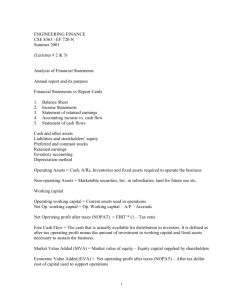

CasestudyonFinancialanalysis

advertisement

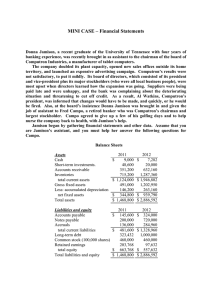

Donna Jamison was brought in as assistant to Fred Campo, Computron’s chairman, who had the task of getting the company back into a sound financial position. Computron’s 2006 and 2007 balance sheets and income statements, together with projections for 2008, are shown in the following tables. Also, the tables show the 2006 and 2007 financial ratios, along with industry average data. The 2008 projected financial statement data represent Jamison’s and Campo’s best guess for 2008 results, assuming that some new financing is arranged to get the company “over the hump.” Balance Sheets Assets 2006 2007 2008E Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets $ 9,000 $ 7,282 $14,000 48,600 20,000 71,632 351,200 632,160 878,000 715,200 1,287,360 1,716,480 $1,124,000 $1,946,802 $2,680,112 491,000 1,202,950 1,220,000 146,200 263,160 383,160 $ 344,800 $ 939,790 $ 836,840 $1,468,800 $2,886,592 $3,516,952 =================================== Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity $145,600 200,000 136,000 $481,600 323,432 460,000 $ 324,000 720,000 284,960 $1,328,960 1,000,000 460,000 $ 359,800 300,000 380,000 $1,039,800 500,000 1,680,936 203,768 97,632 296,216 $663,768 $ 557,632 $1,977,152 $1,468,800 $2,886,592 $3,516,952 =================================== Income Statements Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income $3,432,000 $5,834,400 $7,035,600 2,864,000 4,980,000 5,800,000 340,000 720,000 612,960 18,900 116,960 120,000 $3,222,900 $5,816,960 $6,532,960 $209,100 $17,440 $502,640 62,500 176,000 80,000 $ 146,600 ($ 158,560) $ 422,640 58,640 (63,424) 169,056 $ 87,960 ($95,136) $ 253,584 ================================== 2006 2007 $8.05 100,000 $0.880 $0.220 40% $ 6.638 $40,000 $6.00 100,000 ($0.951) 0.110 40% $ 5.576 $40,000 2008E Other Data Stock price Shares outstanding EPS DPS Tax rate Book value per share Lease payments Ratio Analysis Current Quick Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Debt Ratio TIE EBITDA coverage Profit Margin Basic earning power ROA ROE Price/earnings (P/E) Price/cash flow Market/book 2006 2.3X 0.8X 4.8X 37.3 10.0X 2.3X 54.8% 3.3X 2.6X 2.6% 14.2% 6.0% 13.3% 9.7X 8.0X 1.3X 2007 1.5X 0.5X 4.5X 39.6 6.2X 2.0X 80.7% 0.1X 0.8X 21.6% 0.6% 23.3% 217.1% 26.3X 27.5X 1.1X 2008E ------------------------------------------------------------------------------------------------- $12.16 100,000 $1.014 0.220 40% $ 7.909 $40,000 Industry Average 2.7X 1.0X 6.1X 32.0 7.0X 2.5X 50.0% 6.2X 8.0X 3.6% 17.8% 9.0% 17.9% 16.2X 7.6X 2.9X Note: “E” indicates estimated. The 2008 data are Jamison examined monthly data for 2007 (not given in the detected an improving pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December. Thus, the annual data looked somewhat worse than final monthly data. Also, it appeared to be taking longer for the advertising program to get the message across, for the new sales offices to generate sales, and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than Computron’s managers had anticipated. For these reasons, Jamison and Campo see hope for the company—provided it can survive in the short run. Jamison must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions should be taken. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers. a. Why are ratios useful? What are the five major categories of ratios? b. Calculate the 2008 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company’s liquidity position in 2006, 2007, and as projected for 2008? We often think of ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the liquidity ratios? c. Calculate the 2008 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does Computron’s utilization of assets stack up against that of other firms in its industry? d. Calculate the 2008 debt, times-interest-earned, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios? e. Calculate the 2008 profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you say about these ratios? f. Calculate the 2008 price/earnings ratio, price/cash flow ratio, and market/book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company? g. Perform a common size analysis and percent change analysis. What do these analyses tell you about Computron? h. Use the extended Du Pont equation to provide a summary and overview of Computron’s financial condition as projected for 2008. What are the firm’s major strengths and weaknesses? i. What are some potential problems and limitations of financial ratio analysis? j. What are some qualitative factors analysts should consider when evaluating a company’s likely future financial performance?