ASSOCIATE DEGREE COURSE DEFINITION FORM Course Name

advertisement

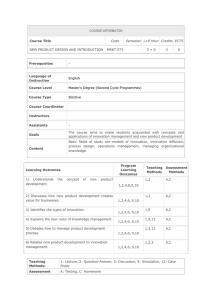

ASSOCIATE DEGREE COURSE DEFINITION FORM Code : BMV1106 Course Name: GENERAL ACCOUNTING Application Theory 56 - Education and Teaching Methods Assign Laboratory Project/ Field Study men 90 Semester Course Objects Learning Outputs and Efficiencies Field Course Others 64 Total 210 4 Credits ECTS Credit 7 Turkish Social Technical Elective X Credit Language (*)FALL / SPRING Basic Field Course Course Type Program Name : Accounting and Tax Practices Elective Analyzing the accounting practices in compliance with uniformity account plan and discussing basic concepts of accounting are aimed. The course will be enriched with examples and practices. Understanding of accounting system, teaching of book keeping methods, introduction to account, understanding of general accepted principles of accounting, book keeping items and accounting reports, Skill of practice accounting and bookkeeping 1.Feyiz,A.M., ‘Dönem Sonu Muhasebe İşlemleri’, ISBN: 975-8779-03-6, Dilara Yayınevi, 2003, Rize, Turkey 2.Bektöre,S., Sözbilir,H. and Banar, K., ‘Muhasebe İlkeleri ve Uygulaması’, Birlik Ofset Yayıncılık, 1993, Eskişehir, Turkey 3. Prof.Dr. Orhan Sevilengül, Genel Muhasebe, Gazi Kitabevi, Ankara,2008 4.Ataman, Ü., ‘Genel Muhasebe Muhasebe Dönem İçi İşlemleri’, Türkmen Kitabevi, 1995, İstanbul, Turkey Textbooks and/or Other Referances ASSESSMENT CRITERIA Theoretical courses Midterm exam Project Course and Term Paper Tick ( X ) please percent (%) X 30 Quiz - Homework presentation Semester Homework (project, raport, ect.) Midterm exam Controls in semester Delivery at midterm X 5 X 5 Oral Exam - Final Exam Laboratory Final exam Tick ( X ) please X Others 60 Others Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Course Lecturer e-mail Web Address Subjects Basic Concepts and Accounting System Balance Sheet Accounts as a briefly Current Assets Fixed Assets Current Liabilities Long Term Liabilities Equity Monograph Practice Appropriate with Uniform Accounting System Midterm Exam Income Statement Accounts Income Statement and Cost Accounts Income Statement and Balance Sheet Accounts Profit/Loss Calculations from Gross Profit Monograph Practice Öğr. Gör. Ferhat Şirin SÖKMEN percent (%) SHORT CYCLE COURSE DETAILS Course Title: Generel Business Lecture Application 56 24 Education and Teaching Methods Lab. Project/ Homework Field Study 30 Semester Course Type X Other Total 36 150 Credits Credit ECTS T+A+L=Credit 4+0+0=4 5 Language 1 Basic Scientific Course Objectives Learning Outcomes and Competencies Vocational School: Şırnak MYO Programme: ACCOUNTANCY Code : ISL1107 Scientific English Technical Elective Social Elective Basic concepts,new techniques that the students can use in their Works and studies. Give the basic knowledge abaout business science. 1-Zeyyat Sabuncuoğlu, T. Tokol ve G. Onal; “İşletme Bilimine Giriş”, Uludağ Üniversitesi, Bursa, 1985. 2-Kemal Tosun; “İşletme Yönetimi Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses If any, mark as (X) Midterm Exams Project Course and Graduation Study Percent (%) 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Historical development of business science,basic concepts Business relationships with other diciplines of science Business objectives Various aspects of business Business envirobment Business environment Social responsibility Classification of enterprises Phases of the business organization Feasibility study Functions of management Functions of management Functions of business Functions of business Öğr. Gör. Ferhat Şirin SÖKMEN Percent (%) SHORT CYCLE COURSE DETAILS Course Title: FUNDAMENTALS OF LAW Lecture Application 28 - Code : BMV1117 Education and Teaching Methods Lab. Project/ Homework Field Study 28 Semester Vocational School: ŞIRNAK MYO Programme: ACCOUNTANCY Other Total 34 90 Credits Credit ECTS T+A+L=Credit 2+0+0=2 3 Language 1 Turkish Course Type Basic Scientific Course Objectives Learning Outcomes and Competencies Textbooks and /or References The aim of the course is to enable students to develop an understanding of general concept of law, the sources of law, legal rights, legal actions and operations. Scientific Technical Elective Social Elective Idea to conduct, behavior development, solution to produce Hukuka Giriş ve Hukukun Temel Kavramları, Doç. Dr. Ömer ANAYURT Hukukun Temel Kavramları Yrd. Doç. Dr. Yahya DERYAL Hukuka Giriş, Anadolu Üniv. Yayınları ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Social Rules and Law The Concept of Law and Legal Sanctions The Turkish Law System, The Branches of Law: Private Law Public Law The Sources of Law, Relations of Law The concept of right , Rights types, Private Rights, Public Rights Personality Concept, Classification of Persons: real and Legal Persons Legal Actions and Operations Acquisition of Rights and Goodwill Rules Protection of Rihts, Responsibility Concept of Obligation, Sources of Obligations The Turkish Judicial System Öğr Gör. Yunus AÇCI Percent (%) SHORT CYCLE COURSE DETAILS Course Title: Basics of Economics Lecture Application 42 0 Vocational School: Şırnak Programme: Accounting Code BMV1115 Education and Teaching Methods Lab. Project/ Homework Field Study Semester Other Credits Credit ECTS T+A+L=Credit 3+0+0=3 4 Language 1 Turkish Course Type Basic Scientific Course Objectives Economics at the basic level to address the issues Learning Outcomes and Competencies Textbooks and /or References Total Scientific X Technical Elective Social Elective Basic level of economics can be detected Genel Ekonomi Tevfik PEKİN Zeus Kitabevi, 2009, İzmir. Genel Ekonomi Tümay ERTEK Beta Yayınları, 2005, İstanbul. İktisada Giriş Ersan BOCUTOĞLU, Derya Kitabevi, 2005, Trabzon. ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects An introduction to economic theory, basic concepts Each economy's basic problems and solution options Economic analysis methods and flow of economic activity Markets, demand, supply and price formation Demand and supply elasticities Consumer and producer equilibrium analysis Costs, and market analysis National income analysis Main concepts of national income National income calculation methods Employment, unemployment and inflation Monetary theory, balance of payments and international economics Foreign trade theory Economic growth, development and globalization Öğr. Gör. Yunus AÇCI Percent (%) SHORT CYCLE COURSE DETAILS Course Title: COMPUTER ACCOUNTING-I Lecture Application 28 14 Education and Teaching Methods Lab. Project/ Homework Field Study 30 Semester Course Type Code : BMV2246 Other Total 36 150 Credits Credit ECTS T+A+L=Credit 2+1+0=2,5 5 Language 3 Basic Scientific Vocational School: Şırnak VS Programme: ACCOUNTIG Scientific X Turkish Technical Elective Social Elective The aim of this course is to prepare the students to the business life by giving information about accounting information systems, to prepare financial statement with computermed records and by teaching package programs have to run. Course Objectives Learning Outcomes and Competencies To be knowledge commercial accounting programs and to gain running skills to the programs. Öğr. Gör. Alim Karataş, Logo Go Eğitim ve Uygulama Kitabı, ISBN: 978-9944-0812-3-8,2007, İstanbul Logo Muhasebe Programı El Kitabı Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s Subjects Accounting Information System Accounting Package Programs LOGO GO Accounting Package Program Company Description Inventory Module Inventory Module Billing Module Billing Module Cash, Banks module Cheque / Shares Module Accounting Modules Accounting Modules Accounting Integration Preparation of Financial Statements Öğr. Gör. Erhan POLAT e-mail Website SHORT CYCLE COURSE DETAILS Percent (%) Vocational School: ŞIRNAK Code : BMV2104 Course Title: TAX LAW Lecture Application 42 - Education and Teaching Methods Lab. Project/ Homework Field Study 20 Semester Course Type Programme: ACCOUNTING AND TAX LAW Total 88 150 Credits Credit ECTS T+A+L=Credit 3+0+0 = 3 5 Language 3 Basic Scientific Other Scientific Turkish Technical Elective Social Elective Tax and law related to the basic concepts of learning, the tax law legal system in place able to comprehend, taxation process, the tax debt to create and eliminate causes can explain the balance sheet items valuation and balance sheet contained in depreciation is needed economic value of their depreciation can calculate the tax-related crimes and penalties and their relationship obtain information about the trial process Course Objectives Faced as a result of this program students learn to solve tax problems are in a particular discipline. Lifelong learning skills wins. National and international opinion about the tax problem will get the ability to specify. Becomes how to communicate enough. Learning Outcomes and Competencies All the tax law - Tax Law (Perspectives Press, Ankara, October 2006, Prof.. Dr. Şükrü KIZILOT) Tax Law of the Turkish tax system (Details Yayıncılık, Ankara 2009, Asst. Assoc. Dr. Hilmi Ünsal) Tax Procedure Act Application ( Finance and Law Publications, Ankara in March 2007, Gurol ÜREL) Communication and Circular of the Ministry of Finance - Constitution - Laws Reasons Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Percent (%) Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s Subjects The concept of tax and tax law, tax law, the legal system in place The sources of tax law Tax laws place, time and meaning in terms of implementation, taxation auythority Basic concepts of taxation Tax License, Representation, Private Contracts and Prohibited Activities, Taxation Procedures Why the End of Tax Debt, Tax Law Periods assignments of the person who paid the tax Valuation – Depreciation Organization Structure of Tax Administration, Tax Audit Institutions, Knowledge Acquisition Tax Crimes and Punishments Major Tax Crimes and Punishments Termination of the Criminal, Criminal and Reducing Causes Administrative Dispute Resolution of Tax Roads Through Judicial Resolution of Tax Disputes Öğr. Gör. Burak KAYA e-mail Website ASSOCİATE DEGREE COURSE DEFINITION FORM Course title : Cost Accountıng Code :BMV 2106 Education and Teaching Methods Program name : Şırnak Accounting and Tax practices Credits Theory Application 42 14 Laboratory - Assignment Project/ Field Study - Semester 75 Course type Basic field Course Course content Cost items,cost calculation methods,cost clasification Course object Learning outputs and Total 49 180 Credit 3,5 Language 3 Field Coursei Others x ECTS Credit 6 Turkish social Technical elective elective To recognise and to hawe knowladge about cost accounting To ensure cost accounting pratics for students Efficiencies Course Book and/or other Sources Maliyet Muhasebesine Giriş – Mustafa Savcı EVALUATION CRITERION Theoretical courses Midterm exam Project Course and Senior Thesis Tick ( X ) please percent (%) X 30 Quiz Tick ( X ) please Midterm exam Controls in semester Homework presentation x 10 Semester Homework (project, raport, ect.) - - viva voce Laboratory - - Final exam Final exam X 60 Delivery at midterm Others Others Week 1 2 3 4 5 6 7 8 9 10 11 12 13 Subjects Basic terms on cost accounting Cost items Cost calculation methods Cost clasification Calculation of cost items Cost distribution Cost calculation based on production Standart cost methods 14 Sorumlu Öğretim Elemanları Elektronik Posta Öğr. Gör. Mithat KASAP percent (%) SHORT CYCLE COURSE DETAILS Course Title: Companies accounting Lecture Application 28 0 Education and Teaching Methods Lab. Project/ Homework Field Study 0 12 14 Semester Course Type Vocational School: ŞIRNAK Programme: Accounting and tax practice Code : BMV 2107 Total 36 90 Credits Credit ECTS T+A+L=Credit 2+0+0=2 3 Language 3 Basic Scientific Other Scientific Turkish Technical Elective Social Elective By learning the types of companies, organizations and activities of companies in the period of profit and loss distributions of capital changes, mergers and be able to apply accounting procedures in the process of disintegration. The types of companies, persons and capital companies can make their separation. Persons and the establishment of capital transactions of capital changes in company taxation of profits, profit and loss distribution, the dispersion (advice) of the accounting processto be able to make records. Capital of the company general assembly, management, audit functions and powers of the organs responsible agency explains. Holding, multinational companies explain subject Prof. Dr. Yurdakul ÇALDAĞ;Şirketler Muhasebesi,Yenilenmiş 3. Baskı,Gazi Kitabevi,Ankara,2003. Prof.Dr.Şeref KKAVAK;Şirketler Muhasebesi,Nobel Yayın Dağıtım,Ankara,2006. Yrd.Doç. Dr. Faruk GÜÇLÜ, Şirketler Muhasebesi,Detay Yayıncılık,Ankara,2008. Course Objectives Learning Outcomes and Competencies Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Project Course and Graduation Study If any, mark as (X) Percent (%) Midterm Exams X 40 Quizzes - - Midterm Controls Homework - - Term Paper Term Paper, Project Reports, etc. - - Oral Examination Laboratory Work - - Final Exam Final Exam X 60 Other - - Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s If any, mark as (X) Percent (%) Midterm Exams Other Subjects In general, the concept of corporate and business types Individual differences between companies and capital companies Companies in a variety of organs, functions and responsibilities Individual company operations and capital changes and the establishment of accounting procedures Profit and loss distribution and accounting of individual company operations Individual taxation and accounting operations of the company's profits Merger and accounting operations of individual company Transactions and accounting records of individual company advice Transactions and accounting records of individual company advice Capital companies, and the importance of cooperatives in our country Company operations and the establishment of capital changes and capital accounting processes Profit and loss distribution of capital and profits of corporate taxation and accounting operations Changes in the type of capital company mergers, liquidation procedures and accounting records Cooperatives accounting procedures, and multi-national holding companies Öğr Gör. Burak KAYA e-mail Website SHORT CYCLE COURSE DETAILS Course Title: DİRECTED STUDY-1 Lecture Application 28 14 Education and Teaching Methods Lab. Project/ Homework Field Study 72 Semester Course Type Code : BMV2106 Other Total 36 150 Credits Credit ECTS T+A+L=Credit 2+1+0=2,5 5 Language 3 Basic Scientific Vocational School: Şırnak VS Programme: ACCOUNTING Scientific X Turkish Technical Elective Social Elective Directed study of a student who had come to the graduation stage with their own areas are concerned, to give the consultants will prepare a thesis about the qualifications are in the works. Directed study, project work, one of the following targets, or collectively to provide a few that are designed to be performed easily. A course of various components, or a program that covered several lessons arising from learning integration; school-defendant and industry-based learning as a whole to bring the individual understanding of the limits of industrial application environment by extending the directly from the program due to learn, to enrich basic research skills and methods development individual or a team taking responsibility in case of project work carried out. Course Objectives Learning Outcomes and Competencies Textbooks and /or References Halil Seyidoğlu,” Bilimsel Araştırma ve Yazma”, ISBN:975-7516-04-X 1992, İstanbul ASSESSMENT CRITERIA Theoretical Courses If any, mark as (X) Project Course and Graduation Study Percent (%) If any, mark as (X) Percent (%) Midterm Exams Midterm Exams X 20 Quizzes Midterm Controls X 20 Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam X 60 Final Exam Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Information Concept Research and Report Preparation Report writing Report Writing stages Analyzing data Report control sections of the report and presenting the report. Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly. Öğr. Gör. Ferhat Şirin SÖKMEN ASSOCİATE DEGREE COURSE DEFINITION FORM Course title : Accounting control Application Theory 42 - Program name: Accointing and tax practices Code BMV 2119 Education and Teaching Methods Assignment Project/ Field Study 45 Laboratory Semester 33 Total 120 Credit 4 Turkish social Course type Basic field Course Course content Control methods,control standart,objective control Course object To reconise and to have knowladge about accounting control Learning outputs and x Credits ECTS Credit 3 Language 3 Field Coursei Others Technical elective elective To train students about accounting control process Efficiencies Course Book and/or other Sources Muhasebe Denetimi - Ümit Gücenme EVALUATION CRITERION Theoretical courses Midterm exam Project Course and Senior Thesis Tick ( X ) please percent (%) X 30 Tick ( X ) please Midterm exam Controls in semester Quiz Homework presentation x 10 Semester Homework (project, raport, ect.) - - viva voce Laboratory - - Final exam Final exam X 60 Others Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Subjects Control term Control methods Controller types Control standarts Objective control Control process Control of financial tables Performance control Delivery at midterm Others percent (%) SHORT CYCLE COURSE DETAILS Course Title: LABOUR AND SOCIAL SECURITY LAW Lecture Application 28 - Code :BMV2120 Education and Teaching Methods Lab. Project/ Homework Field Study 14 Semester Vocational School: Şırnak MYO Programme: ACCOUNTANCY Other Total 18 60 Credits Credit ECTS T+A+L=Credit 2+0+0=2 2 Language 3 Turkish Course Type Basic Scientific Course Objectives Learning Outcomes and Competencies The aim of the course is to prepare students to working life, informed about employee and employer relationships Scientific Technical Elective Social Elective Business relationships can be established in the legal framework and conduct Fundamentals of Business Law- K.TUNÇOMAĞ-T.CENTEL , International Business Law Resources, Business Law Courses -N.ÇELİK, Business Law -Ercan AKYİĞİT, Business Law -Sarper SÜZEK, Business Legislation -Ali GÜZEL, Business Law Practice - M.ŞAKAR, Social Insurance and Labor Law Practice -M.ÇOLAK M. Kemal OKTAR Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Historical, Development and Fundemantal Principles of Labor Law Basic concepts: Employee, Employer, Work Place, office plugin… Service contract, Varieties, Termination of Employment, Result of Employment Termination, Severance Pay Workers Health and Safety in employment Compulsory overtime, Night Work, annual paid leave Collective Aggrement Social Security Concepts, Turkish Social Security System Sontent, Premiums, Collection of Premiums Short-term insurance branches Long-term insurance branches Unemployment Insurance Öğr. Gör. Ferhat Şirin SÖKMEN Percent (%) SHORT CYCLE COURSE DETAILS Course Title: COMPUTER ACCOUNTING-II Lecture Application 28 14 Education and Teaching Methods Lab. Project/ Homework Field Study 30 Semester Course Type Code : BMV2239 Other Total 36 150 Credits Credit ECTS T+A+L=Credit 2+1+0=2,5 5 Language 4 Basic Scientific Vocational School: Şırnak VS Programme: ACCOUNTING Scientific X Turkish Technical Elective Social Elective The aim of this course is to prepare the students to the business life by giving information about accounting information systems, to prepare financial statement with computermed records and by teaching package programs have to run. Course Objectives Learning Outcomes and Competencies Textbooks and /or References To be knowledge commercial accounting programs and to gain running skills to the programs. ETA: Entegre V-7 Entegre Ticari Program Modülleri Kullanım Kitabı, ETA Bilgisayar Yayınları, Yayın No:12, 2005, İstanbul ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s Subjects Accounting Information System Accounting Package Programs ETA SQL Accounting Package Program V.7 veETA Company Description Plan account and accounts Plan account and accounts Accounting chips Accounting chips Practice and Trial Balance for Application and Notebooks Application and Balance Sheet and Income Statement File maintenance Application Application Öğr. Gör. Erhan POLAT e-mail Website SHORT CYCLE COURSE DETAILS Percent (%) Course Title: Turkish Tax System Lecture Application 3 1 Education and Teaching Methods Lab. Project/ Homework Field Study Semester Course Type Other Total Credits Credit ECTS T+A+L=Credit 3.5 5 Language 4 Basic Scientific Course Objectives Learning Outcomes and Competencies Textbooks and /or References Vocational School: ŞIRNAK MYO Programme: Accounting Code: BMV2246 Scientific X Turkish Technical Elective Social Elective Turkish Tax System in The Taxes Turkish Tax System in the need for major tax legislation both in terms of being understandable in terms of meaning. Prof.Dr. Osman PEHLİVAN Vergi Hukuku, Derya Kitabevi, 2008,Trabzon. ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Income Tax Detection of the Income Tax Matrah Detection of Earnings Earnings vre Agricultural Trade Other Types of Earnings Analysis Collection of Income Tax and bed Corporate Tax Liquidation in institutions, Mergers and taxation Property Tax Inheritance Tax Value Added Tax Value Added Tax Motor Vehicles Tax Special Consumption Tax Other Tax Types Öğr. Gör. Burak KAYA Percent (%) ASSOCİATE DEGREE COURSE DEFINITION FORM Course title : External trade ıssues Application Theory 28 - Program name: Şırnak Accounting and tax practices Code : BMV2206 Education and Teaching Methods Assignment Project/ Field Study 9 Laboratory Semester 23 Total Credit 60 Credits ECTS Credit 2 Language 4 2 Turkish social Course type Basic field Course Course content Delivery methods an external trade,paying methods on external trade,economic fusion Course object To teach importance of external trade students Learning outputs and Field Coursei Others x Technical elective elective To train students about globalization and external trade Efficiencies Course Book and/or other Sources Dış Ticaret İşlemleri – Sadettin Gültekin EVALUATION CRITERION Theoretical courses Midterm exam Project Course and Senior Thesis Tick ( X ) please percent (%) X 30 Quiz Tick ( X ) please Midterm exam Controls in semester Homework presentation x 10 Semester Homework (project, raport, ect.) - - viva voce Laboratory - - Final exam Final exam X 60 Delivery at midterm Others Others Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Sorumlu öğretim elemanları Elektronik Posta Subjects Term of external trade Delivery methods on external trade Paying methods on external trade Documents using in external trade Economic fusion European union Free trade regions Öğr. Gör. Yunus AÇCI percent (%) ASSOCİATE DEGREE COURSE DEFINITION FORM Course title : Financial table analyze Application Theory 42 14 Program name:Şırnak Accounting and tax practices Code BMV 2245 Education and Teaching Methods Assignment Project/ Field Study 33 Laboratory 31 120 Credits ECTS Credit 3,5 4 Credit Turkish social Course type Basic field Course Course content Financial tables,financial table analyze techniques,financial planning Course object To learn importance of financial table analyses Learning outputs and Field Coursei Total Language 4 Semester Others x Technical elective elective To learn how to analyses financial tables Efficiencies Course Book and/or other Sources Mali Tablolar Analizi – Ümit Gücenme EVALUATION CRITERION Theoretical courses Midterm exam Project Course and Senior Thesis Tick ( X ) please percent (%) X 30 Tick ( X ) please Midterm exam Controls in semester Quiz Homework presentation x 10 Semester Homework (project, raport, ect.) - - viva voce Laboratory - - Final exam Final exam X 60 Delivery at midterm Others Others Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Sorumlu öğretim elemanları Elektronik Posta Subjects Financial tables Subsidiary financial tables Financial table analyze techniques Financial planning Financial control Effect of enflation on financial tables Öğr. Gör. Burak KAYA percent (%) SHORT CYCLE COURSE DETAILS Course Title: DİRECT STUDY-II Lecture Application 28 14 Education and Teaching Methods Lab. Project/ Homework Field Study 72 Semester Course Type Code : BMV2222 Other Total 36 150 Credits Credit ECTS T+A+L=Credit 2+1+0=2,5 5 Language 4 Basic Scientific Vocational School:Şırnak VS Programme: ACCOUNTING Scientific X Turkish Technical Elective Social Elective Directed study of a student who had come to the graduation stage with their own areas are concerned, to give the consultants will prepare a thesis about the qualifications are in the works. Directed study, project work, one of the following targets, or collectively to provide a few that are designed to be performed easily. A course of various components, or a program that covered several lessons arising from learning integration; school-defendant and industry-based learning as a whole to bring the individual understanding of the limits of industrial application environment by extending the directly from the program due to learn, to enrich basic research skills and methods development individual or a team taking responsibility in case of project work carried out. Course Objectives Learning Outcomes and Competencies Textbooks and /or References Halil Seyidoğlu,” Bilimsel Araştırma ve Yazma”, ISBN:975-7516-04-X 1992, İstanbul ASSESSMENT CRITERIA Theoretical Courses If any, mark as (X) Project Course and Graduation Study Percent (%) If any, mark as (X) Percent (%) Midterm Exams Midterm Exams X 20 Quizzes Midterm Controls X 20 Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam X 60 Final Exam Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Evaluation of projects with every student groups weekly.. Evaluation of projects with every student groups weekly. Evaluation of projects with every student groups weekly. Evaluation of projects with every student groups weekly. Evaluation of projects with every student groups weekly. Evaluation of projects with every student groups weekly. Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Evaluation of projects with every student groups weekly Öğr. Gör. Yunus AÇCI SHORT CYCLE COURSE DETAILS Course Title: FINANCIAL MANAGEMENT Lecture Application 42 14 Education and Teaching Methods Lab. Project/ Homework Field Study 0 26 32 Semester Course Type Vocational School: Şırnak Programme: ACCOUNTING AND TAX PRACTICES Code : BMV 2207 Total 36 120 Credits Credit ECTS T+A+L=Credit 3+1+0=3,5 4 Language 4 Basic Scientific Other Scientific Turkish Technical Elective Social Elective In terms of senior management in the enterprises of the financial statements by highlighting the importance of financial management as a tool to teach how to use it. How to make investment decisions are financial techniques were exploited, business ithe cost of each source of china and most cost-effective resource that has been shown to benefit in how financial techniques. Using financial analysis tools financial statements of the business can make comments about the financial statements and business decisions using information to eliminate the need to choose. Under the control of the business planning and financial information to use, working capital characteristics, types, sources, strategies learns. The concept of investment, investment land be applied to a variety of methods and results of their comments. The division of these resources by making their business resources can calculate their costs and lowest cost source of business can bring Prof. Dr.Ali CEYLAN; İşletmelerde Finansal Yönetim,8. Baskı,Ekin Kitapevi, Bursa ,2003. Prof. Dr.Öztin AKGÜÇ;Finansal Yönetim,6. Baskı,Avcıol Basım Yayın,İstanbul, 1994. Prof.Dr.Öcal USTA;İşletme Finansı ve Finansal Yönetim,Detay Yayıncılık,2. Baskı,2005. Course Objectives Learning Outcomes and Competencies Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 Quizzes If any, mark as (X) Percent (%) Midterm Exams Midterm Controls Homework - - Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects In general, the financing and financial analysis methods Rates, vertical percentages, comparative analysis tables Decision-making of financial information, business plans and controls for use in Methods used in preparing financial plans and plan types Financial audit Short-term funding sources and funding sources Medium-term funding sources Long-term funding sources and auto-financing Costs and optimal capital structure of funding sources Costs and optimal capital structure of funding sources Optimal capital structure-related approaches and methods used in determination of optimal capital structure Dividend distribution policy and payment forms Invest in current assets Fixed assets investment Öğr. Gör. Erhan POLAT SHORT CYCLE COURSE DETAILS Course Title: BANK ACCOUNTING Lecture Application 28 14 Education and Teaching Methods Lab. Project/ Homework Field Study 42 Semester Course Type Code : BMV2246 Other Total 36 120 Credits Credit ECTS T+A+L=Credit 2+1+0=2,5 4 Language 4 Basic Scientific Vocational School: ŞIRNAK VS Programme: ACCOUNTING Scientific X Turkish Technical Elective Social Elective To inform banking accounting procedures, generally accepted accounting principles, accounting standards, uniform record system and also knowledge and skill levels, analysis and synthesis are targeted to improve their skills. Course Objectives Learning Outcomes and Competencies Textbooks and /or References Ability to gain information about deposit and credit accounting operations Aslan Şendoğdu, Banka Muhasebesi, ISBN: 975-591-430-7, 2005, Ankara. Serdar Atay, ‘Banka Muhasebesi’, ISBN:975-7929-62-X, SDÜ Basımevi, 2003, Isparta. Bankacılık Mevzuatı ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 Quizzes If any, mark as (X) Midterm Exams Midterm Controls Homework X 0 Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Bank Accounting Features: Banking Operations, Basic Concepts Related to the Bank Uniform Bank Account Plan, banks Automation Bank Accounting Procedures Funding Procedures: Acceptance of Deposits, Other Funding Transactions Funding Procedures: Acceptance of Deposits, Other Funding Transactions Funding Procedures: Acceptance of Deposits, Other Funding Transactions Credit Operations: Joint Operations Related to Credit, Credit Types Credit Operations: Joint Operations Related to Credit, Credit Types Credit Operations: Joint Operations Related to Credit, Credit Types Financial Transactions: Securities Exchange and Exchange Transactions Financial Transactions: Securities Exchange and Exchange Transactions Service Operations Service Operations Öğr. Gör. Yunuc AÇCI Percent (%) SHORT CYCLE COURSE DETAILS Course Title: FINAL ACCOUNTING TRANSACTIONS Lecture Application 56 Education and Teaching Methods Lab. Project/ Homework Field Study 106 Semester Course Type Code :BMV 1204 Other Total 48 210 Credits Credit ECTS T+A+L=Credit 4+0=4 7 Language 2 Basic Scientific Vocational School: Şırnak VS Programme: ACCOUNTANCY Scientific X Turkish Technical Elective Social Elective Day and work in our lives that are important commercial documents, business and institutions experiencing their commercial transactions, have received their income, they bear the costs and how to be saved, reporting how to do, balance sheet and income statement how to create a students' class, active participation with the controversial taught as trying to be . At the end of this course the students can explain basic concepts related to inventory procedures. In legislation and accounting literature explains the valuation measure. To understand the difference between internal and external accounting documents to perform financial statements at the end of financial period. Yo apply information on a sample faced in the business life. A.M. Feyiz, Dönem Sonu Muhasebe İşlemleri, ISBN: 975-8779-03-6, Dilara Yayınevi, 2007,Rize Adem.Çabuk, Muhasebede Dönem Sonu İşlemleri. ISBN: 975-564-125-3, Bursa, 2006. M.,Özbirecikli, Dönemsonu İşlemleri Muhasebesi, ISBN: 975-896-924-0, Ankara, 2005. Course Objectives Learning Outcomes and Competencies Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Percent (%) Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Definition of inventory - Related Concepts with inventory.. Necessity and comprehensive of the inventory process. Valuation Measurements: Valuation in TTK and VUK in valuation according to the principles of accounting -Commercial and Financial Balance Sheet. Commercial and financial profit, Regulation of financial statements and related Inventory Process, Cash and banks. Securities Trade and other receivables Stocks Stocks Assets Depreciation, Intangible assets, bank loans Trade payables and other debts, own resources, prose accounts Final operations related to reverves and expenses. Regulation of the balance sheet, the accounts closure Application Öğr. Gör. Ferhat Şirin SÖKMEN SHORT CYCLE COURSE DETAILS Code : BMV 1211 Course Title: STATISTICS Lecture Application 42 - Education and Teaching Methods Lab. Project/ Homework Field Study 70 Semester Vocational School: Şırnak MYO Programme: ACCOUNTANCY Other Total 38 150 Credits Credit ECTS T+A+L=Credit 3+0+0=3 5 Language 2 Turkish Course Type Basic Scientific Course Objectives The aim of this course is to define statistics concept and to maintain a general statistics skills for students. Learning Outcomes and Competencies Textbooks and /or References Scientific Technical Elective Social Elective Ability to use Statistics Paul Newbold (2000) İşletme ve İktisat için istatistik. İstanbul: Literatür yayıncılık Mahmut ATLAS (1999) İstatistik 1 Ders Notları. Eskişehir: Birlik Ofset Yayıncılık ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 Quizzes If any, mark as (X) Percent (%) Midterm Exams Midterm Controls Homework X 0 Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Statistics; Definition; Subject and Importance: Basics Unit, Variable: Types of variable Function of statistics: Types of quality. population and sample Data: Collecting data, Classification of data, Grouping the data: Series:Its definitions and types. Series Showing with graphic: Histogram Averages: Sensitive averages; mean and geometric averages, applications Averages: Sensitive averages;Harmonic and square averages, applications Insensitive averages: Median and mode; applications Measurement of variability: variation range,standart deviation Measurement of variability: variance, coefficiency of variation, applications Measurement of Symmetry and Variables; Discontinues Distribution; Regression and Correlation: Dependent variable, independent variable, Regression and Correlation: correlation and coefficient of determination. Öğr. Gör. Burak KAYA SHORT CYCLE COURSE DETAILS Course Title: Commercial Mathematics Lecture Application 56 0 Code : BMV 1207 Education and Teaching Methods Lab. Project/ Homework Field Study Vocational School: Şırnak MYO Programme: ACCOUNTANCY Other Total 120 Semester Course Type Language 1 Basic Scientific Credits Credit ECTS T+A+L=Credit 4+0=4 4 Scientific x Turkish Technical Elective Social Elective To make familiar with problems on purchasing and sales, computing present and future values of bonds, solving problems on interest, discounting and compounding and prepare a background for financial investment decisions. Course Objectives Learning Outcomes and Competencies Textbooks and /or References He/She solves problems on purchasing and sales; computes present and future values of bonds; examines and solves problems on interest, discounting and compounding. Commercial and Financial Mathematics, Mehmet YILDIRIM, Textbook, Balıkesir, 1999. ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) x 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam x 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects Introduction to costs, prices, profit and loss. Break-even analysis. Computing costs, sales revenues and profits of commercial firms. Finding out the ratios of profit or loss. Introduction to interest and discounting. Present and future value of bonds. Midterm exam. Compounding annuities and finding out future value of bonds. Compounding annuities which paid at the end of periods. Examples of applications of compounding annuities. Present value of annuities which earned at the end of periods. Examples of applications of discounting annuities. Computing the internal rate of return of an investment project. Computing the net present value of an investment project. Öğr. Gör. Erhan POLAT Percent (%) SHORT CYCLE COURSE DETAILS Course Title: COMMERICAL LAW Lecture Application 28 - Code : BMV1209 Education and Teaching Methods Lab. Project/ Homework Field Study 28 Semester Vocational School: Şırnak MYO Programme: ACCOUNTANCY Other Total 34 90 Credits Credit ECTS T+A+L=Credit 2+0+0=2 3 Language 2 Turkish Course Type Basic Scientific Course Objectives Learning Outcomes and Competencies The aim of the course is to enable students to develop an understanding of the terms and principals of commercial law. Scientific Technical Elective Social Elective To produce a solution of commercial activities of law Ticaret Hukuk Bilgisi-Y.DERYAL Ticaret Hukuku-M.KARA, Ticaret Hukuku-İ.Y.ASLAN Ticari İşletme Hukuku-M.BAHTİYAR, Ticari İşletme Hukuku-İ.KAYAR Sermeye Şirketlerinde Tasfiye Birleşme,Devir, ve Bölünme Textbooks and /or References ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Subjects Law of Commercial Enterprise: Commercial Business, Real and Legal Persons, Merchant, merchant assistants, Trade name, Business name, Account boks, Commerce Register, Unfair Competition, Brand name, Interest, Joint Liability Types of Contract Commercial Companies, Classification of Companies General Partnership; Formation, Operation, Termination Limited Partnership; Formation, Operation, Termination. Limited Companies; Formation, Operation, Termination. Joint Stock Corporations; Formation, Operation, Termination The Law of Negotiable Investments: Promissory note Bond, Bill of Exchange,, Check, Instructor/s Öğr. Gör. Yunus AÇCI e-mail szengin@balikesir.edu.tr Website www.sahinzengin.com Percent (%) SHORT CYCLE COURSE DETAILS Course Title: Public Finance Lecture Application 3 0 Vocational School: Şırnak Programme: Code : Education and Teaching Methods Lab. Project/ Homework Field Study Semester Other Total Credits Credit ECTS T+A+L=Credit 3 5 Language 2 Turkish Course Type Basic Scientific Course Objectives Learning Outcomes and Competencies Textbooks and /or References To Understand activities of state publicness, reasons and results. Scientific X Technical Elective Social Elective objectives and reasons for the existence of the state's economy with the results of learning Prof.Dr. Osman PEHLİVAN, Kamu maliyesi, Derya Kitabevi, 2008, Trabzon. ASSESSMENT CRITERIA Theoretical Courses Midterm Exams Project Course and Graduation Study If any, mark as (X) Percent (%) X 40 If any, mark as (X) Midterm Exams Quizzes Midterm Controls Homework Term Paper Term Paper, Project Reports, etc. Oral Examination Laboratory Work Final Exam Final Exam X 60 Other Other Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Instructor/s e-mail Website Subjects THE PUBLIC FINANCE SUBJECT, DESCRIPTION AND PARTS PUBLIC-PRIVATE ECONOMIC SECTION JUNCTION ECONOMIC ACTIVITIES AND OBJECTIVES OF PUBLIC REASON PUBLIC EXPENDITURES TYPES OF INCOME TAX AND GENERAL THEORY OF PUBLIC GENERAL THEORY OF TAX CLASSİFİCATİON OF THE TAX TAXATİON PRINCIPLES LOCAL GOVERNMENTS FINANCE STATE BUDGET STATE BUDGET FISCAL POLICY GLOBALIZATION AND THE CHANGING ROLE OF THE STATE GLOBALIZATION AND THE CHANGING ROLE OF THE STATE Öğr. Gör. Erhan POLAT Percent (%)