PowerPoint - iSETI LLC

advertisement

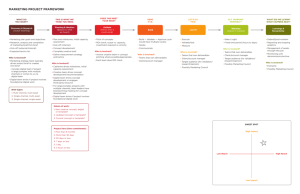

The Holistic Business Model Benjamin T Solomon BSc (Eng), MA Operations Research, MBS Finance QuantumRisk LLC (www.QuantumRisk.com) ©2001 Holistic Business Model: Operations Layer Logic of the Business High Coordination Functional Teams Control Matrix & Project Orgs. Cohesion between Organization Subunits High Channel Replenishment Hierarchical Orgs. Stock Available on Demand Consensus Control Drives Drives the the Organization Milestones Define Goals Missions Define Goals Goals are Formative Objectives Define Goals Driven Leadership Driven Value of Availability to Operations Low Distribution Mgmt. Producers Determine >> Purchasing Mgmt. Product Innovation Switching Costs Purchasing Mgmt. >> Consumers Determine Distribution Mgmt. Product Innovation Planning Drives Execution Drives Organization Organization Relationship Organization Product Competency Process (Equip Mix & Quantity) Variability Group Technology Transaction Management Few Large High Push Scheduling Capacity Drives Scheduling WIP Allocation to Machines Process Complexity Capacity Machines Revenue Sustained by Processing Costs >> Incremental Product Upgrades Materials Cost Revenue Derived from Input Materials Costs Basic Product is Significant Product Product Diversity is Diversity not Important is Critical Equipment Clusters Long Shelf Life Made-To-Order Capacity Available on Demand Low Trading Drives Product Movement Low High Value of Availability to Consumers Low Cost of Product Diversity Availability Multiple Objective Supply Drives Scheduling Work Allocation to Present Time Few Machine Types Many Machine Types Simplifies Planning Complicates Planning Product Upgraded by Product Diversity is Achieved Managing Inputs by Process Management Continuous Flow Process Network Process Orgs. Low Entrepreneurial Org. Low High Cohesion within Organization Subunits Process Clusters High Switching Costs Transaction Value Contract Value >> >> Contract Value Transaction Value Multi Skilled Teams High Assembly Line Quick Response Manufacturing Flexibility Supply Mgmt. >> Capacity Mgmt. >> Capacity Mgmt. Supply Mgmt. Organization Empowerment Short Shelf Life Many Small Capacity Machines Number of Product Types Simple Value Add Many Product Types Capacity Simplifies Planning Complicates Planning Cycletime Simplifies Planning Few Product Types Simplifies Planning Complex Value Add Simple Products WIP Stability Simplifies Planning Simplifies Planning Job Shop Product Diversity Low Equipment Complexity High Low Demand (Prod Mix & Quantity) Variability Reactive Scheduling Low Copyright 2001, Benjamin T Solomon Demand Drives Scheduling Time Allocation on of Work Pull Scheduling High Cost of Product Diversity WIP Drives Scheduling Machine Allocation to WIP Low High Number of Type of Machines Scheduling Management Holistic Business Model: Revenue Transaction Layer R Value Identity Weak Product Company Service Saturation Contact Outlets Presentation Format Transaction Premised Activity Virtual Event Synergy I High Activity Unique Process Involvement is Key to Success Industry Rivalry Map Product Designed-In Operations Competency Presentation High Product Brands Activity Purchasing Perception is Key to Success Achievement is More Perception is More Important than Perception Important than Achievement Process Filling A Need Function not Bound Interaction is More Important Effect is More Important than Knowledge than Actualization by Format Knowledge is More Actualization is More Important than Interaction Important than Effect Format Bound Function Contact Multiple High Product Market Demands Enables Value Product Specialization Variable Cost Reduction Value of Assets Used by Operations Simple Products Uniformity & Consistency Designed-In Specialization Enables Viability The Low Cost Producer Market Consolidates Around Scale Economies Enhanced by Market Demands Clearly Defined Attributes Focused Product Definition Market Demands Variety Uniformity & Cost of Product Variation is Low Product Technology Enables Consistency Economies of Scope Manufacturing / Delivery Process Unique Manufacturing Based on Generic Equipment / Delivery Process Synergy Low Specialization Nurtures Opportunities Competency Low Low Market Demands Features Complex Products: Product Definition Prevents Competency Delivers Value Market Segmentation Reliability Weak Brands Service Brands Niche Substance Premised Business Based Ambience Drives Transactions Traffic Seeks Experience Access Value Identity Outlets Business Drives Transactions Experience is Experience is Unique Reproducible Transaction Nature Expertise Driven Transaction Management Product Definition Product Life Hampers Transaction is Experiential Management Mechanization Process Driven Standardized & Clearly Demand Enables Transaction Defined Products Management Mechanization Transaction Management Comparative Goods Need to be Information Required Physically Present Operations Process Specialization Enables Unit Overhead Cost Reduction Process Specialization Product Attributes Enables Market Segmentation Process Delivers Value Markets Competency Purchasing Low Value Purchasing High Low Value of Assets Purchased by Consumers Multiple Simple Processes Scale Economies Enhanced to Deliver Focused Products by Equipment Specialization Product Specialization Function Purchasing Generic Resources Hampers Unique & Scarce Identity Differentiation Resources Low Timing is Key to Success Processes Ownership is Key to Success Low High Product Filling a Need Format Company Brands Capacity < Scale Economies Increases Consumption Faster than Growth Delivery is More Content is More Important than Content Important than Delivery Event Large Markets High Knowledge Virtual Business Traffic Seeks Saturation Business Based Concept Drives Transactions Closure Convenience Drives Transactions Few Many Transaction Location Copyright 2001, Benjamin T Solomon Transaction Holistic Business Model: Business Management Layer (Structural Positioning) Information Asymmetry Is Great Premium Barriers Intangibles Market Perception Management Barriers Management Market Wealth Creation Market Price Structure Inputs Expertise Competitive External Factors Management Market Expectations Management Information Low High Profitability Unique Know-How Enhances Unique Process Value Add Value Add from Unique Inputs Many Attributes Unique Know-How Does Not Value Add from Generic Inputs Enhance Unique Process Value Add High Product Low Product Differentiation Costs Differentiation Costs Low Value Add Scale Economies Mop-Up Market Demands Minor Specs Market Avoids Minor Market Demands Many Specifications Minor Specifications Market Share Structure Specialized Process Multiple Processes Delivers Values Facilitate Many Formats Few Attributes Many Attributes Market Demands Specific Generic Process Hampers Product Attributes Value Delivery Informed Market Uninformed Market Does Demands Product Stability Not Understand Standards Low Capacity Understands Its Needs Barriers Market Direction Clarity Market State Fragmented Market Narrow Uncertainty Unknown Proliferation Market Product Structure Capacity < Demand Capacity Add is Expensive Value Benefit > Value Add Growth Drains Profits FCF Unable to Sustain Growth Market Growth High Type of Economic Game High Capacity Barriers Fixed Costs Drives Profits Equity Game Retained Earnings Growth Market Access No Market Access to Alternatives to Alternatives Value Benefit ≈ Value Add Few Cost Effective Value Delivery Not Processes Easily Imitated Distribution Economics Value Delivery Hampers Growth Easily Imitated Value Benefit > Value Add Down Stream Down Stream Industry Stagnant Industry Growth Endurance Game Low Capacity Barriers Variable Cost Game Variable Costs Drives Profits Fragmented Funding Drives Viability High Low Market Growth Copyright 2001, Benjamin T Solomon Market Sustainability Win Win Game Few Unit Cost Game Market Share Structure Capacity Add is Relatively Inexpensive Stagnant Down Down Stream Stream Industry Industry Growth High Market Demands Value High Capacity Barriers Installed Capacity Matches Demand Value Benefit ≈ Value Add Installed Capacity > Demand (Rivalry Eliminates Profitability) Zero Sum Game Low Few Consolidation Growth Sustained by FCF Viability DrainsInstalled Profits Up Stream = No Unique Solution Self Sustained Growth Market Recognition Large Market Established Potential Low FCF Unsustainable Low Optimum Location Game = As Close As Possible Installed Up Stream Capacity > Demand Healthy FCF Profitability Markov Chains: Transition State Probabilities Market Advantage Scope Economies Compatibility Based CA Competitive Process Based CA Narrow Market Product StructureProliferation High Status Quo Resource Bidding Game Few Attributes Regular Auction Market Price Structure = Regular Auction Unique Ability to Unique Presentation Deliver Attributes of Multiple Attributes Market Bidding Game Knowledge Based CA Differentiation Uniqueness Based CA = Dutch Auction Premium Innovation/Niche = Dutch Auction Asymmetry is Low High Value Add Market Economics Holistic Business Model: Business Management Layer (Strategy Evaluation) Information Asymmetry Is Great Premium Barriers Intangibles Market Perception Management Barriers Management Market Wealth Creation Market Price Structure Inputs Expertise Competitive External Factors Management Market Expectations Management Information Low High Profitability Clarity Market State Distinctive Value Benefit Low Capacity Needs Barriers Market Uncertainty Direction Unknown Fragmented Market Understands Its Narrow Proliferation Market Product Structure Value Benefit ≈ Value Add High Capacity Rivalry Profitability Attracts New Entrants Resource Bidding Game = Regular Auction Cost Restructuring Endurance Game High Market Growth Type of Economic Game High Capacity Retained Barriers Consolidation Prevents New Entrants Profits Enable Excess Capacity New Markets Equity Game Earnings Growth Value Benefit > Value Add Price Wars Low Capacity Barriers Variable Cost Game Variable Costs Drives Profits Fragmented Funding Drives Viability High Low Market Growth Copyright 2001, Benjamin T Solomon Market Sustainability Win Win Game Fixed Costs Drives Profits Market Share Structure Process Innovation Growth Drains Profits FCF Unable to Sustain Growth Alternative Tech. Pose Threats Rising Value Benefit Expectations Many Attributes Capacity < Demand Unique Value Delivery Market Recognizes Key Attributes Value Benefit > Value Add Alternative Product Formats Erase Profits Few Unit Cost Game Low Market Demands Minor Specs Product Innovation Zero Sum Game Markov Chains: Transition State Probabilities Few Attributes Mop-Up Market Fragmentation Difficult to Imitate Brand Dilution Market Share Structure Cost Effective Value Delivery Market Demands Value High Capacity Barriers Eliminate Excess Capacity Viability DrainsInstalled Profits Up Stream = No Unique Solution Low Cost/Value Benefit Delivery Few Consolidation Growth Sustained by FCF Low FCF Unsustainable Low Optimum Location Game = As Close As Possible Clear Brand Identity Market Advantage Value Benefit ≈ Value Add Self Sustained Growth Increase Capacity Incrementally Up Stream Process Innovation Scope Economies Scale Economies CA Competitive Process Based CA Narrow Market Product StructureProliferation Installed Up Stream Capacity > Demand Healthy FCF New Distribution Channels Up Stream Process Standardization Low Value Compatibility Based Add High Status Quo Profitability Regular Auction Leveraging Core Product Design Many Attributes Market Bidding Game Product Attributes Deliver Value = Dutch Auction Down Stream Process Standardization Up Stream Captive Technologies Few Attributes Product Innovation & Patents Market Price Structure Alternative Product Tech Leakage Knowledge Based CA Differentiation Uniqueness Based CA New Markets Premium Innovation/Niche = Dutch Auction Asymmetry is Low High Value Add Market Economics