Executive Compensation and Business Succession Planning

advertisement

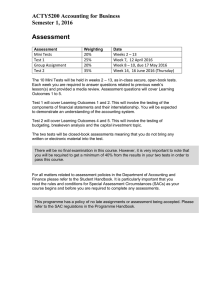

Executive Compensation and Succession Strategies Joel C. Farrar Foster Swift Collins & Smith PC 517.371.8305 jfarrar@fosterswift.com Executive Compensation It’s not the employer who pays the wages. Employers only handle the money. It’s the customer who pays the wages. – Henry Ford Beware of little expenses. A small leak will sink a great ship. – Benjamin Franklin Executive Compensation and Management Succession Strategies January 28, 2016 2 2016, Foster Swift Collins & Smith PC Step One: Identify Business Goals Strategic Planning Increase revenue ■ Decrease expenses ■ Expansion and project-specific goals ■ Department goals ■ Retention goals ■ Customer service goals ■ Safety goals ■ M&A goals ■ Executive Compensation and Management Succession Strategies January 28, 2016 3 2016, Foster Swift Collins & Smith PC Step One: Identify Business Goals Categorize Goals ■ ■ ■ ■ ■ Company-Wide Department Individual Short Term Long Term Develop Metrics to Measure Improvements Executive Compensation and Management Succession Strategies January 28, 2016 4 2016, Foster Swift Collins & Smith PC Step Two: Review Compensation Structure Base salary, bonus and incentive programs, “qualified” plans, welfare benefits, severance benefits, “non-qualified” programs, others Evaluate current strategy in light of goals Identify opportunities to improve Executive Compensation and Management Succession Strategies January 28, 2016 5 2016, Foster Swift Collins & Smith PC Step Three: Develop Strategy Group Employees ■ ■ “C-Suite” Executives Other “top hat” executives ■ ■ ■ “Select group of management or highly compensated employees” Usually SVPs Sometimes directors and top salespeople Usually not managers and below Mid-management Administration Movers Evaluate each group’s ability to affect business goals Select goals to incentivize for each group & key individuals Prepare compensation philosophy and strategy Executive Compensation and Management Succession Strategies January 28, 2016 6 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Limitations on “non-qualified” benefits ERISA – “Top hat” and funding issues (Rabbi Trust) ■ Section 409A – Exemption, compliance and flexibility issues ■ Income tax and deduction issues ■ Timing Company investments Pass-through entities Executive Compensation and Management Succession Strategies January 28, 2016 7 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Program Types ■ ■ ■ ■ ■ ■ Short-term bonus programs Long-term incentive programs Synthetic equity programs Equity programs Elective deferral programs Change of control programs Executive Compensation and Management Succession Strategies January 28, 2016 8 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Short-Term Bonus Programs ■ ■ ■ Available for all employees Discretionary Annual Programs (Growing companies only) Performance-Based Annual Programs Discretionary or non-discretionary performance targets Performance period (1 to 3 years) Performance targets – Company-wide targets (profit, growth, peer group) – Unit/Department targets (profit, expenses) – Individual targets ■ Targeted Incentive Programs Absenteeism Customer satisfaction Move Efficiency Executive Compensation and Management Succession Strategies January 28, 2016 9 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Long-Term Incentive Programs ■ ■ ■ ■ ■ “Top Hat” only Company credits – Long-Term Performance or Excess Benefit Vesting – Golden Handcuff & Non-Compete “Deemed” Investments – ERISA and Tax Issues Payment Events – Section 409A Executive Compensation and Management Succession Strategies January 28, 2016 10 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Synthetic Equity Programs ■ ■ ■ ■ ■ “Top Hat” only Performance Unit, Restricted Stock Unit & Phantom Stock Plans Stock Appreciation Right Plans Form of LTIP – Different from True Equity Benefits No Minority Shareholder Issues, But: Complexity and valuation issues Reduced “ownership” mentality Executive Compensation and Management Succession Strategies January 28, 2016 11 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Equity Programs ■ ■ ■ ■ ■ ■ Available for all employees Stock Options – Qualified or Non-Qualified; Valuation Issues Restricted Stock – Tax and Liquidity Issues LLCs – “Profits” or “Capital” interests Advantage: “Ownership” Mentality Disadvantages: Taxes and Minority Shareholder Issues Access to Information and Meetings Voting Rights Dissenter’s Rights Shareholder Agreement Recommended Executive Compensation and Management Succession Strategies January 28, 2016 12 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Elective Deferral Programs “Top Hat” only ■ Employee Deferrals ■ Income tax deferral (watch owners) Delayed tax deduction Section 409A timing rules “Deemed” investments ■ Payment events ■ Executive Compensation and Management Succession Strategies January 28, 2016 13 2016, Foster Swift Collins & Smith PC Step Four: Evaluate Options Change of Control Programs “Top Hat” only ■ What happens if the company is sold? ■ Retention goal (pre-transaction through transition) ■ Amount of benefit? ■ Fixed amount? Treat like a shareholder? Double or single “trigger”? ■ Section 409A issues ■ Executive Compensation and Management Succession Strategies January 28, 2016 14 2016, Foster Swift Collins & Smith PC Step Five: Implement Strategy Select Mix of Benefits Prepare formal program documents Section 409A Issues ■ ERISA Issues (120-day letter) ■ Communicate programs to employees regularly to maximize incentives Review and refine together with strategic plan Executive Compensation and Management Succession Strategies January 28, 2016 15 2016, Foster Swift Collins & Smith PC Succession Planning Failing to plan is planning to fail. – Benjamin Franklin Executive Compensation and Management Succession Strategies January 28, 2016 16 2016, Foster Swift Collins & Smith PC Why is Succession Planning Important? Succession is inevitable and often catastrophic ■ ■ 70% of business fail to survive the second generation 85% fail to survive the third generation Proactive planning allows us to: Avoid business disturbances ■ Avoid problems with customers, suppliers and employees ■ Improve successor retention ■ Mitigate tax and legal issues ■ Minimize disputes, particularly in family-owned businesses ■ Avoid surprises ■ Executive Compensation and Management Succession Strategies January 28, 2016 17 2016, Foster Swift Collins & Smith PC What is Succession Planning? It means different things to different people: “Selling” or “Getting Out” ■ Keeping a business “in the family” ■ Retiring from a continuing business ■ Process to formally transition management and ownership between generations or to a buyer Executive Compensation and Management Succession Strategies January 28, 2016 18 2016, Foster Swift Collins & Smith PC Practical Considerations Outstanding Debt Value in land, buildings and equipment Owner’s retirement income needs Treating children “fairly” Common solution – Life Insurance Executive Compensation and Management Succession Strategies January 28, 2016 19 2016, Foster Swift Collins & Smith PC Step One: Identify Potential Successors Co-owners Family members (Family issues? Estate planning issues?) Current employees New hires Potential buyers (Competitors) Executive Compensation and Management Succession Strategies January 28, 2016 20 2016, Foster Swift Collins & Smith PC Step Two: Determine Goals Retirement assets and income Keeping the business “in the family” Family’s goals “Getting out” Business continuity Executive Compensation and Management Succession Strategies January 28, 2016 21 2016, Foster Swift Collins & Smith PC Step Three: Plan for Management Succession Identify and groom successors Transitioning responsibilities, authority and relationships ■ Evaluations, feedback and training ■ Retention strategies (discussed previously) ■ Restructure management Dividing responsibilities (checks and balances) ■ Formalizing positions, reporting and responsibilities ■ Outside board of directors? ■ Executive Compensation and Management Succession Strategies January 28, 2016 22 2016, Foster Swift Collins & Smith PC Step Four: Plan for Ownership Succession Estimate cash needs and cash flow ■ ■ Can the business support both the owner and the successors? How will estate taxes be paid? Consider life insurance Determine transaction structure ■ ■ ■ Earn-in (stock purchases, profits interests, executive compensation plans) Earn-out (installment sale of stock, leveraged buy-out) Gifting (annual exclusion $14k; unified credit $5.43M) ■ ■ Viable for smaller businesses “Two-stage” transactions preserve discounts Estate freezing techniques (GRAT) ESOP Third party sale Formalize plan in connection with estate planning Consider appraisals and minority discounts Executive Compensation and Management Succession Strategies January 28, 2016 23 2016, Foster Swift Collins & Smith PC Step Five: Prepare the Business Formalize policies and procedures, legal forms, operating procedures and recordkeeping Corporate Restructuring Entity conversions ■ S corporation election (10 years) ■ Asset divisions and spin-offs ■ Structure future capital investments advantageously (leases, asset purchases, etc.) ■ Executive Compensation and Management Succession Strategies January 28, 2016 24 2016, Foster Swift Collins & Smith PC Executive Compensation and Succession Strategies Joel C. Farrar Foster Swift Collins & Smith PC 517.371.8305 jfarrar@fosterswift.com