13e

Chapter 36:

International Finance

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

International Finance

• Each country has its own currency (except

in Europe, where many countries have

adopted the euro).

• International trade therefore involves two

currencies – that of the exporter (which

needs to pay bills in its currency) and that of

the buyer (which pays for items using its

currency).

36-2

International Finance

• The relative values of the two currencies

will affect trade patterns and ultimately the

answers to the questions of WHAT, HOW,

and FOR WHOM to produce.

36-3

Learning Objectives

• 36-01. Know the sources of foreign

exchange demand and supply.

• 36-02. Know how exchange rates are

established.

• 36-03. Know how changes in exchange rates

affect prices, output, and trade flows.

36-4

Exchange Rates

• Exchange rate: the price of one country's

currency in terms of another’s; the domestic

price of a foreign currency.

• If US$1.50 = 1 euro, then US$1 = 0.67 euro.

• Exchange rates in terms of each other must

be reciprocals of each other.

36-5

Foreign Exchange Markets

• U.S. travelers to Europe have a demand for

euros and a supply of dollars. European visitors

to Disney World have a demand for dollars and

a supply of euros.

• U.S. exporters of goods to Europe get paid in

euros. They have a supply of euros and a

demand for dollars, which they need to pay

their bills.

• European exporters of goods to the U.S. get

paid in dollars. They have a supply of dollars

and a demand for euros.

36-6

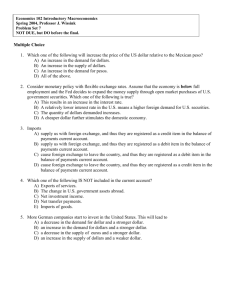

Foreign Exchange Markets

• The market demand for U.S. dollars originates

in

–

–

–

–

–

Foreign demand for American exports.

Foreign tourists in America.

Foreign demand for American investments.

Currency speculators.

Possible government intervention.

• The market demand for U.S. dollars represents

a market supply of foreign currency.

36-7

Foreign Exchange Markets

• The market supply of U.S. dollars originates

in

– American demand for imports.

– American tourists abroad.

– American investments abroad.

– Currency speculators.

– Possible government intervention.

• The market supply of U.S. dollars represents

a market demand for foreign currency.

36-8

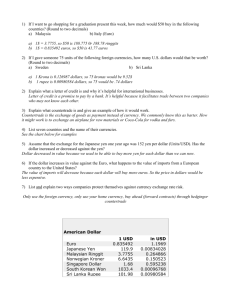

The Value of the Dollar

• The value of the dollar is indicated by its

purchasing power.

• A BMW costing 30,000 euros must be priced in

dollars if it is to be sold in the United States.

– If 1 euro = $1.50, then it will be priced at $45,000.

– If the exchange rate changed to 1 euro = $1.60, then

the BMW’s price in the United States would rise to

$48,000.

– At this higher price, the quantity of BMWs sold will

decrease.

36-9

The Value of the Dollar

• At a high euro price

of the dollar, fewer

will want to buy

dollars and more

will want to sell

dollars. There will

be a surplus of

dollars, and the

dollar’s euro price

will fall.

36-10

The Value of the Dollar

• At a low euro price of

the dollar, more will

want to buy dollars

and fewer will want

to sell dollars. There

will be a shortage of

dollars, and the

dollar’s euro price

will rise.

• The foreign exchange

market will adjust to

its equilibrium price.

36-11

The Value of the Dollar

• Any increase in demand for the dollar or

decrease in supply of the dollar will push

the dollar price in euros up. The dollar

appreciates in value.

• Any decrease in demand for the dollar or

increase in supply of the dollar will push the

dollar price in euros down. The dollar

depreciates in value.

36-12

The Value of the Dollar

• When the dollar appreciates against the

euro, the euro depreciates in value relative

to the dollar.

• When the dollar depreciates against the

euro, the euro appreciates in value relative

to the dollar.

36-13

The Balance of Payments

• The summary of all international money flows

is contained in the balance of payments.

– Balance of payments: a summary record of a

country’s international economic transactions in a

given period of time.

• The balance of payments is divided into three

parts:

– Current account balance (which includes the trade

balance).

– Capital account balance.

– Statistical discrepancy.

36-14

The Balance of Payments

• The current account balance includes

– The trade balance:

• Merchandise exports and imports.

• Service exports and imports.

– Other money flows:

•

•

•

•

Income inflows from U.S. investments abroad.

Income outflows for foreign-owned U.S. investments.

Net U.S. government grants to foreigners.

Net private transfers and pensions.

• There is a net dollar outflow in the current

account.

36-15

The Balance of Payments

• The capital account balance includes

– Inflow due to foreign purchases of U.S. assets.

– Outflow due to U.S. purchases of foreign assets.

– Increase in U.S. official reserves.

– Increase in foreign official assets in U.S.

• There is a net dollar inflow in the capital

account.

36-16

The Balance of Payments

• If we had perfect accounting, the outflow in the

current account would be balanced by the

inflow in the capital account.

• Because the accounting process has several

time lags in collecting data, the third part of the

balance of payments is the statistical

discrepancy, which indeed balances the two

accounts.

• Therefore, the balance of payments always

must equal zero.

36-17

Market Dynamics

• Review:

– Depreciation: a fall in the price of one currency

relative to another.

• Caused by a decrease in demand or an increase in

supply of the first currency.

– Appreciation: a rise in the price of one currency

relative to another.

• Caused by an increase in demand or a decrease in

supply of the first currency.

36-18

Market Dynamics

• What market forces could cause an increase in

demand for the dollar?

–

–

–

–

Foreign incomes rise faster than U.S. incomes.

Foreign prices rise faster than U.S. prices.

Foreigners have an increased need for U.S. goods.

U.S. interest rates become higher than in foreign

countries.

• Vice versa, and there would be a decrease in demand

for the dollar.

• Small changes like these occur all the time, and the

$4 trillion foreign exchange market adjusts to those

changes.

36-19

Do Exchange Rates Matter?

• Daily participants in international trade

prefer stable exchange rates to reduce the

uncertainty in planning.

• Any exchange rate change automatically

alters the prices of exports and imports of

that country, affecting many business

decisions.

36-20

Do Exchange Rates Matter?

• Trade deficits, caused by U.S. demand

increase for foreign goods, essentially

reduced American jobs as more products

were made abroad.

• The returning capital inflow had foreigners

buying U.S. assets, including government

bonds. U.S. foreign debt and interest costs

increased.

36-21

Should the Government Control

Exchange Rates?

• An intervention would be intended to

achieve exchange rate stability.

• However, stable exchange rates can lead to

other economic effects.

• The standard way to eliminate instability in

exchange rates is to adopt fixed exchange

rates.

– All major trading countries agree to keep the

exchange rates between each currency fixed.

36-22

Should the Government Control

Exchange Rates?

• The easiest way to fix exchange rates is to

define each currency’s value against a common

standard, such as a gold standard.

– Gold standard: an agreement by countries to fix the

price of their currencies in terms of gold.

• The problem with fixed exchange rates is that

the demand for and the supply of each

currency will continue to fluctuate, and a fixed

exchange rate does not account for this.

36-23

Fixed Exchange Rates

• With fixed exchange

rates (at e2), the

increase in demand

for pounds generates

a shortage of pounds.

• More dollars flow out

than flow in, so it

creates a balance of

payments (BOP)

deficit for the United

States and a BOP

surplus for Britain.

36-24

Fixed Exchange Rates

• What to do?

• Let the exchange rate

rise (not acceptable),

or the U.S. government

intervenes by selling

pounds it owns and

buying dollars.

• Also, the U.S. could

transfer gold to Britain

for dollars.

• This can be done once

or twice, but cannot be

kept up forever.

36-25

Fixed Exchange Rates

• Alternatively, the United States could erect

protective barriers to eliminate the increased

demand for British goods.

• Or the United States could increase taxes to

reduce disposable income and thereby the

demand for imports.

• Or interest rates could be raised to slow

spending and to draw foreign currency to the

United States.

• To do this, the policy focus would have to shift

away from full employment or price stability.

36-26