Investor Implications for Global Deleveraging

advertisement

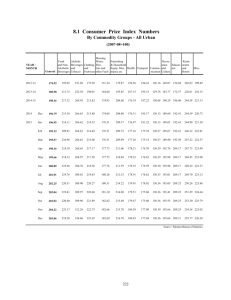

Investor implications for global deleveraging Glyn Owen 20th September 2012 1 global investment management Central government debt burden 1900 to 2011 advanced and emerging economies % Source: Reinhart (2010), Reinhart and Rogoff (2009 and 2011), sources cited therein and the authors 2 global investment management Total debt to GDP for developed economies 1990 - 2012 Source: Deutsche Bank, Haver. September 2012. 3 global investment management Debt composition varies widely Canada 91 Australia 53 105 Germany 60 87 South Korea 81 45 France 48 Spain 72 82 40 80 93 76 111 33 111 97 134 90 76 109 67 100 71 219 99 0 Households 21 83 107 98 Japan 91 87 82 United Kingdom 69 59 49 United States Italy 63 120 200 Nonf inancial corporations 81 226 300 400 Financial institutions 500 600 Government Source: Bloomberg, September 2012. 4 global investment management US fiscal deficit as % of GDP 1791 -2011 Source : Deutsche bank, GFD. September 2012. 5 global investment management Budget deficits larger in the US than in peripheral Europe Budget deficit as a % of GDP % Greece, Ireland, Italy, Portugal and Spain: GDP- weighted fiscal balance US Source: Deutsche bank. September 2012. 6 global investment management Deleveraging: where are we in the cycle? Note: Debt refers to external marketable debt and excludes internal debts, e.g. interbank debts Source: FRB, Haver Analytics, DB Global Markets Research 7 global investment management US real GDP post-war experience: not a normal cycle... Source: Nedgroup Capital. September 2012. 8 global investment management The UK recovery is weaker than in the great depression % Source: Deutsche Bank. September 2012. 9 global investment management Short term interest rates over past 10 years US, UK, Japan and Europe 8.0 7.0 6.0 % 5.0 4.0 3.0 2.0 1.0 0.0 Sep 02 Sep 03 Sep 04 Sep 05 USD 1 Month LIBOR Sep 06 Sep 07 GBP 1 Month LIBOR Sep 08 Sep 09 JPY 1 Month LIBOR Sep 10 Sep 11 Sep 12 EUR 1 Month LIBOR Source: MGIM, Bloomberg. September 2012 10 global investment management The world is not normal: UK base rate 1694 to today Source: Deutsche Bank, GFD. September 2012. 11 global investment management The world is not normal: Swiss government bond yields 1.2% 1.0% 0.8% yield (%) 0.6% 0.4% 0.2% 0.0% -0.2% -0.4% -0.6% 0 5 10 15 20 25 30 years to maturity Swiss government bond yield Source: Bloomberg, MGIM. September 2012. 12 global investment management The world is not normal: 10 year government bond yields 8.0% 7.0% 6.0% Yield 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Jan 00 Jan 01 Jan 02 Jan 03 Jan 04 Jan 05 US Jan 06 Jan 07 Germany Jan 08 Jan 09 Jan 10 Jan 11 Jan 12 UK Source: Bloomberg, MGIM. September 2012. 13 global investment management The world is not normal: US 10 year yield since 1790 Source: Deutsche Bank, GFD, Bloomberg Finance LLp. September 2012. 14 global investment management Quantitative easing: Bank of England balance sheet as a % of GDP Source: Deutsche bank. September 2012., 15 global investment management Tail risk of extreme events are not insignificant • US fiscal cliff • Chinese ‘recession’ • Eurozone disintegration • Journey into the unknown – monetary easing 16 global investment management Fiscal cliff: will need to be tackled after November US budget deficits 4 % of GDP 2 0 Mar 92 Mar 95 Mar 98 Mar 01 Mar 04 Mar 07 Mar 10 Mar 13 -2 -4 -6 -8 -10 -12 US Budget Balance (% GDP) Source: Bloomberg, September 2012 17 global investment management US economic momentum is reasonable – but unemployment remains high US labour market 800 12.0 700 10.0 600 400 6.0 (%) Number of claims (thousands) 8.0 500 300 4.0 200 2.0 100 0 0.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul 80 81 82 83 84 85 86 87 88 89 90 91 93 94 95 96 97 98 99 00 01 02 03 04 06 07 08 09 10 11 12 US Initial Jobless Claims SA US Unemployment Rate (%) Source: Bloomberg, September 2012 18 global investment management US construction: the only way is up? 3000 900 800 2500 700 600 Billion (USD) Volume (thousands) 2000 1500 1000 500 400 300 200 500 100 0 Jan 59 Jan 62 Jan 65 Jan 68 Jan 71 Jan 74 Jan 77 Jan 80 Jan 83 Jan 86 Jan 89 Jan 92 Jan 95 Jan 98 Jan 01 Jan 04 Jan 07 Jan 10 Jan 13 US New Privately Owned Housing Starts 0 Jan 59 Jan 62 Jan 65 Jan 68 Jan 71 Jan 74 Jan 77 Jan 80 Jan 83 Jan 86 Jan 89 Jan 92 Jan 95 Jan 98 Jan 01 Jan 04 Jan 07 Jan 10 Jan 13 US Gross Private Domestic Investment Source: Bloomberg, September 2012 19 global investment management China is landing GDP and industrial production 14% 25% 12% 20% 10% 15% 8% 6% 10% 4% 5% 2% 0% Dec 02 0% Dec 03 Dec 04 Dec 05 Dec 06 China GDP (LHS) Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12 Chinese Industrial Production (RHS) Source: Bloomberg, September 2012 20 global investment management Major macro indicators continue to disappoint Chinese money supply (% yoy) 65 45 60 40 55 35 50 30 Money Supply Growth % Level Chinese PMI: new orders 45 40 35 30 25 20 15 10 5 25 0 20 Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 China New Orders PMI SA China New Export Orders PMI SA Jan Aug Mar Oct May Dec Jul Feb Sep Apr Nov Jun Jan Aug Mar Oct May Dec Jul Feb Sep Apr Nov Jun Jan Aug 98 98 99 99 00 00 01 02 02 03 03 04 05 05 06 06 07 07 08 09 09 10 10 11 12 12 M1 YoY M2 YoY Source: Bloomberg, September 2012. 21 global investment management China’s slowing growth: structural or cyclical? China Real GDP y/y % change 16 14 12 10 8 6 4 2 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 0 2000 % Source: Factset. September 2012. 22 global investment management The European crisis is not simply debt 1.0% -8.0% Current account balance -8.5% Budget deficit to GDP 5.2% -1.7% -4.6% -0.8% -7.2% -4.5% -6.0% -1.9% -2.4% -4.2% -2.1% -2.2% -7.4% Source: IMF, 2012 estimates. 23 global investment management Unit labour costs since the launch of the euro 140 Spain Italy Index level rebased to 100 130 Greece Portugal France Ireland 120 Germany 110 100 90 80 Dec Jul Feb Sep Apr Nov Jun Jan Aug Mar Oct May Dec Jul Feb Sep Apr Nov Jun Jan 99 00 01 01 02 02 03 04 04 05 05 06 06 07 08 08 09 09 10 11 Source: Bloomberg, September 2012 24 global investment management Currencies vs. the Deutschemark 0 0 20 200 400 60 80 600 100 800 120 140 ITL per DEM GRD, ESP, PTE per DEM 40 1,000 160 1,200 180 200 1,400 73 75 77 79 81 Spanish peseta 83 85 87 89 91 93 Greek drachma 95 97 99 01 03 05 07 Italian lira Source: Bloomberg, September 2012 25 global investment management German Labour reform accelerated growth- can Italy? Industrial Production (rebased to 100 January 1995) 150 140 130 120 110 100 90 80 Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec Aug Apr Dec 94 95 96 96 97 98 98 99 00 00 01 02 02 03 04 04 05 06 06 07 08 08 09 10 10 11 12 12 US Germany Italy Source: Bloomberg, September 2012 26 global investment management The European stress / intervention cycle • Don’t underestimate the political will to preserve the Eurozone • Inflate, stagnate or default • Austerity / growth • European bail out of banks • Issue of Eurobonds • ECB – LTRO / OMT / rate cut • Fiscal union 27 global investment management Clear slowdown in global growth Source: JPMorgan, September 2012 28 global investment management Equity market valuations Price/Earnings* Dividend yield 10-year Government bond yields United States 13.8 2.1% 1.7% Eurozone 10.8 4.2% 1.6% United Kingdom 11.2 4.1% 1.7% Germany 10.9 3.7% 1.6% Switzerland 13.4 3.6% 0.5% Japan 13.8 2.4% 0.8% Hong Kong 10.2 3.8% 0.7% Australia 12.6 5.0% 3.1% *current year estimate Source: Bloomberg, Statistics to 06/09/2012. September 2012 29 global investment management MSCI World P/E ratio since 1995 40 35 P/E Ratios 30 25 20 15 10 5 0 Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug Aug 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 MSCI WORLD Source: Bloomberg, September 2012 30 global investment management Investment conclusion • ‘New normal’ is now the consensus • Deleveraging and rebalancing set to continue for years • US – growth risk in 2013 China – structural slowdown underway Europe – stress / intervention cycle to continue • Policy risks are high • Further monetary loosening is certain • Crisis presents an extraordinary valuation opportunity 31 global investment management Implications for portfolio construction • Subdued growth low return expectations • Continued deleveraging and tight credit • High tail risks financial strength is critical high volatility • Cyclical move down in commodities has further to run • Deflation protection in safe haven bonds • Income generating assets important • safe dividend equities • corporate bonds • emerging market bonds Focus on: Diversification by asset class Quality defensive equities Inflation not today’s problem – but might be the end game Exploit tactical opportunities 32 global investment management Introduction to Harmony portfolios • Risk profiled core solutions: Balanced and Growth • Multi-asset, multi-manager, multi-currency • Diversified between local and global investments, asset class, currency, manager and style • Dynamic tactical asset allocation • Available in five currency / regional bases: USD, GBP, EUR, AUD and Asian • The Harmony range uses no derivatives, structured products or CDOs • Managed by Momentum Global Investment Management in London 33 global investment management Harmony Balanced Fund strategic allocation Cash 10.0% Global Equity 10.0% Global Property 10.0% Local Equity 30.0% Local Bonds 30.0% Global Bonds 10.0% Source: MGIM, September 2012 34 global investment management Harmony Growth Fund strategic allocation Cash 5.0% Global Property 10.0% Global Equity 15.0% Local Bonds 15.0% Global Bonds 5.0% Local Equity 50.0% Source: MGIM, September 2012 35 global investment management Harmony US Dollar Balanced 100% 80% 60% 40% 20% 0% 3 months YTD 2011 2010 2009 2008 2007 2006 2005* 3 months YTD 2011 2010 2009 2008 2007 2006 2005* Harmony US Dollar Balanced Peer Rank 7/16 6/16 6/16 7/14 4/14 7/11 3/10 2/10 4/10 Fund Performance 4.0% 5.6% -1.5% 5.6% 20.0% -27.2% 6.7% 13.2% 4.7% Peer Max 5.5% 7.6% 1.6% 12.2% 25.2% -6.7% 7.8% 13.5% 14.2% Peer Min -2.1% 0.5% -9.2% -0.9% -0.7% -36.2% 2.1% 5.0% 0.8% Peer Median 3.5% 5.1% -4.1% 5.4% 15.6% -23.4% 4.7% 8.5% 3.4% September 2012. Past performance is not indicative of future returns. . *30/06/2005 to 30/12/2005 36 global investment management Harmony US Dollar Growth 100% 80% 60% 40% 20% 0% 3 months YTD 2011 2010 2009 2008 2007 2006 2005* 3 months YTD 2011 2010 2009 2008 2007 2006 2005* Harmony US Dollar Growth Peer Rank 3/16 2/16 3/16 6/14 3/14 9/11 3/10 1/10 4/10 Fund Performance 5.4% 7.4% -0.1% 7.8% 23.0% -30.1% 6.5% 15.2% 6.3% Peer Max 5.5% 7.6% 1.6% 12.2% 25.2% -6.7% 7.8% 13.5% 14.2% Peer Min -2.1% 0.5% -9.2% -0.9% -0.7% -36.2% 2.1% 5.0% 0.8% Peer Median 3.5% 5.1% -4.1% 5.4% 15.6% -23.4% 4.7% 8.5% 3.4% September 2012. Past performance is not indicative of future returns. . *30/06/2005 to 30/12/2005 37 global investment management Harmony performance vs. cash, bonds and equities 105 Rebased to 100 (Jun-11) 100 95 90 85 80 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Citigroup WorldBIG TR USD Nov-11 Dec-11 LIBOR USD 7 Day Jan-12 Feb-12 Mar-12 MSCI World TR USD Apr-12 May-12 US Dollar Growth Jun-12 Jul-12 Aug-12 US Dollar Balanced Source: MGIM, Lipper, September 2012. Past performance is not indicative of future returns.. 38 global investment management Disclaimer Momentum Global Investment Management is the trading name for Momentum Global Investment Management Limited. This document does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorised or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this document, and should be satisfied in doing so that there is no breach of local legislation or regulation. The information is intended solely for use by our clients or prospective clients, and should not be reproduced or distributed except via original recipients acting as professional intermediaries. This document is not for distribution in the United States. Prospective investors should inform themselves and if need be take appropriate advice regarding applicable legal, taxation and exchange control regulations in countries of their citizenship, residence or domicile which may be relevant to the acquisition, holding, transfer, redemption or disposal of any investments herein solicited. Any opinions expressed herein are those at the date this material is issued. Data, models and other statistics are sourced from our own records, unless otherwise stated herein. We believe that the information contained is from reliable sources, but we do not guarantee the relevance, accuracy or completeness thereof. Unless otherwise provided under UK law, Momentum Global Investment Management does not accept liability for irrelevant, inaccurate or incomplete information contained, or for the correctness of opinions expressed. We caution that the value of investments in discretionary accounts, and the income derived, may fluctuate and it is possible that an investor may incur losses, including a loss of the principal invested. Past performance is not generally indicative of future performance. Investors whose reference currency differs from that in which the underlying assets are invested may be subject to exchange rate movements that alter the value of their investments. Our investment mandates in alternative strategies and hedge funds permit us to invest in unregulated funds that may be highly volatile. Although alternative strategies funds will seek to follow a wide diversification policy, these funds may be subject to sudden and/or large falls in value. The illiquid nature of the underlying funds is such that alternative strategies funds deal infrequently and require longer notice periods for redemptions. These Investments are therefore not readily realisable. If an alternative strategies fund fails to perform, it may not be possible to realise the investment without further loss in value. These unregulated funds may engage in the short selling of securities or may use a greater degree of gearing than is permitted for regulated funds (including the ability to borrow for a leverage strategy). A relatively small price movement may result in a disproportionately large movement in the investment value. The purpose of gearing is to achieve higher returns associated with larger investment exposures, but has concomitant exposure to loss if positive performance is not achieved. Reliable information about the value of an investment in an alternative strategies fund may not be available (other than at the fund’s infrequent valuation points). Under our multi-management arrangements, we selectively appoint underlying sub-investment managers and funds to actively manage underlying asset holdings in the pursuit of achieving mandated performance objectives. Annual investment management fees are payable both to the multimanager and the manager of the underlying assets at rates contained in the offering documents of the relevant portfolios (and may involve performance fees where expressly indicated therein). Momentum Global Investment Management Limited (Company Registration No. 3733094) registered office at 20 Gracechurch Street, London EC3V 0BG. Momentum Global Investment Management Limited is authorised and regulated by the Financial Services Authority in the United Kingdom, and is an authorised Financial Services Provider pursuant to the Financial Advisory and Intermediary Services Act 37 of 2002 in South Africa. © Momentum Global Investment Management Limited 2012 39 global investment management Contact: Lucy Richardson Marketing Manager Momentum Global Investment Management Lucy.richardson@momentumGIM.com T: +44 207 939 1725 www.momentumgim.com 40 global investment management