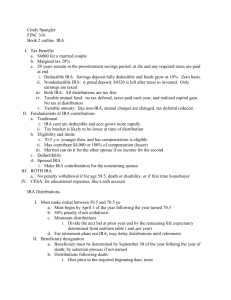

Self Dealing Prohibited Transaction

advertisement

9 Wealth Building Tips Using Self Directed IRAs Presented by Matthew A. Tillack Disclaimer All Self-Directed Investing University presentations and webinars are for educational and informational purposes only. They should not be interpreted as legal advice or legal opinion of any kind. Viewers/Users of these materials should not in any manner rely upon or construe the information within this resource material as legal, or any other professional advice. No one should act or fail to act based upon the information in these materials without seeking the services of a competent legal or other professional. Self-Directed Investing University makes no claim, promise or guarantee about the accuracy, completeness or adequacy of the information contained in or linked to this presentation. Therefore, we expressly disclaim liability for errors and omissions in the content. Self-Directed Investing University does not endorse, affirm, recommend the company, product, employer, employee(s) or any third party affiliate(s). The opinions expressed in the presentation may be opinions of the author(s) and/or presenter(s) and do not reflect the views of Self-Directed Investing University nor their employee(s), company owner(s) or custodian. Self-Directed IRA University will not be liable or responsible for any claim, loss, injury, liability, or damages related to the use of the information within this presentation or webinar including but not limited to direct or indirect incidental or consequential loss or damages, compensatory damages, loss of profits, tax statue, or your individual retirement account arrangement(s). IRA Origins • Traditional IRA started in 1974 • ERISA (Employee Retirement Income Security Act) • Created so citizens could save for retirement independent of employer sponsored plans • Federal rules require that a qualified bank, credit union, or a “non-bank” custodian such as a regulated-trust company hold the IRA. Key Points • A Self-Directed IRA gives the account owner full control over account management and investment selection. • A self-directed IRA can move beyond stocks, bonds and mutual funds allowing you to invest into "alternative" or hard assets like real estate, precious metals, private equity, notes, etc. • You can diversify your portfolio to protect against market volatility and high interest rates while investing in what you know and understand. • Investment gains are tax-deferred or tax-free. In the News • Mitt Romney, former CEO of Bain Capital, and former Presidential Candidate, who invested his self-directed IRA into early stage or turn-around private businesses that was not publically traded. His IRA value was reported at between $20.7 million and $101.6 Million. “Bain Gave Staff a Way to Swell IRAs by Investing in Deals” -Mark Maremont, The Wall Street Journal (March 22, 2012). • Paypal founder and CEO, Peter Thiel, reportedly bought shares in his self-directed Roth IRA for $510,000 and received $31.5M for them when the company sold to eBay. “Why—And—How Congress Should Curb Roth IRAs” -Deborah L. Jacobs, Forbes (March 26, 2012). • Yelp founder and Chairman, Max Levchin, whose self-directed Roth IRA acquired shares in the early stages of Yelp (at excellent value) and was worth $95M in 2012, when numbers were reported. 30 IRA Assets 25 1.9 1.9 2 2 5 5.2 5.2 5.2 4.9 2.9 2.9 3 3 3 6.2 6.5 6.6 6.8 6.8 6.5 5.9 7 7.3 7.4 7.6 7.6 7.3 2012 2013 2014: Q3 2014: Q4 2015: Q1 2015: Q2 2015: Q3 1.9 20 1.7 Annuity Reserves Government DB Plans 1.5 15 4.3 1.2 0.9 3 2.6 3.5 2 4.6 Private-Sector DB Plans DC Plans IRA's 10 5 0 2 2.6 5 2.8 2.7 5.3 3.6 3 2000 eData 4.3 1.9 4.7 3.7 2007 2008 are estimated. Note: For definitions of plan categories, see Table 1 in “The U.S. Retirement Market, Third Quarter 2015.” Components may not add to the total because of rounding. Sources: Investment Company Institute, Federal Reserve Board, Department of Labor, National Association of Government Defined Contribution Administrators, American Council of Life Insurers, Internal Revenue Service Statistics of Income Division, and Government Accountability Office Assets in individual retirement accounts (IRAs) totaled $7.3 trillion at the end of the third quarter of 2015, a decrease of 4.8 percent from the end of the second quarter. Defined contribution (DC) plan assets fell 4.1 percent in the third quarter to $6.5 trillion. Government defined benefit (DB) plans—including federal, state, and local government plans—held $5.0 trillion in assets as of the end of September, a 3.9 percent decrease from the end of June. Private-sector DB plans held $2.8 trillion in assets at the end of the third quarter of 2015, and annuity reserves outside of retirement accounts accounted for another $1.9 trillion. Self-Directed IRA vs. Regular IRA • A self-directed IRA is technically not any different than other IRAs (or 401ks) as selfdirected IRAs follow the same rules as any other IRA. They also receive the same tax benefits as all other IRAs. • "Self-directed" is a descriptive term, not a legal or IRS distinction. • The IRS does not approve or endorse investments. According to IRS Publication 3125 – The IRS does not review or approve investments. The IRS does not advise people on how to invest in their IRAs. What Does “Financially Secure” Mean? • The U.S. Social Security Administration Defines Financial Security as: – • $3,000 per month at the age of 65 ONLY APPROXIMATELY 5% OF AMERICANS ACHIEVE THIS, AND ARE ABLE TO TRULY RETIRE. Tip 1: Benefits of a Self-Directed IRA • Tax Advantages - Profits are tax-free or tax- deferred • Compounding wealth - (due to tax-sheltered status) • Asset Protection • Wealth for future generations • Investment Diversification • Invest in what you know • Seven different self-directed accounts • Almost anyone can have a self-directed account • Even small balance accounts can invest • Millions of dollars are available to finance your deals Tip 2: The Importance of Building Your Team • Financial Planner – for overall success • Accountant/CPA • Attorney • Real Estate Agent • Title Company • Custodian/Administrator • Non-Recourse Lender (if applicable) Six Non Traditional Asset Classes/Options/Types 1. Real Estate • • • • • • • • • • • Residential rental property Multi family rental property Commercial property Real estate development Undeveloped land Developed land Foreclosures Real Estate options Mobile homes Rehabs and flips Storage units • • • • Farm Land Foreign Real Estate Joint Ventures and Partnering Crowdfunding Investments Six Non Traditional Asset Classes/Options/Types Cont. 2. Tax Liens / Tax Deeds • • Tax Lien Tax Deed 3. Promissory Notes • • • • • Secured notes Unsecured notes Mortgage/deeds of trust Business loans, secured by assets of company Automobile notes Six Non Traditional Asset Classes/Options/Types Cont. 4. Entities & Non-Publicly Traded Companies • • • • • • • • • • • Private stock offerings Private placements Limited liability companies Limited partnerships C corps Joint ventures Hedge funds REITS Crowdfunding Investments Foreign entities Startup companies Six Non Traditional Asset Classes/Options/Types Cont. 5. Traditional Assets • • • • • • Stocks Bonds Mutual funds ETFs CDs Treasuries Six Non Traditional Asset Classes/Options/Types Cont. 6. Other Options • • • • • • • • • • • • Structured settlements Accounts receivable U.S. Treasury gold and silver coins Gold bullion, silver bullion, platinum and palladium Foreign currency exchange Commodities Futures Factoring Oil & gas ventures Mineral rights Water rights Equipment leasing Six Non Traditional Asset Classes/Options/Types Cont. Other Options • • • Judgments Websites Certain Intellectual Property The list goes on… Tip 3: Three Major Prohibited Transactions Some transactions violate the basic intent of your IRA. Your retirement plan is intended to benefit you when you retire and not before. Any transactions providing immediate financial or other gain to the account holder or other disqualified persons are not allowed. Prohibited transactions have to do with intent; as in those transactions that run afoul of what the account is intended for, your future retirement. Any action or transaction that can be construed as providing you with direct use or benefit is not allowed. ERISA and the IRS code prohibit a number of transactions between a plan and a “Party in Interest” / “Disqualified Person”. Three Major Prohibited Transactions IRC 4975 – Outlines three main categories of prohibited transactions. 1. Direct Prohibited Transaction: Any transaction between your IRA and yourself or other “Disqualified Person.” 2. Extension of Credit Prohibited Transaction: Any transaction where there is an extension of credit between an IRA and a disqualified person or vice versa. 3. Self-Dealing Prohibited Transaction: Any transaction where a disqualified person (e.g., IRA owner) receives a current benefit from the IRAs investments. Direct Prohibited Transaction A direct prohibited transaction occurs when an IRA engages in a “transaction” with a “disqualified person”. IRC §4975 (c) A “Transaction” includes a purchase, sale, lease, exchange, loan, extension of credit, services, goods, etc. A “Disqualified Person” includes the IRA owner (as fiduciary), spouse, children, and parents (ancestors and lineal descendants and their spouses). Also, partnerships and companies you or other disqualified persons own 50% or more of. Disqualified Persons • • • • • • • • • The IRA owner The IRA owner’s spouse; Ancestors (parents, grandparents, great-grandchildren and their spouses) Lineal Descendants (children, grandchildren, great-grandchildren and their spouses) Fiduciaries (advisors, brokers, accountants, attorneys) Those providing services to the plan (including a trustee), An employer whose employees are covered by the plan Any corporation, partnership, trust, or estate where a disqualified person has a 50% or greater interest A 10% or more owner, partner, officer, director, or highly compensated individual referenced in the prior bullet point Disqualified Persons Who May My IRA Transact Business With? • • • • • • • • • • • Brothers and sisters Aunts, uncles, cousins Nieces and nephews Spouse’s brothers and sisters Spouse’s parents (in-laws) Spouse’s grandparents (in-laws) Step-mother and Step father (if un-adopted) Step children (if un-adopted) Spouses step-children Step-brother and step-children Your grandparent’s spouse, if not your natural grandparent • • • Other third party investors or acquaintances Companies the IRA owner or other disqualified persons own and control less than 50% (beware of self dealing) Everyone else not disqualified in IRC§4975 (e)(2) Extension of Credit Prohibited Transaction IRC §4975 (c)(1)(B) Occurs when there is a “lending of money or other extension of credit between a plan [IRA] and a disqualified person.” 1. If an IRA obtains a loan the loan must be “non-recourse” (e.g., the lender’s sole recourse is against the asset). The IRA owner cannot personally guarantee the loan. 2. UDFI Tax will be due on net income from debt. Profits attributable to retirement plan cash or other non-debt investment is not subject to UDFI tax. Self Dealing Prohibited Transaction A self dealing prohibited transaction occurs when the IRA owner or other disqualified person benefits from the IRA’s investments. IRC §4975 (c)(1)(D),(E), and (F). 1. No personal use of IRA assets. For example, IRA owned rental property cannot be used by a disqualified person to the IRA (e.g. IRA owner, spouse, etc…). 2. No compensation or commissions paid to a disqualified person as a result of an IRA’s investment. (e.g. avoid commissions, salary, etc.). 3. Bottom line, Don’t use IRA assets. Use of IRA assets without payment results in a benefit to a disqualified person and is self dealing while use and payment by a disqualified person is a transaction with a disqualified person and is a direct prohibited transaction. Prohibited Transactions Examples • • • • • • • • • • Buying the property of a disqualified person in your IRA Borrowing money from your IRA to pay off a personal mortgage Taking personal payment directly from an income producing property Hiring a disqualified person to provide services for a property held in your IRA (i.e., using your spouse as the property manager) Using real estate owned by your IRA as collateral for a personal loan Any use of a property owned by your IRA that brings personal benefit to you, rather than the account Using property owned by your IRA as your vacation home Allowing a disqualified person to live in an IRA-owned property Allowing fiduciaries to obtain or use the plan’s income or assets for their own interest Using the account as security for a loan Six Prohibited Transactions – IRC Section 4975 1. 4975(c)(1)(A): The direct or indirect Sale, exchange, or leasing of property between an IRA and a “disqualified person” 2. 4975(c)(1)(B): The direct or indirect lending of money or other extension of credit between an IRA and a “disqualified person” 3. 4975(c)(1)(C): The direct or indirect furnishing of goods, services, or facilities between an IRA and a “disqualified person” 4. 4975(c)(1)(D): The direct or indirect transfer to a “disqualified person” of income or assets of an IRA 5. 4975(c)(1)(E): The direct or indirect act by a “Disqualified Person” who is a fiduciary whereby he/she deals with income or assets of the IRA in his/her own interest or for his/her own account 6. 4975(c)(i)(F): Receipt of any consideration by a “Disqualified Person” who is a fiduciary for his/her own account from any party dealing with the IRA in connection with a transaction involving income or assets of the IRA Tip 4: Items Not To Hold Inside Your IRA Prohibited Holdings – IRS Publication 408 • Life insurance contracts, IRC § 408(a)(3); • Collectibles IRC § 408(m); – – – – – – – – – Works of art Rugs Antiques Metals (other than gold, silver, platinum, or palladium bullion) Gems Stamps Coins (except certain U.S. minted coins) Alcoholic beverages and certain other tangible personal property Prohibited Investments • S-corporation stock, IRS Letter Ruling 199929029, April 27, 1999, IRC §1361 (b)(1)(B); and • In addition to these restrictions, you may not borrow from an Individual Retirement Annuity contract [IRC 408(e)(3)] • or use your IRA as security for a loan [IRC 408(e)(4)] • Any investment that constitutes a prohibited transaction pursuant to IRC § 4975 (e.g., using your IRA funds to purchase any investment from a disqualified person such as a spouse, parent, child, etc…). Prohibited transactions are covered at length in a future module Prohibited Transaction Penalties If an IRA owner engages in a prohibited transaction with his or her own IRA, the consequence is that the entire IRA is disqualified and distribution of. Disqualification results in distribution of the entire account, based on the fair market value of all assets in the account, based on the fair market value of all assets in the account as of January 1 of the year in which the prohibited transaction occurred. IRC §4975 (c)(3), IRC §408 (e)(2)(A). Distribution of an IRA results in possible taxes on amounts distributed, early withdrawal penalties, and revocation of tax-preferential treatment on the IRA’s investments that occurred after the prohibited transaction. If a prohibited transaction occurs between an IRA and a disqualified person other than the IRA owner, then the consequence is an excise tax of 15% on the amount involved to the disqualified person who was a party to the transaction and a potential additional 100% penalty if the prohibited transaction is not corrected Investment Purchase Steps Self-Directed Investing Expenses Related To Investment Payments/Profits from Investment Tip 5: How To Title Asset Documentation Self-Directed IRA Titling Remember you and your IRA are two separate entities, and as such, any investment needs to be titled in the name of the IRA. Titling is the name, or “title”, that is used to reference your IRA. It is important to reflect your IRA as purchaser on investment documents, rather than your personal name. “iPlanGroup Agent for Custodian FBO Client Name IRA” or “ABC Trust Company Custodian FBO Client Name IRA” Seven Investment Purchase Steps ① Establish & Fund Your Account ② Investment Selection & Document Preparation ③ Investment Authorization ④ Investment Review ⑤ Signing of Documents ⑥ Investment Funding ⑦ Maintaining the Investment Tip 6: Maintaining Your Investment Expenses: Any expenses associated with the investment (maintenance, improvements, property taxes, condo association, general bills, capital calls etc.) must come from the IRA. Cash Flow/Profits: All profits must return to the IRA, meaning all income (rent, note payments, dividends) and profits (selling of property, return of capital investment, note principal pay off) are deposited back into your IRA. Tip 7: Account Options Tax-Deferred Tax-Free • • • • • • Traditional IRA SEP IRA SIMPLE IRA Individual/Solo 401(k) • • Roth Coverdell Education Savings Account (ESA) Health Savings Account (HSA) Roth Individual/Solo 401(k) Five Steps for Establishing an Account Step 1: Locate and choose a company to hold your plan Step 2: Complete your new account application Step 3: Fund your account Step 4: Provide a copy of your photo ID Step 5: Submit your new account kit Seven Different Funding Options ① Trustee to Trustee Transfer ② Direct Rollover ③ Distribution Rollover (60 Day Rollover) ④ Contribution (earned income – W2, 1099) ⑤ Roth Conversion ⑥ QDRO (Qualified Domestic Relations Order) ⑦ Inherited IRA Potential Account Type Funding Options • • • • • • • • • • • IRAs (Roth and Traditional) Simple IRA SEP IRA Inherited IRA 401(k) Section 457 plans 403(b) Keogh Pensions Profit sharing plan Cash balance plan • • • • • • • • • • Money purchase pension plan Defined benefits plan Defined contribution plans Solo/individual 401(k) Roth 401(k) Qualified annuities Stock bonus plan Combination plans (combined profit sharing and money purchase plan) Thrift savings plan Employee stock ownership plan Tip 8: Fees & Expenses ① ② ③ ④ ⑤ ⑥ ⑦ ⑧ Are the fees all inclusive? Are there transaction fees? Investment purchase or sale fees Per check fees Quarterly fees Keep a buffer in the account for expenses, wires, overnight checks, etc. Generally an all inclusive fee schedule is the way to go The least expensive isn’t always the best Fee Schedule Example Tip 9: Tax Issues for IRA Investments: UBIT & UDFI Tax There are multiple situations where taxable transactions could happen inside your IRA How it Works Online Access Fund Your Investment Find Your Investment Fund Your Account Open Account • Complete the New Account Application •Transfer •Direct Rollover •60 Day Rollover •Roth Conversion •Real Estate •Note(s) •Private Companies •Land •Precious Metals •Ect. •Investment Authorization Form •Supporting Documentation Enjoy Tax-Free or Tax-Deferred Profits! •View your Account Online Castle House Purchase Price: $235,000 Expenses: $25,000 Sold For: $370,00 Total Profit: $110,000 6 Month Hold Time 1 Month on the Market 1 Offer Received After Pictures Castle House Construction Pictures 3691 Sutherland Purchase Price: $71,000 Repairs: Sold For: Net Profit: $65,000 $235,000 $74,394 5 Month Hold Time 1 Month on the Market 4 Offers Received Before Pictures 17454 Shaw Purchase Price: $87,100 Repairs: Sold For: Rents Received: $70,000 Still Owned $31,500/Year Income Earning Rental Property After Picture 3691 Sutherland After Pictures LaBelle Mobile Home Park $136,000 Purchase Price: Expenses: Sold For: Rents Received: 5 Yr. Mineral Lease: $0 Still Owned $77,000/Year $115,000 Incoming Earning Mobile Home Park Royalties (20% of Production) After Picture Before Picture