Accounting Project

advertisement

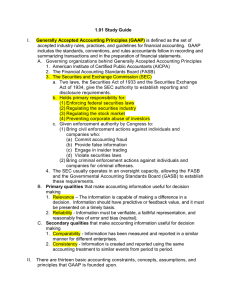

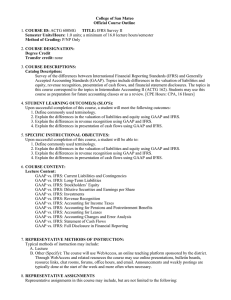

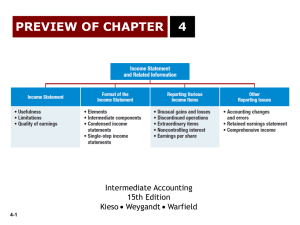

Since the switch from GAAP to IFRS in 2006, there has not been an abundance of academic research performed in the field of Share Capital. As share capital is a significant source of investment, firms need to generate capital to develop and grow. This lack of academic research certainly does not imply lack of debate or discussion surrounding share capita In 2006 Canada made the change from GAAP (Generally Accepted Accounting Principles) to IFRS (International Financial Reporting Systems). The main reasoning behind this change was the U.S. GAAP was too rule bound, detailed, expensive, and inappropriate for the smaller Canadian marketplace. This change in the equity portion of the balance sheet involved both changes in vocabulary and processes. The following represents the vocabulary changes from GAAP to IFRS. GAAP Common Stock Retained earnings/Reinvested earnings Accumulated other comprehensive income Pain-in Capital in excess of par/Additional paid in capital IFRS Share Capital Retained earnings/Retained profits General reserve & other reserve accounts Share Premiums The main equity difference from GAAP to IFRS is the calculation of treasury stocks. A treasury stock is when a corporation buys back its outstanding common stock. Under IFRS, treasury stock is shown as a deduction from shareholder’s equity at the cost. If these stocks are resold, the profit or loss is shown as a change in equity. This method of calculating treasury stock is different from GAAP, which effects the calculation of diluted earnings per share, as treasury stock is needed in that calculation. GAAP used year-to-date weighted average in the calculation of diluted EPS based on each quarterly EPS calculation and the average market prices. As share values may rise or fall considerably during the year, this method may leave firms with, what could be, a misleading EPS based on only quarterly performance. “IFRS, however, calculated incremental shares using weighted average at the end of the year, rather than on a quarterly basis. Thus different average stock prices are used to determine the dilutive effect of convertible financial instruments.” (Fay 50) This change in Earnings per Share may change a potential investor’s opinion on how profitable a company is if they are not familiar with the differences in the two methods. Overall this change will help with the fluctuation of diluted EPS in companies, as it is calculated at the end of the year rather than on a quarterly basis.