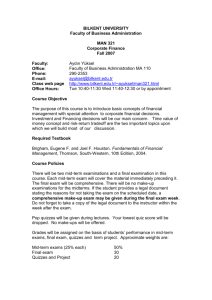

course outline

advertisement

MBA 611 FINANCIAL & MANAGERIAL ACCOUNTING COURSE OUTLINE SEMESTER: FALL 2014/2015 FACULTY MEMBER’S DETAILS NAME: Charoula Charalambus OFFICE HOURS: By Appointment EMAIL: chara.charalambous@gmail.com WEB SITE:http://www.cdacollege.ac.cy/site/business-studies/index.htm Course Description The objective of the course is to introduce the accounting concepts and financial principles to make decisions. Financial accounting is presented in terms of a management decision-making approach. Starting with the balance sheet and income statement, the course explores the principles applied to financial transactions of monetary assets and revenue, cost of sales and inventory, fixed assets, debt and owners’ equity. Finally, the statement of cash flow is presented. Learning Outcomes By the end of this course the students should be able to: 1. Understand the role of accounting within a business environment 2. Apply accounting tools to understand and evaluate business performance and profitability 3. Create, interpret and use financial statements in making managerial decisions 4. Understand the accounting cycle 5. Understand and apply costing techniques and critically evaluate each in various circumstances 6. Identify and communicate a firm’s objectives in financial terms Prerequisite(s) : Elementary level Accounting or Consent of Instructor Type of Course: Compulsory for MBA Teaching Methods This module utilizes a mixture of lectures, problems and case studies discussion, independent and private study, preparation of projects, quizzes and group work. 1 Course Teaching Hours 42 hours a semester. The course is delivered during a 13-week semester. Each lecture is 4 periods. Assessment method and weight 50% coursework and 50% final examination. The students are assessed via 2 group quizzes (15% of total grade), a mid-term exam (30% of the total grade), a final examination (50% of the total grade) and 5% is given for class attendance. The quizzes consist of several multiple-choice questions and may take the form of group work within the lecture. Mid-term and final exams consist of several multiple-choice questions, problem solving exercises or essays. They will require students to assess financial performance and support their conclusions based on analysis of financial statements, using critical thinking. All the assessments are based on the presented material and the recommended textbook. Passing mark 60%. Assessment method and weight Class Participation and Tests 5% Assignments: 15% Mid Term Examination 30% Final Examination 50% Class Participation and Tests: Requires participation in discussions, solving of exercises given in the class and study of case studies. Class attendance is expected and absences will affect your final grade. Assignments: The students will be assigned to carry out a practical and numerical exercise over the topics covered in the course outline. The students are requested to deliver their assignments on an individual basis and on time. Although collaboration among the students for the preparation of the assignments is encouraged, students should avoid copying. Mid-term examination: The mid-term examination will be of two hours. It will be consist of multiple-choice questions and numerical exercises. Final Examination: The final examination will be of two hours. It will be comprehensive and it will test the students on the material covered during the semester. 2 MBA Grading System The final course grade at the end of the semester will be given as a letter grade as follows: % Grade Grade Grade Points per Credit Grade Meaning 4.00 90-100 A Excellent 85-89 B+ Very Good 3.50 80-84 B Good 3.00 75-79 C+ Above 2.50 Average 70-74 C Average 2.00 Below 65-69 D+ 1.50 Average 60-64 D Poor 1.00 Below F Failure 0.00 60 Required Textbook Title: Financial & Managerial Accounting Author(s): Horngren, Harrison and Oliver Publisher: McGraw-Hill Edition: 2nd Year: 2009 ISBN: 0135080193 Textbooks, References, Other Bibliography Title: Author(s): Publisher: Year: Accounting: text and cases (1999) – Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant Introduction to Management Accounting - Charles T. Horngren, B000APT4WU Paper 3 (INT) FINANCIAL ACCOUNTING (FA) ACCA Kaplan Publishing 2008 Gary L. Sundem, William O. Stratton, Dave Burgstahler, Jeff Schatzberg Managerial Accounting - Hilton, Ronald Managerial Accounting: An Introduction to concepts, methods and uses Sidney, Davidson 3 LEARNING OUTCOMES TABLE Weeks Learning Outcomes and Content of the Course 1 To point out the Nature of Accounting: Balance Sheet and Income Statement Nature and Purpose of Accounting Balance Sheet: Accounting Categories and Related Concepts Income Statement: Presentation and Related Concepts 2 Activities Discussion Questions & Exercises The Recording Business Transaction, Accounts and Journal To explain the Recording Business Transaction, Ledger, Discussion Trial Balance Questions And Adjusting Process Exercises & The Accounting Cycle Record-keeping fundamentals Accounting Systems 3 4 Discussion Questions Exercises Discussion Questions Exercises To Implement the Accounting Cycle Revenue and Monetary Assets Revenue: Timing and Amount Monetary Assets: Accounting and Analysis & & To employ Financial Statements and Practice Balance Sheet/Statement of Financial Position 5 To Analyze. Financial Statements and Statement/Statement of Income and Expenditure Income Discussion Questions Exercises & 6 Examine the Inventory Valuation Methods Cost of Sales and Inventory Costs of Sales: Merchandising, Manufacturing and Service Companies Inventory Valuation Methods Discussion Questions & Exercises Revision for the mid-term exams 7 Revision for the mid-term exam Mid-term Exams 8 Compose the Internal Control and Cash Discussion Questions Exercises Discussion Questions Exercises 9 Explain and prepare Receivables 4 & & 10 Long-lived Assets Acquisition Depreciation Disposal Natural resources and Intangible Assets Discussion Questions Exercises & Discussion Questions Exercises & Discussion Questions Exercises & Determine Plant Assets and Intangibles 11 12 Demonstrate The Statement of Cash Flow Debt and Equity Debt: Accounting and Analysis Equity: Proprietorship, Partnership, and Corporations Statement of Cash Flow Concept of Flow Statements Method of Computing and Presenting Cash Flow Explain Financial Statement Analysis Prepare Financial Statement Analysis 13 Revision for the final examination Revision Estimated Student workload Activity Class attendance Independent Study Mid-term Preparation Mid-term Examination Assignment Preparation Assignment Presentation Exercises Preparation Final Exam Preparation Final Examination Total Hours 42 68 20 1.5 19 0.5 13 34 2 200 OTHER INFORMATION Class attendance: Students are expected to attend the classes regularly and be punctual. Office hours: Students are encouraged and advised to visit regularly their instructor during the office hours and discuss promptly any issue that seems to be important for the student and his/her success. Humane matters: Inform your faculty member for any un-expectancies that may occur, thus not allowing you to carry out your responsibilities. Library: You are advised to visit regularly the library of our College and read articles published in academic journals. I recommend you studying regularly among others, articles of your interest, published in international journals. 5 6