session presentation

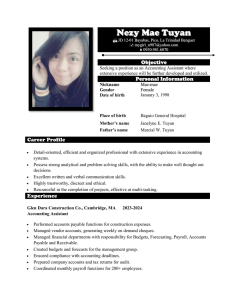

Payroll Accounting

Presented by

May Perkins, CPP

Agenda

Purpose of Accounting

Accounting Concepts – Accounting Cycle

Chart of Accounts

Balance Sheet

Income Statement

Payroll Specific Accounts

Payroll Accrual

Double Entry Accounting - Debits and Credits

Agenda

Preparing a Journal Entry

Accounting Elements of Payroll Transactions

Reconciliations

Budgeted Payroll Expenses

Payroll and Audit Considerations

Questions and Thoughts

Purpose of Accounting

To identify, measure and report financial information of a company

To provide information to different users so that they can use it to make business decisions

The Payroll department must gather accurate and timely data regarding wages paid, taxes withheld and other deductions

This data allows the Accounting department to prepare complete financial statements

Purpose of Accounting

Business

Transactions

Financial

Accounting

(external)

Managerial

Accounting

(internal)

Accounting Concepts

Basic Accounting Cycle

Ledger

Trial

Balance

Financial

Statements

Journal

Transaction

Accounting Cycle

Journal (book of original entry) – a complete record of every business transaction

Ledger – a record of business transactions kept by account and grouped by account type (e.g., assets, liabilities, etc.)

Trial Balance – a listing of the accounts in the general ledger along with each account’s balance

Financial Statements

Balance Sheet

A statement of the financial position at a given point in time

Assets, Liabilities and Equity

Income Statement

Operation results for a given time period at a specified date

Revenues and expenses

Chart of Accounts

Chart of Accounts – a listing of all the accounts and account types into which business transactions will be recorded

Account – a record in the general ledger that is used to collect and store similar information

The Types of Accounts:

1. Asset

2. Liability

3. Equity

4. Revenue

5. Expense

Summarized Chart of Accounts

Account Type Account Number Range

Assets

Liabilities

Equity

Revenue

Expenses

10000 – 19999

20000 – 29999

30000 – 39999

40000 – 49999

50000 – 89999

Account Types – Balance Sheet

Assets

An item of economic value over which the company has legal control

Liabilities

Monies owed to external entities

Company debts that have not yet been paid

Owner’s Equity

Monies owed to internal entities (the owners)

The company’s net worth

The Accounting Equation

Assets

=

Liabilities

+

Equity

The company’s resources Claims against the company’s resources

Account Types – Income Statement

Revenue

Inflows from the delivery or manufacture of a product or from the rendering of a service

Identifies amounts received for goods sold during the accounting period

Expense

The cost for goods and services consumed by the company

Net Income = Revenues - Expenses

Payroll Specific Accounts

Assets

Cash (payroll checking account)

Liabilities

Salaries/Wages Payable

Deductions

Employee Taxes Withheld

Expenses

Salaries/Wages Expense

Employer Taxes

Accounting Terms

General Ledger – that part of the accounting system that contains the balance sheet and income statement accounts

Fiscal Year – an accounting year that equals 12 consecutive months (may not = a calendar year)

Journal Entry – the entry made in a journal

Post – to enter a business transaction into a journal or ledger

Accounting Concepts

Cash Method

Revenues and expense are recognized when the cash is received or paid (checkbook accounting)

Accrual Method

Revenues are recognized in the period they are earned and expenses are recognized in the period they are incurred

Accrual – a journal entry posted to bring the balance sheet and income statement up to date on an accrual basis

Payroll Accrual Example

Payroll pay date = 6/06/14

Pay period end date = 5/31/14

Pay period = 5/18/14 – 5/31/14

The May portion of the 6/06/14 payroll needs to be accrued into May since the payroll system will post it to 6/06/14

Payroll Accrual Example

The accrual entry would need to be reversed on

6/01/14 so that the 6/06/14 payroll posting will net to just the June portion

When possible, accrual entries need to be based on actual numbers (i.e., the actual 6/06/14 payroll posting). If that is not possible, the best available information should be used.

Accounting Concepts

Double Entry Accounting keeps the basic accounting equation balanced.

Every business transaction involves an exchange between at least two accounts

This exchange takes the form of debits and credits to those accounts

For each debit, there is an equal and opposite credit to another account

Debits and Credits

Whether a debit or credit increases or decreases an account depends on the type of account to which is being posted

Debit Balance Credit Balance

Asset

Expense

Liability

Equity

Revenue

Debits and Credits

Account

Type

Asset

Liability

Equity

Normal

Balance

Debit

Credit

Credit

What a debit does

Increases

Decreases

Decreases

What a credit does

Decreases

Increases

Increases

Revenue Credit

Expense Debit

Decreases

Increases

Increases

Decreases

Accounting Terms

“T” Account – a visual aid used by accountants to illustrate a journal entry’s effect on general ledger accounts

Salary & Wage Expense Accrued Wages

Preparing a Journal Entry

Steps to prepare a manual journal entry:

1) Identify the accounts involved

2) Identify the account type of each account

3) Determine whether the transaction is increasing or decreasing each account

4) Apply the logic of the account type table

5) Make sure that the total $ amount of the debits equal the total $ amount of the credits

Journal Entry Example

Journal entries are normally written in a columnar format to help distinguish the debits from the credit

Date Account Description Debit

5/31/14 Salary & Wage Expense $50,000.00

Accrued Salaries &

Wages

Accrue the May portion of the 6/06/14 payroll

Credit

$50,000.00

Journal Entry – Hourly-Paid Wages

Date Account Name

8/08/14 Wages Expense – Delivery Dept.

Wages Expense – Warehouse Dept.

FICA Tax Payable

Federal Inc. Tax Withholdings Payable

State Inc. Tax Withholdings Payable

401(k) Payable

Health Ins. Expense

Health Ins. Expense

United Way Payable

Garnishment Payable

– Delivery Dept.

– Warehouse Dept.

Debit

1,000.00

1,300.00

Credit

175.95

300.00

110.00

70.00

90.00

80.00

30.00

50.00

Net Payroll Payable 1,394.05

Record hourlypaid employee’s wages and withholdings for the workweek

7/27/14 – 8/02/14 that will be paid on 8/08/14

Journal Entry – Employer’s Portion

Date Account Name

8/08/14 FICA Expense - Delivery

FICA Expense – Warehouse

Unemployment Tax Expense – Warehouse

Worker’s Compensation Ins. Expense

Holiday, Vac. Sick Days Exp. – Delivery

Holiday, Vac. Sick Days Exp.

– Warehouse

401(k) Expense – Delivery

401(k) Expense – Warehouse

FICA Tax Payable

Unemployment Tax Payable

Worker’s Compensation Ins. Payable

Holiday, Vacation, Sick Days Payable

Debit

76.50

99.45

4.00

46.00

100.00

130.00

10.00

25.00

401(k) Payable

Record the company’s payroll related expenses for the 8/08/14 payroll

Credit

175.95

4.00

46.00

230.00

35.00

Journal Entry – Distribution &

Remittance

Date Account Name

8/08/14 Net Payroll Payable

Cash

Record the distribution of the hourly-paid payroll of 8/08/14

Debit

1,394.05

Credit

1,394.05

Date Account Name

8/11/14 FICA Tax Payable

Federal Inc. Tax Withholdings Payable

State Inc. Tax Withholdings Payable

Debit

351.90

300.00

110.00

401(k) Payable

Cash

105.00

Record the remittance of the 8/08/14 hourly-paid payroll withholdings

Credit

866.90

Accounting Elements of Payroll

Transactions

Expenses

Wages paid

Benefits paid

Employer taxes

Employer deductions (offsets to expense)

Accounting Elements of Payroll Transactions

Assets

Net payroll check amount

Payment of employee tax withholdings

Payment of employee deductions

Payment of employer taxes

Liabilities

Tax withholdings

Employee deductions (paid to 3 rd parties)

Reconciliations

Should be performed at month-end or as soon as possible

Confirm that all entries have been posted

Confirm that payments are on schedule

Verify that expenses are accurately booked and balance with payroll

Verify that liability accounts are accurate

Budgeted Payroll Expenses

Salary

Regular

Overtime

Vacation

Bonuses

Employer Taxes

Employer Paid Benefits

Payroll Expenses to Budget

Reasons actual to budget variances need to be identified

Potential errors can be discovered

Future expenditures can be adjusted to meet company objectives

Payroll Expenses to Budget

Reasons you might not tie to budget

Headcount

Vacancy rate

Working more hours than budgeted

Error in a general ledger posting

Error in the budget

Payroll and Audit Considerations

Separation of duties

Check stock security

Check signers

Reconciliation approvals

Ghost payrolls / Buddy punching

Checks and balances

System audits

?

Please remember to fill out your evaluation form