Completing the Accounting Cycle

advertisement

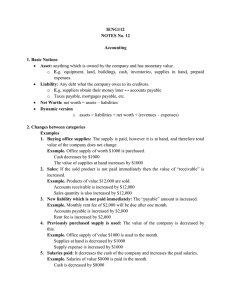

Completing the Accounting Cycle Chapter 4 Objective 1 Prepare an accounting work sheet. The Accounting Cycle The accounting cycle is the process by which accountants prepare financial statements for an entity for a specific period of time. The Accounting Cycle For a new business, begin by setting up ledger accounts. For an established business, begin with account balances carried over from the previous period. The Accounting Cycle Accounts Receivable 1,350 Accounts Receivable 1,700 Service Revenue 1,700 Accounts Receivable 1,350 1,700 Accounts Receivable 1,350 1,700 3,050 The Accounting Cycle Cash Accounts receivable Balance Sheet Work Sheet 12,100 3,050 Income Statement The Accounting Cycle Adjusting entries Cash 12,100 Closing entries Accounts Receivable 3,050 Postclosing Trial Balance Cash 12,100 Accounts receivable 3,050 The Accounting Work Sheet What is the work sheet? A work sheet is a multi-columned document used by accountants to help move data from the trial balance to the financial statements. It is an internal document. The Accounting Work Sheet Trial Balance Dr. Cr. 12,100 1,350 250 15,500 7,500 1,200 1,100 1,500 7,200 1,000 23,700 12,000 Account Title Cash Accounts receivable Supplies Equipment Accum. depreciation Accounts payable Salary payable Unearned revenue Capital Withdrawals Revenue Salary expense Supplies expense Depreciation expense Totals 42,200 42,200 ©2002 Prentice Hall, Inc. Business Publishing Adjustments Dr. Cr. Accounting, 5/E Adjusted Trial Balance Dr. Cr. Horngren/Harrison/Bamber 4-9 The Accounting Work Sheet a The company has earned revenue of $1,700 which will be collected next month. b Inventory of supplies at month end totaled $150. c Depreciation for the period was calculated as $200. The Accounting Work Sheet Trial Balance Adjustments Account Title Dr. Cr. Dr. Cr. Cash 12,100 Accounts receivable a) 1,700 1,350 Supplies b) 100 250 Equipment 15,500 Accum. depreciation 7,500 c) 200 Accounts payable 1,200 Salary payable 1,100 Unearned revenue 1,500 Capital 7,200 Withdrawals 1,000 Revenue 23,700 a) 1,700 Salary expense 12,000 Supplies expense b) 100 Depreciation expense c) 200 Totals 2,000 2,000 42,200 42,200 ©2002 Prentice Hall, Inc. Business Publishing Accounting, 5/E Adjusted Trial Balance Dr. Cr. 12,100 3,050 150 15,500 7,700 1,200 1,100 1,500 7,200 1,000 25,400 12,000 100 200 44,100 44,100 Horngren/Harrison/Bamber 4 - 11 The Accounting Work Sheet Account Title Cash Accounts receivable Supplies Equipment Accum. depreciation Accounts payable Salary payable Unearned revenue Capital Withdrawals Revenue Salary expense Supplies expense Depreciation expense Totals ©2002 Prentice Hall, Inc. Adjusted Trial Balance Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 Income Statement Dr. Cr. Balance Sheet Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 25,400 1,000 12,00 0 44,100 100 200 Business44,10 Publishing Accounting, 5/E 1,000 18,700 31,80 0 Horngren/Harrison/Bamber 4 - 12 The Accounting Work Sheet Account Title Cash Accounts receivable Supplies Equipment Accum. depreciation Accounts payable Salary payable Unearned revenue Capital Withdrawals Revenue Salary expense Supplies expense Depreciation expense Totals ©2002 Prentice Hall, Inc. Adjusted Trial Balance Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 Income Statement Dr. Cr. 25,400 25,400 1,000 Balance Sheet Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 12,000 100 200 12,300 1,000 12,00 0 44,100 25,400 18,700 100 200 31,80 Business44,10 Publishing Accounting, 5/E Horngren/Harrison/Bamber 4 - 13 0 The Accounting Work Sheet Account Title Cash Accounts receivable Supplies Equipment Accum. depreciation Accounts payable Salary payable Unearned revenue Capital Withdrawals Revenue Salary expense Supplies expense Depreciation expense Totals Net income ©2002 Prentice Hall, Inc. Adjusted Trial Balance Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 Income Statement Dr. Cr. 25,400 25,400 1,000 Balance Sheet Dr. Cr. 12,10 0 3,050 150 15,50 7,700 0 1,200 1,100 1,500 7,200 12,000 100 200 12,300 13,100 25,400 1,000 12,00 0 44,100 25,400 18,700 100 13,100 200 25,400 31,80 31,800 Business44,10 Publishing Accounting, 5/E Horngren/Harrison/Bamber 4 - 14 0 Objective 2 Use the work sheet to complete the accounting cycle. Recording the Adjusting Entries The work sheet helps identify the accounts that need adjustments. Actual adjustment of the accounts requires journalizing and posting the entries. Recording the Adjusting Entries The adjusting entries may be recorded in the journal when they are entered on the work sheet. Many accountants journalize and post the adjusting entries just before they make the closing entries. Objective 3 Close the revenue, expense, and withdrawal accounts. Closing the Accounts Closing the accounts is the end of period process that prepares the accounts for recording transactions during the next period. Closing the Accounts Closing Entries Revenues increase Owner’s Equity. Expenses and Withdrawals decrease Owner’s Equity. Closing the Accounts Revenues and Expense accounts are closed to Income Summary. Income Summary is closed to Capital. Withdrawals are closed to Capital. In a corporation, Dividends are closed to Retained Earnings. Closing the Accounts Income Summary A debit balance represents net loss. A credit balance represents net income. Closing the Accounts Revenue 28,500 12,000 7,500 9,000 Salary Exp 1,500 3,300 1,800 Rent Exp 800 800 Supplies Exp 350 350 ©2002 Prentice Hall, Inc. (Close Revenue Account) Income Summary (Close Expense 4,450 28,500 Accounts) 24,050 (Close Income Summary) Capital Account 24,050 2,500 (Close Withdrawals Withdrawals Account) 2,500 2,500 Business Publishing Accounting, 5/E Horngren/Harrison/Bamber 4 - 23 Postclosing Trial Balance The accounting cycle ends with the postclosing trial balance. The postclosing trial balance is dated as of the end of the period for which the statements have been prepared. Permanent Accounts What accounts never close? – Assets – Liabilities – Owner’s equity Balances of permanent accounts carry over to the next period. Objective 4 Classify assets and liabilities as current or long-term. Liquidity This is a measure of how quickly an item can be converted into cash. On the balance sheet, assets and liabilities are classified as either current or long-term to indicate their relative liquidity. Current Assets Current assets are cash, or will be converted to cash, in one year or within the normal business operating cycle. What are some other examples? – short-term receivables – inventory – prepaid expenses Current Liabilities Current liabilities are debts or obligations due within one year or within the operating cycle. What are some examples? – accounts and salary payables – short-term notes payable – unearned revenue Long-term Assets and Liabilities Long-term assets include all other assets. – property, equipment, and intangibles Long-term liabilities are all other debts due in longer than one year or the entity’s operating cycle. The Classified Balance Sheet Debit side Current assets Long-term assets Credit side Current liabilities Long-term liabilities Listed in the order of decreasing liquidity Listed in the order of how soon they must be paid The Classified Balance Sheet XYZ Services January 31, 20XX Assets Current assets: Cash 12,100 Accounts receivable 3,050 Supplies 150 Total current assets 15,300 Plant assets Equipment 15,500 Less Accum. deprec. 7,700 7,800 Total assets 23,100 Liabilities Current liabilities: Accounts payable Salary payable Unearned revenue Total liabilities Owner’s equity Capital Total liabilities and owner’s equity 1,200 1,100 1,500 3,800 19,300 23,100 Different Formats of the Balance Sheet Report Format Assets Liabilities Owner’s Equity Account Format Assets = Liabilities + Owner’s Equity Objective 5 Use the current ratio and the debt ratio to evaluate a company. Comparative Financial Statements They enhance the user’s ability to analyze a company’s past performance. What are two common ratios used to measure liquidity? 1 Current ratio 2 Debt ratio Current Ratio This measures the ability of a business to pay its current liabilities with its current assets. Current ratio = Current assets ÷ Current liabilities Debt Ratio It indicates the proportion of a business’s assets that are financed with debt. It measures their ability to pay both current and long-term debt. Total liabilities ÷ Total assets Trend Analysis Decision makers compare various ratios over a period of time. End of Chapter 4