Chapter2Overheads

advertisement

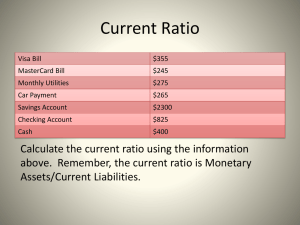

Chapter 2: Financial Planning Objectives • Explain the concept of financial planning, its components, and its benefits. • Describe financial statements, particularly the balance sheet and the income and expense statement. • Use financial ratios to evaluate your financial strength and progress. Objectives • Identify the purposes and methods of financial recordkeeping. • Describe the use of computer software in personal financial planning. • Explain how to choose a professional financial planner. Financial Planning The process of developing and implementing a coordinated series of financial plans to achieve financial success. Common Financial Behaviors BEWARE! • No clear goals • Disorganized records • Lack of economic understanding • Flawed decision making Components of Successful Financial Planning • Specified values • Explicitly stated goals • Informed economic projections • Logical and consistent financial strategies Economic Data Living Expenses Earnings Earnings Values Attitudes Lifestyle Wants Needs Relationships Money Wealth Earnings Managerial Effort Planning Decision Making Implementing Controlling Evaluating Coping and Adapting Feedback Communication Financial Plans For Spending/Saving Financial Plans For Risk Management Input Throughput Achievement Of Financial Objectives Financial Plans For Capital Accumulation Output Financial Statements FUNCTIONS PERFORMED: • Compilation of financial data • Communicate information • Indicate financial condition • Prepares user to read corporate financial statements The Balance Sheet VALUE OF EVERYTHING OWNED MINUS EVERYTHING OWED: • Assets – Items owned • Liabilities- Items owed • Net worth– Difference between what one owns and owes. Assets- Liabilities = Net Worth Assets • Monetary assets • Tangible or use assets • Investment assets Liabilities • Short-term liabilities – anything that will be paid off in 12 months or less. • Long-term liabilities—anything that will still have a balance after 12 months. Income - Expense Statement SUMMARY OF CASH-FLOW TRANSACTIONS OVER TIME: •Income – How much you made. •Expenses – How much you spent. •Net gain or loss—How much you have left. •Income – Expenses = Net gain or loss Incomes • Salaries or wages • Bonuses and commissions • Child support and alimony • Public assistance • Social Security and pensions Incomes • Scholarships and grants • Interest and dividends • Income from the sale of assets • Other income (gifts, tax refunds, rent, royalties) Expenses • Fixed expenses—items that are the same every month (you don’t have control over these). • e.g. house payment, car payment, insurance premium • Variable expenses—expense changes based on the way you live (you have control over these). • e.g. meals, utilities, entertainment Financial Ratios OBJECTIVE ASSESSMENTS OF FINANCIAL STATUS: • • • • Basic liquidity ratio Debt-to-asset ratio Debt-service-to-income ratio Investment-assets-to-net-worth ratio Basic Liquidity Ratio This ratio tell you how many months of expenses you could pay with the your monetary assets. This would be significant if you lost your job and had to make your monthly payments. In this example the person has 1.08 expense months of monetary assets. Debt-to-Asset Ratio Debt Service-to-Income Ratio Investment Assets-to-Net Worth Ratio Good Debt vs. Bad Debt Debt incurred for consumption is bad debt. Bad Debt = Debt Danger Ratio Annual Income Debt Danger Ratio beyond 25% can spell trouble. Assessing Financial Progress • Balance sheet • Income - expense statement • Financial ratios • Am I spending, saving, and investing money where I really want to? Financial Recordkeeping DETERMINE: • Where you are • Where you have been • Where you are going Recordkeeping Issues • Original source records • Safeguarding/storage of records • Use of computer software Professional Financial Planning • Commission-only • Fee-only • Fee-based • Designations and credentials Key Words and Concepts Financial Planning is the process of developing and implementing a coordinated series of financial plans to achieve financial success. Values are fundamental beliefs about what is important, desirable, and worthwhile. Financial Goals are the specific long- and short-term objectives to be attained through financial planning and management efforts. Financial Strategies are preestablished plans of action to be implemented in specific situations. Financial Statements are compilations of personal financial data designed to communicate information on money matters. Balance Sheet (or net worth statement) describes an individual’s or family’s financial condition on a specified date. Income and Expense (or cash flow) Statement lists and summarizes income and expense transactions that have taken place over a specific period of time. Assets include everything you own that has monetary value. Liabilities are your debt. Net Worth is the dollar amount left when what is owed is subtracted from the dollar value of what is owned. Everything should be calculated at fair market value. Key Words and Concepts (Cont.) Fair Market Value is the amount a buyer would pay a willing seller. Monetary Assets (or liquid assets) include cash and near-cash items that can be readily converted to cash. Tangible (or use) Assets are physical assets that have fairly long lifespans and could be sold to raise cash but whose primary purpose is to provide maintenance of one’s lifestyle. Investment assets (also known as capital assets) include tangible and intangible items acquired for the monetary benefits they provide. Diversification of investments means the investor puts money in a variety of investments. Short-term (or current) Liability is an obligation that will be paid off within one year. Long-term Liability is an obligation that will be paid off in more than one year. Insolvent means net worth is negative. Fixed Expenses are usually paid in the same amount during each time period. Variable Expenses are expenditures over which and individual has considerable control. Net Gain/Loss shows the amount of money left after you subtract expenses from income. Financial Ratios are objective numerical calculations designed to simplify making judgmental assessments of financial strength over time. Key Words and Concepts (Concl.) Liquidity is the speed and ease with which an asset can be converted into cash. Financial Ratios: Basic Liquidity Ratio: monetary (liquid) assets monetary expenses Reveals the number of months a family could continue to meets its expenses from monetary assets after a total loss of income. Families should have a basic liquidity ratio of 3. Debt-to-Asset Ratio: total debt total assets Measures the solvency and ability to pay debt Debt Service-to-Income Ratio: annual debt repayments gross income Provides an incisive view of the total debt burden of an individual. A ratio of .36 or less indicates that gross income is adequate to make debt repayments. Investment Assets-to-Net Worth Ratio: investment assets net worth Expresses how well an individual is advancing toward their financial goals for capital accumulation. Experts recommend 50% or higher.