Production And Cost in the Long Run

advertisement

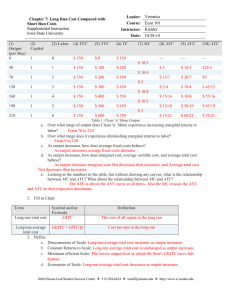

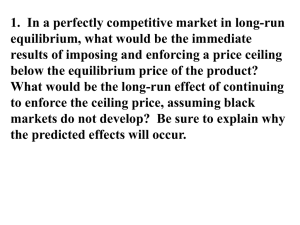

Production And Cost in the Long Run • In the long run, costs behave differently – Firm can adjust all of its inputs in any way it wants • In the long run, there are no ___ inputs or ___ costs – All inputs and all costs are ______ – Firm must decide what combination of inputs to use in producing any level of output • The firm’s goal is to ___________ – To do this, it must follow ______________ • To produce any given level of output the firm will choose the input mix with the lowest cost Different ways to wash 196 cars per day Capital cost =$75 per day Labor cost = $60 per unit per day Method Quantity of Quantity of Cost Capital Labor A 0 9 B 1 6 C 2 4 D 3 3 Production And Cost in the Long Run • Long-run total cost – The cost of producing each quantity of output when the least-cost input mix is chosen in the long run • Long-run average total cost – The cost per unit of output in the long run, when all inputs are variable • The long-run average total cost (LRATC) – Cost per unit of output in the long-run LRTC LRATC Q Long-Run and Short-Run Costs for Spotless Car Wash Output TC($) LRTC($) 0 30 90 130 161 184 196 250 300 75 135 195 255 315 375 435 0 100 195 255 315 360 390 650 1,200 LRATC($) The Relationship Between LongRun And Short-Run Costs • For some output levels, LRTC is ______ than TC • Long-run total cost of producing a given level of output can be less than or equal to, but never greater than, short-run total cost (LRTC ≤ TC) • Long-run average cost of producing a given level of output can be less than or equal to, but never greater than, short–run average total cost (LRATC ≤ ATC) Average Cost And Plant Size • Plant – Collection of fixed inputs at a firm’s disposal • Can distinguish between the long run and the short run – In the long run, the firm can change the size of its plant – In the short run, it is stuck with its current plant size • ATC curve tells us how average cost behaves in the short run, when the firm uses a plant of a given size • To produce any level of output, it will always choose that ATC curve—among all of the ATC curves available—that enables it to produce at lowest possible average total cost – This insight tells us how we can graph the firm’s LRATC curve Figure 7: Long-Run Average Total Cost Dollars ATC1 $4.00 ATC0 ATC2 3.00 C D B A 2.00 LRATC ATC3 E 1.00 0 30 Use 0 automated lines 90 130 161 184 175 196 Use 1 automated lines 250 Use 2 automated lines 300 Use 3 automated lines Units of Output Graphing the LRATC Curve • A firm’s LRATC curve combines portions of each ATC curve available to firm in the long run – For each output level, firm will always choose to operate on the ATC curve with ________________ • In the short run, a firm can only move along its current ATC curve • However, in the long run it can move from one ATC curve to another by varying the size of its plant – Will also be moving along its LRATC curve Economics of Scale • Economics of scale – Long-run average total cost _____ as output increases • When an increase in output causes LRATC to decrease, we say that the firm is enjoying economics of scale – The more output produced, the lower the cost per unit • When long-run total cost rises proportionately less than output, production is characterized by economies of scale – LRATC curve slopes ________ Figure 8: The Shape Of LRATC Dollars $4.00 3.00 LRATC 2.00 1.00 130 0 Economies of Scale 184 Constant Returns to Scale Diseconomies of Scale Units of Output Gains From Specialization • One reason for economies of scale is gains from specialization • The greatest opportunities for increased specialization occur when a firm is producing at a relatively low level of output – With a relatively small plant and small workforce • Thus, economies of scale are more likely to occur at lower levels of output More Efficient Use of Lumpy Inputs • Another explanation for economies of scale involves the “lumpy” nature of many types of plant and equipment – Some types of inputs cannot be increased in tiny increments, but rather must be increased in large jumps • Plant and equipment must be purchased in large lumps – Low cost per unit is achieved only at high levels of output • Making more efficient use of lumpy inputs will have more impact on LRATC at low levels of output – When these inputs make up a greater proportion of the firm’s total costs • At high levels of output, the impact is smaller Diseconomies of Scale • Long-run average total cost _______ as output increases • As output continues to increase, most firms will reach a point where bigness begins to cause problems – True even in the long run, when the firm is free to increase its plant size as well as its workforce • When long-run total cost rises more than in proportion to output, there are diseconomies of scale – LRATC curve slopes ________________ • While economies of scale are more likely at low levels of output – Diseconomies of scale are more likely at higher output levels Constant Returns To Scale • Long-run average total cost is ______ as output increases • When both output and long-run total cost rise by the same proportion, production is characterized by constant returns to scale – LRATC curve is ___ • In sum, when we look at the behavior of LRATC, we often expect a pattern like the following – Economies of scale (decreasing LRATC) at relatively low levels of output – Constant returns to scale (constant LRATC) at some intermediate levels of output – Diseconomies of scale (increasing LRATC) at relatively high levels of output • This is why LRATC curves are typically U-shaped Using the Theory: Long Run Costs, Market Structure and Mergers • The number of firms in a market is an important aspect of market structure—a general term for the environment in which trading takes place • What accounts for these differences in the number of sellers in the market? – Shape of the LRATC curve plays an important role in the answer LRATC and the Size of Firms • The output level at which the LRATC first hits bottom is known as the minimum efficient scale (MES) for the firm – Lowest level of output at which it can achieve minimum cost per unit • Can also determine the maximum possible total quantity demanded by using market demand curve • Applying these two curves—the LRATC for the typical firm, and the demand curve for the entire market—to market structure – When the MES is small relative to the maximum potential market • Firms that are relatively small will have a cost advantage over relatively large firms • Market should be populated by many small firms, each producing for only a tiny share of the market LRATC and the Size of Firms • There are significant economies of scale that continue as output increases – Even to the point where a typical firm is supplying the maximum possible quantity demanded • This market will gravitate naturally toward monopoly • In some cases the MES occurs at 25% of the maximum potential market – In this type of market, expect to see a few large competitors • There are significant lumpy inputs that create economies of scale – Until each firm has expanded to produce for a large share of the market Figure 9: How LRATC Helps Explain Market Structure LRATCTypical Firm Dollars F $160 E 80 DMarket 0 1,000 3,000 100,000 Units per Month Figure 9: How LRATC Helps Explain Market Structure LRATCTypical Firm Dollars $160 80 DMarket 0 100,000 Units per Month Figure 9: How LRATC Helps Explain Market Structure Dollars LRATCTypical Firm H $200 F E 80 DMarket 0 25,000 100,000 Units per Month Figure 9: How LRATC Helps Explain Market Structure LRATCTypical Firm Dollars $160 E F 80 DMarket 0 1,000 10,000 100,000 Units per Month LRATC and the Size of Firms • The MES of the typical firm in this market is 1,000 units – Lowest output level at which it reaches minimum cost per unit – For firms in this market, diseconomies of scale don’t set in until output exceeds 10,000 units • Since both small and large firms can have equally low average costs with neither having any advantage over the other – Firms of varying sizes can coexist The Urge To Merge • If by doubling their output, firms could slide down the LRATC curve in Figure 9, and enjoy a significant cost advantage over any other, stillsmaller firm, they would – This is a market that is ripe for a merger wave • A sudden merger wave is usually set off by some change in the market • Market structure in general—and mergers and acquisitions in particular—raise many important issues for public policy – Low-cost production can benefit consumers—if it results in lower prices