Overhead Costing: Definition, Allocation & Absorption Methods

advertisement

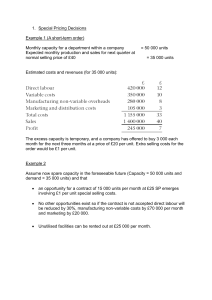

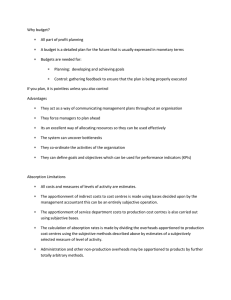

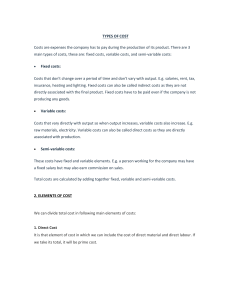

Topic: Overhead Costing Definition: Overheads are the aggregate of indirect materials, indirect labour and indirect expenses. it is made up of a number of cost elements; materials; labour and expenses therefore, its determination and control is complex and more challenging. Examples include: a. Cost of cleaning materials b. Cost of stationery c. Cost of consumable materials d. Supervision cost e. Bonus payable to employees f. Salaries of indirect workers g. Lighting and heating h. Rent and rates i. Insurance premium j. Depreciation of fixed assets. TYPES AND CLASSIFICATION OFOVERHEADS Overheads can be classified variously as follows: a. production overheads b. administrative overheads c. marketing, selling and distribution overheads d. research and development overheads The objective of overhead cost determination is to: a. enable overhead cost to be absorbed by products and b. provide useful information for management decision making and cost control decisions Overheads can be analysed as consisting of: i. Indirect materials cost ii. Indirect labour cost and iii. Indirect expenses. Overheads can also be analysed either as - Fixed overheads or - Variable overheads Overhead Allocation and Apportionment Methods a. Overhead Allocation This is the assignment of overheads to cost centres directly without sharing. Overhead cost that is specifically incurred in respect of a particular cost centre is wholly assigned to that cost centre; this is referred to as overheads allocation. b. Overhead Apportionment This is the sharing of overhead cost incurred in respect of a number of cost centres to the centres involved using a fair and equitable basis of apportionment. There are some overhead costs that are incurred for a number of cost centres and at times even for the whole organization. Such overheads cannot be allocated but must be apportioned. The basis of apportionment should be fair and equitable. Examples of bases of apportionment commonly used are: i. Space occupied by cost centre ii. Number of employee iii. Value of plant iv. Number of material requisitioned v. Kilowatt hours of energy used vi. Horse power energy used, etc. Where the cost centres involved are production and service cost centres, then the overheads relating to the service cost centres must be re-apportioned to the production cost centre. One of the following methods can be used for the re-apportionment of service cost centre overheads to production cost centres where service cost centres serve one another. That is where there is reciprocal service The Concept of Overhead Absorption This is the process of assigning overhead costs to products or services produced. Overheads are absorbed into products by first calculating the overhead absorption rate and then applying the calculated overhead absorption rate to determine the overhead absorbed by each cost unit Methods of overheads analysis To determine the overhead cost per unit of any product or service therefore, the following process is followed: a. The organization is divided into cost centres which represent areas of the business, items of equipment or persons with respect to which cost can be gathered and related to cost unit. There are two types of such cost centres i. production cost centres i. service cost centres b. Allocate to the various cost centres, the cost incurred for each of them that can be wholly assigned to the cost centre without sharing or apportionment. c. Those overhead costs that are incurred for more than one cost centre, should be apportioned among the beneficiary cost centres. The apportionment should be done using a fair, equitable and reasonable basis of apportionment. Some bases that can be used include: i. Basis Floor space or area occupied ii. Kilowatt hours iii. Value of Plant and Machinery iv. Number of employees v. Number of requisitions Type of overhead Rent Rates Heating and lighting Insurance of buildings, etc. Electricity Power, etc. Depreciation of Plant & Machinery Insurance of plant Plant maintenance, etc. Canteen expenses Supervisors' wages Personnel dept expenses Stores expenses Indirect material expenses, etc d. Re-apportion the overhead cost of the service cost centres to the production cost centres.The reason for this reapportionment is that cost units are not produced in the service cost centres and so it will not be possible for the cost units to absorb the overhead costs of the service cost centres unless and until such have been reapportioned to the production cost Centres. When re-apportioning service cost centre overheads it is important to observe whether or not the service cost centres serve each other. That is, whether or not they provide reciprocal services. If they don't provide reciprocal services, then the following procedure should be followed: i. First re-apportion the service cost centre that serves other service cost centres beginning with the service cost centre that serves the largest number of cost centres. ii. Repeat the first process until all service cost centres overheads have been reapportioned to production cost centres. Note that under these circumstances once a service cost centre's overheads have been re-apportioned, that centre does not receive any re-apportioned overheads. Where the service cost centres provide reciprocal services, it means one service cost centre serves another and receives services from that other. In such a situation the following methods can be used for the re-apportionment: i. elimination method ii. Continuous allotment method iii. Simultaneous equation method Overheads Absorption Methods a. The Concept of Overhead Absorption This is the process of assigning overhead costs to products or services produced. Overheads are absorbed into products by following the process below: i. Calculate the overhead absorption rates ii. Apply the calculated overhead absorption rate to determine the overhead absorbed Methods of Overhead Absorption. Generally, overhead absorption rate (OAR) is computed as OAR = Budgeted overheads Budgeted activity level There are different factors that could possibly be used as activity level. These include the following: i. Direct labour hours ii. Machine hours iii. Units of production iv. Direct material cost v. direct labour cost vi. Prime cost, etc. Why Predetermined Rates Are Used a. Actual overheads are not known until after the end of a given period. b. Actual overheads are substantially influenced by the general price level and actual activity levels are subject to wide fluctuations Blanket Overhead Absorption Rates Versus Cost Centre Overhead Absorption Rates. Where an overhead recovery rate is in respect of the whole factory it is termed a blanket overhead recovery rate or factory wide overhead recovery rate. Blanket overhead recovery rates are not very appropriate because of the following reasons a. The factory consists of different production cost centres and products may consume cost centre overheads in different proportions. b. Different activity bases drive cost for different products in different proportions. Determination and Treatment of Over or Under Absorption of overhead Overhead absorbed = Overhead absorption rate X actual quantity of activity base. It is unlikely for the actual overhead incurred to be the same as the overheads absorbed. This thus creates a situation of over absorbed overheads or under absorbed overheads. Treatment of under or over absorption of overheads a. Adjust the under or over recovery to cost units produced during the period. - This may not be worthwhile and such historical information is of no use to management b. Carry the under or over recovery to future accounting periods - This results in a distortion of performance figures. c. Treat the under or over recovery as a period cost by writing it off in the Profit and Loss account. - This is the most preferred treatment. The treatment of overheads could be done using a. Absorption costing system where both fixed and variable overheads are considered and charged to products. b. Marginal costing system where only variable overheads is considered and absorbed into products and fixed overheads treated as a period cost and charged to Profit & Loss account. Activity-Based Costing Activity-Based Costing is a costing approach that focuses on how costs of resources utilised are traced to activities that causes them to incur and then to absorb overhead to products or services based on the activities utilisation. Thus, ABC identifies factors that cause or drive costs and termed those factors as cost driver. Cost Driver is defines as “any factor that causes a change in the cost of an activity (CIMA). Examples of Cost Drivers are: • Number of materials handling or issued • Number of machine set-up • Number of machine hours • Number of inspector orders Stages in ABC Two stages are involved in how overheads are absorbed into products through ABC. They include: 1. Stage One: Grouping of overheads into pool in accordance with identifying activities that drive them 2. Stage Two: Determination of how much overhead should be charged The first stage involves identification of cost driver that allows cost to be incurred. The steps required in this first stage include: Step 1: Identify and classify activities; Step 2: Selection of cost driver bases such as number of machine set-up etc; Step 3: Assigning of cost to each activity or cost pools; and Step 4: Ascertainment of activity cost per cost driver base. The formula is: Cost Driver Rate = Activity cost for each cost pool Quantity of cost driver available Stage Two: This stage computes amount of overheads to be recovered i.e assuming 100 units of product Lare to be manufactured. If total overhead is determined as: Machine set up: 20 set up x N40 = Materials handling: 10 issues- 10 x N20 = 800 200 Total 1,000 Overhead rate per unit of output of product = N1,000 100 = N100 MULTIPLE-CHOICE QUESTIONS 1. Overheads are the aggregates of A. Indirect materials, indirect labour and indirect expenses B. Expenses incurred over the normal expense heads C. Expenses incurred by the owners of the business D. All uncontrollable expenses E. All unauthorized expenses 2. Distinguish between overhead allocation and overhead apportionment A. Allocation is used in government whilst apportionment is used in the private sector B. Allocation is assigned direct to cost centres whilst apportionment is shared to a number of cost centres C. Allocation is made scientifically whilst apportionment is done arbitrarily D. Allocation benefits only managers whilst apportionment benefits junior staff E. Both terms mean the same thing 3. What is the usual basis of apportioning factory rent? A. Number of employees B. Number of machines C. Floor space occupied D. Kilowatt of energy used E. Number of pillars 4. What distinguishes a profit centre from a cost centre? A. Direct Cost B. Indirect Cost C. Profit D. Loss E. Revenue 5. What does OAR stand for in overheads accounting? A. Organisational Accounting Returns B. Overheads Accounting Rate C. Overheads Accounting Returns D. Overheads Absorption Rate E. Organisational Absorption Rate 6. Over – absorption of factory overhead due to inefficiency of management should be disposed of by A. Transfer to costing profit and loss account B. Carry forward to next year C. Supplementary rate D. Comprehensive rate E. Allocation 7. How do you treat a cost that is impossible to identify with a particular cost centre? A. Allocate it B. Distribute it C. Apportion it D. Recover it E. Amortise it 8. Which of the following basis is suitable for apportioning Building Depreciation Overhead? A. Number of Employees B. Book Value of Equipment C. Space Occupied D. Number of Unit/Department E. Weight of Materials 9. Which of the following is NOT a functional classification of overhead? A. Variable overhead B. Production overhead C. Administration overhead D. Distribution overhead E. Selling overhead 10. In overhead costing OAR stands for: A. Overheads Accounting Rate B. Overheads Accounting Returns C. Overheads Absorption Rate D. Organisational Accounting Re-absorption E. Overheads Absorption Returns 11. A location, person or item of equipment for which costs may be ascertained and used for the purpose of cost control is _______ A. Revenue Centre B. Profit Centre C. Investment Centre D. Cost Centre E. Contribution Centre SHORTANSWER QUESTIONS 1. Where the actual overhead for a period exceeds the predetermined overheads, we have a case of …… 2. A system of continuously reallocating each service cost centre overhead until the amounts become insignificant is known as ………………. 3. Overheads covering cost of securing orders, publicizing and presenting to customers the products of a company in proper forms at acceptable prices and delivery of the goods to customers are generally known as ………………… 4. Where the production process is highly mechanized making the use of labour hours inappropriate for overhead absorption, what alternative basis may be used? 5. Which is the best way to treat over- and under-absorbed overheads for a period? 6. When the amount of overhead absorbed is more than the amount of actual overheads incurred, it is known as…………………. 7. The difference between overhead incurred and overhead absorbed is known as………………. 8. When apportioning canteen service overhead cost among departments in an organisation, what basis of apportionment would be most appropriate? 9. Allocation of support department costs to other support departments and to the operating departments in a sequential manner that partially recognizes the mutual services provided among all support departments is referred to as…………………… Question 1 Apple Ltd. makes wooden crates which are sold to brewers and soft drinks bottling companies. The production work involves three production departments, Sawing, Assembling and Finishing. There are also two service departments, Maintenance and Materials Handling. During the year ended 31st December 1991, 40,000 crates were made: Costs incurred: Materials issued Direct Wages Overheads Sawing (N) Assembly (N) Finishing (N) 800,000 300,000 120,000 600,000 150,000 80,000 100,000 250,000 30,000 Materials handling wages totalled N21,000 Maintenance wages totalled N45,000 Consumable stores totaled N15,000 (maintenance) The departments' benefits from the service departments are as follows: Sawing Assembly Finishing Materials Handling % % % % Maintenance 30 40 20 10 Materials Handling 50 20 30 Required: (a) Prepare a Statement showing the overheads allotted to each production department (b) Calculate the unit cost of a wooden crate. Question 2 Lamina Manufacturing Company has four production departments and three service departments. Indirect labour and other indirect costs for a typical month have been allocated as shown below: Lamina Manufacturing Company Production Department Maintenance Indirect labour Other Indirect Costs Grinding Blending ¢000 4,600 1,400 ¢000 3,300 1,200 Firing Polishing ¢000 5,400 2,800 ¢000 2,900 1,600 Service Department Adminis Personnel Maintenance tration ¢000 ¢000 ¢000 700 1,800 800 500 300 1,200 The service departments' costs are allocated as follows: Grinding Personnel (%) Administration (%) Maintenance (%) 15 10 15 Blending 25 30 30 Firing 30 40 40 Polishing 20 15 5 Adminis tration 5 10 Maintenance 5 5 In the Grinding and Firing Departments, an overhead rate per machine hour is used; whereas in the Blending and Polishing Departments, an overhead rate per direct labour hour is used. Machine hours are budgeted as 620 in the Grinding Department and 520 in the Firing Department. Direct labour hours are budgeted as 1,050 in the Blending Department and 450 in the Polishing Department. Required: (a) Determine the total overheads for each of the production cost centres. (b) Calculate the overhead recovery rates for each of the production department Question 3 Enyo Manufacturing Company Ltd. produces three products - Frytol, Brilliant and Pepsodent. The cost estimates of each of the products are given below: Frytol Brilliant Pepsodent Direct Materials N720 N1,280 N1,800 Direct Labour: Production Dept. at ¢60/hr. 2 hrs. 1.5 hrs. 2 hrs. Finishing Dept. at ¢40/hr. 2 hrs. 2.5 hrs. 1 hr. Variable Overheads N80 N30 N40 Fixed overhead cost for the following year is estimated at ¢6 million and planned production is: Frytol 10,000 units Brilliant 20,000 units Pepsodent 40,000 units The directors are considering alternative methods of absorbing fixed overheads into product costs and you have been asked, as the Cost Accountant, to calculate the rates to be applied for the following alternatives: i, Direct Labour Costs ii, Percentage of Total Variable Cost Question 4 Agape Co. Ltd. operates two production departments (machining and assembling) and one service department (which is responsible for maintenance). The data below was extracted from the books of the company on 31st July, 1998. Hours Spent Machining Assembling Maintenance Direct labour hours 600 Machine hours 300 Expenses Indirect labour Indirect materials Machine handling Housekeeping Air Conditioning Rent and rates Supervision N’ 000 200 420 N’ 000 250 450 50 30 160 240 70 30 120 180 N’ 000 120 500 80 100 50 150 200 Expenses of the maintenance centre are subsequently re-apportioned to the two production centres in proportion to the total expenses incurred by those departments during the month. Predetermined overhead rates were established as follows: Budgeted Monthly overhead Planned machine hours Planned direct labour hours Machining N’ 000 2,000 500 Assembling N’ 000 1,200 400 You are required to : a. calculate the overhead absorption rates which were in operation during July; b. prepare a statement showing the actual overhead borne by the production department for July; c. state the extent to which overhead was under- absorbed or over-absorbed by the production departments during the month of July. Question 5 MMT manufactures two products. The company provides you with the following details relating to 2015 financial year 1. Units Produced: Product AB - 150,000 units Product CD - 200,000 units 2. Cost drivers identified Activity Activity Cost Pool ( N ) Machine set up 300,000 60 set up Materials issued 200,000 90 requisition Quality control 100,000 40 inspection 3. Cost drivers identified Activity Machine set up Materials issued Quality control PRODUCT AB CD 10 10 20 10 10 5 You are required to determine overhead absorption rate through activity based costing Question 6 Monami Limited has three production departments namely MIXING, FILLING and SEALING and two service departments: ADMIN and ENGINEERING. The overhead departmental distribution summary shows the following. MIXING N600,000 FILLING N500,000 SEALING N400,000 ADMIN N150,000 ENGINEERING N120,000 The service department expenses are allotted on a percentage basis as follows: ADMIN ENGINEERING MIXING FILLING SEALING 40% 30% 20% 30% 40% 15% ADMIN ENGINEERING 10% 15% You are required to apportion the expenses of ADMIN and ENGINEERING departments to the production departments using continuous allotment method. Round up to the nearest whole number