102-Corporate Advisory Services

advertisement

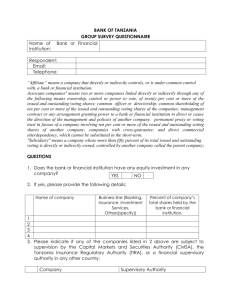

CORPORATE ADVISORY SERVICES CORPORATE RESTRUCTURING Revising the organizational structure Rearrangement and negotiation of organizational functions Reverse of a merger Objective of restructuring is to increase value CORPORATE RESTRUCTURING REASONS Need to meet global competition Better align interests of managers and shareholders Mainly done to reverse conglomerate mergers Make the firm more attractive to investors TYPES OF CORPORATE RESTRUCTURING Spin-Offs: A company owns or creates a subsidiary whose shares are distributed on a pro rata basis to the shareholders of the parent company. Parent company usually retains a small percentage of ownership of subsidiary – 10 to 20%. Often Spin-Offs follow an IPO sale of under 20% of shares. Subsidiary becomes a public firm. Cash flow is not generated from a spin-off. TYPES OF CORPORATE RESTRUCTURING Equity Carve-outs It is the IPO of some part of the common stock of the subsidiary. Seasoned equity offer of parent company. Cash flow is generated but differs in that this initiates public trading of subsidiary. Equity claim is on subsidiary’s assets and not parent’s assets TYPES OF CORPORATE RESTRUCTURING • Split-ups When a firm splits into two or more entities – usually accomplished with carve-outs and spin-offs of individual parts of the firm. TYPES OF CORPORATE RESTRUCTURING • Divestitures Sale of segment of a company to a third party for cash and / or securities. INTENTION OF DIVESTITURES Dismantling conglomerates Abandoning core business Changing strategies Adding value by selling into a better segment Large additional investment required Repeat past successes Discard unwanted business from prior acquisitions Finance prior acquisitions done before LBO Ward off takeover Meeting Government requirements LBOs LBO is purchase of a company by a small group of investors, financed heavily with debt Usually resulting in becoming a private company LBO involves large ownership by managers Usually to turn firm around LBO interim financing is usually bank debt Permanent financing Bank debt (Senior, Secured) High-yield bonds (Junk bonds) HOSTILE MERGERS • • • • • Bidder Unwanted Targeted repurchase Target firm agrees to buy back some shares from bidder (usually at a premium) Self-tender Firm makes offer to buy back its own shares (limit) while excluding targeted shareholders Poison Pills Calls with contingent strike prices Issued to shareholders Legislation HOSTILE MERGER JARGONS Golden Parachutes Crown Jewels White Knights Lock Ups Shark Repellents Green Mailing