IAS 2 Inventory

advertisement

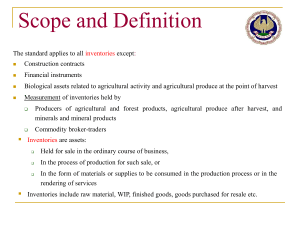

IAS 2 IAS 2 – www.iasplus.com Recognised as current assets in the SOFP Held for sale in the ordinary course of business Includes work-in-progress, finished goods & materials waiting to be used in production process Par 6: Inventories are assets: Held for sale in the ordinary course of business (finished goods) In the process of production for such sale (work in progress) ; or In the form of materials or supplies to be consumed in the production process or in the rendering of services (raw materials & consumables) Par 9: Inventory shall be measured at the lower of cost and net realisable value Net realisable value < Cost write down Par 10: Cost of inventory shall comprise the following: Cost of purchase (incl. transport inward & nonrefundable taxes arising from acquisition); Costs of conversion (eg. direct labour, depreciation of machinery, consumables & appropriate allocation of fixed and variable overheads); and All other costs incurred in bringing the inventories to their present location and condition (eg. cost of designing a product for a particular customer) Par 16: Amounts specifically excluded from cost: Abnormal amounts of wastage Storage costs General administrative overheads; and Selling expenses Recognised as expenses in I/S Par 25: Cost of all inventory determined using either: First-in-first-out (FIFO) cost formula Weighted average cost formula ◦ Average calculated on period basis (over a certain) ◦ Average per shipment received Example – Ch.17 p.4 Costs directly related to production ; eg. direct labour costs Systematic allocation of fixed & variable production overheads incurred Fixed overheads include the following: ◦ ◦ ◦ ◦ Factory supervisor’s wages Rent & rates of factory Depreciation & maintenance of factory equipment Factory heating, repairs, insurance, payroll costs, etc. Example 17.3 – pg. 5 IAS 12 par 13: Allocation of fixed production overheads Based on normal capacity of production facilities Normal capacity = average number of units produced under normal circumstances Actual < Normal Normal Actual > Normal Actual Variable production overheads allocated based on actual use of production facilities Example 17.4 – pg. 7 Valuation rule = lower of cost & net realisable value Write down to NRV when expected realisable value < cost NRV = Selling price (in the ordinary course of business) – completion costs - selling costs Each inventory item written down on item by item basis, or groups of similar items not on classification basis Estimates of realisable value based on most reliable evidence available Not normally written down to NRV May be written down when as a result of decline of price in raw material or when the cost of finished goods > NRV Replacement cost may be used as measure of NRV of raw material When inventories sold: ◦ recognise carrying amount as expense ◦ In period related revenue recognised Write down of inventories: ◦ recognise loss/impairment as expense when it occurs Reversal of write down ◦ Recognised in period it occurs Inventory as a separate line item in SOFP & further analysis in the notes Cost of sales presented as a separate line item in I/S Any expense (write-down; inventory losses) recognised in the I/S Accounting policy adopted in measuring Cost formula (FIFO or WA) SOFP & Notes thereto: ◦ Total carrying amount of inventory ◦ Classifications ◦ Inventories pledged as security for liabilities I/S & Notes thereto: ◦ Inventories recognised as expense ◦ Write down of inventories & reversal (reduction of expense) ◦ Circumstances that led to the reversal of a writedown