February 2003: Inside Ownership and Leverage Reductions

advertisement

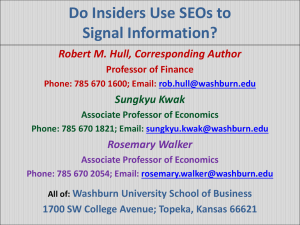

Inside Ownership and Leverage Increases Robert M. Hulla,b Sungkyu Kwaka Rosemary Walkera aSchool of Business, Washburn University, 1700 SW College Avenue, Topeka, KS 66621 bCorresponding author. Tel.: + 1-785-231-1010; fax: + 785-231-1063. E-mail address: rob.hull@washburn.edu (R. Hull) Beatrice Presentation, Topeka, Kansas, February 2003 Published by Global Business and Economics Review, 2005 Abstract In this paper, we investigate the role of inside ownership in explaining announcement period stock returns for senior-for-junior transactions. We find that returns are more positive for firms with higher inside ownership percentages. Returns become even more positive for firms in which insiders are expected to be increasing their ownership percentages. JEL classifications: D820; G140; G320 Key Words: Inside ownership; Senior-for-junior; Announcement period return; Security type; Firm size Prior Research: Two Lines of Research Empirical researchers (Masulis, 1983; Cornett and Travlos, 1989; Shah, 1994; Hull, 1994; Hull and Michelson, 1999) document statistically significant positive stock returns at the announcement of senior-forjunior transactions. These transactions can signal positive information stemming from insider behavior (Leland and Pyle, 1977), the alteration in fixed obligations (Ross, 1977), adverse selection (Myers, 1984), and firm size (Bhushan, 1989). Researchers investigate the effect of inside ownership on the market's reaction to the announcements of various corporate decisions, including stock repurchases (Vermaelen, 1981), dividend initiations (Born, 1988), selloffs (Hirschey and Zaima, 1989), stock splits (Han and Suk, 1998), and junior security offerings (Hull and Mazachek, 2002). They find that firms with higher inside holdings have greater announcement period returns. Purpose In this paper, we extend pure leverage increase and inside ownership research by testing whether announcement period stock returns for senior-for-junior announcements are more positive for firms with higher levels of inside ownership. Testable Hypotheses H1: The stock returns for senior-for-junior announcements will be more positive for firms with higher levels of inside ownership. H2: The stock returns for senior-for-junior announcements will be more positive for firms in which insiders are expected to undergo greater increases in their levels of ownership. Table 1: Descriptive Statistics Key Variable Mean (Median) 14.95% (10.73%) Senior Offering Value $184M ($41M) Common Stock Value $975M ($223M) $2169M ($460M) 14.69% (8.54%) Inside Ownership Firm Value Senior Offering Value as a Percentage of Firm Value Table 2: Panel A. Announcement return results by portfolio Sample Tested Number of Observations All 48 0.23% 55.60% 4.86% 5.10*** Portfolio 1 16 0.23% 3.45% 2.66% 2.16** Portfolio 2 16 4.10% 20.10% 4.33% 2.54*** Portfolio 3 16 20.20% 55.60% 7.59% 4.20*** Portfolios Inside Cumulative Ownership Abnormal Percentages Returns t-statistic Table 2: Panel B. Tests for equality of portfolio returns Test Portfolios Compared Test Statistic F-test 1, 2, and 3 F = 2.45* t-test 1 and 2 t = 0.79 t-test 2 and 3 t = 1.31* t-test 1 and 3 t = 2.26** Table 3. Correlation Results CAR INS PCH PRM TYP LFS CAR INS PCH PRM TYP LFS --0.28** 0.39*** 0.31* -0.27* -0.31** 0.29** ---0.04 0.03 0.22 -0.58*** 0.34** -0.08 --0.32** -0.47*** -0.11 0.37*** 0.03 0.25* ---0.29** -0.12 -0.26* 0.28* -0.35** -0.29** ---0.19 -0.33** -0.49*** -0.17 -0.14 -0.18* --- Table 4: Regression Results CON. a0 INS a1 PCH a2 PRM a3 TYP a4 LFS a5 2.358 0.39 0.128 1.88** 3.608 1.37* 3.079 1.66* -3.349 -1.65* -0.651 -1.19 -3.470 -0.95 0.166 2.74*** 4.396 1.72** 3.358 1.82** -2.919 -1.45* ----- ----- ----- -0.874 -0.56 0.143 0.131 3.747 2.47*** 2.50*** 2.08** R2 Value (FValue) 0.35 (4.51***) 0.33 (5.23***) 0.31 (6.72*** ) SUMMARY This study extends the pure leverage increase and inside ownership research by examining the role of inside ownership when firms announce senior-for-junior transactions. Tests of portfolios, formed according to the percentage of inside ownership, show that portfolios with higher levels of inside ownership have stock returns significantly more positive than those with lower levels of inside ownership. Correlation and regression tests offer further evidence that the level of insider ownership influences the market response. These tests also show that the market response becomes more positive when insiders are expected to undergo greater increases in their ownership. We find that the market reaction continues to become more positive if firms announce greater premium or if the announcing firm is a smaller firm. Practical Conclusion Practically speaking, our findings can guide managers in terms of what to expect when announcing a pure leverage increase. Managers of firms with high inside ownership can anticipate a more positive market response. This positive response can be enhanced if insiders are perceived as increasing their percentages of ownership. Managers can further increase the positive response if they announce a premium or represent a small where less information about the firm is available.