compulsory earthquake insurance as of 27th

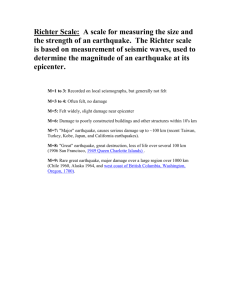

advertisement

Erhan Tuncay Ex Vice Chairman of TCIP’s BoD (TURKEY) Saturday, 28.9.2013 TURKISH CATASTROPHE INSURANCE POOL May 2010, ISTANBUL AGENDA Background of TCIP Current Structure of TCIP Basic Figures of TCIP Emergency Action Plan of TCIP HISTORY The devastating Earthquakes in Marmara region on 17th August and 12th November 1999 Insured loss: around USD 800 milion Economic loss: over USD 10 billion Low insurance penetration (especially for residential risks) Burden on public budget Decree law no 587 – compulsory earthquake insurance as of 27th September 2000 untill 18th of August 2012 As from 18th August 2012 new 6305 Catastrophe Insurance Law PRE-TCIP WHY Reactive solutions versus proactive solutions Shortage of funds in immediate need Allowance of funds to those in need is problematic Political and bureaucratic considerations may prevail Government priorities is on getting back to economic and social life GOVERNMENT’S PRIORITIES A compulsory earthquake insurance system for homeowners Affordable price for every homeowner True risk transfer mechanism Claims-paying capacity to limit government’s exposure Build national catastrophes reserves by time improvement of risk culture and insurance consciousness in public Rely on distribution channels of Turkish insurance industry ESTABLISMENT OF TCIP LEGAL AND FINANCIAL BASE OF TCIP Financed by Marmara Earthquake Emergency Reconstruction Project co-financed by Turkish Government World Bank European Bank for Reconstruction and Development Decree law no 587 – compulsory earthquake insurance as of 27th September 2000. Eureko Sigorta is tendered for the following 5 years till August, 2015 As from 18th August 2012 new 6305 Catastrophe Insurance Law PUBLIC-PRIVATE PARTNERSHIP HOUSEHOLDERS RISK MANAGEMENT BEHAVIOUR INSURER REINSURER TCIP SALES FUNCTIONS OPERATIONAL SERVICES RISK MANAGEMENT SUPPORT CLAIMS MANAGEMENT AUTHORITIES REGULATION SUPERVISION LEGAL FRAMEWORK RISK MANAGEMENT SUPPORT DISASTER MANAGEMENT STRUCTURE OF TCIP THE TREASURY GENERAL DIRECTORATE OF INSURANCE REINSURANCE TCIP BOARD OF DIRECTORS FUND MANAGMENT CONTRACTUAL AGREEMENT CLAIM MANAGEMENT COMPANY IT PR INSURANCE COMPANIES CLAIM OPERATIONS AGENCIES BROKERS BANC ASSURANCE 16 MILLION HOMEOWNERS DIRECT & ADC PROGRES AFAD (Disaster and Emergency Management Presidency) has been established decentralized cat management Increased cooperation between AFAD and other instittions Increased involvement into national earthquake issues Participating into Istanbul Disaster and Emergency Action Plan Improved the terms and conditions of Tariff and Earthquake General Conditions New Parliament law as from 18 August 2012 Beside Land Registrar Office and Mortgage transaction, utility services request earthquake policies Public perception on public aid has not been changed AFAD COORDINATING NATIONAL ACTIVITIES IT INFRASTRUCTURE IT STRUCTURE COMPANIES / AGENTS ACENTALAR INTERNET CALL CENTER LEASED LINE ANKARA ISTANBUL DASK DISASTER RECOVER CENTER - Merkez FIREWALL FIREWALL WEB SERVER WEB SERVER DMZ DMZ WAN J2EE APPLICATION SERVER J2EE APPLICATION SERVER DATABASE J2EE APPLICATION SERVER LDAP REPLICATION LDAP DATABASE State of the art technology Continuous improvement 99,9% service level Various level Back-up services, data and programs Investing into satellite and mobile technologies Disaster Recovery Center is able to be in full operation within 2 hours ACVIEVEMENTS and NEW LAW NEW LAW ACHIEVEMENTS Improved penetration from 4% to 35% Increased public awareness for earthquake and insurance Centralized marketing activities and brand management Kept pricing at affordable level Claims-paying capacity: USD 4 billion Solid reinsurance program Operational efficiency Improved coordinated work between the public agencies, the insurance industry, universities, etc.. Model structure for effective publicprivate partnership NATIONAL Finding quality capacity Ethical sensitivity STRATEGIC PLAN FOR 2023 Inforce since 18th of August 2012: flexible framework enabling improvements on product and structure Improve awareness and sign of state support Increased check points in utility services Additional natural perils to be included in case of market shortage Able to provide reinsurance support for natural perils Treasury to act as the last resort by providing reinsurance support Able to establish alternative distribution channel Government aid being subject to having TCIP policy Other articles on cat response, scientific research, international coordination COMPULSORY EARTHQUAKE INSURANCE INSURABLE PROPERTY In general meaning, intended for dwellings that remain inside the boundaries of the municipalities; Building constructed as dwellings on lands subject to private ownership and has registered title deed, Independent sections within the context of the Condominium Law No: 634, Independent sections situated inside residental buildings but used as small business establishment, bureau and similar purposes, By reason of natural disasters, properties built by the government or built by housing credit. UN-INSURABLE PROPERTY The properties that fall outside the Compulsory Earthquake Insurance are as follows: The dwellings belonging to public body and institutions, The dwellings built in residential areas of a villages, The dwellings entirely used for commercial and industrial purposes (Block of offices, business center, administ.sevice buildings, training center buildings etc.), The dwellings that are still under construction, COMPULSORY EARTHQUAKE INSURANCE INSURABLE PROPERTY With the Insurance; Compulsory INSURABLE PROPERTY Earthquake Earthquakes Fires as a result of earthquakes Explosions as a result of earthquakes Landslides as a result of earthquakes Tsunami as a result of earthquakes Building only causing material damages to the insured buildings are covered up to the sum insured by TCIP including foundations, main walls, common walls separating independent sections, ceilings and bases, stairs, platforms, halls, roofs, and chimneys. SCOPE OF COVER AND TARIFFICATION SCOPE OF COVER INSURABLE PROPERTY Only Earthquake and following SIMPLE TARIFF Only Building Earthquake Zone Construction Type M² of apartment No contents Fires No BI Explosions Landslides Tsunami TYPE OF CONSTRUCTIO N Zone 1 Zone 2 Zone 3 Zone 4 Zone 5 TYPE OF CONSTRUCTION UNIT ONSTRUCTION COST PER M² Steel, RC 2.20 1.55 0.83 0.55 0.44 Steel, RC 700 TL Masonary 3.85 2.75 1.43 0.60 0.50 Masonary 500 TL Others 5.50 3.53 1.76 0.78 0.58 Others 260 TL Prices for a 100 square meter dwelling Type of construction Sum Insured Turkish Lira Zone 1 Zone 2 Zone 3 Zone 4 Zone 5 Steel or R/C 70.000 164 119 68 49 41 Masonary 50.000 202 148 82 40 35 Others 26.000 153 102 56 30 25 BASICS OF TCIP BASIC FIGURES Total No of policies BASIC FACTS OF COVERAGE 5.950.000 Total coverage 151.490.500.000 € Compulsory for household owner’s Annual premium Only residential buildings Avg. Sum insured Avg. Premium 239.666.000 € 25.465 € 40 € Total Claim Files 20.622 Total claims paid 56.996.000 € Only earthquake risk, no flood, windstorm, clearance etc. Only building coverage, no contents, no business interruption, etc Only TCIP is providing earthquake cover to households up to SI 150.000 TL First loss based policy Recently, Renewal Discounts provided * as 06.09.2013 ** Euro 2,714 %43,7 PORTFOLIO PENETRATION 7.000.000 NUMBER OF POLICIES (000) 6.000.000 227.511 %32,0 %28,3 1.135.179 805.077 610.854 461.681 UNINSURED HOMES INSURED HOMES MAR MARA 2.046.411 İÇ ANADOLU 1.543.486 EGE KARADENİZ 572.893 DOĞU ANADOLU 1.164.909 737.969 1.707.403 AKDENİZ 3.252.134 179.717 0 PORTFOLIO DIST FOR EQ ZONES %28,3 1.000.000 %23,8 %23,5 2013 2.000.000 GÜNEYDOĞU 5.950 4.786 3.000.000 2012 3.725 2011 3.287 2010 3.436 2009 2.844 2008 2.618 2007 2.554 2006 2.417 2005 2.090 2004 2.022 2003 2.128 2002 2.428 2001 2000 159 5.000.000 4.000.000 %35,5 2.528.876 INSURANCE PENETRATION PORTFOLIO DIST PER REGIONS ZONE 5 1,0% EAST ANATOLIA 3,6% MEDITERRAIN 10,0% ZONE 1 45,7% ZONE 4 16,0% EAGEN 14,0% MARMARA 42,8% ZONE 3 10,9% ZONE 2 26,4% BLACKSEA 7,6% SOUTH EAST ANATOLIA 3,0% CENTRAL ANATOLIA 19,0% TCIP IN NEAR FUTURE 6.000.000 policies 10.000.000 number of householders to reach Increase communication and public relation activities Excelling in claim management Increased use of Technology EMERGENCY ACTION PLAN Why Secure un-interrupted service availability Plan “Pre-During-After” Earthquake activities Plan available resources according to size of earthquake Plan coordination activities with related Institutions NEW ERA IN CAT MANAGEMENT LESSONS LESSONS Less loss of lives in the countries with stringent building codes (Chile and New Zealand) Multiple events are not unusual (1999 Turkev and 2011 New Zealand) Secondary risk causing severe damages (tsunami, aquafaction) Modeling has it’s limitation Underestimated scenarios Economic Political Demographic Ambiguity on expectations from insurance industry Importance of strong construction industry Operational capacity is as important as financial capacity Outdated operational manuals Procedures must be simple and lean Application of sum insured or indemnity limits Necessity for collaboration between; Industries companies and public offices cities-countries Lack of; adjusting capacity technology Field knowledge 12.01.10 7.0 Haiti Earthqauke 11.01.11 Australian Flood 27.02.10 8.8 Chile Earthquake 11.03.11 8.9 Japan Earthquake 04.09.10 7.1 New Zealand Earthquake 22.02.11 6.3 New Zealand Earthquake CAT EVENT CLAIM MANAGEMENT DASK HASAR DANIŞMA KURULU HASAR TESPİT UZMANLARI SORUMLU LUK BÖLGELER İ Collaboration with reinsurers SORUMLU LUK BÖLGELER İ SORUMLU LUK BÖLGELER İ SORUMLU LUK BÖLGELER İ SORUMLU LUK BÖLGELER İ TCIP EMERGENCY CALL CENTER TO INCREASE MODELLING CAPACITY TO IMPROVE DATABASE TO IMPROVE UNDERWRITING YÖNETİM PLATFORMU SORUMLU EKSPER BÜROLARI LİSANSLI EKSPERLER EĞİTİM PLATFORM Strong and efficient client contact Emergency call center services Fast and accurate claim adjusting Claim adjusting resources Main Emergency TO INCREASE COORDINATION W/ INSURANCE INDUSTRY OBSTACLES OBSTACLES IN MASSIVE CLAIM OPERATION Limited number of claim adjusters Long period of training and education Limited number of training courses No promise of income for adjusters To be raedy for service in un-known time in the future TRAINING PROGRAMS AND INSTITUTIONS Construction knowledge Princeples of insurance – TCIP Claim adjusting knowladge Claim database modelling Universities Insurance Institutes Engineering associations Claim adjusters association FUTURE COMMUNICATION PLAN FACE TO FACE COMMUNICATON LOCAL COMMUNICATION CITIES IN CONTEST EARTHQUAKE SEMINARS BRAND AWARENESS EARTHQUAKE TRAILER THE HURRIYET TRAIN TOUCHING YOUTH GENERATION TCIP MEETING YOUTH 3.NATIONAL FILM CONTEST GET SUPPORT OF PUBILIC OPINION LEADERS COLLABORATION W/ UNIVERSITIES MEETING W/ ACADEMICIANS BE CLOSE TO INSURANCE CO’S CAMPAIGN FOR AGENCIES AND BANK BRANCHES TCIP LISTENING THE INDUSTRY INC POPULARITY OF EQ INSURANCE TCIP ON SOCIAL MEDIA FREQUENT APPEREANCE ON TV CONTINUES COMMUNICTION AND PUBLIC RELATION CONTINUES COMMUNICATION AND PUBLIC RELATIONS CHALLENGES AND OBJECTIVES CHALLENGES Low insurance awareness Enforcement of new Catastrophe Insurance Law Low penetration rate Restructuring of TCIP after a decade Aligning with national databases Effective control level in public offices Ensuring sound reconstruction activities after claim payment High cost of maintaining contingency capacity OBJECTIVES Increasing number of policies Excelling in Cat Response Establishing strong synergy between institutions Public offices Insurance companies, intermediaries Claim adjusters Increasing Reinsurance capacity Using alternative claim financing tools Implementation of new projects TURKISH CATASTROPHE INSURANCE POOL