Plvs Study Guide

advertisement

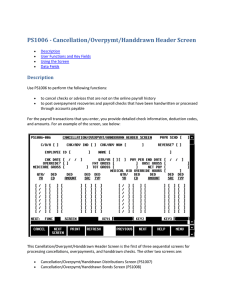

UNIT 1: FINANCIAL PLANNING Financial Literacy: Is the ability to plan, read, and understand financial information. Also knowing how to responsibly handle your money. Short Term Goals: A goal to be achieved within the next three months. Intermediate Goals: A goal that is set for three months to a year. Long Term Goals; A goal that will take longer than a year to achieve. Values: The beliefs, qualities, or standards, that you consider important or desirable. Components if a SMART goal: S: Specific M: Measurable A: Attainable R: Realistic T: Time Bound UNIT 2: PAY CHECKS, TAXES, AND BUDGETING Gross Income: The total amount of income from wages before any payroll deductions. Mandatory Deductions: Federal income tax, state income tax, Social Security tax, and Medicare tax Net Pay: Also called “take home pay” : it’s the amount of income after payroll deductions. Social Security Tax: A payroll deduction collected by the employers by law and sent to the federal government to provide a small income and other services to the elderly, disabled Americans, and orphaned minors. Medicare Tax: A payroll deduction collected by employers by law and sent to the federal government to provide medical insurance to the elderly and some disabled Americans. Federal income tax: A payroll deduction collected by employers by law and sent to the federal government to support governmental programs. State Income Tax: A payroll deduction collected by employers by law and sent to the state government to support state services. Hourly Gross Pay is calculated by: Multiplying the total hours worked by the amount you earn per hour. UNIT 2 CONTINUED How Is Gross Pay Calculated? The number of hours you work X the hourly rate Budget: A spending plan for managing money during a given period of time. Fixed Expense: expenses that cost the same amount every time Variable Expense: expenses that are not fixed. Steps to creating a budget: 1. Decide on a time frame for tracking your income and expense 2. List all the money you have coming in and total your income 3. List your expenses and total you expenses 4. Subtract your total expenses from you total income 5. Look at your budget and your financial plan. UNIT 3: INVESTMENTS Savings: an amount of money that is set aside to be used for a future purpose. Investing: Putting money to use in a venture that offers the possibility of growing in values as interest, income, or increased value. Stocks: an investment that makes the investor a part owner of a company. Bonds: A formal agreement where you (the bond holder) will lend money to a borrower who can then use that money for a set period of time. In exchange you, as the lender, will get paid a specific amount of interest. UNIT 4: CREDIT Advantages and Disadvantages of credit: Advantages Disadvantages Convenience Interest Protection Overspending Emergencies Debt Opportunity To Build Credit Indentify Theft Quicker Gratification Special Offers Credit: An amount of money, or something of value, that is loaned on trust and with the expectation that it will be repaid at a later date. Interest: 1. Payment for the use of money ( principal x interest rate x time) 2. A charge for a loan, usually created as a percentage of the principal What is a credit score?: A number that reflects your creditworthiness based on the 4 c’s. Banks can check the score to get an idea of your creditworthiness It will change over time based on your financial situation. UNIT 5 BANKING Overdraft or bouncing a check: A check written for an amount that exceeds the current balance in your account. What is a check register: A place to immediately record all monetary transactions for a checking account. What is bank reconciliation: Balances the checkbook register each month to the balance shown on the statement. Signature Card: used by the bank to confirm the identity of the account holder.