial Economics”. 7. If this is a course revision, briefly describe the requested change: 8. Course credit: Lecture Hours 3 Weekly OR Per Term Credit Hours s.h. Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Other (e.g., independent study) Please explain. Total Credit Hours 9. Anticipated annual student enrollment: s.h. 3 10 10. Changes in degree hours of your programs: Degree(s)/Program(s) Changes in Degree Hours 11. Affected degrees or academic programs, other than your programs: Degree(s)/Program(s) Changes in Degree Hours 12. Overlapping or duplication with affected units or programs: X Not applicable Documentation of notification to the affected academic degree programs is attached. 13. Council for Teacher Education (CTE) approval (for courses affecting teacher education): X Not applicable Approved by GCC April 2012; posted summer of 2012 s.h. Applicable and CTE has given their approval. 14. University Service-Learning Committee (USLC) approval: X Not applicable Applicable and USLC has given their approval. 15. Statements of support: a. Staff X Current staff is adequate Additional staff is needed (describe needs in the box below): b. Facilities X Current facilities are adequate Additional facilities are needed (describe needs in the box below): c. Library X Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Unit computer resources X Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): e. ITCS resources X ITCS resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software Approval from the Director of ITCS attached 16. Course information (see: Graduate Curriculum and Program Development Manual for instructions): a. Textbook(s) and/or readings: author(s), name, publication date, publisher, and city/state/country. Include ISBN (when applicable). Mathematical Interest Theory (second edition), by L. J. Federer Vaaler & J. W. Daniel, 2009, MAA, Washington, DC, ISBN 978-0-88385-754-0 Derivative Markets (third edition), by R. L. McDonald, 2009, Prentice Hall, ISPB 978-0321543080 Approved by GCC April 2012; posted summer of 2012 b. Course objectives for the course (student – centered, behavioral focus) If this is a 5000-level course that is populated by undergraduate and graduate students, there must be differentiation in the learning objectives expected. Upon completion of this course, students will be able to: 1. Write an equation of value given a set of cash flows and an interest rate 2. Calculate the value of annuities given level of payments, type(immediate/due), and interest rates. 3. Calculate the outstanding loan balance at any point in time. 4. Calculate the amount of interest and principal repayment of a loan payment at any point in time. 5. Given any four of price, redemption value, yield rate, coupon rate, and term of bond, calculate the remaining term. 6. Evaluate an investor’s margin position based on changes in asset values. 7. Evaluate the payoff and profit of basic derivative contracts. 8. Use the concepts of no-arbitrage to determine the theoretical value of futures and forwards. 9. Calculate the value of options using binomial model and Black-Scholes formula. 10. Explain and demonstrate how to control risk using the method of delta hedging. c. Course topic outline The list of topics should reflect the stated objectives. 1. Growth of money Accumulation and amount function Simple interest and compound interest Simple discount and compound discount Force of interest 2. Annuities Annuities immediate/due Perpetuities Non-level annuities 3. Loan repayment Amortized loans and amortization schedule The sinking fund method 4. Bonds Basic bond formula The premium-discount formula Bond amortization schedule 5. Stocks and financial markets Hedging Arbitrage Futures/forwards/options 6. Valuation of options European, American, Exotic options Binomial tree method Black Scholes Model Approved by GCC April 2012; posted summer of 2012 d. List of course assignments, weighting of each assignment, and grading/evaluation system for determining a grade Quizzes (15%) 3 Tests (3*15=45%) Homework (10%) 1 Final (30%) Grade in course: A: 90% and above B: 80-89% C: 70-89% F: 69% and below Approved by GCC April 2012; posted summer of 2012