ACC 1A and 1B assessment

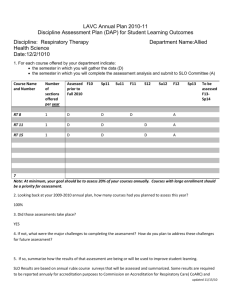

advertisement

Assessment Summary Sheet Unit: _Accounting_____________ Contact Person: _Cheryl Honoré___________ Date: __May 19, 2011___________ Student Learning Outcomes Assessment Update 1. In order to maintain our accreditation status, it is essential that every unit has an ongoing, robust assessment process. This document is used to complete the annual ACCJC report on our progress in assessing student learning. Please complete the information carefully so that our college’s annual report will reflect accurate data. Please add lines as needed. Name of Program or Course (please list programs first) Number of Sections Offered this academic year Number of Sections Assessed this academic year Student learning outcomes have been identified (Yes = 1/No = 0) Assessment information or data has been generated (Yes = 1/No = 0) Assessment done this academic year (Yes = 1/No = 0) Assessment information or data has been used to improve student learning (Yes = 1/No = 0) ACC 1A - Principals of Accounting I ACC 1B - Principals of Accounting II ACC 55 - Applied Accounting/Bookkeeping ACC 65 - Computerized Accounting 6 6 1 1 1 1 2 2 1 1 1 1 2 0 1 0 0 0 0 0 1 0 0 0 2. Fill out the chart on the next page for each assessment project your unit is engaged in. Copy and paste more charts as needed if your unit has more than two assessment projects. For Steps 1 – 3, put an X on the line to indicate your answers. For step four and five use the forms on the subsequent pages to add your brief narrative. By 2012 our accreditation will require that you assess at least one SLO for each course in your discipline. STUDENT LEARNING OUTCOMES Standard Report Form 2011____ Today’s Date: _May 19, CONTACT PERSON: _ Cheryl Honoré____________________Phone _951-_571-_6108__Email: Cheryl.Honore@rcc.edu___Full Time: _X_ Part-Time___ Course Number: _ACC 1A_ Course Title: Principals of Accounting I___ Course Section Numbers: _Spring 2010 – 22000,22001,22002; Fall 2010 – 27141, 27142, 27143____ Course Type: Face-to-face: _ X_ Hybrid:___ On-Line: ___ Fast-Track: ___ Daytime: _4__ Evening: _2__ LIST SLO TO BE ASSESSED: Analyze, explain, solve problems and apply the principles of financial accounting to varied economic units within a business entity. Step 1: Taking Stock Step 2: Time & Methods of Assessment Step 3: Measurement Criteria Step 4: Summary & Analysis of Data Step 5: Use of Results and Modifications WHY? HOW? WHAT? RESULTS Act, enact, and disseminate Provide a clear “picture” of why you selected this student learning outcome and explain the project or assignment you will be using as the assessment tool. How will the learning outcome be assessed? Mark “X” to one or more: 1._X_Improve instruction 2._X_Student success 3.___Equity 4.___Retention rates 5.___Persistence rates 6.___Course completion 7.___Other Mark “X” to one or more: 1. ___Self (student) reported gains 2. ___Portfolio 3. ___Analytic Rubric 4. _X_Pre/Post Assessment 5. ___Other What are your expectations? Analyze and report on the results of the assessment. Please select from this example or you may create your own. Example: 1. ___specific % of all submissions will display competency 2. ___benchmark not available; assessment activity to serve as initial benchmark. 3. _X_other See the next page to provide assessment details. Report on how you will use the results of the assessment for improving teaching and learning. See the next page to provide assessment details. Assessment Detail Please provide narrative details for previous worksheet(s). Unit: _Accounting_____ Course: _ACC 1A____Contact Person: _ Cheryl Honoré_______ Date: __May 19, 2011_ Step 4: Summary & Analysis of Data Step 4a. Provide an overview of the selection processes for the outcome, identifying methods, criteria, and results from the SLO. The SLO was selected because it is central to disciplinary knowledge. The Pre/Post Test used to assess this SLO includes one question from each of the 12 on-line chapter quizzes that were assigned to the students throughout the semester. The Pre/Post Test was administered (on line) during the first two weeks, and again in the last two weeks of the spring 2010 and fall 2010 semesters. The Pre and Post Test were timed, and access to them was restricted, to prevent the students from simply looking up the answer to every question. (See Appendix A for the Pre/Post Test.) Two measurement criteria were selected: 1. Improvement on the Post-Test as compared to the Pre-Test Analysis of the data shows improvement in the responses to all 12 questions on the Post Test. This suggests that students know more when they finish the class, than they know when they began the class. 2. Average of 60% or higher competency on all Post-Test questions The students averaged 60% or higher on eleven of the twelve questions. (See Appendix B for the Assessment Results.) Step 4b. Provide specific analysis of data from assessment and discuss the successes or concerns related to what the data indicates regarding student learning. Only 49% of the students correctly answered the question on pricing bonds (question 12). Because of time constraints, the chapter on bonds is covered in one class session (the last lecture). Therefore, in spring 2011 a pre-lecture assignment, to introduce the students to the topic of bonds, was assigned. Step 4c. Include all potential links to other outcomes in the course, other courses, or any other parts of the institution you deem appropriate. The SLO is a prerequisite skill for ACC 1B. Step 5. Use of Results and Modifications As a result of the assessment, is the unit considering any modifications to the curriculum? Yes. What are they? In spring 2011 a prelecture assignment, to introduce the students to the topic of bonds, was assigned. When will they occur? Spring 2011. Do they involve other units? No. Is any consideration being given to modifying the existing SLO? No. Note: please expand table sections as necessary. Today’s Date: _May 19, STUDENT LEARNING OUTCOMES Standard Report Form 2011____ CONTACT PERSON: _ Cheryl Honoré____________________Phone _951-_571-_6108__Email: Cheryl.Honore@rcc.edu___Full Time: _X_ Part-Time___ Course Number: _ACC 1B_ Course Title: Principals of Accounting II___ Course Section Numbers: _Spring 2010 – 22003; Fall 2010 – 27144____ Course Type: Face-to-face: _ X_ Hybrid:___ On-Line: ___ Fast-Track: ___ Daytime: _1__ Evening: _1__ LIST SLO TO BE ASSESSED: Analyze, explain, solve problems and apply managerial accounting principles to manufacturing and service enterprises within a business entity Step 1: Taking Stock Step 2: Time & Methods of Assessment Step 3: Measurement Criteria Step 4: Summary & Analysis of Data Step 5: Use of Results and Modifications WHY? HOW? WHAT? RESULTS Act, enact, and disseminate Provide a clear “picture” of why you selected this student learning outcome and explain the project or assignment you will be using as the assessment tool. How will the learning outcome be assessed? Mark “X” to one or more: 1._X_Improve instruction 2._X_Student success 3.___Equity 4.___Retention rates 5.___Persistence rates 6.___Course completion 7.___Other Mark “X” to one or more: 1. ___Self (student) reported gains 2. ___Portfolio 3. ___Analytic Rubric 4. _X_Pre/Post Assessment 5. ___Other What are your expectations? Analyze and report on the results of the assessment. Please select from this example or you may create your own. Example: 4. ___specific % of all submissions will display competency 5. ___benchmark not available; assessment activity to serve as initial benchmark. 6. _X_other See the next page to provide assessment details. Report on how you will use the results of the assessment for improving teaching and learning. See the next page to provide assessment details. Assessment Detail Please provide narrative details for previous worksheet(s). Unit: _Accounting_____ Course: _ACC 1B____Contact Person: _ Cheryl Honoré_______ Date: __May 19, 2011_ Step 4: Summary & Analysis of Data Step 4a. Provide an overview of the selection processes for the outcome, identifying methods, criteria, and results from the SLO. The SLO was selected because it is central to disciplinary knowledge. In 2009, a Pre/Post Test was created that includes 12 questions (one question per chapter) from the 11 on-line chapter quizzes that were assigned to the students throughout the semester. The Pre/Post Test was administered (on line) during the first two weeks, and again in the last two weeks of the spring 2010 and fall 2010 semesters. The Pre and Post Test were timed, and access to them was restricted, to prevent the students from simply looking up the answer to every question. (See Appendix C for the Pre/Post Test.) Two measurement criteria were selected: 1. Improvement on the Post-Test as compared to the Pre-Test Analysis of the data shows improvement in the responses to all 12 questions on the Post Test. This suggests that students know more when they finish the class, than they know when they began the class. 2. Average of 60% or higher competency on all Post-Test questions The students averaged 60% or higher on eleven of the twelve questions. (See Appendix D for the Assessment Results.) Step 4b. Provide specific analysis of data from assessment and discuss the successes or concerns related to what the data indicates regarding student learning. Only 50% of the students correctly answered the question on differential analysis (question 9). Therefore, in spring 2011 a pre-lecture assignment, to introduce the students to the topic of differential analysis, was assigned. Step 4c. Include all potential links to other outcomes in the course, other courses, or any other parts of the institution you deem appropriate. The SLO links to ACC 38. Step 5. Use of Results and Modifications As a result of the assessment, is the unit considering any modifications to the curriculum? Yes. What are they? In spring 2011 a prelecture assignment, to introduce the students to the topic of differential analysis, was assigned. When will they occur? Spring 2011. Do they involve other units? No. Is any consideration being given to modifying the existing SLO? No. Note: please expand table sections as necessary. 1 The accounting equation may be expressed as a. Assets - Liabilities = Stockholders’ Equity b. Assets = Equities - Liabilities c. Assets + Liabilities = Stockholders’ Equity d. Assets = Revenues less Liabilities Problem Name: c Multiple Choice 01-042 | Problem ID: wrcf10t/c Multiple Choice 01042 2 The process of initially recording a business transaction is called a. posting b. trial balancing c. balancing d. journalizing Problem Name: c Multiple Choice 02-037 | Problem ID: wrcf10t/c Multiple Choice 02037 3 Adjusting entries are a. optional under generally accepted accounting principles b. the same as correcting entries needed to bring accounts up to date and match revenue and expense d. rarely needed in large companies Problem Name: c Multiple Choice 03-013 | Problem ID: wrcf10t/c Multiple Choice 03013 4 The classified Balance Sheet will subsection the assets section as follows a. Other Assets and Property, Plant and Equipment b. Current Assets and Other Assets c. c. Current Assets and Property, Plant, and Equipment d. Current Assets and Investment Revenue Problem Name: c Multiple Choice 04-024 | Problem ID: wrcf10t/c Multiple Choice 04024 5 Multiple-step income statements show a. neither gross profit nor income from operations b. income from operations but not gross profit c. both gross profit and income from operations d. gross profit but not income from operations Problem Name: c Multiple Choice 05-011 | Problem ID: wrcf10t/c Multiple Choice 05-011 6 The inventory system employing accounting records that continuously disclose the amount of inventory is called a. periodic b. retail c. physical d. perpetual Problem Name: c Multiple Choice 06-021 | Problem ID: wrcf10t/c Multiple Choice 06021 - 7 Which of the following items that appeared on the bank reconciliation did not require an adjusting entry? a. deposits in transit b. bank service charges c. NSF checks d. a check for $630, recorded in the check register for $360 Problem Name: c Multiple Choice 07-048 | Problem ID: wrcf10t/c Multiple Choice 07048 8 After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $460,000 and Allowance for Doubtful Accounts has a balance of $30,000. What is the net realizable value of the accounts receivable? a. $30,000 b. $490,000 c. $430,000 d. $460,000 Problem Name: c Multiple Choice 08-022 | Problem ID: wrcf10t/c Multiple Choice 08022 9 When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is a. straight-line b. declining-balance c. MACRS d. units-of-production Problem Name: c Multiple Choice 09-021 | Problem ID: wrcf10t/c Multiple Choice 09021 10 Each year there is a ceiling for the amount that is subject to all of the following except a. Social security tax b. Federal unemployment tax c. Federal income tax d. State unemployment tax Problem Name: c Multiple Choice 10-051 | Problem ID: wrcf10t/c Multiple Choice 10051 11 Stockholders’ equity a. includes retained earnings and paid-in capital b. is shown on the income statement c. is usually equal to cash on hand d. includes paid-in capital and liabilities Problem Name: c Multiple Choice 11-012 | Problem ID: wrcf10t/c Multiple Choice 11012 12 If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $100,000 will be a. Greater than or less than $100,000, depending on the maturity date of the bonds b. Equal to $100,000 c. Greater than $100,000 d. Less than $100,000 Problem Name: c Multiple Choice 12-010 | Problem ID: wrcf10t/c Multiple Choice 12010 1. a 7. a 2. d 8. c 3. c 9. d 4. c 10. c 5. c 11. a 6. d 12. d Appendix B ACCOUNTING 1A SLO Assessment Results PRE TEST SPRING 2010 POST TEST FALL 2010 SPRING 2010 AVERAGE QUESTION 22000 22001 22002 27141 27142 27143 1 81% 74% 97% 70% 70% 40% 2 44% 44% 48% 40% 30% 3 78% 70% 79% 60% 4 56% 48% 48% 5 75% 81% 6 39% 7 AVERAGE Change from Pre-Test % Change from PreTest FALL 2010 22000 22001 22002 27141 27142 27143 72% 76% 86% 94% 80% 80% 100% 86% 14% 20% 30% 39% 94% 86% 76% 80% 60% 90% 81% 42% 106% 50% 60% 66% 94% 100% 100% 90% 80% 90% 92% 26% 39% 30% 40% 60% 47% 100% 93% 94% 100% 100% 90% 96% 49% 104% 86% 80% 80% 90% 82% 76% 100% 82% 80% 90% 100% 88% 6% 7% 26% 36% 20% 40% 20% 30% 71% 79% 100% 90% 80% 80% 83% 53% 177% 35% 44% 25% 50% 50% 30% 39% 71% 64% 59% 60% 90% 70% 69% 30% 76% 8 50% 48% 64% 60% 40% 50% 52% 94% 71% 94% 90% 90% 90% 88% 36% 70% 9 30% 22% 54% 30% 10% 20% 28% 53% 57% 47% 60% 90% 70% 63% 35% 127% 10 37% 37% 29% 20% 20% 30% 29% 71% 64% 76% 80% 70% 60% 70% 42% 145% 11 40% 52% 61% 30% 50% 40% 45% 82% 64% 76% 100% 90% 80% 82% 37% 81% 12 37% 30% 18% 20% 10% 20% 22% 44% 43% 47% 60% 50% 50% 49% 27% 119% 1 The cost of a manufactured product generally consists of which of the following costs? a. Direct materials cost and direct labor cost b. Direct materials cost and factory overhead cost c. Direct labor cost and factory overhead cost d. Direct labor cost, direct materials cost, and factory overhead cost Problem Name: c Multiple Choice 01-018 | Problem ID: wrma10t/c Multiple Choice 01-018 - 2 Which types of inventories does a manufacturing business report on the balance sheet? a. Finished goods inventory and work in process inventory b. c. Direct materials inventory, work in process inventory, and finished goods inventory Direct materials inventory and work in process inventory d. Direct materials inventory and finished goods inventory Problem Name: c Multiple Choice 02-060 | Problem ID: wrma10t/c Multiple Choice 02-060 - 3 The cost system best suited to industries that manufacture a large number of identical units of commodities on a continuous basis is: a. process b. first-in, first-out c. job order d. departmental Problem Name: c Multiple Choice 03-003 | Problem ID: wrma10t/c Multiple Choice 03-003 - 4 A firm operated at 80% of capacity for the past year, during which fixed costs were $210,000, variable costs were 70% of sales, and sales were $1,000,000. Operating profit was: a. $590,000 b. $490,000 c. $90,000 d. $210,000 Problem Name: c Multiple Choice 04-041 | Problem ID: wrma10t/c Multiple Choice 04-041 - 5 Under variable costing, which of the following costs would not be included in finished goods inventory? a. Fixed factory overhead cost b. Variable factory overhead cost c. Direct labor cost d. Direct materials cost Problem Name: c Multiple Choice 05-006 | Problem ID: wrma10t/c Multiple Choice 05-006 - 6 The production budgets are used to prepare which of the following budgets? a. Sales in dollars b. Sales in units c. Operating expenses d. Direct materials purchases, direct labor cost, factory overhead cost Problem Name: c Multiple Choice 06-024 | Problem ID: wrma10t/c Multiple Choice 06-024 - 7 A favorable cost variance occurs when a. Actual costs are more than standard costs. b. Standard costs are less than actual costs. c. Standard costs are more than actual costs. d. None of these choices is correct. Problem Name: c Multiple Choice 07-010 | Problem ID: wrma10t/c Multiple Choice 07-010 - 8 Avey Corporation had $275,000 in invested assets, sales of $330,000, income from operations amounting to $49,500 and a desired minimum rate of return of 7.5%. The rate of return on investment for Avey Corporation is: a. 10% b. 18% c. 8% d. 7.5% Problem Name: c Multiple Choice 08-037 | Problem ID: wrma10t/c Multiple Choice 08-037 - 9 A business is operating at 70% of capacity and is currently purchasing a part used in its manufacturing operations for $24 per unit. The unit cost for the business to make the part is $36, including fixed costs, and $28, not including fixed costs. If 15,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it? a. $180,000 cost increase b. $180,000 cost decrease c. $60,000 cost decrease d. $60,000 cost increase Problem Name: c Multiple Choice 09-007 | Problem ID: wrma10t/c Multiple Choice 09-007 - 10 An analysis of a proposal by the net present value method indicated that the present value of future cash inflows exceeded the amount to be invested. Which of the following statements best describes the results of this analysis? a. The proposal is desirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis. b. The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis. c. The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis. d. The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis. Problem Name: c Multiple Choice 10-016 | Problem ID: wrma10t/c Multiple Choice 10-016 - 11 Adirondak Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plant-wide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. From the following information, determine the plant-wide factory overhead rate: a. $32.00 per dlh b. $ 7.20 per dlh c. $24.80 per dlh d. $14.64 per dlh Problem Name: c Multiple Choice 11-005 | Problem ID: wrma10t/c Multiple Choice 11-005 12 What are the objectives of Just-In-Time (JIT) manufacturing? a. A process orientation b. Increasing inventory levels c. Increased number of inspections d. Eliminating waste Problem Name: c Multiple Choice 12-006 | Problem ID: wrma10t/c Multiple Choice 12-006 1. d 7. c 2. b 8. b 3. a 9. d 4. c 10. a 5. a 11. d 6. d 12. d Appendix D ACCOUNTING 1B SLO Assessment Results SPRING 2010 PRE TEST FALL 2010 SPRING 2010 POST TEST FALL 2010 AVERAGE QUESTION 22003 27144 1 69.57% 70.00% 2 56.52% 3 AVERAGE Change from PreTest % Change from Pre-Test 22003 27144 69.79% 86.67% 90.00% 88.34% 18.55% 26.58% 60.00% 58.26% 93.33% 80.00% 86.67% 28.41% 48.76% 34.78% 30.00% 32.39% 86.67% 80.00% 83.34% 50.95% 157.29% 4 47.83% 60.00% 53.92% 86.67% 80.00% 83.34% 29.42% 54.57% 5 43.48% 50.00% 46.74% 73.33% 90.00% 81.67% 34.93% 74.72% 6 56.52% 40.00% 48.26% 80.00% 60.00% 70.00% 21.74% 45.05% 7 52.17% 40.00% 46.09% 80.00% 60.00% 70.00% 23.92% 51.89% 8 13.04% 20.00% 16.52% 80.00% 80.00% 80.00% 63.48% 384.26% 9 17.39% 30.00% 23.70% 40.00% 60.00% 50.00% 26.31% 111.01% 10 56.52% 40.00% 48.26% 86.67% 70.00% 78.34% 30.08% 62.32% 11 47.83% 30.00% 38.92% 93.33% 70.00% 81.67% 42.75% 109.85% 12 43.48% 50.00% 46.74% 93.33% 90.00% 91.67% 44.93% 96.12%