Boundless Study Slides

advertisement

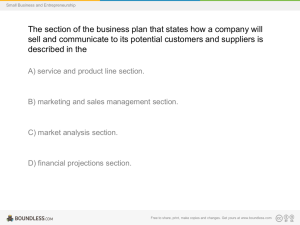

Boundless Lecture Slides Available on the Boundless Teaching Platform Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless Teaching Platform Boundless empowers educators to engage their students with affordable, customizable textbooks and intuitive teaching tools. The free Boundless Teaching Platform gives educators the ability to customize textbooks in more than 20 subjects that align to hundreds of popular titles. Get started by using high quality Boundless books, or make switching to our platform easier by building from Boundless content pre-organized to match the assigned textbook. This platform gives educators the tools they need to assign readings and assessments, monitor student activity, and lead their classes with pre-made teaching resources. Using Boundless Presentations The Appendix The appendix is for you to use to add depth and breadth to your lectures. You can simply drag and drop slides from the appendix into the main presentation to make for a richer lecture experience. Get started now at: http://boundless.com/teaching-platform Free to edit, share, and copy Feel free to edit, share, and make as many copies of the Boundless presentations as you like. We encourage you to take these presentations and make them your own. If you have any questions or problems please email: educators@boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com About Boundless Boundless is an innovative technology company making education more affordable and accessible for students everywhere. The company creates the world’s best open educational content in 20+ subjects that align to more than 1,000 popular college textbooks. Boundless integrates learning technology into all its premium books to help students study more efficiently at a fraction of the cost of traditional textbooks. The company also empowers educators to engage their students more effectively through customizable books and intuitive teaching tools as part of the Boundless Teaching Platform. More than 2 million learners access Boundless free and premium content each month across the company’s wide distribution platforms, including its website, iOS apps, Kindle books, and iBooks. To get started learning or teaching with Boundless, visit boundless.com. Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements > Profitability Ratios Profitability Ratios • Basic Earning Power (BEP) Ratio • Return on Common Equity • Return on Total Assets • Profit Margin • Operating Margin Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting?campaign_content=book_378_section_102&campaign_term=Accounting&utm_campaign=powerpoint&utm _medium=direct&utm_source=boundless Analyzing Financial Statements > Profitability Ratios Basic Earning Power (BEP) Ratio • The higher the BEP ratio, the more effective a company is at generating income from its assets. • Using EBIT instead of operating income means that the ratio considers all income earned by the company, not just income from operating activity. This gives a more complete picture of how the company makes money. • BEP is useful for comparing firms with different tax situations and different degrees of financial leverage. Basic Earnings Power Ratio View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting/textbooks/boundless-accounting-textbook/analyzing-financial-statements-16/profitability-ratios-102/basicearning-power-bep-ratio-422- Analyzing Financial Statements > Profitability Ratios Return on Common Equity • ROE is net income divided by total shareholders' equity. • ROE is also the product of return on assets (ROA) and financial leverage. • ROE shows how well a company uses investment funds to generate earnings growth. There is no standard for a good or bad ROE, but a higher ROE is better. Return on Equity View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting/textbooks/boundless-accounting-textbook/analyzing-financial-statements-16/profitability-ratios-102/returnon-common-equity-423- Analyzing Financial Statements > Profitability Ratios Return on Total Assets • ROA is net income divided by total assets. • The ROA is the product of two common ratios: profit margin and asset turnover. • A higher ROA is better, but there is no metric for a good or bad ROA. An ROA depends on the company, the industry and the economic environment. • ROA is based on the book value of assets, which can be starkly different from the market value of assets. Return on Assets View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting/textbooks/boundless-accounting-textbook/analyzing-financial-statements-16/profitability-ratios-102/returnon-total-assets-424- Analyzing Financial Statements > Profitability Ratios Profit Margin • Profit margin is the profit divided by revenue. • There are two types of profit margin: gross profit margin and net profit margin. • A higher profit margin is better for the company, but there may be strategic decisions made to lower the profit margin or to even have it be negative. Net Profit Margin View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting/textbooks/boundless-accounting-textbook/analyzing-financial-statements-16/profitability-ratios-102/profitmargin-425- Analyzing Financial Statements > Profitability Ratios Operating Margin • The operating margin equals operating income divided by revenue. • The operating margin shows how much profit a company makes for each dollar in revenue. Since revenues and expenses are considered 'operating' in most companies, this is a good way to measure a company's profitability. • Although It is a good starting point for analyzing many companies, there are items like interest and taxes that are not included in operating income. Therefore, the operating margin is an imperfect measurement a company's profitability. Operating margin formula View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.www/boundless.com/accounting/textbooks/boundless-accounting-textbook/analyzing-financial-statements-16/profitability-ratios102/operating-margin-426- Appendix Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements Key terms • asset Something or someone of any value; any portion of one's property or effects so considered. • EBIT Earnings before interest and taxes. A measure of a business's profitability. • equity Ownership, especially in terms of net monetary value, of a business. • gross profit The difference between net sales and the cost of goods sold. • net income Gross profit minus operating expenses and taxes. • net profit The gross revenue minus all expenses. • operating income Revenue - operating expenses. (Does not include other expenses such as taxes and depreciation). • Return on Assets A measure of a company's profitability. Calculated by dividing the net income for an accounting period by the average of the total assets the business held during that same period. Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements Return on Assets The return on assets ratio is net income divided by total assets. That can then be broken down into the product of profit margins and asset turnover. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikipedia. "Return on assets Du Pont." GNU FDL http://en.wikipedia.org/wiki/Return_on_assets_Du_Pont View on Boundless.com Analyzing Financial Statements Basic Earnings Power Ratio BEP is calculated as the ratio of Earnings Before Interest and Taxes to Total Assets. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikipedia. "Financial ratio." GNU FDL http://en.wikipedia.org/wiki/Financial_ratio View on Boundless.com Analyzing Financial Statements Operating margin formula The operating margin is found by dividing net operating income by total revenue. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikipedia. "Operating margin." GNU FDL http://en.wikipedia.org/wiki/Operating_margin View on Boundless.com Analyzing Financial Statements Return on Equity The return on equity is a ratio of net income to equity. It is a measure of how effective the equity is at generating income. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikipedia. "Return on assets Du Pont." GNU FDL http://en.wikipedia.org/wiki/Return_on_assets_Du_Pont View on Boundless.com Analyzing Financial Statements Gross Profit Margin The percentage of gross profit earned on the company's sales. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikibooks. "GCSE Business Studies/Ratio Analysis." CC BY-SA 3.0 http://en.wikibooks.org/wiki/GCSE_Business_Studies/Ratio_Analysis View on Boundless.com Analyzing Financial Statements Net Profit Margin The percentage of net profit (gross profit minus all other expenses) earned on a company's sales. Free to share, print, make copies and changes. Get yours at www.boundless.com Wikibooks. "GCSE Business Studies/Ratio Analysis." CC BY-SA 3.0 http://en.wikibooks.org/wiki/GCSE_Business_Studies/Ratio_Analysis View on Boundless.com Analyzing Financial Statements At the end of a fiscal year, a company had $8,000,000 in revenues, $6,000,000 in operating expenses and $500,000 in non-operating revenue. Its total assets at the end of the year was $15,000,000. What is its Basic Earning Power ratio? A) 0.1333 B) 0.5667 C) 1.667 D) 0.1667 Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements At the end of a fiscal year, a company had $8,000,000 in revenues, $6,000,000 in operating expenses and $500,000 in non-operating revenue. Its total assets at the end of the year was $15,000,000. What is its Basic Earning Power ratio? A) 0.1333 B) 0.5667 C) 1.667 D) 0.1667 Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Analyzing Financial Statements A company has assets of $2,000,000, net sales of $3,000,000, and $1,500,000 in equity. Its net income is $10,000,000. What is its return on equity? A) 6.667 B) .15 C) 3.333 D) 5 Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements A company has assets of $2,000,000, net sales of $3,000,000, and $1,500,000 in equity. Its net income is $10,000,000. What is its return on equity? A) 6.667 B) .15 C) 3.333 D) 5 Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Analyzing Financial Statements A company had $5,000,000 in total revenues for its fiscal year. Its expenses for the year were $3,500,000. Its total assets were $12,500,000. What is the company's return on assets for the fiscal year? A) 0.12 B) 0.40 C) 0.28 D) 0.70 Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements A company had $5,000,000 in total revenues for its fiscal year. Its expenses for the year were $3,500,000. Its total assets were $12,500,000. What is the company's return on assets for the fiscal year? A) 0.12 B) 0.40 C) 0.28 D) 0.70 Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Analyzing Financial Statements During a fiscal year, a company had $25,000,000 in total sales. It had a cost of goods sold (COGS) of $18,000,000 and $4,000,000 in additional expenses. What is the company's gross profit margin? A) 12% B) 16% C) 28% D) 33.33% Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements During a fiscal year, a company had $25,000,000 in total sales. It had a cost of goods sold (COGS) of $18,000,000 and $4,000,000 in additional expenses. What is the company's gross profit margin? A) 12% B) 16% C) 28% D) 33.33% Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Analyzing Financial Statements During a fiscal year, a company has $20,000,000 in revenue. Its operating expenses are $17,000,000. What is the company's operating margin? A) 0.85 B) .73 C) 0.15 D) .13 Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements During a fiscal year, a company has $20,000,000 in revenue. Its operating expenses are $17,000,000. What is the company's operating margin? A) 0.85 B) .73 C) 0.15 D) .13 Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Analyzing Financial Statements Attribution • Wikipedia. "Return on assets Du Pont." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Return_on_assets_Du_Pont • Wikipedia. "Return on assets." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Return_on_assets • Wiktionary. "asset." CC BY-SA 3.0 http://en.wiktionary.org/wiki/asset • Wiktionary. "net income." CC BY-SA 3.0 http://en.wiktionary.org/wiki/net+income • Wikipedia. "Earnings before interest and taxes." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Earnings_before_interest_and_taxes • Slideshare. "Financial Statement Analysis." CC BY-SA http://www.slideshare.net/nristreet/financial-statement-analysis12978969 • Connexions. "Profitability Ratios." CC BY 3.0 http://cnx.org/content/m15556/1.8/ • Wikipedia. "EBIT." CC BY-SA 3.0 http://en.wikipedia.org/wiki/EBIT • Wikipedia. "Return on Assets." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Return%20on%20Assets • Wikibooks. "GCSE Business Studies/Ratio Analysis." CC BY-SA 3.0 http://en.wikibooks.org/wiki/GCSE_Business_Studies/Ratio_Analysis • Wikipedia. "Net profit." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Net_profit • Wikipedia. "Profit margin." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Profit_margin • Wiktionary. "gross profit." CC BY-SA 3.0 http://en.wiktionary.org/wiki/gross+profit • Wiktionary. "net profit." CC BY-SA 3.0 http://en.wiktionary.org/wiki/net+profit • Wikipedia. "Return on equity." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Return_on_equity • Wikipedia. "Equity (finance)." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Equity_(finance) • Wiktionary. "equity." CC BY-SA 3.0 http://en.wiktionary.org/wiki/equity Free to share, print, make copies and changes. Get yours at www.boundless.com Analyzing Financial Statements • Wikipedia. "Financial ratio." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Financial_ratio • Wikipedia. "Operating margin." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Operating_margin • Boundless Learning. "Boundless." CC BY-SA 3.0 http://www.boundless.com//finance/definition/operating-income Free to share, print, make copies and changes. Get yours at www.boundless.com