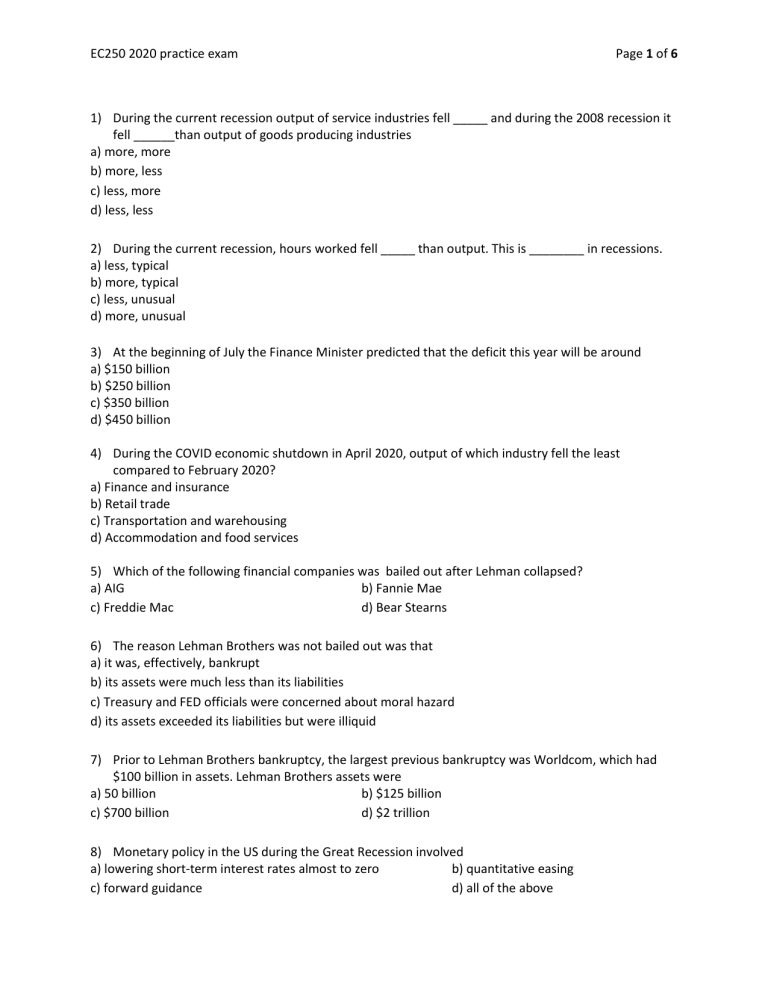

EC250 2020 practice exam Page 1 of 6 1) During the current recession output of service industries fell _____ and during the 2008 recession it fell ______than output of goods producing industries a) more, more b) more, less c) less, more d) less, less 2) During the current recession, hours worked fell _____ than output. This is ________ in recessions. a) less, typical b) more, typical c) less, unusual d) more, unusual 3) At the beginning of July the Finance Minister predicted that the deficit this year will be around a) $150 billion b) $250 billion c) $350 billion d) $450 billion 4) During the COVID economic shutdown in April 2020, output of which industry fell the least compared to February 2020? a) Finance and insurance b) Retail trade c) Transportation and warehousing d) Accommodation and food services 5) Which of the following financial companies was bailed out after Lehman collapsed? a) AIG b) Fannie Mae c) Freddie Mac d) Bear Stearns 6) The reason Lehman Brothers was not bailed out was that a) it was, effectively, bankrupt b) its assets were much less than its liabilities c) Treasury and FED officials were concerned about moral hazard d) its assets exceeded its liabilities but were illiquid 7) Prior to Lehman Brothers bankruptcy, the largest previous bankruptcy was Worldcom, which had $100 billion in assets. Lehman Brothers assets were a) 50 billion b) $125 billion c) $700 billion d) $2 trillion 8) Monetary policy in the US during the Great Recession involved a) lowering short-term interest rates almost to zero b) quantitative easing c) forward guidance d) all of the above EC250 2020 practice exam Page 2 of 6 9) A financial institution expects has a leverage of 5. The return on its assets is 10%. This means that the return on its own funds is a) 10% b) 20% c) 40% d) 50% 10) A financial institution has $1 in capital, borrows $7 and buys $8 in assets. Its leverage is a) 1 b) 7 c) 8 d)15 11) Before the Great Recession, the unemployment rate in Canada was ________ than in the US, and right when the recession ended it was ________ than in the US. a) higher, lower b) higher, higher c) lower, higher d) lower, lower 12) Which of the following is not a stock? a) number of people in the work force c) deficit b) government debt d) the level of inventories 13) Which of these is included in GDP a) the value of the dinner you prepare for yourself c) unsold goods added to inventory b) a used car d) the cost of pollution 14) In the calculation of GDP, Statistics Canada imputes the value of a) government services b) owner – occupied housing c) both a) and b) d) imputations are not used in the calculation of GDP 15) Gross Domestic Product a) measures all economic activity in Canada, also illegal c) measures production of all goods and services in Canada b) measures all income of Canadians d) none of the above 16) GDP calculation uses value added a) to avoid double counting of intermediate goods and services b) because it measures how valuable output is c) because it does not include indirect taxes d) because it measures the beneficial value of production 17) A baker buys flour for $2, makes bread and sells it for $3 to the store. The store sells the bread for $6. The value added by the store is: a) 1 b) 2 c) 3 d) none of the above 18) GDP calculated as sum of production equals GDP calculated as sum of expenditure a) plus net increase in inventories b) minus net increase in inventories c) plus indirect taxes d) minus indirect taxes 19) A machine gets used in the production process. It cost $20 to buy and $24 to replace. Using the economic approach, the amount that should be subtracted from GDP as depreciation is a) 20 b) 22 c) 24 d) depreciation allowance, as prescribed by tax laws EC250 2020 practice exam Page 3 of 6 20) GNP = GDP a) plus factor income of Canadians abroad b) minus factor income of Canadians abroad c) plus factor income of Canadians abroad minus foreign factor income in Canada d) minus factor income of Canadians abroad plus foreign factor income in Canada 21) Ireland has a lot of capital from the UK. Because of this a) British GDP is greater than British GNP b) British GDP is greater than Irish GDP c) Irish GDP is greater than Irish GNP d) Irish GDP is smaller than Irish GNP 22) Which of the following statements is true? a) GDP is a measure of national wealth c) NNP is a measure of national wealth b) GNP is a measure of national wealth d) None of the above 23) Barter a) requires double coincidence of wants c) is impractical if there are many goods b) is time consuming d) all of the above 24) Money a) Is any asset that is used to intermediate exchange c) has always been used, even in primitive societies b) has to have government support d) is necessary for trade 25) Which of the following is not a role of money a) medium of exchange c) unit of account b) universal acceptance d) store of value 26) Bitcoin, and other cybercurrencies, cannot play the role of money because: a) they are not universally accepted b) their value changes all the time c) they are unsafe (can be hacked) d) all of the above 27) If the nominal interest rate is 2 % and the inflation rate is 3 %, the real interest rate is: a) 1 % b) 5 % c) –1 % d) –5 % 28) Which price index includes prices of imported goods? a) CPI c) both b) GDP deflator d) neither 29) In the last 100 years, the price level in Canada increased, approximately a) three times b) 8 times c) twenty times d) a hundred times 30) If the cost of printing a $20 dollar note is 10 cents, and the cost of distributing it is 10 cents, and the note lasts 5 years, what is the amount of seigniorage per year? a) $19.80 b) $3.96 c) cannot be determined without knowing the interest rate Bank of Canada earns on its assets d) cannot be determined without knowing Bank of Canada operating cost, net of interest EC250 2020 practice exam Page 4 of 6 For questions 31 and 32, consider the following price information: year 2016 2017 Price of X 2 4 Quantity of X 100 50 Price of Y 4 2 Quantity of Y 50 100 31) The inflation rate, using the GDP deflator, is a) -50% b) -20% c) 0% d)25% 32) Using the table above, the inflation rate using CPI is: a) -50% b) -20% c) 0% d)25% 33) Hyperinflation is when the inflation rate exceeds a) 50% a month or 600% per year c) 100% per month or 1200% per year b) 50% a month or over 10 000% per year d) 100% per month or over 400 000% per year 34) Nominal GDP exceeds real GDP if a) Prices have decreased since the base year c) Prices have increased since the base year b) Prices are falling d) Prices are rising 35) If a Big Mac is CAD 6 in Canada, GBP 5 in the UK, and the exchange rate is CADGBP=0.7 then, using this information only, the real exchange rate of CAD in terms of GBP is a) 0.5 b) 0.84 c) 1.20 d) 2 36) Your nominal wage increased from $10 to $11, while the price level increased from 120 to 125. As a result, your real wage increased, approximately, by a) 2.5% b) 7.5% c) 10% d) 12.5% 37) Over a long period of time, real wages increased by 200% while nominal wages increased by 500%. This means that the price level a) increased by 100% b) doubled c) increased by 300% d) both a) and b) are true 38) Appreciation of the Canadian dollar means a) increase in the nominal exchange of the dollar under flexible exchange rates b) decrease in the nominal exchange of the dollar under flexible exchange rates c) increase in the nominal exchange rate under fixed exchange rates d) decrease in the nominal exchange rate under fixed exchange rates 39) An increase in the demand for Canadian physical assets (land, companies) a) increases the demand for Canadian dollars on the foreign exchange market b) decreases the demand for Canadian dollars on the foreign exchange market c) increases the supply of Canadian dollars on the foreign exchange market d) none of the above EC250 2020 practice exam Page 5 of 6 40) If demand for Canadian exports increases a) The Canadian dollar will appreciate in terms of US dollar b) The Canadian dollar will depreciate in terms of US dollar c) The US dollar will appreciate in terms of the Canadian dollar d) None of the above 41) If the absolute purchasing power parity holds a) the nominal exchange rate is one b) the real exchange rate is one c) goods in Canada are cheaper than abroad d) goods in Canada are more expensive than abroad 42) If the nominal exchange rate is 10 , the domestic price level is 100, and the foreign price level is 900, then the real exchange rate is a) 0.8 b) 0.9 c) 1.11 d) 1.5 43) If the domestic price level is 400 and the foreign price level is 200 then the purchasing power parity exchange rate is a) ½ b) 1 c) 2 d) 4 44) Since 1998, the exchange rate of the Canadian dollar a) Is completely flexible, with Bank of Canada not intervening on the foreign exchange market, except in extraordinary circumstances b) Is controlled by the Bank of Canada which prevents quick depreciation or appreciation of the Canadian dollar, but does not try to affect the level of the exchange rate c) Is controlled by the Bank of Canada which controls the exchange rate to the benefit of Canadian exporters d) Is fixed in terms of a basket of foreign currencies 45) As a result of a currency crisis in Asinia, the exchange rate of the US dollar increased from 1 Asinian peso/dollar in 1999 to 2 peso/dollar today. This means that the Asinian peso, in terms of the dollar, lost _________ of its value: a) 200% b) 100% c) 50% d) None of the above 46) As a result of a currency crisis in Asinia, the exchange rate of the US dollar increased from 1 Asinian peso/dollar in 1999 to 2 peso/dollar today. This means that the dollar, in terms of the Asynian peso, a) Appreciated by 50% b) Appreciated by 200 % c) Appreciated by 100% d) Depreciated by 50% 47) CAD exchange rate a) is determined by the market c) depends on the demand and supply of Canadian dollars b) has been quite volatile d) all of the above EC250 2020 practice exam Page 6 of 6 48) When the relative PPP holds: a) absolute PPP holds as well b) law of one price holds for every good c) the country with higher inflation has depreciating currency d) the country with higher inflation has appreciating currency 49) Suppose that Canadian one-year bonds are paying 3.0% interest while one-year US bonds are paying 2.0% interest. If you expect that the nominal exchange rate in a year’s time will be CADUSD=0.90 you should be indifferent between US bonds or Canadian bonds if the current exchange rate is (approximately): a) 0.89 b) 0.91 c) 0.88 d) 0.92 50) The interest parity condition predicts that an increase in the Canadian interest rate will cause a) appreciation of the US dollar b) expectations of appreciation of the US dollar c) depreciation of the Canadian dollar d) appreciation of the Canadian dollar