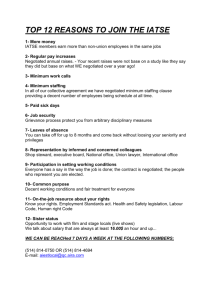

Competitive vs Negotiated Bond Sales

advertisement

BOND ISSUANCE A School District Perspective Linda D. Quinley, CFO/COO Columbia Public Schools Kevin F. Supple, CFO Francis Howell R-III School District Why This Session? • Legislation has been proposed to require school districts to use only competitive bond sales • This session will explore the relative advantages of competitive and negotiated bond sales, from the perspective of two practicing CFOs DEFINITIONS Competitive Sale • Bonds are advertised for sale • Advertisement includes both the terms of the sale and the terms of the bond issue • Any broker dealer or dealer bank may bid on the bonds at the designated date and time • The bonds are awarded to the bidder offering the lowest interest cost Competitive Sale • Issuer, typically with a financial advisor or investment banker, conducts all the origination tasks necessary for the bond offering • Structuring the maturity schedule • Preparing the official statement • Verifying legal documents • Obtaining a rating • Securing credit enhancement • Timing the sale Why A Competitive Sale? • Attractive debt amount • Traditional financing structure • Issuer has a good reputation and name recognition in the municipal market • Issue has an investment grade credit rating • Relatively stable conditions exist in the municipal securities market Competitive Sale Advantages • Competitive environment • Lower spreads • Open process • Satisfies legal requirements in all states • Establishes direct costs in advance Competitive Sale Disadvantages • Risk premium • Limited timing and structural flexibility • Minimum issuer control over underwriter selection and bond distribution Negotiated Sale • Underwriter is selected to purchase the bonds • Terms of the bonds are tailored to meet the demands of the underwriter's investor clients, as well as the needs of the issuer • Sale may include a process known as a presale in which underwriters seek customer indications of interest in the issue before establishing final bond pricing • Underwriter sells the bonds to its investor customers Negotiated Sale • Two party process • Issuer should have sufficient knowledge of debt financing to take an active role in establishing the terms of the issue and sale • Independent financial advisor can serve as a third party negotiator Why A Negotiated Sale? • Unusually large or a very small debt amount • Complex or non-traditional financing structure • Issuer is a new or infrequent participant in the marketplace • Issue has a low or questionable credit rating • Volatile conditions exist in the municipal securities market Negotiated Sale Advantages • Effective for complex or non-traditional financings • More flexible timetable • Longer pre-sale market assessment • Underwriters may be removed or replaced • Assistance to the issuer in setting rates, terms, and conditions of the bond issue • Influence over underwriter selection and bond distribution Negotiated Sale Disadvantages • Lack of competition in pricing • Elements of spread open to fluctuation • Appearance of favoritism CONSIDERATIONS Issuer Characteristics • Market familiarity • Credit strength • Policy goals Financing Characteristics • Type of debt instrument • Issue size • Complexity of issue • Market conditions • Your story Competitive Discipline Negotiated Sale • Selection of underwriter • Competitive underwriter market • Aftermarket tracking of performance Competitive Sale • Bidding process • Costs of appraising the prospects of the issue • Accessibility of the bidder to downstream retail or institutional investors • Perceived ability of the bidders to prevail against their rivals Research Says… • Conflicting studies of relative merits of competitive vs. negotiated sales • Study results limited due to number of issues included in analysis • Self-selection bias • Sample selection bias • Empirical evidence will yield biased estimates of expected interest cost unless there are controls for factors that bear on the negotiated/competitive choice REAL STORIES FROM TWO DISTRICTS Columbia Public Schools Francis Howell R-III School District Take Aways • Issuers have been well served by both competitive and negotiated sale strategies • The municipal bond marketplace is taking advantage of information technology innovation • Administrative enhancements offer great opportunities for efficient and effective bond sale programs Alternate Approaches • Conduct competitive bidding within the legal framework of a negotiated sale • Infuse competition in the negotiated sale process • Unbundle financial services Conclusions • Neither the competitive sale nor the negotiated method of sale is ideal for all bond issues. • The appropriate method of sale should be determined on a case-by-case basis after evaluating a number of factors related to the proposed financing, the issuer, and the bond market. • The challenge for public issuers is to properly identify how the relevant decision factors apply to their proposed bond issues. Recommendations • Participate in all aspects of the bond issuance • Assess the level of demand for the issue • Focus on the total costs of the financing • When in doubt, hire a financial advisor • Evaluate the method of sale for every issue QUESTIONS? Resources A Comprehensive Evaluation of the Comparative Cost of Negotiated and Competitive Methods of Municipal Bond Issuance, Municipal Finance Journal, Vol. 28, No. 4, Winter 2008 Advantages and Circumstances Favoring Competitive and Negotiated Sales of Securities, http://www.speerfinancial.com/advantages.php Resources Competitive Versus Negotiated Sale of Debt, Issue Brief No. 1, California Debt and Investment Advisory Commission, September 1992 Best Practices Related to Debt Issuances, Government Finance Officers Association, 1994 The Municipal Underwriting Process, PiperJaffray, http://www.piperjaffray.com/pdf/021614_municipalbondunderwriting.pdf Resources Bond Sale Methods (Competitive vs. Negotiated Bond Sales) , WM Financial Strategies, http://www.munibondadvisor.com/SaleChoice.htm Competitive and Negotiated Bonds Sales - Making the Right Choice, WM Financial Strategies, http://www.munibondadvisor.com/SaleMethodWhitePaper.htm