Presentation on LLP by

advertisement

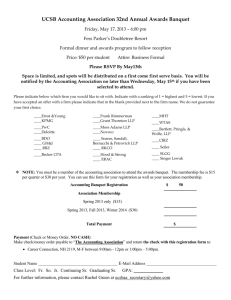

‘LLP: Emerging Area for Professionals’ SIZE & STRUCTURE OF THE ECONOMY GDP break – up in 1991 $330 Billion Agriculture Industry Service 40.2% Source: Planning Commission 32.4% 27.5% GDP break – up in 2008 $1.09 Trillion 17.6% Agriculture 52.9% Industry Service Source: India Brand Equity Foundation Despite rapid growth of the service sector in the last few years, service based organizations such as doctors, lawyers and accountants have not been able to grow to their full potential 29.5% CHANGING BUSINESS ENVIRONMENT Diversification of expertise Increasing convergence Litigious environment Changing consumer concerns Emerging technology Professionals Changing basis of competition Globalisation Changing regulations Economies of scale ORGANIZATION FORMS IN INDIA Three organization forms have dominated the Indian business scene Companies, Partnerships and Sole Proprietorships Sole Proprietorship & Partnerships Company Largely unregulated and are being used by entities from small kirana stores to large international professional outfits Regulated entity with various compliance procedures Unlimited liability poses a significant hindrance to growth Besides corporate tax, companies are also liable to dividend distribution tax Traditional form of partnership does not permit expansion beyond 20 partners Due to the inherent restrictive characteristics of the existing forms, a definite need was felt to evolve a structure which would aid the growth of professional firms LIMITED LIABILITY PARTNERSHIP The Limited Liability Partnership (LLP) Bill, 2008 which was earlier cleared by the Rajya Sabha, was approved by the Lok Sabha on 12th December, 2008 Partnership Companies Limited Liability Partnership Limited Liability Partnerships combine the characteristics of corporate and non-corporate entities The advent of the LLP’s in addition to providing the Indian entrepreneur a new business form, will provide Indian professional organizations a level playing field with their international counter-parts. PARTNERSHIP FIRM IN INDIA Partnership Firm has been the form of organization of choice for professionals and small business entities. Partnership in India was governed exclusively by The Partnership Act, 1932. However, it has the following drawbacks- It does not recognize distinction between the firm and its partners. Maximum no of partners restricted to 20. Liability of each partner unlimited. GENESIS OF LLP Limited partnership had its origin in Italy. Eventually the idea of Limited Liability Partnership spread out to other European countries, particularly France, Germany, Great Britain and other countries like U.S.A., Singapore and Japan. The LLP Act, 2008 heavily leaned on UK and Singapore Acts. With the spurt in cross border economic activities, small and medium entities carry on their businesses competing with large enterprises. Recognition of legal entity status to them was necessitated. ENTRY OF LLP IN INDIA MSMEs Development Act, 2006 was passed and the Acts governing the C.A.s, C.S.s and C.W.A.s professions were amended in 2006. Naresh Chandra Committee Report II(2003) indirectly suggested this form of organisation by suggesting to lessen the regulatory impact of the Companies Act. Directly, it came out as a recommendation of the J.J. Irani Committee(2005) to be adopted as a new form of business. The Government has now enacted LLP Act,2008 which has come into force from January 9, 2009. A LLP is an alternative business structure falling between a partnership firm and a corporate body, combining the limited liability benefits of a company with the flexibility of a partnership. MAIN FEATURES OF LLP LLP can be formed to carry on any lawful trade, business, profession or occupation. LLP is a body corporate with a status distinct from its partners and has a perpetual succession. Addition or departure of partners to the LLP will not affect its existence. A partner is not personally liable, directly or indirectly for an obligation of a LLP, solely by reason of his being a partner of the LLP. However, personal liability of a partner for his wrongful act or omission continues. Foreign LLPs will also be permitted to establish a L.L.P. in India. Rules will be formulated for this purpose. MAIN FEATURES OF LLP LLP will require at least two partners who could be individuals and/or bodies corporate. Two individuals, of whom one is a resident of India, will be the ‘designated partner’. Bodies corporates may nominate their nominees as designated partners. The designated partners shall be answerable for all acts, matters and things required to be done by the LLP in respect of compliance of the provisions of the proposed legislation and be liable for penalties for noncompliance. If at any time the number of partners of a LLP falls below two and the business is carried on with only one partner for more than six months, the lone partner will be liable for the obligations of the LLP during that period. ADVANTAGES OF LLPs Limited compliance Companies are required to keep detailed minutes to record all proceedings and resolutions. However the LLP business structure requires lower compliance and is easier to operate. COMPARISON PARTICULARS PARTNERSHIPS LLPS PVT. LTD. CO. Members 2 to 20 Minimum 2 partners 2 to 50 shareholders Liability Unlimited, Partners jointly liable for action Limited except in case of fraud, wrongful act Limited Registration Registration with ROF optional Registration with ROC required Registration with ROC required Documents to be filed None required unless registered File annual accounts & submit annual statement on solvency Annual Statement of accounts, Board meetings, Share register Dissolution By agreement, mutual consent, insolvency By agreement or by order of National Company Law Tribunal By court order once the affairs of the company have wound up Transfer / Inheritance of shares Not transferable, in case of death legal heir receives Transferable, but transferee may not have management rights Transferable with the consent of Board of Directors Taxation Income of partners taxed not of partnership Unspecified Income of Company is taxed TAXATION ISSUES Capital gains liability A situation can arise where the partners could be contributing assets towards the capital at the time of formation of LLP or receiving their share of capital and accumulated profits on transfer of their shares. The mode of valuation of assets for income tax purpose and who would be liable to pay capital gains on transfer of assets of a partnership / company upon their conversion into a LLP Stamp duty Whether the assets transferred by a partnership or a company at the time of their conversion to LLP or in the event of their merger or amalgamation will attract stamp duty on the book value of their assets is still not clear REGISTRATION An incorporation document is required to be filed with the Registrar of Companies the State where the registered office of the LLP is to be situated. Upon fulfilment of the conditions specified in the Act with respect to the form and content of the incorporation document, the Registrar will within a period of fourteen days, register the incorporation document and give a certificate that the LLP is incorporated. Upon registration, a LLP, by its name will be capable of: Suing and being sued; LEGISLATION Acquiring, owning, holding and developing or disposing off property, whether movable or immovable, tangible or intangible; Having a common seal, if it decides to have one; and Doing and suffering such other acts or things as bodies corporate may lawfully do and suffer. Every LLP shall either have the words “limited liability partnership” or “LLP” as its last name. OBJECTS OF LLP S. 11(2)(c) requires only the proposed business of the LLP to be stated in the incorporation document with no need to state the Objects as in the case of a company under the Companies Act. LLP may state in the incorporation document that its proposed business is the business as defined in S.2(1)(c) of the LLP Act. The Registrar cannot refuse to register such a document on the ground that the objects are not specific. Para 8 of the First Schedule to the Act provides that no change in the nature of business may be made without the consent of all the partners. S. 3(2) provides that the LLP agreement and any changes made therein shall be filed with the Registrar. The LLP agreement and changes therein filed with the Registrar are not open for public inspection. FINANCIAL YEAR Financial year means the uniform Financial Year commencing on 1st April every year and ending on 31st March of the following year. RELATION BETWEEN PARTNERS Typically, the mutual rights and duties (including the limits of investment) of the partners of a LLP inter se and those of the LLP and its partners shall be governed by a registered agreement between partners or between the LLP and the partners. Any change in the LLP agreement is required to be filed with the Registrar. A person may cease to be a partner in accordance with the provisions of the LLP agreement or in the absence of an agreement as to cessation of being a partner by giving a notice of not less than thirty days of his intention to resign. CHANGE IN CONSTITUTION A person shall mandatorily cease to be a partner upon (i) his death or dissolution of the partnership; (ii) being declared of an unsound mind by a competent court; or (iii) his application to be adjudged an insolvent or being declared an insolvent. Upon cessation, unless otherwise provided in the LLP agreement, the ‘former partner’ or a person entitled to his share in consequence of his death or insolvency will be entitled to receive (i) an amount equal to capital contribution actually made by the former partner into the partnership; and (ii) his right to share in the accumulated profits, after deduction of accumulated losses determined on the date of cessation. A notice to the Registrar has to be given regarding any change in partnership. DEFINATIONS Foreign Limited Liability Partnership S. 2(1)(m) – Foreign LLP means a LLP formed, registered or incorporated outside India and which establishes a place of business in India for carrying on their business in India in accordance with the rules to be made by the Central Government pursuant to S. 59. Limited Liability Partnership S. 2(1)(4) – LLP means a partnership formed and registered under the Act. The term ‘partnership’ not defined. Application of the Partnership Act not barred S. 71. Definition of partnership given under s. 4 of the Partnership Act, 1932 ought to hold good for the purposes of the LLP Act also. Partnership under the LLP Act should connote the relationship between the persons who have agreed to share the profits of a business. CONVERSION FIRM INTO LLP A firm, private company and a public unlisted company (“Converting Entity”) can be converted into a limited liability partnership in accordance with the provisions of the Act. Pre-conditions for Conversion to a LLP: If the Converting Entity is a private company or an unlisted public company, then its assets should be free from any security interest at the time of making the application. The partners of the LLP will have to comprise only of all the shareholders/partners of the Converting Entity. CONDITIONS FOR CONVERSION 1) Transfer of the property, assets, interests, privilleges, obligations and undertaking of the firm to the LLP subject to the partners of the firm becoming partners of the LLP and the LLP consenting to be bound by the provisions of the LLP Act. 2) All partners of the firm to be comprised as the partners of the LLP. 3) Application for conversion to be filed with the Registrar of Companies. 4) Within 15 days of registration, LLP to inform the R.O.F. about the conversion. 5) In case of refusal to register, appeal lies to Tribunal / CLB. 6) Registration in relation to property stands vested in the LLP. 7) Pending proceedings to continue in the name of the LLP. 8) Continuance of conviction, ruling, order of judgement enforceable against the LLP. CONDITIONS FOR CONVERSION 9) Existing and subsisting agreements of the firm bind the LLP fully. 10) Existing contracts of the firm bind the LLP. 11) Partners of the erstwhile firm who continue shall be jointly and severally liable for pre-conversion liability and obligations of the firm subject to indemnification by the LLP, if nothing contrary to it exists in the LLP agreement. 12) Every official correspondence of the LLP to bear a notice of such conversion for 12 months commencing not later than fourteen days after the date of registration. Caution – The conversion procedure does not preserve or protect any approval, permit or licence issued under written laws as specific to none but the firm before the date of registration of its conversion into LLP. APPLICATION PROCESS The Converting Entity will need to submit the application to the Registrar along with a statement of all the shareholders/partners (as applicable) in the prescribed form and within 15 days of registration, intimation of conversion to the concerned Registrar of Companies or Registrar of Firms (as applicable) shall be made. Upon Conversion to LLP: All tangible and intangible property owned by the Converting Entity shall without requirement of any further act vest in the LLP. All legal proceedings by or against the Converting Entity shall be continued, completed and enforced by or against the LLP. All contracts, deeds, bonds, agreements etc shall continue in the name of the LLP. FINANCIAL DISCLOSURES The limited liability partnership is required to maintain proper books of accounts and yearly file its ‘statement of accounts and solvency’, and ‘annual return’. All documents filed by the limited liability partnership including incorporation documents and statement of accounts and solvency will be available for inspection by any person in the manner prescribed. COMPROMISE, ARRANGEMENT, WINDING UP AND DISSOLUTION There are provisions in the Act relating to compromise and arrangement between a limited liability partnership and its creditors and/or partners and provides for mechanisms in the event of a proposed merger of a limited liability partnership with another. A limited liability partnership may also be wound up voluntary by its partners or by the National Company Law Tribunal for reasons such as inability of the limited liability partnership to pay its debts, default in filing returns etc for five consecutive years, if in the opinion of the Tribunal it is just and equitable to wind it up. TAX AND OTHER IMPLICATIONS Taxing it as a ‘Company’ Since in India, LLP is visualized as company and it will be regulated under the Companies Act, it may be taxed like a company and ignore the existence of partners for tax purposes like that of shareholders. Taxing it as a ‘Firm’ This will be on the same line of that of company; however certain variances such as ceiling of remuneration to partner, interest on capital etc., have to be made on the same line as Partnership Firms. On the same basis as an ordinary partnership firm, the LLP will pay tax on its profits after deduction of business expenditure, salaries and interest paid to the partners and in turn, partners will be liable to pay tax on their salary and interest receipts. TAX AND OTHER IMPLICATIONS Treat it as a ‘Pass through or fiscally transparent’ entity Another way is that the profits of the LLP will be taxed directly in the hands of its partners and not the entity. This treatment was proposed by the Naresh Chandra Committee and also the same is being followed in countries such as United Kingdom etc. Here the partners will be liable to pay tax on share from LLP’s profits received in their hands as per their taxable status which is a major incentive especially for the Individual shareholders. TAX AND OTHER IMPLICATIONS The tax treatment of the LLP is not addressed in the Act and would need to be dealt with separately as a part of the Income Tax Act, 1961 In the United Kingdom the concept of 'fiscal transparency' has been applied to a LLP, i.e. where the LLP itself is not taxed as an 'entity' but the partners of the LLP are taxed individually based on their tax status and tax positions. The same concept of 'pass through' was introduced in Section 10(23FB) of the IT Act for any income of a Venture Capital Company (VCC) or Venture Capital Fund (VCF) in a Venture Capital Undertaking (VCU). However by way of amendments by Finance Act 2007 the applicability of the said section was restricted by amending the definition of VCU and making the same applicable only to a few sectors. This also gave administrative convenience by taxing only the VCC or VCF. The investors in their desire to be taxed on a pass through basis, are attempting to structure VCF so as to effectively achieve tax pass through for their investments by resorting to 'trust taxation' mechanism. ET dated 16 Feb., 2009 “An LLP would be taxed for its income while the income of individual partners would be tax free. This benefit is not available to companies,” said an official privy to the development. Companies pay tax on their profits and again pay dividend distribution tax when they distribute profits among shareholders. The LLP format protects partners from double taxation. “Although LLPs can be registered in India from April this year, the announcement of the tax code can be done by the Government that comes into power after the general elections as annual accounts of LLPs will be finalised only at the end of the 2009-10 fiscal year,” the official said. Therefore, the details of the LLP tax regime will be unveiled in the Finance Bill presented by the new government later this year. The proposals will be implemented through an amendment to the Income-tax Act.” ISSUES The Income tax Act does not have a provision exempting transfers of assets from firm, private company or unlisted public company to LLP. New clauses may be inserted in Section 47 of the Income tax Act to exclude such transactions from the meaning of ‘Transfer’. Definition of ‘Employer’ may be amended to include LLPs for the purposes of FBT. Transfer pricing provisions would require amendment to S.92A to provide criteria for determining non resident entities to be regarded as ‘Associated Enterprise’. Since, foreign limited liability partnerships have been permitted under the Act, the Foreign Exchange Management Act will need to be amended accordingly. As of now only non resident Indians and persons of Indian origin can make investments in partnerships on a nonrepatriation basis. ISSUES Section 36 of the Act provides that the incorporation document, names of partners and changes (if any), statement of account and solvency and annual return shall be available for inspection by any person. Since the accounts of the LLP also need to be made public, the professional firms before taking the decision to convert into a LLP will also have to consider these Corporate Governance aspects which are inherent to a LLP but different from the way traditional law firms have been operating in India. Court related mergers, acquisitions and winding up of companies have traditionally been time consuming and expensive. Unless the rules made under the Act, specify for a settlement of these in a time bound manner, mergers, and winding up of the limited liability partnership may also face the same challenges as faced by an incorporated company. YOUR QUESTIONS PLEASE !!! Nihar Jambhusaria Executive Director Direct Line: +91 22 66729709 Mobile: +91 98202 37681 nihar.jambusaria@bdoharibhakti.co.in Disclaimer The views contained in this presentation is solely that of the Speaker and should not necessarily be construed as an Opinion of the Company. Before implementing any of the views the expert guidance is recommended.