Loans

advertisement

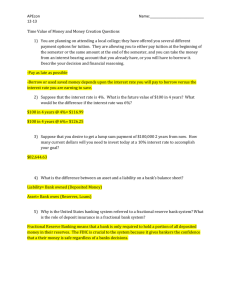

Treasury Yield Curves (Measure of Market Traders’ DY/Y and DP/P Expectations) Web address: http://www.federalreserve.gov/releases/h15/ No revisions, instant data from bond markets Reflects the collective wisdom on the likely direction of the economy (DY/Y) and inflation (DP/P). Expectations of future economic growth and inflation determine which Treasury debt securities are the most attractive to buy. The yield curve shape is a powerful forecasting tool. Federal Reserve sets short-term yields by targeting the fed funds interest rate. Bond traders determine longer-term yields. Normal Yield Curve Shape: Lower short-term yields with yields gradually rising with bond maturity. (longer maturities face greater unknown risks – war, politics, DP/P - and hence require higher returns). The 3-month versus 30-year spread is about 2.5 percentage points with a normal yield curve. Steep Yield Curve Shape: Federal Reserve lowers short term rates to counter recession or inflation fears induce bond traders to sell long-term bonds. The 3-month versus 30-year spread is greater than 2.5 percentage points. Flat Yield Curve Shape: The economy is in danger of slipping into recession resulting in lower inflation. Bond traders buy long-term bonds to lock in higher long term yields => long-term yields fall relative to short-term yields. Probability of recession is 50% according to a Federal Reserve study. Inverted Yield Curve Shape: Short-term yields higher than long-term yields. Siren call that a recession is coming. The bond market believes the Federal Reserve is keeping monetary policy to tight and money supply growth to low. The last seven recessions have been preceded by an inverted yield curve 9 months – on average - in advance. If yield inversion is greater than 2.4 percentage points, then probability of recession is 90% in the next 18 months. ------------------------------------------------------------------------------------------------------------------------------------------------ Market Analysis: Bonds: Yield curve represents bond market Stocks: Stock prices are based on expectations of future profits and economic activity, so the yield curve can serve as an effective market-timing strategy tool Dollar: Inverted Y.C. may reduce foreign investor appetite for U.S. assets if believe recession is coming => $. However, an inverted Y.C. may attract “hot money” into U.S. investments if short-term U.S. interest rates are significantly above overseas short-term interest rates => $ Treasury Yield Curves 6 Yield to Maturity 5 June 2007 4 April 2013 3 2 1 0 1 2 3 5 10 15 Years to Maturity 20 25 30 Interest Rates and Recessions 1988-2012 10 10 9 9 8 8 7 7 6 6 5 5 4 4 3 3 2 2 1 1 0 0 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Recession Baa Fed Funds 10-yr Treas What is owned Assets Reserves Liabilities + NW Deposits (Vault cash/Fed Dep.s) Investments Loans Lent Funds to Borrowers What is owed Bank Balance Sheet Consumer Business Student Channel Funds Building Checking Deposits Savings MMDA CDs IRAs Surplus Funds from Savers Borrowings Net Worth Assets = Liabilities + NW T –Account Shows D in balance sheet + Loans Real Interest Rate QSLF = D Deposits + Deposits QDLF = D Loans S=I Loanable funds Stock Vs Flow Chapter 14 Bank Balance Sheet Reserves Deposits that a bank keeps as cash in its vault or on deposit with the Federal Reserve. Bank run Many depositors simultaneously decide to withdraw money from a bank. Bank panic Many banks experiencing runs at the same time. Required reserves Reserves that a bank is legally required to hold, based on its checking account deposits. Required reserve ratio The minimum fraction of deposits banks are required by law to keep as reserves. Excess reserves Reserves that banks hold over and above the legal requirement. Fractional reserve banking system A banking system in which banks keep less than 100 percent of deposits as reserves. The Federal Reserve System How the Federal Reserve Manages the Money Supply Monetary policy The actions the Federal Reserve takes to manage the money supply and interest rates to pursue economic objectives. To manage the money supply, the Fed uses three monetary policy tools: Open market operations The buying and selling of Treasury securities by the Federal Reserve in order to control the money supply. Federal Open Market Committee (FOMC) The Federal Reserve committee responsible for open market operations and managing the money supply Discount policy Discount loans Loans the Federal Reserve makes to banks. Discount rate The interest rate the Federal Reserve charges on discount loans. Reserve requirements Assets FED RES Liab. + NW FX Reserves Currency in Treasury Circulation Bonds Assets HHs Liab. + NW Currency CHK Dep.s Loans Savings MMDA CDs Reserves Disc. Loans Other assets Required Reserves = Reserves = Required Reserves + Excess Reserves Reserves = Vault cash + Deposits at Fed Res 10% x CHK Deposits Assets BANKs Liab. + NW Reserves CHK Dep.s Treasury Bonds Loans Net Worth Savings MMDA CDs Disc. Loans Net Worth Federal Reserve Assume: Currency in Circulation -$100 1. 2. 3. RR = 0.10 x Deposits Banks Max. P ER = 0 Required Reserves +100 Credit Union B Clear checks between A,B,C,D Banks are the heart/pump of the economy Req. Reserves +8.10 Loans +72.90 Deposits +$72.90 Deposits +$81 Req. Reserves +10 Loans +90 Deposits +$100 Deposits +$90 HH Sector Savings & Loan C Bank D Req. Reserves +7.29 Loans +65.61 Req. Reserves +9 Loans +81 Bank A Cash = $100 The act of originating a loan, is the act of creating money Cash -$100 Dep. +100 Dep. +90 Loans +90 Dep. +81 Loans +81 Dep. +72.9 Loans +72.9 M1 = Curr + Chk Deposits Sum = Dep. + 900 Loans + 900 Sum of an Infinite Geometric Series Let OD = original deposit D Loans = 0.9 OD + 0.92 OD + 0.93 OD +… D Loans = 0.9 [OD + 0.9 OD + 0.92 OD +…] D Loans = 0.9 [OD + D Loans] (1- 0.9)D Loans = 0.9 OD D Loans = 0.9 OD (1 - 0.9) D Loans = 9 (100) D Loans = 900 = D Deposits D Loans Federal Reserve T-Bill +100 Reserves +100 Open Market Purchase 1. Fed buys T-Bill from bank A 2. Bank Excess Reserves 3. r = reserve requirement = 10% D Deposits = (1/r) x D Reserves $1,000 = (1/0.10) x $100 M1 = Curr + Chk Deposits Savings & Loan C Req. Reserves +9 Loans +81 Deposits +$90 Credit Union B Req. Reserves +10 Loans +90 Bank A Excess Res. +100 T-Bills -100 Excess Res. -100 Loans +100 Asset Exchange Portfolio Rebalance Deposits +$100 The act of originating a loan, is the act of creating money HH Sector Assets Liabilities Dep. +100 Loans +100 Dep. +90 Loans +90 Dep. +81 Loans +81 Sum = Dep. + 1,000 Loans + 1,000 Let x = loaned out/pass through % Let r = required reserve ratio = 1 - x Sum of Infinite Geometric Series S = 1 + x + x2 + x3 + … S = 1 + x [1 + x + x2 + …] S = 1 + x [ S] S–xS=1 S = 1/(1 - x) S = 1/r Simple deposit multiplier (ratio of D chk deposits / D reserves) If r = 10%, then multiplier = 10 D checking deposits = 1/r * D reserves $1,000 = 10 * $100 Recall Expenditure Multiplier DY = (1/1-MPC) x DI Producer Price Index (Measures changes in prices paid by businesses) Web: www.bls.gov/ppi One revision published with 4 month lag. Annual revision in February. PPI measures changes in prices that manufacturers and wholesales pay for goods during various stages of production. It is the oldest inflation measure; index began in 1902. Labor department issues questionnaires to 30,000 firms on 100,000 different items. A basket of goods is formed to create an index that starts at 100 and reflects average price of goods in 1982. PPI is the first inflation number of the month. Follow price changes along the production pipeline to determine where price pressures originate. 3 progressive stages of production give rise to 3 price indexes: PPI Crude Goods – cost of raw materials entering the market for the first time (wheat, cattle, soybeans, coal, crude petroleum, sand, timber). Price changes can be a function of changing supply which is a function of droughts, freezes, animal disease, geopolitical factors. Core Crude Goods – (nonfood materials less energy) is a good leading indicator of U.S. and world economic growth. This index responds quickly to shifts in economic activity. Prices are very sensitive to economic turning points. If businesses expect an increase in future demand, the demand for metals, paper boxes, timber will rise => price crude goods => price intermediate goods => price final goods. Price increases move down the production pipeline. PPI Intermediate Goods – cost of commodities that have undergone transitional processing (flour, paper, auto parts, leather, fabric) PPI Finished Goods – final processing stage (apparel, furniture, automobiles, meats, gasoline) Products retailers pay for. Total finished goods index is a measure of inflation in the long-run. Not a perfect leading indicator of consumer price inflation. There is a link between PPI finished goods and CPI. The two indexes may diverge on a month-to-month basis, but tend to move in tandem and are correlated over a longer (6-9 month) term. PPI does not include service prices or imported prices, whereas CPI does. Core PPI Finished Goods – excludes food and energy prices and gives a more accurate reading of the underlying inflation trend. The core rate index is a proxy for near-term inflation Inflation, DP/P, is public enemy number one to the financial markets. An PPI => CPI A 12-month perspective is a better way to view the PPI numbers. ------------------------------------------------------------------------------------------------------------------------------------------------ Market Analysis: Bonds: PPI => (DP/P)Et+1 => DBonds => iBonds Stocks: PPI => production costs => profits => dividends => price stocks Dollar: PPI => (DP/P)Et+1 => ishort-term => dollar 3 Stages of Production 3 Price Indexes Manufacturer 1 Crude Materials: Unmanufactured goods •Grains •Raw cotton •Scrap steel •Timber •Crude petroleum Manufacturer 2 Intermediate Goods: Semi-finished goods •Flour •Cotton yarn •Steel •Lumber •Petroleum Wholesaler Finished Goods: Ready for sale to final demand user •Bread •Apparel •Cars •Furniture •Gasoline Inflation (Producer Price Index) (year over year % growth) 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 -5% -5% -10% -10% -15% -15% Finished Goods Intermediate Materials, Supplies, Components Core Inflation (Producer Price Index) (year over year % growth) 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% -35% -40% 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Core Finished Goods Core Crude Goods Core Intermediate Materials, Supplies, Components 10 11 12 13 14 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% -35% -40%