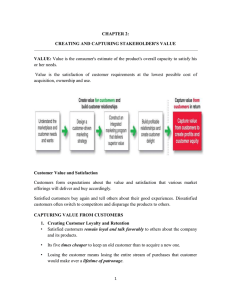

Full Text (Final Version , 267kb)

advertisement