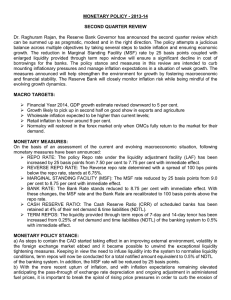

money market

advertisement

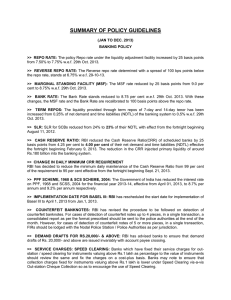

MONEY MARKET It is not a single market but a collection of markets for several instruments. Main players are: RBI, DFHI, Mutual Funds, Banks, Corporate Investors, Non-Banking finance companies, State government, Primary Dealers, Public Sector Undertakings, NRI’s and Overseas corporate bodies. Functions of Money Market A balancing mechanism to even out the demand for and supply of short-term funds. A focal point for central bank intervention for influencing liquidity and general level of interest rates in the economy. Reasonable access to suppliers and users of short-term funds to fulfill their borrowings & investment requirements. Money Market Instruments Treasury Bills (T-bills) Call/Notice money market Certificates of Deposit (CD) Commercial Paper Commercial Bills (CB) KEY TERMINOLOGIES MONEY MARKET MUTUAL FUNDS (MMMFs) : It mobilises savings from small investors and invest them in a short-term debt instruments or money market instruments. Discount & Finance House of India ( DFHI): KEY TERMINOLOGIES Cash Reserve Ratio (CRR): a portion of deposits (as cash) which banks have to keep/maintain with the RBI. Statutory Liquidity Ratio (SLR): banks are required to invest a portion of their deposits in government securities as a part of their statutory liquidity ratio (SLR) requirements. KEY TERMINOLOGIES Repo (Repurchase) Rate: It is the rate at which banks borrow funds from the RBI to meet the gap between the demand they are facing for money (loans) and how much they have on hand to lend. Reverse Rapo Rate : The rate at which RBI borrows money from the banks (or banks lend money to the RBI) is termed the reverse repo rate. Bank Rate: This is the rate at which RBI lends money to other banks (or financial institutions).The bank rate signals the central bank’s long-term outlook on interest rates. If th Prime Lending Rate: It is the minimum lending rate charged by the bank from its best corporate customers or prime borrowers. Liquidity Adjustment Facility (LAF): Providing various general and sector specific refinance facilities to the commercial banks i.e. Export Credit Refinance (ECR) and Collateralized Lending Facility (CLF). Treasury Bills A short term promissory notes issued by the Central Government to tide over short-term liquidity shortfalls. A negotiable security, highly liquid, absence of default risk, assured yield and are eligible for inclusion in the securities for SLR purpose. Issued for maturities of 91, 182 & 360 days. Types of Auctions in T-Bills Multiple – Price Auction UniformPrice Auction Commercial Papers Unsecured promissory note issued by highly rated companies. Issuing company should get itself rated by approved rating agencies. Minimum period 7 days & maximum 1 year. Issued at a discount & the discount is determined by market forces. Certificates of Deposits Unsecured, negotiable, short-term instruments in bearer form. Issued by Commercial Banks and development financial institutions. Time deposit of specific maturity. Issued by banks during the period of tight liquidity, at relatively high interest rate Commercial Bills It is a short-term, negotiable and self-liquidating instrument with low risk. Transferable by endorsement and delivery. Call/Notice Money Market It is a market for very short-term funds repayable on demand and with a maturity period varying between one day to fortnight. Money is borrowed to maintain minimum level of CRR. Call rate is determined by market forces of demand & supply.