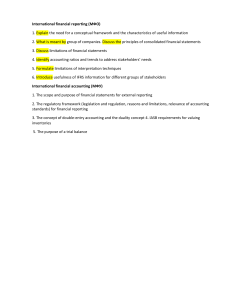

IAS 2: Inventories Table of Contents 1 IAS 2: Inventories .................................................................................................................... 3 2 Objective .................................................................................................................................. 3 3 Scope ....................................................................................................................................... 3 4 Definitions ............................................................................................................................... 4 5 4.1 Inventories are assets:....................................................................................................... 4 4.2 Net realisable value .......................................................................................................... 4 4.3 Fair value .......................................................................................................................... 5 Measurement of inventories .................................................................................................... 5 5.1 Cost of inventories ........................................................................................................... 5 5.2 Costs of purchase ............................................................................................................. 5 5.3 Costs of Conversion ......................................................................................................... 5 6 Measurement Techniques: ........................................... Ошибка! Закладка не определена. 7 Disclosure ................................................................................................................................ 6 1 2 IAS 2: Inventories In April 2001 the International Accounting Standards Board (Board) adopted IAS 2 Inventories, which had originally been issued by the International Accounting Standards Committee in December 1993. IAS 2 Inventories replaced IAS 2 Valuation and Presentation of Inventories in the Context of the Historical Cost System (issued in October 1975). In December 2003 the Board issued a revised IAS 2). Other Standards have made minor consequential amendments to IAS 2. They include IFRS 13 Fair Value Measurement (issued May 2011), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November 2013), IFRS 15 Revenue from Contracts with Customers (issued May 2014), IFRS 9 Financial Instruments (issued July 2014) and IFRS 16 Leases (issued January 2016). Objective The objective of this Standard is to prescribe the accounting treatment for inventories. A primary issue in accounting for inventories is the amount of cost to be recognised as an asset and carried forward until the related revenues are recognised. This Standard provides guidance on the determination of cost and its subsequent recognition as an expense, including any write-down to net realisable value. It also provides guidance on the cost formulas that are used to assign costs to inventories. 3 Scope This Standard applies to all inventories, except: (a) Financial instruments (refer to IAS 32 and IFRS 9); (b) Biological assets and agricultural produce at harvest (refer to IAS 41). The Standard does not apply to: (a) Agricultural and forest products, or minerals, measured at net realizable value under industry practices, with changes recognized in profit or loss. (b) Commodity broker-traders measuring inventories at fair value less costs to sell, with changes recognized in profit or loss. For agricultural products and minerals, net realizable value is used at specific stages, such as after harvest or extraction, when sale is guaranteed or there is minimal risk of failure to sell. Broker-traders mainly acquire inventories for near-term resale and profit from price fluctuations. These inventories are excluded from the measurement requirements of this Standard. 4 Definitions The following terms are used in this Standard with the meanings specified: 4.1 Inventories are assets: (a) held for sale in the ordinary course of business; (b) in the process of production for such sale; or (c) in the form of materials or supplies to be consumed in the production process or in the rendering of services. Under IAS 2 - Inventories, these components form part of the inventory's total carrying amount, which must be properly classified and disclosed in the financial statements. The classification helps stakeholders understand the entity's production and operational processes. 4.2 Net realisable value Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. 4.2.1 Example of Net Realizable Value (NRV): Description Amount (per Explanation unit) Estimated Selling Price $20 The price at which the inventory is expected to be sold. Estimated Costs of $2 Costs required to complete the production of the item Completion Estimated Costs to Make the (if any). $3 Sale Net Realizable Value (NRV) Costs related to selling the product, e.g., shipping, marketing. $15 NRV = Selling Price - Costs of Completion - Costs to Make Sale Cost of Inventory (per unit) $18 The cost incurred to acquire the inventory. Lower of Cost or NRV $15 The value used for inventory reporting under IAS 2 (NRV is lower). 4.3 Fair value Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See IFRS 13 Fair Value Measurement.) The former is an entity-specific value; the latter is not. Net realisable value for inventories may not equal fair value less costs to sell. 5 Measurement of inventories/ Inventory Valuation Methods 5.1 Net Realisable value Inventories shall be measured at the lower of cost and net realisable value. 5.1.1 Cost of inventories The cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition 5.1.2 Costs of purchase The costs of purchase of inventories comprise the purchase price, import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), and transport, handling and other costs directly attributable to the acquisition of finished goods, materials and services. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase. 5.1.3 Costs of Conversion Costs of Conversion refer to the expenses involved in turning raw materials into finished goods. These include direct labor costs and a proportionate share of both fixed and variable production overheads. Fixed production overheads are constant costs, like factory depreciation and management salaries, which do not change with production levels. Variable production overheads are costs that fluctuate with production volume, such as indirect labor and materials. Fixed overheads are allocated based on the normal production capacity, and unallocated costs are recognized as an expense. If production is unusually high, the allocation per unit decreases. Variable overheads are allocated based on actual usage. In cases where multiple products are made together (e.g., joint products or main and byproducts), costs are divided using a consistent, rational method, such as the relative sales value. For immaterial by-products, their net realizable value is deducted from the main product's cost. 5.1.4 Other Costs: These are costs incurred in bringing the inventories to their present location and condition, such as: o Design costs for specific customers (if directly attributable to inventory). o Costs of storage (only if required for production, not general storage costs). o Abnormal costs, like material wastage, are excluded. 5.2 Standard Cost Method: Uses normal levels of materials, labor, and efficiency to calculate inventory costs, which are regularly reviewed. 5.3 Retail Method: Used in retail for large volumes of items with similar margins. The inventory cost is determined by reducing the sales price by the gross margin percentage. 6 Disclosure The financial statements shall disclose: (a) the accounting policies adopted in measuring inventories, including the cost formula used; (b) the total carrying amount of inventories and the carrying amount in classifications appropriate to the entity; (c) the carrying amount of inventories carried at fair value less costs to sell; (d) the amount of inventories recognised as an expense during the period; (e) the amount of any write-down of inventories recognised as an expense in the period in accordance with paragraph 34; (f) the amount of any reversal of any write-down that is recognised as a reduction in the amount of inventories recognised as expense in the period in accordance with paragraph 34; (g) the circumstances or events that led to the reversal of a write-down of inventories in accordance with paragraph 34; and (h) the carrying amount of inventories pledged as security for liabilities