Chapter 2

The Competitive Environment:

Assessing Industry

Attractiveness

by Robert Pitts

& David Lei

Slides prepared by

John P. Orr

Cameron University

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-1

What you will learn…

Slide 1 of 2

• The nature of the general environment,

also known as the macroenvironment

• Macroenvironment influences over

competition between firms and

organizations

• The nature of the industry environment,

also known as the competitive

environment

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-2

What you will learn…

Slide 2 of 2

• The Five Forces that make up the

industry environment:

–

–

–

–

–

Barriers to entry

Supplier power

Buyer power

Availability of substitutes

Rivalry among firms

• The concept of Strategic Groups

• Techniques companies use to monitor

changes in the environment

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-3

Personal Computer: Key Parts

• Microprocessor

• Hard drive

• CD-ROM or DVD

drive

• Printed circuit boards

• Keyboard

• Monitor

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-4

The Concept of Environment

• Environment

All external forces, factors, or conditions

that exert some degree of impact on the

strategies, decisions, and actions taken by

the firm

• Macroenvironment

• General environment

The broad collection of forces or conditions

that affect the firm or organization in every

industry

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-5

Macroenvironment Influences

Demographic

Political

Global

Social/

Cultural

Technological

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-6

The Competitive Environment

• Industry Attractiveness

The potential for profitability

in a given industry

• Industry Structure

The interrelationship among the factors in a

firm’s competitive or industry

environment.

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-7

Ex. 2-1. Porter’s Five Forces

Model of Industry Attractiveness

Potential

Entrants

Threat of new entrants

Suppliers

Bargaining

power of

suppliers

Industry

competitors

Rivalry

among

existing firms

Bargaining

power of

buyers

Buyers

Threat of substitute products or services

Substitutes

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-8

Barriers to Entry

•

•

•

•

•

•

•

•

•

•

•

Economies of scale

Proprietary product differences

Brand identity

Switching costs

Capital requirements

Access to distribution channels

Absolute cost advantages

Proprietary learning curve

Access to necessary inputs

Government policy

Expected retaliation

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-9

Determinants of Rivalry

•

•

•

•

•

•

•

•

•

•

Industry growth

Fixed (or storage) cost / Value added

Intermittent overcapacity

Product differences

Brand identity

Switching costs

Concentration and balance

Informational complexity

Diversity of competitors

Exit barriers

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-10

Determinants of Substitution Threat

• Relative price/ Performance of

substitutes

• Switching costs

• Buyer propensity to substitute

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-11

Determinants of Supplier Power

• Differentiation of inputs

• Switching costs of suppliers

and firms in industry

• Presence of substitute inputs

• Supplier concentration

• Importance of volume to supplier

• Cost relative to total purchases in the

industry

• Impact of inputs on cost or differentiation

• Threat of forward integration vs.

backward integration

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-12

Determinants of Buyer Power

Slide 1 of 2

•

•

•

•

Bargaining leverage

Buyer concentration vs. firm concentration

Buyer volume

Buyer switching costs relative

to firm switching costs

• Buyer information

• Ability to backward integrate

• Substitute products

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-13

Determinants of Buyer Power

Slide 2 of 2

•

•

•

•

•

•

•

•

Pull-through

Price sensitivity

Price / Total purchases

Product differences

Brand identity

Impact on quality/performance

Buyer profits

Decision makers’ incentives

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-14

Ex. 2-2. Strategic Groups

in the Personal Computer Industry

Apple

Product Quality

High

Dell

Compaq

Hewlett-Packard

IBM

Gateway

Packard Bell

AST Research

Tandy

Fragmented

Players

Exited from

market, 1999

Low

Low

High

Customization and Speed of Delivery

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-15

Trends in Strategic Groups

• Strategic groups can shift over time as

market changes

• Entire strategic groups can

emerge or disappear over time

• Industry consolidation alters

strategic groups

• Distinctiveness enhances firm’s

sustainable competitive advantage

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-16

Monitoring the Environment

• Environmental Scanning

The gathering of information about external

conditions for use in formulating

strategies

• Competitor Intelligence Gathering

Scanning specifically targeted

or directed toward a firm’s

rivals

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-17

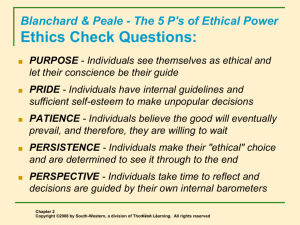

Advantage and Ethics

• Legal Requirements

• Long-Run Consequences

– Charges of price-gouging

– Threat of regulation

– Potential of regulation to

stifle innovation

Copyright ©2003 by South-Western, a division of Thomson Learning. All rights reserved.

Slide 2-18