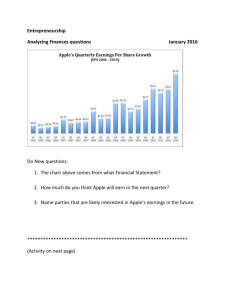

Macy's Presentation

advertisement

macy’s, Inc. By S a n die W i l ey macy’s, Inc. Macy’s, Inc. is one of the nation’s premier omnichannel retailers, with fiscal 2014 sales of $28.1 billion. The company operates the Macy’s and Bloomingdale’s brands with about 825 stores in 45 states, the District of Columbia, Guam and Puerto Rico under the names of Macy’s and Bloomingdale’s, themacys.com and bloomingdales.com websites, and 13 Bloomingdale’s outlet stores. Bloomingdale’s in Dubai is operated by Al Tayer Group LLC under a license agreement. Macy’s, Inc.’s diverse workforce includes approximately 172,500 employees. Prior to June 1, 2007, Macy’s Inc. was known as Federated Department Stores, Inc. The company’s shares are traded under the symbol “M” on the New York Stock Exchange. Direct Competitor Comparison M DDS PVT1 PVT2 Industry Market Cap: 22.79B 5.57B N/A N/A 6.32B Employees: 166,900 21,600 116,0001 13,9001 13.79K 0.02 0.05 N/A N/A 0.00 28.10B 6.78B 12.98B1 3.15B1 1.76B 0.40 0.37 N/A N/A 0.36 3.92B 816.90M N/A N/A 103.90M 0.10 0.08 N/A N/A 0.06 Net Income (ttm): 1.53B 331.85M N/A 62.90M1 N/A EPS (ttm): P/E (ttm): 4.22 15.83 7.79 17.38 N/A N/A N/A N/A 0.11 24.91 PEG (5 yr expected): 1.35 1.40 N/A N/A 1.36 P/S (ttm): 0.81 0.83 N/A N/A 5.68 Qtrly Rev Growth (yoy): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Operating Margin (ttm): DDS = Dillard's Inc. Pvt1 = J. C. Penney Corporation, Inc. (privately held) Pvt2 = Saks Incorporated (privately held) Industry = Department Stores 1 = As of 2013 EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization EPS – Earnings Per Share P/E – Price –Earnings Ratio PEG – Price/Earnings Ratio divided by year-over-year earnings growth rate (the lower the better) P/S – Price to Sales Ratio ttm - Trailing twelve months Dollars in Millions Revenue Trend $30,000.00 6.00% $25,000.00 5.00% $20,000.00 4.00% $15,000.00 3.00% $10,000.00 2.00% $5,000.00 1.00% $0.00 0.00% 2009 2010 Net Sales 2011 Net Income 2012 Cost of Goods Sold 2013 Profit Margin 2014 Market Share Price VS Earnings per Share $70.00 $60.00 $50.00 Dollars $40.00 $30.00 $20.00 $10.00 $0.00 2009 2010 2011 Basic earnings per share 2012 Market Share price 2013 2014 Interest Expense Trend 9000.00 6.00 8000.00 5.00 7000.00 4.00 Dollars in Millions 6000.00 5000.00 3.00 4000.00 2.00 3000.00 2000.00 1.00 1000.00 0.00 0.00 2009 2010 2011 2012 2013 2014 -1000.00 -1.00 Short-term debt Long-Term Debt Interest expense Income before interest expense and income taxes Times Interest earned Working Capital VS Long-Term Debt $9,000.00 1.60 $8,000.00 1.55 $7,000.00 1.50 Dollars in Millions $6,000.00 $5,000.00 1.45 $4,000.00 1.40 $3,000.00 1.35 $2,000.00 1.30 $1,000.00 $- 1.25 2009 2010 Working Capital 2011 Long-term Debt 2012 2013 Current Ratio 2014 The Street Analysis Macy's Inc - M - EQUITY Reviewed By: TheStreet Ratings on April 30, 2015. Report Summary: TheStreet Ratings team rates Macy's Inc as a Buy with a ratings score of A. Report Snippet: We rate MACY'S INC (M) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, notable return on equity, solid stock price performance, growth in earnings per share and expanding profit margins. We feel these strengths outweigh the fact that the company has had generally high debt management risk by most measures that we evaluated. Rating: 4.67 out of 5, 'A' Buy. You can view the full analysis from the report here: M Rating Report Other Opinions Guru Rating Scorecard P/E Growth Investor Peter Lynch M gets a 72% rating based on Peter Lynch's methodology. Value Investor Benjamin Graham M gets a 43% rating based on Benjamin Graham's methodology. Momentum Strategy Investor Validea M gets a 57% rating based on Validea Momentum methodology. Growth/Value Investor James O'Shaughnessy M gets a 100% rating based on James O'Shaughnessy's methodology. Small Cap Growth Investor Motley Fool M gets a 59% rating based on Motley Fool's methodology. Contrarian Investor David Dreman M gets a 50% rating based on David Dreman's methodology. Growth/Value Investor Martin Zweig M gets a 62% rating based on Martin Zweig's methodology. Price/Sales Investor Kenneth Fisher M gets a 60% rating based on Kenneth Fisher's methodology. Recommedation Macy’s Inc. has seen an increase in sales and income over the last few years. They have covered their expenses and have increased their earnings per share. Recent news indicate Macy’s venturing into the Outlet market. If this venture is successful, Macy’s should expect to see a significant increase in sales and income. Macy’s is currently carrying a lot of debt. It is therefore that I would only recommend Macy’s as a buy for those who are willing to take a slight risk.