Draft CIP - City of Oak Harbor

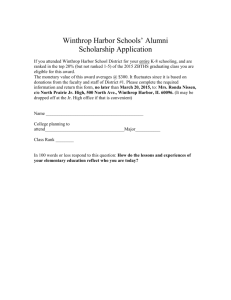

advertisement