Market Update - Sites at Lafayette

Lafayette College Investment

Club

September 5, 2014

Overview

1. Introductions

2. Career Services

3. What is the Investment Club?

4. Market Update (What You Missed This Summer…)

5. Why JOIN?

Introductions

Name

Year

Major

Position

Previous Experience

Club Involvement

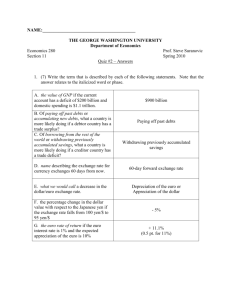

Career Services

What Is the Investment Club?

• Independently run equity based student portfolio of over $500K

Purpose:

• Provide students the opportunity to get involved and excited about financial industry

• Engage members through pitches, market analysis, and other informational presentations

Opportunities

• Market Updates

• Financial Analysis

• Industry Insight

• Networking

Networking

Market Update

• WHAT A BLEEPING SUMMER!

• WHAT ’S GOING ON THIS WEEK?

ECB Negative Interest Rates

WHY would they do it?

•

Historical move for a big central bank

• From zero-interest-rate policy (ZIRP) to NIRP

• Cheap medium term loans for lending to Eurozone businesses

• As expected the US dollar strengthened by 1.5% against the

Euro a few hours later

Stimulate economic growth

June

ECB Negative Interest Rates

>>>>> FAST FORWARD A FEW

MONTHS

• Further lowered deposit rates -0.2%

• Other programs to produce more economic stimulus (eg: ABS purchase program)

US GDP Growth Numbers

• GDP expanded at 4.2% rate in second quarter

•

Personal consumption, private investments, exports, and government spending

•

Some economists believe these results are nothing too impressive

• Year GDP could possible reach just a 2% growth because of Q1 decline.

June

Summer Unemployment Rates

•

July employment report was modestly disappointing, with payrolls rising 209,000 compared to expectations of 230,000

•

Unemployment rate went from 6.1% in June to a small rise to 6.2% in July, as participation increased

•

Recent date shows that participation rate is starting to increase as a strong labor market draws candidates back to the job hunt

• FED believes that “there remains significant underutilization of labor resources”

July

Rough Summer for International

Markets

Argentina BES (Portugal)

•

Faced default to bondholders for the second time in 13 years

•

Bank files for bankruptcy protection

•

Argentine stocks plunged as expected

•

Hidden, under the table dealings led to huge losses

•

No repercussions but raised concerns about Emerging Market

Economies and investing

•

Resolved and split into two banks: good, bad

July-August

Geopolitical Risk Rises for Global

Investors

• Jan 2014 – political crises have rocked the news

• Crises have had minimal lasting impact on markets

• Underestimated risks and volatility

(due to abundant liquidity)

• 28% of investors identified geopolitics as the biggest risk, compared to 14% in June

What Happened This Week

• The dollar has climbed as the Fed gets closer to raising rates, helped by the possible further loosening of monetary policy by European and Japanese central banks

• Consumer prices in the euro zone dropped to 5 year lows

• Dollar General raised its offer for Family Dollar – contemplating a hostile bid

• Goldman Sachs loaned Portuguese bank Espirito Santo $835 million after near collapse

• Barclays is selling its Spanish retail-bank unit for $1 billion

• Tesla Motors has selected the state of Nevada to house its new $5 billion dollar

“gigafactory”

• The S&P continues to hover around the 2,000 mark

Why JOIN?

Next Meeting

September 12 th

12:15

Simon Basement