Business Basics Selecting the right legal entity

advertisement

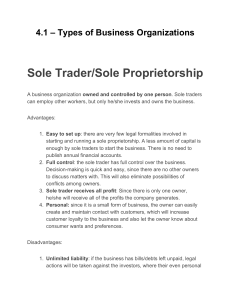

Business ownership Types of business ownership / responsibilities, investment & profits Business ownership Ownership types: o Sole Trader o Partnerships o Private Limited Company o Public Limited Company o Limited Liability Partnership o Cooperative o Community Interest company (CIC) Business ownership Snippets: o Sole traders must raise all the finance to set up and run the business themselves o Partners can all contribute to the financing of a firm o Private limited companies can sell shares to family, friends and associates o Public limited companies can raise finance by selling shares on the stock market Business ownership Limited liability explained: o A sole trader or partnership can be held responsible for all the debts of the firm o The owners of limited companies can only be held responsible up to the value of their investment in the business Business ownership Ownership and Control o Owners often want to keep control of their businesses o This leads many small firms to stay as sole traders, even though this limits their funds o Taking on new partners or shareholders cuts the amount of control that owners have o If you hold the majority of shares (over 50%) you can keep some control, but not all Business ownership Legal Responsibility: o Sole traders have no legal formalities to go through, apart from registering for VAT if their turnover reaches a certain amount o Partnerships also have no legal formalities but may choose to sign a Deed of Partnership o Companies have to go through a series of legal formalities Business ownership Registering as a Sole Trader: o Register as self-employed by contacting HM Revenue and Customs (HMRC) o Complete an annual self-assessment form for tax, so you need to keep accurate records to support this (we will cover this area on the finance module) o Pay Class 4 National Insurance Contributions which are payable as a percentage of your net profits when they reach a certain level, as well as fixed rate Class 2 NICS (currently £….. PW) Business ownership Forming a Limited Company: o Limited companies must produce two documents o Memorandum of Association and Articles of Association o If these are acceptable, the Registrar of Companies awards a Certificate of Incorporation o The company can then trade Business ownership Other Legal Requirements: o A limited company must also send a copy of its annual accounts to the Registrar o It must also hold an Annual General Meeting and invite its shareholders to attend o Becoming a Public Limited Company involves far more time and cost o It must have a minimum of £50,000 share capital Business ownership Where the Profits go: o Limited companies use part of their profits to pay a dividend to shareholders o They can choose not to pay a dividend but always have to pay interest on any borrowing the company has made o Profits can be ‘retained’ and ploughed back into the company Business ownership Profits and Losses: o Any profits made (once tax has been paid) can be kept by the owners of the business o This makes Sole Trader (and partnership) businesses very attractive o But remember … whatever funds have been put into the business will be lost if it goes bust! Business ownership Some sources of investment: o Loans o Overdrafts o Profits that are fed back into the business o Shares o Grants and donations o Crowd funding o Investors