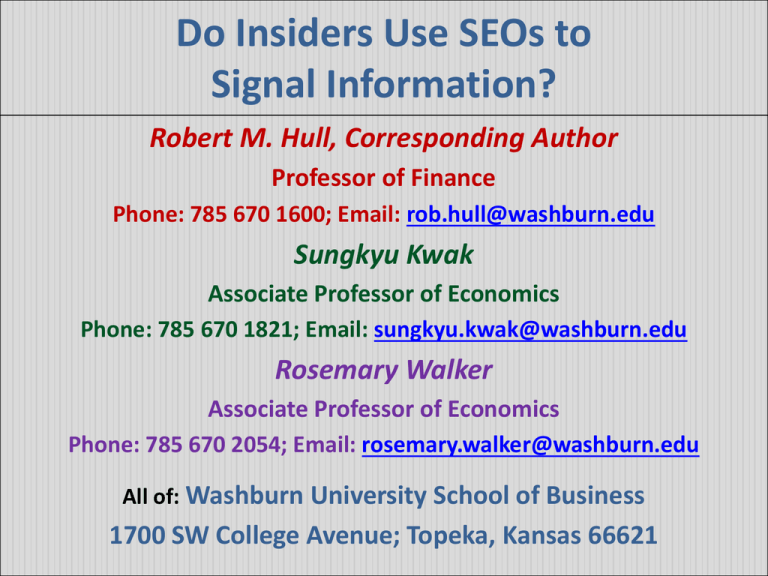

Do Insiders use SEOs to Signal Information?

advertisement

Do Insiders Use SEOs to Signal Information? Robert M. Hull, Corresponding Author Professor of Finance Phone: 785 670 1600; Email: rob.hull@washburn.edu Sungkyu Kwak Associate Professor of Economics Phone: 785 670 1821; Email: sungkyu.kwak@washburn.edu Rosemary Walker Associate Professor of Economics Phone: 785 670 2054; Email: rosemary.walker@washburn.edu All of: Washburn University School of Business 1700 SW College Avenue; Topeka, Kansas 66621 Introduction THIS PAPER COVERS TWO LINES OF RESEARCH: Insider Signaling Seasoned Offerings WHO ARE INSIDERS? Section 16 of the Securities Exchange Act of 1934 defines insiders as officers, directors, and beneficial owners. "Officer" refers to president, vice president, secretary, treasurer or financial officer, comptroller, principle accounting officer, or any person who does such managerial functions. "Director" refers to a member of the board of directors. "Beneficial owner" refers to a large shareholder who owns 10 percent or more of a class of registered equity shares in the firm. Introduction (continued) In regards to insider signaling, researchers have investigated the effect of inside ownership on the market's reaction to the announcements of various corporate decisions. These corporate decisions include: Stock repurchases (Vermaelen, 1981) Dividend initiations (Born, 1988) Sell-offs (Hirschey and Zaima, 1989) Stock splits (Han and Suk, 1998) Security offering announcements (Cornett & Travlos, 1989; Copeland & Lee, 1991; Hull & Mazachek, 2001) Introduction (continued) The prior research focuses on either the level of inside holdings at the time of the announcement (Hull and Mazachek, 2001) or inside trading before and after the time of the announcement (Copeland and Lee, 1991). In some cases, inside changes are simply proxied by a variable that is really just the percentage change in outstanding common stock (Cornett and Travlos, 1989). Findings of these studies are at time cited as being consistent with Leland and Pyle (1977). However, the Leland and Pyle signaling theory advances the notion that it is the change in insider ownership percentage that influences stock value at the time of an announcement as opposed to (i) the level of inside ownership or (ii) what insiders themselves do prior to or after the announced event. Introduction (continued) What insiders do prior to or after the event should not impact the actual market response at the time of a corporate management decision announcement such as a seasoned offering announcement. To our knowledge, researchers have not examined how actual changes in the percentage of inside ownership impacts the announcement period returns for seasoned stock offerings (or other corporate events for that matter). Thus, an examination of the change in inside ownership percentage is a missing gap in the research that this paper attempts to address. Introduction (continued) Besides the insider signaling research, this study covers the seasoned offering research. The seasoned offering line of research has its origins in a number of early empirical studies (Masulis, 1983; Asquith and Mullins, 1986) that document negative announcement period returns. Regardless of the purpose of the offering, the general consensus is that the negative news is being signaled about the stock being overpriced. If this is the case, then more negative news should be signaled if insiders are lowering their ownership percentages. Introduction (continued) Hull and Mazachek (2001) look at the amount of inside ownership at the time of the seasoned offering announcement. – They find that greater levels of inside ownership can be associated with greater negative signaling for equity and equity-like offerings. In regards to the strength of the market response to a seasoned offering announcement, explanations for a greater negative response include those associated with – greater issue costs (Hull & Kerchner, 1996), – smaller firm size (Bhushan, 1989), – greater net negative agency costs (Jensen & Meckling, 1976; Jensen, 1986), and – greater decreases in inside percentages (Leland & Pyle, 1977). This paper will focus on Leland & Pyle theory while revisiting the seasoned offering announcement period results that are largely a phenomenon of the 1970s and 1980s. Introduction (continued) Unlike prior studies and keeping with the actual notion of Leland and Pyle, our paper examines the actual percentage change in inside holdings caused by an announcement. We do this for a sample of 729 seasoned offerings (SEOs) from 1999 through 2006. No one (to our knowledge) has investigated how the actual change in insider percentages influences stock price behavior either at the time of offering or for longer time periods. The information about the actual change in insider percentages (brought about by the planned offering) is revealed in the prospectus at the time of the registration announcement. I. Descriptive Statistics * We identify seasoned offering announcement dates from the Investment Dealers' Digest (IDD) and gather inside ownership data from the prospectus filed with the Securities and Exchange Commission (SEC) as part of a registration statement. * Other information gathered from IDD and the company’s prospectus include the offer price, the number of shares being offered (both primary and, if applicable, secondary), the purpose of the offering, the number of post-outstanding shares, and the issue costs. * Other sources used for empirical tests include Compustat Annual Files and CRSP Daily Return Files. I. Descriptive Statistics (continued) – We get return data from the CRSP Daily Return Files. • When checking to see if abnormal returns render the same results as raw returns, we utilize the OLS market model procedure described by Brown and Warner (1985) to calculate cumulative returns. – When applying this model, we compute alpha and beta parameters using the equal-weighted CRSP NASDAQ, AMEX, and NYSE indices for respective NASDAQ, AMEX, and NYSE firms. – The comparison period includes the 500 trading days before and after the announcement day. I. Descriptive Statistics (continued) • For inclusion in the sample for empirical tests, an observation must satisfy the following five screens. – First, it must be a seasoned stock offering that is announced in the Investment Dealers Digest. – Second, we must be able to obtain its prospectus. – Third, the prospectus must have inside ownership percentage data before and after the announcement. • The inside data includes the combined percentage holdings of all officers & directors and the percentage holdings of all beneficial owners who own & control at least five percent of the outstanding shares either by themselves or through other family members or through control of other entities that own shares. – Fourth, it must have available stock return data needed to perform statistical tests. • While some tests require other data, observations without the required data can be lost for these tests. I. Descriptive Statistics (continued) • After applying these screens, we have 729 seasoned stock offerings remaining from – the 1,601 for which we could find prospectuses, and – the 2,371 firms identified from IDD. • Table I provides descriptive statistics for our sample of 729 offerings that occur for the seven years and three months from January 1999 through March 2006. • The time period statistics in Table I reveal that about 40% of the observations occurred in 19992000. This can be at explained by the fact that the stock market was peaking during these two years. Key Variables Mean Median Range Percentage of Inside Ownership Before 48.76% 45.60% 1.30% – 100.0% Percentage of Inside Ownership After 38.04% 34.10% 0.00% – 100.0% Change in the Percentage of Inside Ownership -10.72% -9.10% -42.00% – +7.75% Total Shares Offered (Primary plus Secondary) 6.766M 4.250M 0.550M – 135.1M Secondary Shares as Percentage of Total Shares 39.16% 24.72% 0.00% – 100.0% Offer Value (Offer Price × Total Shares Offered) 211.60M 109.14M 5.00M – 8,782M Common Value 2,164.6M 719.7M 20.3M – 46,134M Offer Value as Percentage of Common Stock Value 16.20% 14.62% 0.00% – 223.0% Firm Value 5,430M 1,039M 31.0M – 340,121M Issuance Expenses as Percentage of Offer Value 5.73% 5.69% 0.00% – 23.00% Issuance Expenses as Percentage of Common Value 0.98% 0.82% 0.00% – 7.00% Two-Day Return (Days -1, 0) -1.51% -1.32% -35.32% – +42.43% Three-Day Return (Days -1, 0, +1) -0.99% -1.31% -49.00% – +52.00% Four-Day Return (Days -2, -1, 0, +1) -1.53% -1.46% -58.42% – +48.93% 131.78% 53.66% -99.4% – +3408.7% 24.09% 3.07% 2.68% – +221.19.7% Four-Year Firm Returns around Day 0 (n = 621) Four-Year Market Returns around Day 0 (n = 654) I. Descriptive Statistics (continued) • Table I next reports statistics for key variables. – The mean (median) inside ownership percentage before the announcement is 48.76% (45.60%), while after the offering the mean (median) values are 38.04% (34.10%). – The mean (median) change in the percentage of inside ownership is -10.72% (-9.10%) indicating that a typical firm’s insiders decrease their percentage ownership by about ten percent. – Another statistic from Table I deserving more emphasis is the number of shares sold by current owners (which includes insiders). • The mean (median) for this statistic is 39.16% (24.72%). – The mean (median) percentage change in common stock value is 16.20% (14.62%) indicating that firms are selling about $1 of shares for every $6 or $7 dollars in current value. I. Descriptive Statistics (continued) • Table I also reports issuance expenses data as given in the prospectus, which consists mostly of the underwriting discount. – These expenses do not include other perks such as warrants, money from exercising overallotment options, underpricing, and other miscellaneous expenses (like employees’ time). • Prior research (Hull and Kerchner, 1996) finds that underpricing can range from 1/2 – 2/3 of the expenses reported in the prospectus. • The OTC research (Hull and Fortin, 1994) suggests that all other expenses can equal that reported in the prospectus. – Thus, it appears that issuance expenses given in Table I (which is about 1% of common stock value) can explain most, if not all, of the fall in stock value at the time of the announcement. – This is because Table I reports that fall ranges from about -0.99% to about -1.53% depending on which days are used when computing the announcement period return. • For the two-day return (which is the return commonly used) the mean (median) return is -1.51% (-1.32%). I. Descriptive Statistics (continued) • Finally, as seen in Table I, the typical firm experiences positive returns for the four years around their seasoned offering. – These four years include the two years prior and the two years after the offering. – The mean (median) four-year return is 131.78% (53.66%). The mean (median) return on a comparable market index is only 24.09% (3.07%). – Although the results may be biased due to losing 108 firms without sufficient stock price data, the return is positive enough to indicate that the recent time period used in this study (1999-2006) gives long-term returns for seasoned offerings similar to prior studies. – Thus, we verify prior conclusion that stock offerings tend to take place during periods when the stock is doing well and/or overpriced. Panel A. Announcement Period Return Results Sample Number of Mean Change in Inside Mean Two-Day Return Companies Ownership Percentage (Range) (Range) All Portfolios 729-10.72% (-42.00% – +7.75%) -1.51% (-35.32% – +42.43%) Portfolio 1 243-3.05% (-5.80% – +7.75%) -1.69% (-35.32% – +31.19%) Portfolio 2 243-9.12% (-12.50% – -5.90%) -1.20% (-31.82% – +42.43%) Portfolio 3 243-19.99% (-42.00% – -12.50%) -1.63% (-24.65% – +26.42%) Panel B. Tests for Equality of Portfolio Returns Test Portfolios Compared Test Statistic F-test 1, 2, and 3 0.24 t-test 1 and 2 0.61 t-test 2 and 3 0.57 t-test 1 and 3 0.08 II. Return Results To investigate whether returns are more negative for firms with greater decreases in inside ownership percentages, we partition our seasoned offering sample into three portfolios. Portfolio 1 includes firms with the least changes in inside ownership percentages. Portfolios 2 and 3 consist of firms with the middle and greatest changes in inside ownership percentages, respectively. Signaling theory rooted in Leland and Pyle (1977) predicts that Portfolio 1 will have the least negative return and Portfolio 1 will have greatest negative return. II. Return Results (continued) • Table II provides mean two-day announcement period returns for days -1 to 0. – The first row in Panel A reports that the two-day return of -1.51% for the total sample is statistically significant (t = -4.76). – The last three rows in Panel A provide two-day return results for the three portfolios. Inconsistent with signaling theory, these rows reveal that returns do not decrease monotonically with the decrease in inside ownership percentages. – The least negative return is -1.20% (t = -2.12) for portfolio 2, in which the change in inside ownership percentages ranges from -12.50% to -5.90%. – For portfolio 1, the return is the most negative at -1.69% (t = -2.93) even though the change in inside ownership percentage only ranges from -5.80% to +7.75%. – For portfolio 3, the return is similar to portfolio 1 with a return of -1.63% (t = -3.25) even though the change in inside ownership percentages range from -12.40% to -42.00%. – In conclusion, the respective means (medians) for the change in inside ownership percentages of -3.05%, -9.12%, and -19.99% for portfolios 1, 2, and 3 do not render two-day return results predicted by signaling theory. II. Return Results (continued) • Panel B in Table II reports statistical results when comparing portfolio two-day returns and confirm the conclusion generated from Panel A. • The first row provides analysis of variance results when testing whether returns are identical across portfolios. • The F-statistic of only 0.24 reveals that returns are not significantly different across portfolios. • Although not presented in table format, comparable results are found when the sample is partitioned into either four or five portfolios. II. Return Results (continued) The last three rows in Panel B report nonpaired one-tailed parametric t-statistics when testing the null hypothesis that the return for the portfolio with the lesser decreases in inside ownership percentages is more negative or equal to the return for the portfolio with greater decreases in inside ownership percentages. Comparisons between any two portfolios do not reject the hypothesis that returns are equal. In fact, the t-statistics are all rather anemic offering no support for Leland & Pyle (1977). II. Return Results (continued) • The results in both panels of Table II offer evidence that the wealth effects do not differ across firms with dissimilar inside ownership percentages. • Inconsistent with signaling theory based in Leland and Pyle (1977), seasoned offering announcement period returns by companies with greater decreases in inside ownership percentages are not associated with greater negative returns. • Thus, investors in firms undergoing seasoned offerings cannot expect a more negative market response as the inside ownership percentages decreases. III. Other Tests and Results • We conduct a number of other tests. – First, we repeat prior research by looking at the level of inside ownership. – Consistent with this research, we find that the strength of the market response increases as the level of inside ownership increases. – For the percentages of inside ownership after the offering as given by the prospectuses, we find that the mean values for the percentage of inside ownership for portfolios 1, 2, and 3 are 15.29%, 34.42% and 64.47%. – These three portfolios (ranked according the level of inside ownership and not the change in inside ownership percentage) renders mean two-day returns of -0.57%, -1.49%, and 2.46% for portfolios 1, 2, and 3. – The F-statistic for the two-day return is 2.97 (significant at the 5% level). – For four-day returns, portfolios 1, 2, and 3 have returns of -0.17%, -1.05% and 3.37% with an F-statistic is 5.73, which is significant at the 1% level. – The three-day return has the highest F-statistic at 5.73. – Finally, considering the t-tests for portfolios 1 and 3, which should have the greatest differences, the two-day, three-day, and four-day returns have t-statistics of 2.42, 3.31, and 3.06 (all significant at the 1% level). – These results suggest that investors will disregard changes in inside ownership percentages at the time of the seasoned offering if they still maintain high ownership levels after the offering. III. Other Tests and Results (continued) • Besides the above tests, we also ran a number of other tests. • For example, the results using three-day returns and four-day returns are similar to the two-day returns reported in Table II with all F and ttests insignificant. • Similarly, adjusting for expected returns using various models do not change our results. • In addition, we repeated our tests by deleting observations that are typically omitted such as REITs, financials and utilities. – Deleting these observations do not change our results, which may be explained by the fact these firms do not dominate any of the portfolios. • Similarly, adjusting for issuance costs following the methodology of prior research (Hull and Fortin, 1994; Hull and Kerchner, 1996) does not change our findings. – Once again, it is because the issuance costs are similar for all portfolios. • Finally, a number of tests indicate that firm size is not a significant factor in explaining our conclusions regarding the change in insider percentages. III. Other Tests and Results (continued) • Finally, we conducted some tests on betas and long-run returns where returns were adjusted based on betas and also matching NASDAQ, AMEX or NYSE indices. • One striking finding involves a statistically significant relationship between betas and changes in insider ownership proportions. – Firms undergoing greater insider changes have lower betas. • Long-run return findings include – Firms where insiders are undergoing greater changes perform poorer before the seasoned offering announcement. • Holds for one, two, and three year periods and is statistically significant at 1% level for one year period (marginally significant for other periods). – Firms where insiders are undergoing greater changes perform better after the seasoned offering announcement. • Holds for one, two, and three year periods and statistically significant for each period at 1% levels, respectively. • Two possible interpretations of long-run return findings: – Insiders sell a higher proportion of their shares when the company has inferior returns the year prior and in the process show no understanding of the relative superior future prospects of their own companies – Insiders sell a higher proportion of their shares because they are conservatively diversifying their own holdings all the while still maintaining higher levels of ownership where this higher level really reveals what they think about their firms’ future performances. IV. Summary Prior research, not only in security offerings announcements but also other areas of corporate announcements, indicates that inside ownership is an important determinant of how the market reacts. These studies often focus on either the level of insider holdings or insider trading around the time of the offering. This paper examines actual changes in inside holdings for seasoned offerings, which is the inside information that tells us more precisely what insiders feel about the company. This information can be revealed at the time of the registration announcement when the prospectus states exactly what insider ownership percentages are expected to be both before and after the offering. IV. Summary (continued) In examining prospectuses for 729 seasoned offerings from 1999 through 2006, we find surprising and unexpected results. In particular, we discover no relationship between changes in inside ownership percentages and how the stock prices responds. We attribute the difference in our results to the fact that the market looks at the level or percentage of ownership and not how the percentage changes. This appears to be an anomaly because signaling theory rooted in Leland and Pyle (1977) specifies that the change in insider percentages should reveal what insiders think about the firm’s prospects. By simultaneously lowering their ownership proportions, yet selling at a premium value, it appears that insiders are able to maximize their own welfare at the expense of current and newer shareholders. IV. Summary (continued) • Practically speaking, our findings can guide managers in terms of what to expect when announcing a seasoned offering where insiders are also selling (or at least not buying). – For example, if inside holdings are already high and remain at relatively the same level, then investors appear to be unconcerned about insider behavior. • Investor concern may also be mitigated due to the fact the firms undergoing seasoned offerings perform relative well for the four years surrounding the offering compared to benchmark market indices. • If investors believe the firm is already in safe hand, then insider behavior is less of a concern.