Lenders Place Their Bets on Mobile Banking

advertisement

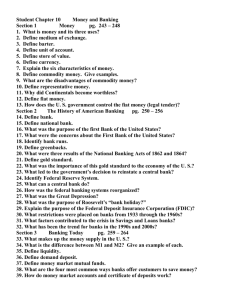

Lenders Place Their Bets on Mobile Banking Check Deposit by Smartphone and Other Services Help Banks Draw Customers, Cut Costs By Saabira Chaudhuri Updated April 9, 2014 9:26 p.m. ET Stephan Roulland uses his phone's camera to make a check deposit. Jason Henry for The Wall Street Journal Stephan Roulland used to walk to his nearest bank branch every time he wanted to deposit a check for his business, burning nearly an hour in the process. Now, the 37-year-old owner of a tech firm in San Francisco snaps a picture of the check with his smartphone through Bank of the West's mobilebanking app and deposits it without leaving his office. (An hour? Takes an average person 10-20 minutes…still, its attractive to get in done in 3 or 4 minutes, without leaving home or office…Mr. B) At Banks, Mobile Becomes a Must Mobile services are becoming must-haves for a growing number of banking customers. With deals like free checking increasingly falling by the wayside and interest rates remaining stubbornly low, technological advances that make banking more convenient are gaining traction. "It saves me so much time," Mr. Roulland said. At a time when banks are struggling with revenue and profit growth, mobile banking is emerging as a critical weapon in the battle to retain customers and cut expenses. The average cost to a lender for a mobile transaction is 10 cents, about half that of a desktop-computer transaction and far less than the $1.25 average cost of an ATM transaction, according to data from Javelin Strategy & Research. But the spread of smartphones and tablets also presents risks for banks. Customers today expect their lenders to offer a range of mobile services, from simple functions such as balance inquires and transfers to trickier maneuvers like paying bills through photo imaging. When banks don't deliver, some customers are walking. All told, about 60% of smartphone or tablet users who switched banks in the fourth quarter said mobile banking was an important factor in the decision, up from 7% in the second quarter of 2010, according to data from New York-based consulting firm AlixPartners. "It's the fastest-growing portion of the consumer business," said Timothy Sloan, chief financial officer of Wells Fargo. The lender says 40% of its customers with bank accounts are active users of its mobile-banking service, mainly to deposit checks, transfer funds between accounts and check balances. Mike Welsh, a Denver-based waiter, said he favors one of Wells Fargo's competitors. After being disappointed by his experience trying to make credit-card payments on Wells Fargo's mobile-banking app, Mr. Welsh said he is closing his account with the San Francisco-based lender and will only use his Bank of the West account. He said he finds the mobile app from that lender, a unit of France's BNP Paribas SA, easier to use. "Every customer relationship is important to us, and we want to work with our customers to address any issues as they use different channels and change how they interact with money," said a Wells Fargo representative. Mobile banking still has its doubters, in part because of security fears. The percentage of customers who cite such concerns as a deterrent to their use of mobile-banking services stood at 41% in July 2013, not far from the 45% registered two years earlier, according to Javelin. But as mobile-device use increases, more customers are giving it a try. "The world is quickly going mobile, and if banks aren't there already, they're way behind," says Robert Meara, a senior analyst at financial-services research and consulting firm Celent. Some mobile functions are especially appealing. While customers can view balances, transfer money and perform other functions using ordinary computers, they can deposit checks only in person or on a mobile device. That is why mobile deposits are increasingly a must-have for consumers. About 34% of bank customers used the function in the fourth quarter of 2013 versus 22% two years earlier, according to AlixPartners. That jump was the biggest among any type of mobile-banking function. "There are few things more inconvenient to banking consumers than carrying a check around and waiting to come to a branch or ATM," Mr. Meara said. For banks, mobile deposits are especially cost-efficient. J.P. Morgan Chase & Co. recently said mobile check deposits cost the bank three cents per transaction, versus 65 cents for deposits made with a teller. Smaller banks are getting into the act, too. First Niagara Financial Group Inc. in Buffalo, N.Y., added a mobile-deposit feature in February. "Our customers' behavior is changing," said First Niagara's retail planning director, Jay Clark. "We have to change with that." The challenge for banks is to provide mobile services with minimal interruptions or glitches. Some bank customers have said they find their banks' apps frustrating to use. Ryan Allen, a Bank of America Corp. customer in Phoenix, said he has given up on trying to deposit checks using the bank's mobile app. "It took me 25 minutes to get their app to work," Mr. Allen said, adding that his last mobile check deposit went through only after multiple attempts with several different kinds of smartphones. "It's quicker for me to drive to the bank." A Bank of America spokeswoman said its customers deposit more than 163,000 checks a day through their mobile phones. Some customers said they are so dissatisfied with their lenders' mobile-deposit functions that they are changing banks. "How come this bank with the kind of weather we have in NJ and NY doesn't have mobile deposits! I'm just going to switch banks," wrote one user on the Google Play app store page for Santander's U.S. mobile-banking app. A Santander U.S. spokeswoman said the bank will launch a mobile-deposit option within the next few months. http://online.wsj.com/news/articles/SB10001424052702303847804579481811781070456 ************************************************************* (more on following pages) Here are excerpts from an April 15 story on Bank of America’s earnings entitled Mobile Banking Lifts BofA, by Saabira Chaudhuri: Bloomberg News On Wednesday, Chief Executive Brian Moynihan said more than 10% of all the deposits that consumers make at the lender “are now done through mobile devices as people effectively carry a branch in their pocket.” Mr. Moynihan said the Charlotte, N.C.-lender’s mobile banking efforts helped it reduce costs at its consumer banking business by about 4% from a year earlier. Bank of America reported 15 million mobile banking active accounts for the first quarter, up from 12.6 million a year earlier and 9.7 million in the first quarter of 2012. Meanwhile, mobile was involved in 10% of total deposit transactions at Bank of America in the first quarter, up from 6% in the prior-year’s quarter. Bank of America’s branch total declined by 189 in 2013, according to SNL Financial. On Wednesday, the bank said it had cut branches on a net basis by about 300 units in the past 12 months, which had helped contribute to a $180 million in expense savings in the consumer and business banking division during the first quarter. “Banking centers and basic tele-transactions continue to decline as customers move their business to mobile and online transactions,” said Mr. Moynihan on the call. Still, he noted that between 7 million and 7.5 million people come into Bank of America’s branches every week. http://blogs.wsj.com/moneybeat/2014/04/16/mobile-banking-lifts-bofa/?mod=yahoo_hs ************************************************************* In Pictures… In two years, what percentage of banking customers will use mobile banking apps? 40-60%? In two years, what percentage of banking customers will use mobile banking apps to deposit checks? 40-60%?? In two years, what percentage of banking customers who switch primary banks will cite mobile apps as important or extremely important in their decision? Still 50-60% ?? In two years, what percentage of top-25 banks will offer mobile check deposits? Nearly 100% ?? Bank of America noted that 7 million customers still visit a branch office every week. This adds up to 364 million transactions per year. If they can process transactions for .10 instead of $4.25, as the research above notes, how much would they save if half of those visits were done via mobile apps? $4.15 savings * (364,000,000/2) = $755,300,000. If Bank of America has 10.5 billion shares outstanding, how much would this savings add to EPS? .755,300,000/10,500,000,000 =.072 (7.2 cents per share) …that’s a lot of zeros. Welcome to the big leagues. If the stock trades at a P/E ratio of 20, how much would this add to the stock’s price? .072*20 = $1.44, or a 9% move. That’s a nice gain. Now you’re thinking like a fundamental stock analyst! Do you think more Americans or more Chinese use mobile banking apps? _ China____ Now you’re thinking like a global analyst!