Why budget

advertisement

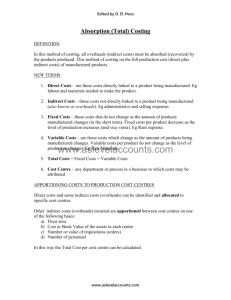

Why budget? All part of profit planning A budget is a detailed plan for the future that is usually expressed in monetary terms Budgets are needed for: Planning: developing and achieving goals Control: gathering feedback to ensure that the plan is being properly executed If you plan, it is pointless unless you also control Advantages They act as a way of communicating management plans throughout an organisation They force managers to plan ahead Its an excellent way of allocating resources so they can be used effectively The system can uncover bottlenecks They co-ordinate the activities of the organisation They can define goals and objectives which can be used for performance indicators (KPIs) Absorption Limitations All costs and measures of levels of activity are estimates. The apportionment of indirect costs to cost centres is made using bases decided upon by the management accountant this can be an entirely subjective operation. The apportionment of service department costs to production cost centres is also carried out using subjective bases. The calculation of absorption rates is made by dividing the overheads apportioned to production cost centres using the subjective methods described above by estimates of a subjectively selected measure of level of activity. Administration and other non-production overheads may be apportioned to products by further totally arbitrary methods. Steps in ABC 1. Identify the major activities taking place in the organisation. Examples might be machine related, labour related, ordering, materials handling. 2. Determine cost drivers for each major activity. For example, for power costs this might be machine time; for example set-up costs, the number of production runs. 3. Create cost centre/cost pool for each major activity. 4. Trace the cost of activity to products according to the product’s demand for activities.