Financial Freedom Power Point

advertisement

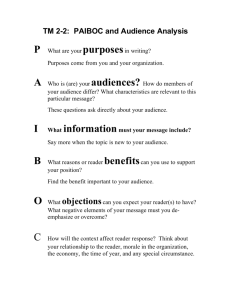

FINANCIAL FREEDOM A PUBLICATION PRESENTED BY THE: A comprehensive package of interactive instructions on how to navigate personal finance FINANCIAL ISSUES ADDRESSED Managing Cash Banking Basics Finding a Job Consumer Credit Buying or Leasing a Car Managing Risk With Insurance Find a Place to Live Financing Your Education Identity Theft THE CONTENT IS APPROPRIATE FOR BOTH HIGH SCHOOL AND MIDDLE SCHOOL AUDIENCES This workbook can be used as a text or supplement in a Financial Education class or as a self-study guide in the financial literacy component of an Economics or Financial Algebra class. EACH CHAPTER IS CONSISTENTLY FORMATTED AND THE CONTENT IS LINKED TO THE NEW GENERATION SUNSHINE STATE STANDARDS EACH CHAPTER OFFERS: A QUALITATIVE REVIEW OF THE FUNDAMENTALS OF THE SUBJECT A GLOSSARY OF THE KEY TERMS NECESSARY FOR COMPREHENSION A VARIETY OF IN CONTEXT ACTIVITIES AS THE CHAPTER PROGRESSES A WIDE ARRAY OF LINKS TO ONLINE REINFORCEMENT ACTIVITIES, VIDEO CLIPS, ILLUSTRATIVE EXERCISES AND EXTENSION READINGS FOR GREATER DEPTH OF KNOWLEDGE POWER POINTS THAT SUMMARIZE THE FOUNDATION OF EACH CHAPTER MOST CHAPTERS HAVE PRE AND POST-TEST ASSESSMENTS A TEACHER ANSWER KEY FOR EACH ACTIVITY AND ASSIGNMENT Chapter One is all about maximizing your purchasing power through a realistic budgeting process. The key is to be conscious of where every dollar is spent and weigh each potential purchase against your long-term goals. Chapter Two introduces the reader to the basics of banking, both traditional and contemporary. This section is conscious of the fact that banking services are in the middle of a gradual transition away from the manual processes of the past to the online and paperless methods gaining popularity. The reader will survey banking products and fees as well as the steps involved in managing various accounts. Chapter Three addresses the world of job searching. How to hunt and capture the right job, and the professional development necessary in order to keep the job. Inside are instructions on how to construct the perfect resume and prepare for the interview process. There is also a section on the benefits of entrepreneurship as an alternative to working for someone else. Chapter Four tackles the extremely important subject of consumer credit. This section reveals the secrets to establishing a good credit rating and the means to keep track of it. The different types of credit and credit services are discussed and what to do if you are denied credit. An emphasis is placed on the importance of a good credit score when accessing all kinds of financial services and modern conveniences. Chapter Five discusses the often intimidating process of acquiring transportation. The often asked questions of “new or used” and “buy or lease” are explored here. In addition, the process of shopping for a car and the confusing dealership language are simplified to prepare the person anxious for some new wheels. Chapter Six covers the vast world of risk management by addressing three types of insurance most people carry: life, auto, and health. The different types of insurance are clarified as well as a discussion on how to shop for the insurance you need. A lot of attention is paid to the limbo health insurance is currently in as our nation struggles with how to define it. Careful consideration is given to the laws that dictate Florida insurance consumers and the riddles are solved surrounding all of the technical jargon. Chapter Seven talks about the evolving topics around finding a place to live. The recent housing crisis has caused our nation to reevaluate home owning. This chapter takes on the questions surrounding “buying or renting” and simplifies the leasing and mortgage processes. There is significant attention paid to the rights and responsibilities of home owning as well as home leasing. The focus is to help the reader make the right decision in this turbulent market. Chapter Eight unravels the confusion around financing an education. This section focuses on getting the most out of one’s education dollars by unmasking the college loan process, pointing out where to look for financial aid and scholarships, showing how to budget for postsecondary education and ultimately make the right choice to fit one’s needs. Chapter Nine addresses the increasing prevalence of identity theft in our transactional interactions. Though all kinds of threats are discussed, extra emphasis is placed on the cyber form as so much of our lives dwell online. The reader is provided with an explanation of identity theft, how to protect personal information, and what to do if your defenses are breeched. IT’S ALL ABOUT THE KIND OF LIFE YOU WANT TO LEAD A COMPLETE DEVOTION TO MONEY WILL LEAD ONE TO IGNORE THE CONSEQUENCES OF THE CHOICES MADE. WHAT ARE SOME OF THOSE CONSEQUENCES? TOO MANY PEOPLE FALL PREY TO THE CONSTANT BOMBARDMENT OF TEMPTATION SURROUNDING US EVERYDAY. CONSEQUENTLY, IT BECOMES DIFFICULT TO BALANCE THEIR INCOME AND EXPENDITURES. GROWING DEBT TODAY MORTGAGES THE FUTURE. ONLY THROUGH CAREFUL PLANNING, GOAL SETTING, DISCIPLINE AND SACRIFICE CAN FINANCIAL FREEDOM ULTIMATELY BE ATTAINED