Statement of Cash Flows

advertisement

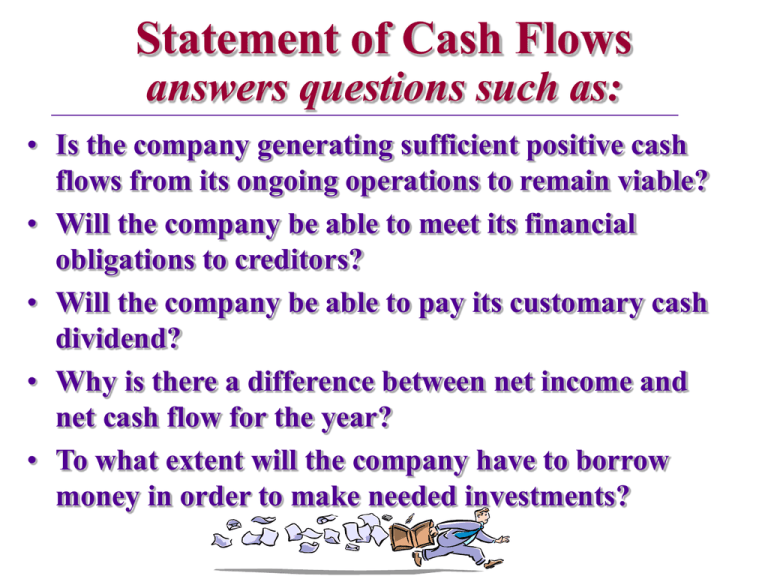

Statement of Cash Flows answers questions such as: • Is the company generating sufficient positive cash flows from its ongoing operations to remain viable? • Will the company be able to meet its financial obligations to creditors? • Will the company be able to pay its customary cash dividend? • Why is there a difference between net income and net cash flow for the year? • To what extent will the company have to borrow money in order to make needed investments? Statement of Cash Flows • Reports the Cash Effects – of an enterprise’s operations (through CA & CL) – its investing transactions (LT Assets) – its financing transactions (LT Liabilities & Owners’ Equity) • Should Reconcile Net Income to Net Cash Flow from operating activities Statement of Cash Flows: Investing Activities Cash Received From: • Collection of principal from debtors • Sale of loans to third parties • Sale of debt or equity securities of other entities • Sale of property, plant & equipment Cash Paid For: • Loans made or purchased by the entity • Purchase of debt or equity securities of other entities • Purchase of property, plant & equipment Statement of Cash Flows: Financing Activities Cash Received From: • Issuance of equity securities (stock) • Sale of bonds, mortgages, notes & other shortterm or long-term borrowings Cash Paid For: • Cash dividends • Purchase of treasury stock • Repayment of principal on amounts borrowed Statement of Cash Flows: Operating Activities Cash Received From: • Producing & selling goods • Providing services • Interest • Dividends • other Cash Paid For: • Inventory • Salaries & wages • Taxes, duties, fines, fees, penalties • Interest • Other expenses Balance Sheet: 8 Major Classifications 1) Current Assets 6) Current Liabilities – Cash 7) Long-Term Liabilities – Short-Term Investments 8) Owners’ Equity – Receivables – Inventories – Prepaid Expenses 2) Long-Term Investments 3) Property, Plant & Equipment 4) Intangible Assets 5) Other Assets – – – – – Capital Stock Additional Paid-in Capital Retained Earnings Treasury Stock Other Items of Comprehensive Income Statement of Cash Flows: Direct vs. Indirect Methods Direct Method • Requires a supplemental reconciliation of net income to cash flow from operating activities. • Net income is reconstructed on a cash basis. • Used by 2.5% of companies. Indirect Method • No supplemental schedule is required. • Net income is reconciled to cash flow from operating activities. • Used by 97.5% of companies. Statement of Cash Flows: Indirect Method CASH FLOW FROM OPERATING ACTIVITIES: Net Income + “Non-cash” Expenses - “Non-cash” Revenues - Increases in Current Assets + Decreases in Current Assets - Decreases in Current Liabilities + Increase in Current Liabilities +/- Losses & Gains Reported on the Income Statement = Net Cash Flow from Operating Activities CASH FLOW FROM INVESTING ACTIVITIES: + Net Decrease in all other Long Term Assets - Net Increase in all other Long Term Assets = Net Cash Flow from Investing Activities CASH FLOW FROM FINANCING ACTIVITIES: + Net Decrease in all other LT Liabilities & Equities - Net Increase in all other LT Liabilities & Equities = Net Cash Flow from Financing Activities Statement of Cash Flows • Reports the Cash Effects – of an enterprise’s operations (through CA & CL) – its investing transactions (LT Assets) – its financing transactions (LT Liabilities & Owners’ Equity) • Should Reconcile Net Income to Net Cash Flow from operating activities Statement of Cash Flows: Indirect Method CASH FLOW FROM OPERATING ACTIVITIES: Net Income + “Non-cash” Expenses - “Non-cash” Revenues - Increases in Current Assets + Decreases in Current Assets - Decreases in Current Liabilities + Increase in Current Liabilities +/- Losses & Gains Reported on the Income Statement = Net Cash Flow from Operating Activities CASH FLOW FROM INVESTING ACTIVITIES: + Net Decrease in all other Long Term Assets - Net Increase in all other Long Term Assets = Net Cash Flow from Investing Activities CASH FLOW FROM FINANCING ACTIVITIES: + Net Decrease in all other LT Liabilities & Equities - Net Increase in all other LT Liabilities & Equities = Net Cash Flow from Financing Activities Interpretation of the Statement of Cash Flows Examine the operating activities section carefully. – Negative cash flow is usually a sign of fundamental difficulties. – Ultimately, a positive cash flow is necessary to avoid liquidating assets or borrowing money to pay for day-today activities. Evaluate Financial Liquidity: Net Cash Provided by Operations Average Current Liabilities = Current Cash Debt Coverage Ratio Evaluate Financial Flexibility: Net Cash Provided by Operations Average Total Liabilities = Cash Debt Coverage Ratio Evaluate Financial Flexibility: Net Cash Provided by Operations - Capital Expenditures - Cash used for dividends = Free Cash Flow