Introduction to International Political Economy

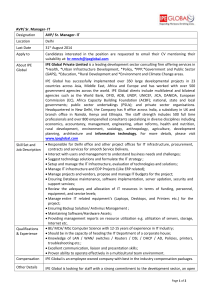

advertisement

Introduction to International Political Economy International Political Economy Prof. Tyson Roberts Lecture Goals • What is IPE? • Why is IPE important? • Applying the IPE framework to the EU Review of concepts • • • • • • • • Utility Expected utility Time discounting/present value Pareto efficiency/optimality Externalities Transaction costs Institutions Market as freedom vs. market as prison 3 • “Institutions are the rules of the game in society or, more formally, are the humanly devised constraints that shape human interaction.” (North, 1990) • In other words, institutions (formal & informal) are like common habits shared in a society that shape how people respond to situations because of expected payoffs Takeaways from Rodrik Chapter 1 • Markets & states are substitutes: alternative institutions for allocation & re-allocation of resources • Markets & states are complements: – States (and interstate arrangements) enable markets to function, and – Markets efficiently facilitate economic exchange for states 5 What is IPE? What is IPE? • Oatley: IPE “studies life in the global economy. It focuses most heavily on the enduring political battle between winners and losers from global economic exchange” (p. 1) 7 What is IPE? • Oatley: IPE “studies life in the global economy. It focuses most heavily on the enduring political battle between winners and losers from global economic exchange” (p. 1) • Grieco & Ikenberry: “a field whose central concern involves the reciprocal relationships between state interests and power on the one hand, and world market structures and economic dynamics on the other” (p. 3) 8 • Y = α + βX + ε • Economic winners • Market exchange Market exchange Politics 9 Why is IPE important? Source: PWT 10 Why is IPE important? Source: WDI 11 Why is IPE important? Source: WDI 12 Developing economies Transition economies 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 Why is IPE important? FDI, % of GDP 6 5 4 3 2 1 0 -1 Developed economies 13 Why is IPE important? Source: S&P 500 (Orange) and EuroStoxx 500 (Blue) from Economist, Feb. 6, 2011 14 Why is IPE important? 15 Why is IPE important? Figure 3 High 1 Capital Mobility and the Incidence of Banking Crisis: All Countries, 18002007 Share of Countries in Banking Crisis, 3-year Sum (right scale) 0.9 1914 0.8 0.6 20 0.5 Percent Index 30 25 0.7 Capital Mobility (left scale) 0.4 0.3 35 15 1825 1980 1860 10 0.2 1945 0.1 5 1918 Low 0 0 1800 1810 1820 1830 1840 1850 1860 1870 1880 1890 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 Sources: Bordo et al. (2001), Caprio et al. (2005), Kaminsky and Reinhart (1999), Obstfeld and Taylor Source: (2004), Reinhart andauthors. Rogoff 2008 and these Notes: As with external debt crises, sample size includes all countries, out of a total of sixty six listed in 16 1820 1825 1830 1835 1840 1845 1850 1855 1860 1865 1870 1875 1880 1885 1890 1895 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 New Immigrants per 1000 residents Why is IPE important? New Immigrants Per 1000 Residents 60 50 40 30 Canada Australia USA 20 10 0 Source: MPI Data Hub and Angus Maddison 17 Why is IPE important? 18 The Value of Models Source: Tetlock 2008: Expert Political Judgment 19 Traditional Schools of IPE • Mercantilist • Liberal • Marxist Traditional Schools of IPE • Mercantilist: Actor is the state, interest is accumulating wealth, policy preferences include export promotion & import protection • Liberal: Actor is the individual, interest is individual welfare maximization, policy preference includes free trade • Marxist: Actor is the class (capitalist vs. workers), interest for capitalist is to profit maximize, policy preferences include property rights & union busting Modern Approach to (International) Political Economy is Generalizable • “Actors” Who are some actors we might consider in IPE? (Write down 10) Actors • • • • States Corporations Individuals Organizations of states, corporations, or individuals State Actors • Actors within states – Governments (executive & cabinet) – Legislatures – Bureaucracies • States as national economies – – – – Large vs small Rich vs poor Lenders vs borrowers Manufacturing-based vs. farming-based • Organizations of states – UN, WTO, IMF, EU, ASEAN, etc. Corporation Actors • Actors within corporations – Shareholders – Management – Employees • Corporation sectors – Manufacturers – Financial services – Non-financial services • Organizations of corporations – Chambers of Commerce, industry groups, etc. Individual Actors • • • • • • • • • • • Consumers Workers/Employees Borrowers Investors and lenders Tax-payers Government service recipients Voters Politicians Landlords Renters Organizations of individuals: unions, associations, parties, etc. Actors, Interests, & Policy Preferences • Actor: Borrowers – Governments, economies, firms, or individuals • Interest: Want easy & cheap access to credit • Policy Preference: Low interest rates, loose conditions, no penalties Actors, Interests, & Policy Preferences • Actor: Lenders – Governments, economies, firms, or individuals • Interest: Want high returns & low risk • Policy Preference: High interest rates, strict conditions, tough penalties Preference intensity • Individuals have many attributes • For example, I am … – – – – – – – – A borrower A lender An investor A consumer An employee An employer A tax payer A government services recipient Preference intensity Which of my attributes will determine my (most intense) policy preferences? Policy preference intensity An actor’s (most intense) policy preferences are determined by 1. Susceptibility of attributes/assets to policy 2. Concentration & functional specificity of attributes/assets 3. Ideology Groups, institutions, & outcomes • Some actors will act as groups – Similar interests – Few collective action problems • Group size, enforcement mechanisms, etc. • Institutions (as cause) – help determine which actors will group together, and – which groups will achieve preferred policy • Institutions (as effect) – Groups dissatisfied with policy outcome will attempt to change political institutions Continental Break-up podcast • • • • • Who are the primary actors? What are their interests? What are their policy preferences? How do they group together? What are the institutions that dictate outcomes? EU Example, Part I • Lender countries prefer strict rules (Germany wanted United States of Europe), low inflation rates • Borrower countries prefer loose rules, domestic sovereignty, care less about inflation • EU institution: Treaty among sovereign nations – Formal: consensus, each state has equal votes (Germany wants peace & customers, willing to accept smaller countries as equal partners) • Policy outcome: Maastricht Treaty: Moderately strict rules with no teeth Examples of Consensus Institutions • Voluntary and informed decisions => Pareto improvements • Market exchange. Actors: transacting parties • Treaty. Actors: sovereign nations • Policy change. Actors: institutional veto players Introduction of Euro reduced borrowing costs for many “less developed” European economies 37 When investors realized/were told indebted countries could default (Maastricht Treaty doesn’t include bailouts), interest rates rose => vicious cycle, crisis 39 EU Example, Part II • Crisis => – Large negative effect on borrowers (& lenders, less so) • Pressure to change policy: – Lender countries want more teeth • Institution – Formal: consensus – Informal: negotiating power of lenders was increased • New policy proposal: – More information & more teeth Market as freedom: Trade enables Pareto improvements PIMCO Greece Offer loans Sit on cash Borrow & invest/ spend 4, 4 2, 2 Live on modest means 2, 2 2, 2 In good market conditions, win/win transactions are readily available 41 Market as Prison: In crisis, PIMCO’s pursuit of profits undermines Greek democratic autonomy Withdraw funds P: Exit G: Default P Austerity Lend G High spending budget Withdraw funds P: Higher return G: Avoid default P: Exit G: Default P Lend P: Low Return G: Continue spending 42 Solving sequential games in game theory • Players make choices sequentially • Payoffs are result of choices made by each player • To solve, look at last move first and work backwards • Subgame perfect equilibrium: Actions each player would choose at each decision node 43 PIMCO can choose to withdraw funds (Exit) or continue lending (Loyalty) after seeing Greece’s policy decision Withdraw funds P: Exit G: Default P Austerity Lend G High spending budget Withdraw funds P: Higher return G: Avoid default P: Exit G: Default P Lend P: Low Return G: Continue spending 44 Numerical values for payoffs Greece • Best outcome: Continue high spending (and avoid default) = +1 • 2nd best: Avoid default (but austerity) = -1 • 3rd best: Default = -3 Pimco • Best outcome: High returns = +1 • 2nd best: Exit (and invest elsewhere) = 0 • 3rd best: Low returns = -1 PIMCO’s Loyalty payoff is better than the Exit payoff if Greece chooses Austerity Withdraw funds P: 0 G: -3 P Austerity Lend G High spending budget Withdraw funds P: 1 G: -1 P: 0 G: -3 P Lend P: -1 G: 1 46 PIMCO’s Exit payoff is better than the Loyalty payoff if Greece chooses to Continue spending Withdraw funds P: 0 G: -3 P Austerity Lend G High spending budget Withdraw funds P: 1 G: -1 P: 0 G: -3 P Lend P: -1 G: 1 47 Step 1: Last player chooses best payoff from each node Withdraw funds P: 0 G: -3 P Austerity Lend G High spending budget Withdraw funds P: 1 G: -1 P: 0 G: -2 P Lend P: -1 G: 1 48 Step 2: Replace decision nodes with payoffs from players best choice P: 1 G: -1 Withdraw funds P: 0 G: -3 P Austerity Lend G P: 0 G: -2 High spending budget Withdraw funds P: 1 G: -1 P: 0 G: -2 P Lend P: -1 G: 1 49 Step 3: Previous player chooses best payoff from each node (in this case the only node) P: 1 G: -1 Withdraw funds P: 0 G: -3 P Austerity Lend G P: 0 G: -2 High spending budget Subgame Perfect Equilibrium: • G: Austerity, P: Lend if Austerity, Withdraw if Spend Withdraw funds P: 1 G: -1 P: 0 G: -2 P Lend P: -1 G: 1 50 Subgame Perfect Equilibrium: G: Austerity, P: Lend if Austerity, Withdraw if Spend P: 1 G: -1 Withdraw funds P: 0 G: -3 P Austerity Lend G P: 0 G: -2 High spending budget Withdraw funds P: 1 G: -1 P: 0 G: -2 P Lend P: -1 G: 1 51 Because PIMCO has a viable exit option, Greece is under pressure to accept conditions P: 1 G: -1 Withdraw funds P: 0 G: -3 P Austerity Lend G P: 0 G: -2 High spending budget Investors’ economic freedom imprisons democratic government Withdraw funds P: 1 G: -1 P: 0 G: -2 P Lend P: -1 G: 1 52 Other sources of funds, such as domestic taxpayers, may not have an attractive exit option (e.g., jail if don’t pay taxes) Stop paying taxes Austerity, low taxes C Pay taxes G High spending, high taxes C: -2 G: -3 Stop paying taxes C: 1 G: -1 C: -2 G: -2 53 C SOLVE! Pay taxes C: -1 G: 1 53 Other sources of funds, such as domestic tax payers, may not have an attractive exit option (e.g., jail if don’t pay taxes) Government can then use spending to buy political support Subgame Perfect Equilibrium: • G: Spend, C: Pay if Austerity, Pay if Spend Austerity, low taxes Stop paying taxes C Pay taxes G Continue Spending, high taxes Lack of economic freedom undermines political freedom C: -2 G: -3 Stop paying taxes C: 1 G: -1 C: -2 G: -2 54 C Pay taxes C: -1 G: 1 54 A generalized view of IPE actors • Businesses & investors can influence government (as can any other group) • Governments can command and induce businesses (as they can any other group) • Capitalism can therefore protect or undermine democracy, depending in part on the distribution of economic resources and the institutional environment 55 When actors have more influence • Government relies heavily on actor’s loyalty • Actor has viable exit options – Investors: global capital markets enable exit by withdrawing funds – Citizens: competitive democracy enables “exit” from loyalty to government if citizens can act collectively 56 The latest: Anti-austerity SYRIZA party poised to win Greek election on Jan. 25 Some takeaways • Markets & states are substitutes: alternative institutions for allocation & re-allocation of resources • Markets & states are complements: – States (and interstate institutions) enable markets to function, and – Markets efficiently facilitate economic exchange for states • If current institutions deliver outcomes unsatisfactory to actors, actors can sometimes change institutions 58 Some more takeaways • Actors with Exit options have more Voice if they also have valuable resources • Actors without Exit options (or w/o valuable resources) may be resigned to Loyalty • Democracy reduces transaction costs => Voice • If Exit options for private resource-holders are lacking, this may undermine democracy • If a minority has most resources + Exit options, this may also undermine democracy 59 More takeaways • IPE affects economics and politics for everyone in an increasingly globalized world • The IPE method – Actors’ interests => policy preferences, which interacts w/ institutions to determine group formation. – Groups then interact w/ institutions => policy outcomes and/or new institutions • The modern IPE method can capture the 3 traditional IPE schools and beyond Final takeaways • In Europe, everyone’s interests favored the Euro, until the crisis. – Rational? – Imperfect information? – Time horizons?